8-envelope contrarian EA sequel: how the lot size increases (lev8 means "the deeper, the stronger")

In the previous article, daedalus-k (lev8 / lev10)

organized the reasons why ranges are easy and strong trends are difficult, from the perspective of range vs. trend.

In this sequel, I will summarize as simply as possible the feature of daedalus-k-lev8,

the mechanism where the lot size increases as the divergence deepens.

(*This article does not guarantee trading results. Please conduct verification and demo trading before real operation.)

1) Conclusion: The deeper the divergence (strong price movement), the larger the lot

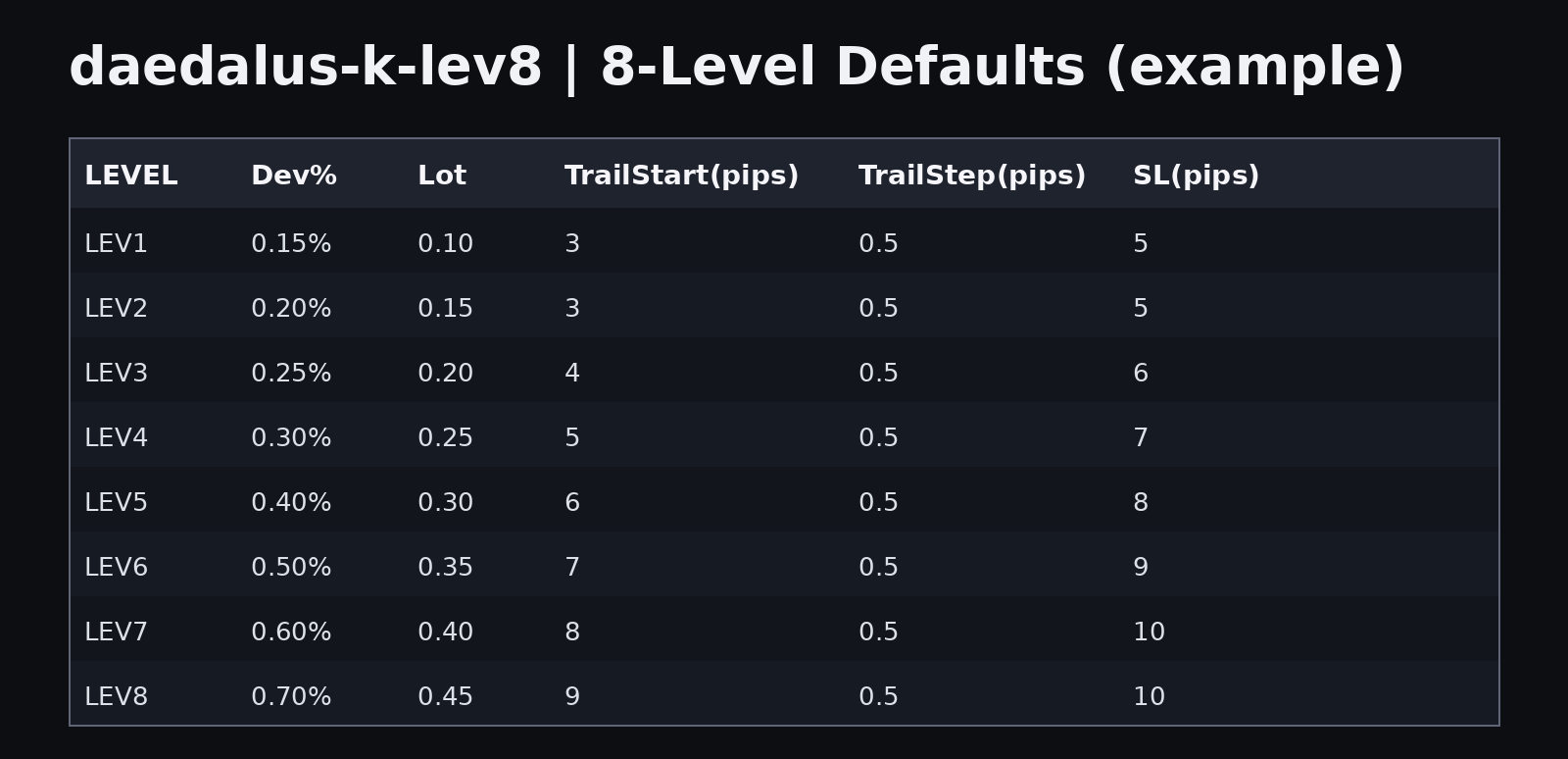

daedalus-k-lev8 uses eight envelopes to tier the depth of divergence.

From shallow divergence (LEV1) to deep divergence (LEV8), treated as levels,

the design is that the deeper the level, the larger the lot size.

The aim is simple:

"Don't forcefully enlarge at shallow positions; the more overshoot, the stronger the target."

This is the concept.

2) 8 envelopes visualize "the depth of overshoot"

This EA visualizes the order of deviation from lines with smaller variance,

visually showing the progression from shallow to deep divergence.

(Default example)

0.15% / 0.20% / 0.25% / 0.30% / 0.40% / 0.50% / 0.60% / 0.70%

*Envelope period: 20

*Moving average: Exponential (Close)

In other words, by how far the price has deviated from each line

you can determine progressively how much overshoot there is now.

3) Increasing the lot size comes with both advantages and risks

The design where deeper divergence increases the lot size has both benefits and cautions.

【Advantages】

• In situations where the price is drawn in more deeply, it is easier to target returns

• It is easier to avoid unnecessary additional positions at shallow levels

• It is easier to judge “how far to pull back”

【Cautions】

• In strong trends, continuing deep divergence tends to increase risk

• Compatibility with market conditions (range/trend) becomes more important

• If unsure, it is safer to adjust the lot side to create an upper limit

4) If uncertain: set the lot as "fixed" or create an upper limit

If you are afraid of the lot increasing, the following are practical for operation.

• Set the same lot for all levels (fixed)

• Limit the lot only for LEV7–LEV8 (upper limit)

• Or make the higher-level operation conditions stricter (reduce frequency)

First, check the default behavior → if anxious, adjust the lot for safety.

5) How is lev10 different?

lev10 is a model that can tier-judge even deeper divergence zones than lev8.

Therefore, it targets those who want to pull in even deeper (wait for larger swings).

However, aiming for deeper zones also increases the importance of risk management in strong trend phases,

so it is recommended to first check whether the market is leaning toward a range.

Summary: The deeper it is, the more you target with strength. Accordingly, market selection and upper limit management are important

・Eight envelopes tier the depth of divergence

・The deeper the divergence, the larger the lot (strong price movement, stronger targeting)

・There are advantages, but risk tends to rise in trend phases

・If uneasy, risk can be managed with fixed or upper-limit lots

・lev10 is a model that waits one level deeper, increasing the importance of management

【Product pages】

daedalus-k-lev8:

daedalus-k-lev10:

(*This article does not guarantee trading results. Please conduct verification and demo trading before real operation.)

× ![]()