Envelope Countertrend EA Sequel: Markets I excel at and markets I struggle with (Range/Trend)

Envelope mean-reversion is appealing, but depending on the market environment, its usefulness can clearly be “hits / misses.”

In the previous sequel article, daedalus-k (lev8 / lev10)

was designed to not enter as soon as it touches, and to wait for the shape to align with an EA.

This time, we go one step further and summarize, in a brief way, the markets where this EA excels (frequent usage) and where it struggles (reduced usage) from the perspectives of range / trend.

(※This article does not guarantee trading results. Please be sure to verify and demo-trade before actual use.)

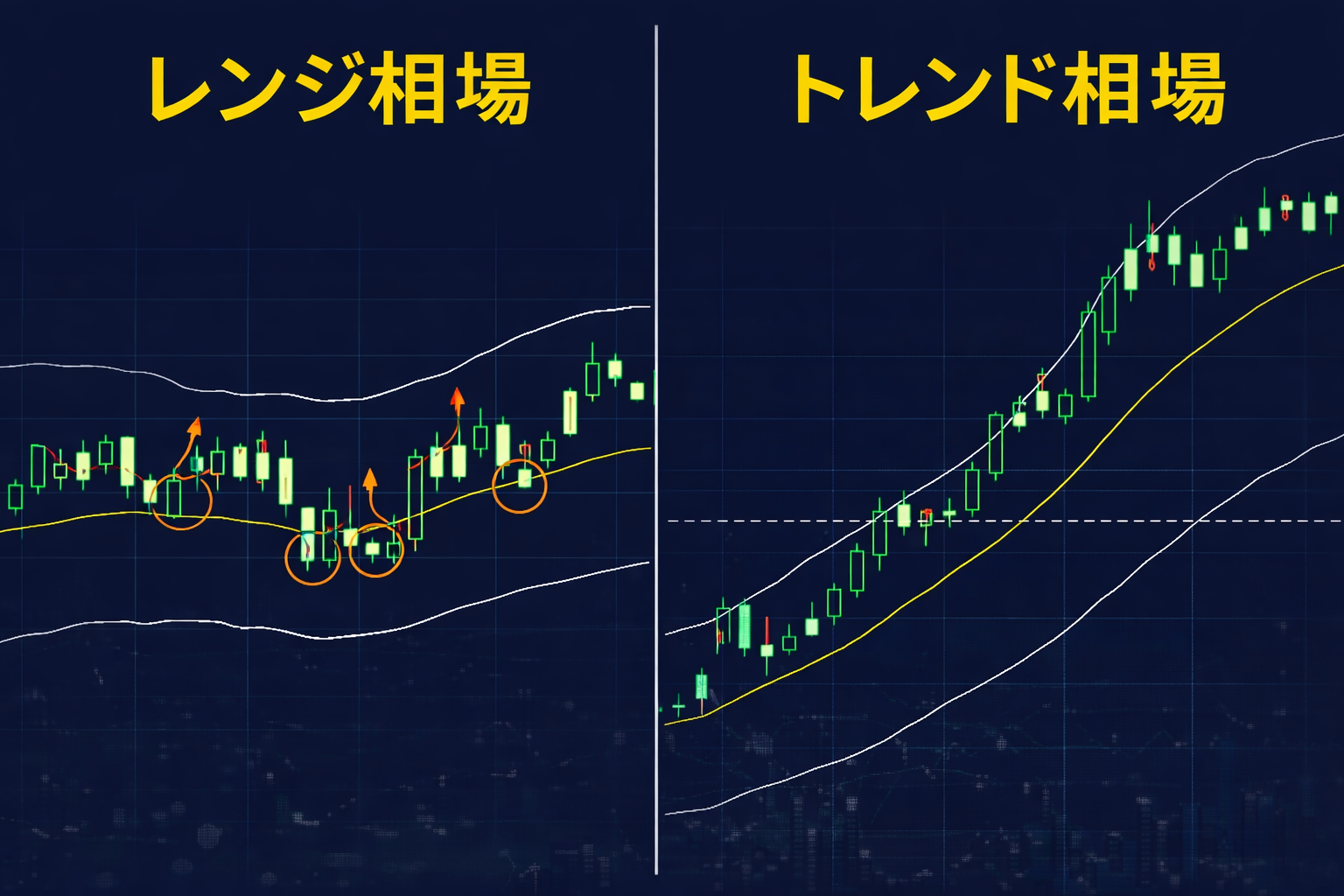

1) Conclusion: Ranges are strong, strong trends are weak

daedalus-k (lev8 / lev10) is built with the idea of avoiding common negating moves of contrarian trading:

・Jumping in the moment it touches a line

・Consecutive entries during a trend

Thus, its compatibility is simple:

・Strong points: Range (markets that swing back and forth)

・Weak points: Strong trends (markets that don’t revert)

By grasping these two, you’ll immediately feel more convinced that it “doesn’t move / doesn’t hit.”

2) Markets it excels in: Range (markets with reversals)

In ranging markets, prices tend to go “overshoot → come back,” so the EA’s contrarian entries increase.

The typical shapes in a range look like this.

・Touches the envelope

・Overextends once (breaks out)

・Bounces back

・Crosses the line (baseline) again

The more reversals there are, the easier it becomes to form contrarian setups.

3) Markets it struggles with: Strong trends (markets that don’t revert)

On the other hand, in strong trends, prices tend to “keep pushing / not revert,” making contrarian trades unfavorable.

In particular, the following conditions reduce its usage.

・Prices continue in one direction with shallow retracements

・Envelope continues to expand in the same direction

・Even when there is a rebound, it’s quickly pushed back and no swing occurs

4) 1-minute check: How to distinguish range vs. trend

No difficult indicators needed; just focus on these two points to start.

【Check ①】Slope of the moving average (MA)

・Flat to gently sloped → Range-oriented (more frequent usage)

・Steep slope → Trend-oriented (less frequent usage)

【Check ②】Shape of the envelope

・Oscillating up and down, converging/diverging repeatedly → Range-oriented

・Expanding in one direction continuously → Trend-oriented

With just “MA slope” and “envelope shape,” you can largely judge.

5) Note: The relationship between 8-envelope levels and “usage”

This EA uses eight envelopes to tier the depth of deviation.

(From shallow deviations to deep deviations, captured by levels)

Therefore, in a range with reversals, tiered judgment tends to be effective, while in a strong trend that doesn’t revert it tends to be unfavorable.

※In the next article, we will explain this “8 levels” and the mechanism of increasing lot size.

Summary: When the market matches, hesitation decreases

・Strengths: Range (with reversals)

・Weaknesses: Strong trends (no reversals)

・How to distinguish: MA slope and envelope shape

・First step is to run it in markets where it fits

【Product page】

daedalus-k-lev8:

https://www.gogojungle.co.jp/systemtrade/fx/18687

daedalus-k-lev10:

https://www.gogojungle.co.jp/systemtrade/fx/20780

(※This article does not guarantee trading results. Please be sure to verify and demo-trade before actual use.)