[EA Production] Completion Report for Main Expert Advisor

Hello. This is 2pay.

This time is a completion report for the EA I run myself. There may not be much truly useful information.

*In the previous column there seemed to be several restricted expressions, so I will change some expressions. It may be hard to read, but please understand.

// ---

A while ago I talked about an EA that achieved over 80% in seven months of operation. The EA's name is "HGT".

HGT is a tuned version of the currently sold AL_56, adjusted to my own trading environment. (During that process, the platform was also migrated to MT5)

Both have continued to generate profits since the turn of the year, and I believe they will continue to function well in the future.

About six months ago I decided to create an even more precise EA based on HGT. (One month after HGT started operating)

I wonder when I’m reporting this.

During this period I was hooked on time-based trading logic, so I implemented functions that could add logic with a single line.

When you want to add new logic, you can mix it into the existing portfolio by simply adding a one-line function that specifies direction, lot, in-time, out-time, etc.

Since the basics are kept the same, adding/deleting/modifying logic is easy, which greatly accelerates development.

// ---

The development steps (achievements) are as follows:

• Indicator creation to seek edge (1 month)

• Edge search (2 weeks)

• Edge verification and selection (1 month)

• Building the EA foundation (1 month)

• Refinement of logic (2 weeks)

• Optimization of logic (2 weeks)

• Brush-up of logic (2 weeks)

• Logic integration and adjustment (1 week)

• Demo operation (1 month)

There are many cautions when developing and testing, butit's a hassle, sothey will be omitted.

I cannot fully cover it all, so I would like to talk about it another time.

// ---

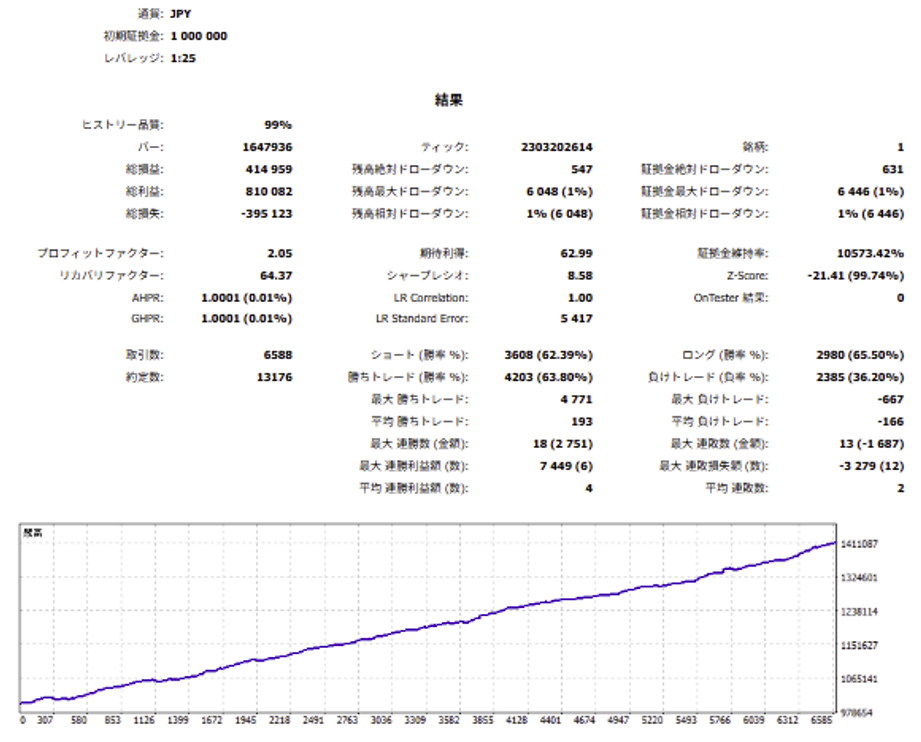

Below are the results for HGT and the new EA.

They cannot be compared in a simplistic way, but I have tested them under aligned conditions as much as possible.

• Start capital: 1,000,000 yen

• Period: 2004-2025

• Lot: 0.01 (fixed)

In actual operation, percentage lot splitting and other adjustments are used, so performance may differ slightly.

(Parameters and trade distribution are kept confidential.)

First, HGT.

The expected value is about 1.5, which is sufficient for operation. (With split lots, the expected value is about 1.7)

Each individual trade has a low frequency, so I accumulate by combining multiple logics (a total of 6 logics).

In my case I assume compounding, so without a certain trading frequency, compounding cannot work.

One slight twist is that in addition to time-based matching, there is a price action judgment.

I thought this would boost performance, but in fact for the HGT logic, the expected return can decrease slightly compared to before including price action judgments.

However, when viewed by risk-reward ratio, the risk reduction effect is slightly higher, which ultimately helps stabilize gains and losses.

// ---

Next is the performance of the new EA. The name is confidential.

This one has seven logics in two patterns, totaling 14 logics.

By redefining market structure, I inherited the strengths of HGT while meticulously building each logic one by one.

The expected value exceeds 2, and the growth curve is more linear than HGT.

The most recent two years (2024-2025) are outside the optimization period, but the growth rate remains at the same pace as before.

Of course it is a single-position EA, so it does not hold enormous drawdowns like averaging down.

One major objective in creating the new EA is to improve performance, but there is another goal as well.

That is to improve the compounding performance.

I cannot provide a full report, but briefly, with the highest risk setting (maximum drawdown allowed 4%), HGT achieves an average annual return of about 200%, while the new EA achieves about 300% average annual return.

Since my premise is compounding, development is designed with compounding in mind.

The goal is not necessarily the single-best-performing logic but the design that allows the most capital to be put to work while keeping risk acceptable.

In fact this system originally produced around PF2.2. Looking at logics individually, it’s around 2.5 or so.

No matter how excellent a logic is, if you don’t allocate lots, funds won’t grow, so I’ve incorporated mechanisms to maximize lot sizing while minimizing performance sacrifices.

// ---

That brings us to the end of this update.

There is a lot I want to write, but for now I will leave it as a completion report.

As I continue to develop, I hope to share new insights as well.

Thank you for reading.