The translation of the HTML content is: Did you manage to take proper profits?

Last weekend, the market moved a lot due to the Bank of Japan's rate check, didn't it?

What I often think in such moments is that

those who are winning tend to firmly capture profits during these times.

When there is no clear direction and volatility seems low,

they refrain from trading and stay calm,

and in places where anyone can make big profits in a short time like this,

they stay focused and take the profit.

I have interacted with many traders,

and although their logics, strategies, and approaches differ,

in general, most of them trade like this.

On the other hand, those who lose

don't have a clear sense of direction and volatility seems low,

for some reason they trade hard on that currency pair and time,

injuring their losses gradually,

are just left watching with fingers in their mouths.

To be honest, that was me in the past (lol).

And this is true even with wonderful logics, signals tools,

if you trade like this,

it's hard to consistently make profits.

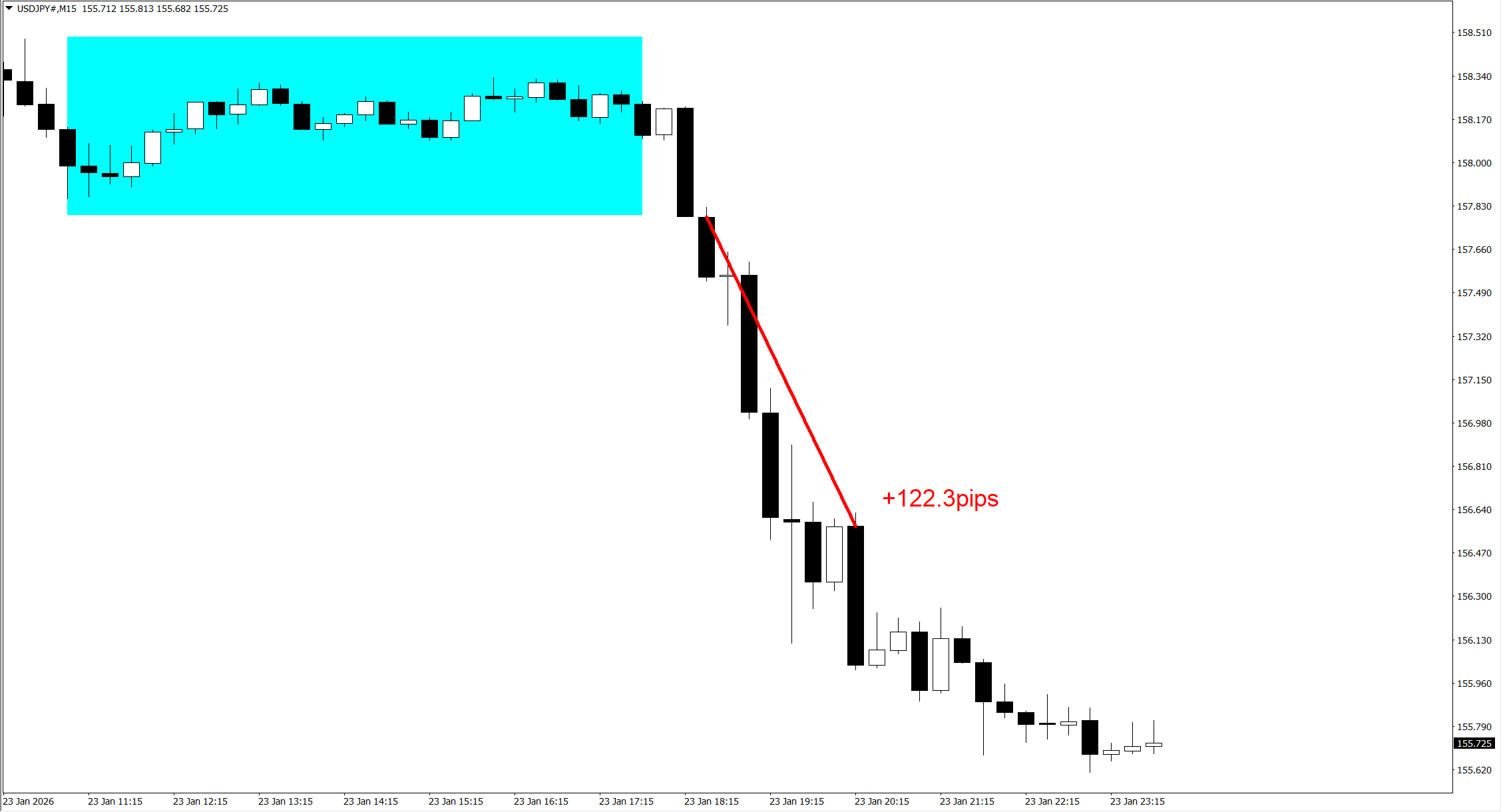

For example, please look at the chart below.

It looks very hard to trade, doesn't it? (sweat)

Here the price movement is only about 10 pips up and down,

and even if you labor to trade,

you can only aim for a profit roughly equal to the spread plus a bit,

making it physically difficult to realize large profits.

I think you can understand that.

In my logic, during the period shown in the chart above,

there is a rule to refrain from trading,

so I think most buyers are not trading,

but those using other logics or signal tools or EA might

have traded vigorously in such places.

No matter how wonderful a signal tool or logic you have,

if you trade hard in market like the above chart,

profits are hard to come by and

losses are more likely to occur.

As I often say,

simply obtaining a great logic or signal tool does not win you trades.

Forex trades 24 hours a day,

but there are times and periods that are suitable for trading, and currency pairs as well.

If you trade without considering these,

even trades that could win may not.

So, specifically, when and with which currency pair should you trade?

I recently released a method that allows anyone to determine this without discretion.

It can be done without discretion.

in a practical way

that can be donewithout discretion.

And since I released this method a few days ago,

I've received a great number of grateful comments.

- After reading this, I realized I had been trading on currency pairs that were hard to trade.

- I didn't know exactly how to choose currency pairs, so this is very helpful!

- With other signal tools I bought,

there were times it worked well and times it didn't at all.

I couldn't understand why,

but after reading this, I can identify when to trade at a glance,

and I can trade only during the favorable times.

- There was no one who could teach me this.

Most people sell signal tools or methods,

so which currency pair and when to trade to unleash maximum power

was almost always a matter of discretion or market awareness, things beginners don't know.

But with this method, anyone can trade without confusion.

People have said things like this.

Clearly, many people trade without much awareness of this,

and judge based only on backtests of logics or tools,

trading as a result.

As in the feedback I received,

when it comes to logics or signal tools,

when and which currency pair to trade is extremely important.

Rather, if you trade without considering this,

no matter how good the logic or tool is, you likely won't win.

So, in what situation did I trade? It was during the big market move last week.

This logic is

・Entry is two candlesticks

・Exit is one candlestick

When more people want to buy than sell, you hold a long position; when more want to sell than buy, you hold a short position

and this is distilled to the extreme in this logic.

And since it is discretionary-free, even beginners share the same profits.

Until the rate check, the USD/JPY did not show large volatility.

Gold was actually easier to trade in this environment.

All of this can be determined by“Maximizing profits without discretion”.

However, after the rate check, the market moved significantly and remained volatile.

If you had switched currency pairs according to the rules and shifted to USD/JPY,

you could have targeted large profits.

Constantly selecting currency pairs that are moving strongly

is crucial.

Even if you choose currency pairs that are quiet and trade hard,

no matter how great the signal tool, you won't win.

The key is how you select currency pairs that move strongly.

In the chart above, in the light blue boxed areas, the

“Ultra-High Win Rate FX Logic”does not generate a single entry signal.

And right after a range, as the market seems likely to move again, a sell signal appeared and

we were able to capture a significant profit.

This is because

When more people want to buy, you hold a long position; when more want to sell, you hold a short position

This is how these trades are possible.

You are not predicting the direction of the market in advance.

You simply ride the movement as it happens.

Choosing currency pairs is not about predicting which pair will move the most in advance,

you just pick currency pairs that are already moving strongly.

Everything is backward-looking.

Most people try to forecast in advance.

Even rate checks are often partly anticipated,

but few can specifically predict that USD/JPY will move significantly in advance.

My method does not forecast in advance;

everything is done after the fact.

This allows for steadily high win rates in trading.

In the order of the chart above,

first,“Maximizing profits without discretion”selects currency pairs and times where profits are easier to target,

then,“Ultra-High Win Rate FX Logic”provides the entry signal,

and you exit according to the rules.

All without discretion, ensuring the same trades for everyone.

Most people focus only on logics.

Moreover, they judge based solely on past performance when selecting logics.

Instead, determine which currency pair to trade now and whether the current market is suitable for trading,

and only then use the logic.

This leads to more efficient trading.

This time, rate checks caused USD/JPY to move significantly,

and going forward, interventions may be considered,

and high-volatility markets may continue.

In this way, markets are always changing.

Optimal currency pairs are also constantly changing.

And how quickly you grasp this and switch to the optimal currency pair to trade makes a big difference in results.

When talking with many people, I found that many do not consciously consider this and trade mainly by backtesting logics or tools,

so I explained it again here.

And a further feature of my logic is to prioritize

“Getting beginners to profitability quickly”

as the first objective, and to design products accordingly.

Currently, I offer seven logics,

and all of them arecandlestick-based

Therefore, the charts are very simple, and

they can be traded on smartphones as well.

Thus,without discretion

for busy people, you can trade on your smartphone

as well.

If you want to do similar trading,

by obtaining my logics,

you can trade without forecasting the future,

and continue for a long time in any market conditions.

Because the logics are simple,

they will continue to be applicable no matter how the market changes in the future.

And among the seven logics, their features differ, so I summarize them below.

“Candlestick FX Logic”

The main feature of this logic is

more entry opportunitiesas a discretionary-free logic.

Entries and exits are decided solely by candlesticks.

It also supports from 1-minute charts up to daily charts, making it suitable for scalping, day trading, and swing trading, so you can operate in your preferred style.

For more details, please watch the following videos and read the free bonuses.

Key points to winning in FX

Password

“Ultra-High Win Rate FX Logic”

This logic is all abouthigh win rateand aims to trade without losing.

Techniques to turn losses into winsand to avoid losses as much as possible.

This is especially recommended for beginners who want to start making profits quickly.

It is the quickest to learn among the five logics.

For more details, please watch the following videos and read the free bonuses.

How to achieve maximum performance with minimal effort

Password

“Breakout FX Logic”

A logic focused on pursuing profits relentlesslyThis logic also trades using candlesticks only.

If you want to know more, please watch the following videos and read the free bonuses.

How to relentlessly pursue profits without forecasting

Password

“Ultra-Fast FX Logic”

A logic specialized for 1-minute scalping.

Conceptually, a single trade may be completed in a few minutes.Rather than aiming for large trends, the style is to take about 10 pips repeatedly and promptly.

“Trend Scalping FX Logic”

1-minute scalping, but when a trend appears, go all in for profits.

Holding a position until the trend ends can yield, even on 1-minute charts, profits over 400 pips.

This is especially recommended for those who want large profits in a short period.

For more details, please watch the following videos and read the free bonuses.

How to aim for large profits in a short period

Password

“Auto FX Logic”

A method that automates entry to exit and trades automatically.

No matter how the market changes in the future,

it enables discretionary-free flexible response and automates it,

creating a logic where beginners can achieve the same profits.

For more details, please watch the following videos and read the free bonuses.

How to become truly profitable in FX

This logic is focused on aiming for large profits in a very short time.

It targets reversals to overextend moves, and

this kind of movement will be applicable regardless of future market conditions,

and it will work in any market situation.

Of course, it is discretionary-free and can be practiced immediately by beginners,

so it is easy to implement quickly.

For more details, please watch the following videos and read the free bonuses.

How to forecast future price movements

Rather than wasting time chasing tools or EAs that only win temporarily,

obtain logics that capture the essence of the market and generate long-term profits,

and truly become able to increase profits.