[Free Recommendation: "What-If Alert" Included!] Intervention Aftermath PRO Market Report (January 22, 2026, 6:00 AM)

The stormy market panic is over!

Pro insights: “What-If Strategy”—Reverse thinking for turning the tables

On days when the market is turbulent and full of “NG” signals,don’t rely on luck,just wait for conditions to be met—this is a practical way to survive in the market.

Introduction

Geopolitical risks, trade frictions, record gold prices, and a weakening dollar... Have you ever faced a trading screen flooded with bright red “NG” signals and felt panicked?

“Teacher! The screen is all red with ‘NG’! Gold is too high and the dollar is falling—what should I do?!

This cry of distress is exactly the wall many beginners hit. Yet professional traders do not move blindly or fall into despair in a raging storm. Theyuse the What-If Strategyto spot the exceptions in the storm and calmly set traps to wait for opportunities.

This market report is generated with the new features of “Intervention Ripple PRO 6.0”

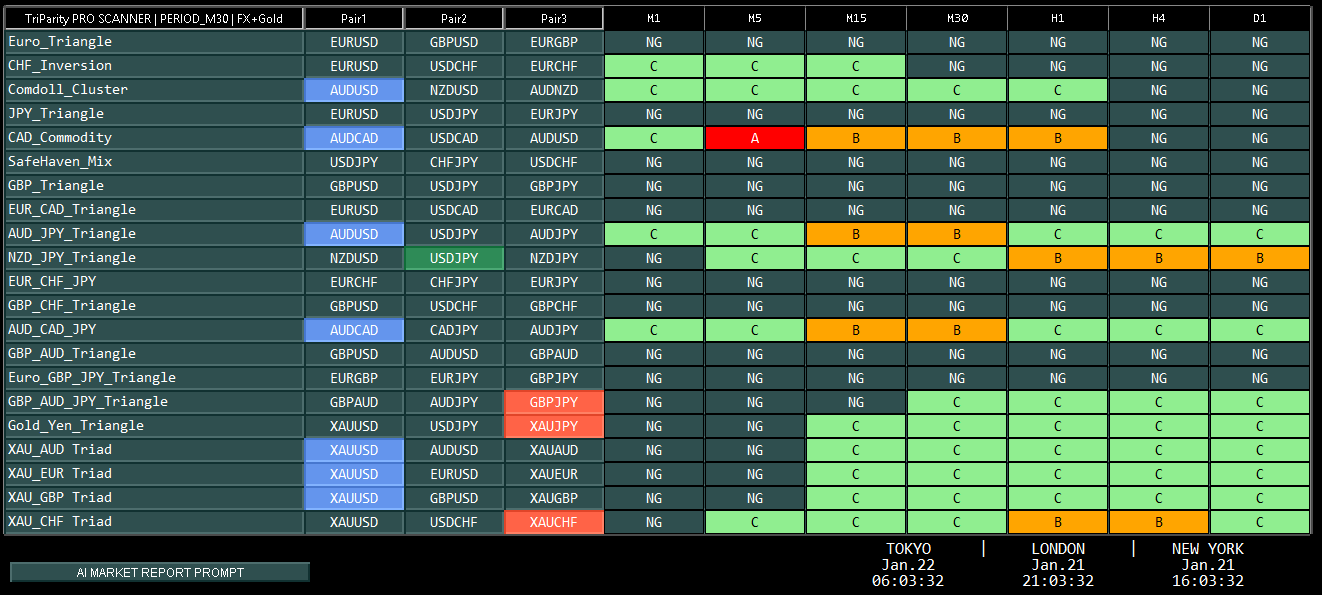

The manuscript for the market report covered in this article isgenerated using the new features released on January 20 (Tuesday) for “Intervention Ripple PRO 6.0”. Specifically,the Scanner’s view of the current market situation (multi-currency × multi-timeframe assessment) is automatically generated into a prompt file for ChatGPT with a single button press.

In other words, what we are doing is simple:

- Read the latest status with the Scanner

- Click the button once(Output a ChatGPT prompt file)

- Feed that prompt to ChatGPT andcreate a market report (strategy proposal + alert setting recommendations)

Thanks to this “one-click generation,” even beginners can more easily decide what to wait for in the current market and what conditions to use to act (What-If Strategy).

▶ Intervention Ripple PRO (product page)

1. Do not fight the storm. Look for the exception

On days when the market is wild and full of NG signals,it is not a day to forcefully fight. Pros stay calm here andpractice waiting as a strategy in preparation for the coming distortion (opportunity).

- Market report: a brief summary to quickly grasp the day’s market environment

- What-If Strategy alerts: not a forecast to rely on,“If conditions are a certain way, then this is the move”—decide in advance and wait

- Effective window: ~24 hours: for today to tomorrow. It isn’t the same every day, so updates are expected

2. A red screen doesn’t mean you’re bad; it means the environment is stormy

As geopolitical and trade frictions raise risk aversion, beginners may feel that “NG signals mean the end.” But what matters here isnot your skill but the environmentto reassess.

The current storm mainly consists of three factors.

- Risk aversion(flight to safety)

- Gold surged(safe-haven buying)

- Sell America → dollar weakens(US assets are being sold)

In other words, the NG-heavy environment isn’t your fault; it’s a sign that the market as a whole is difficult on that day..

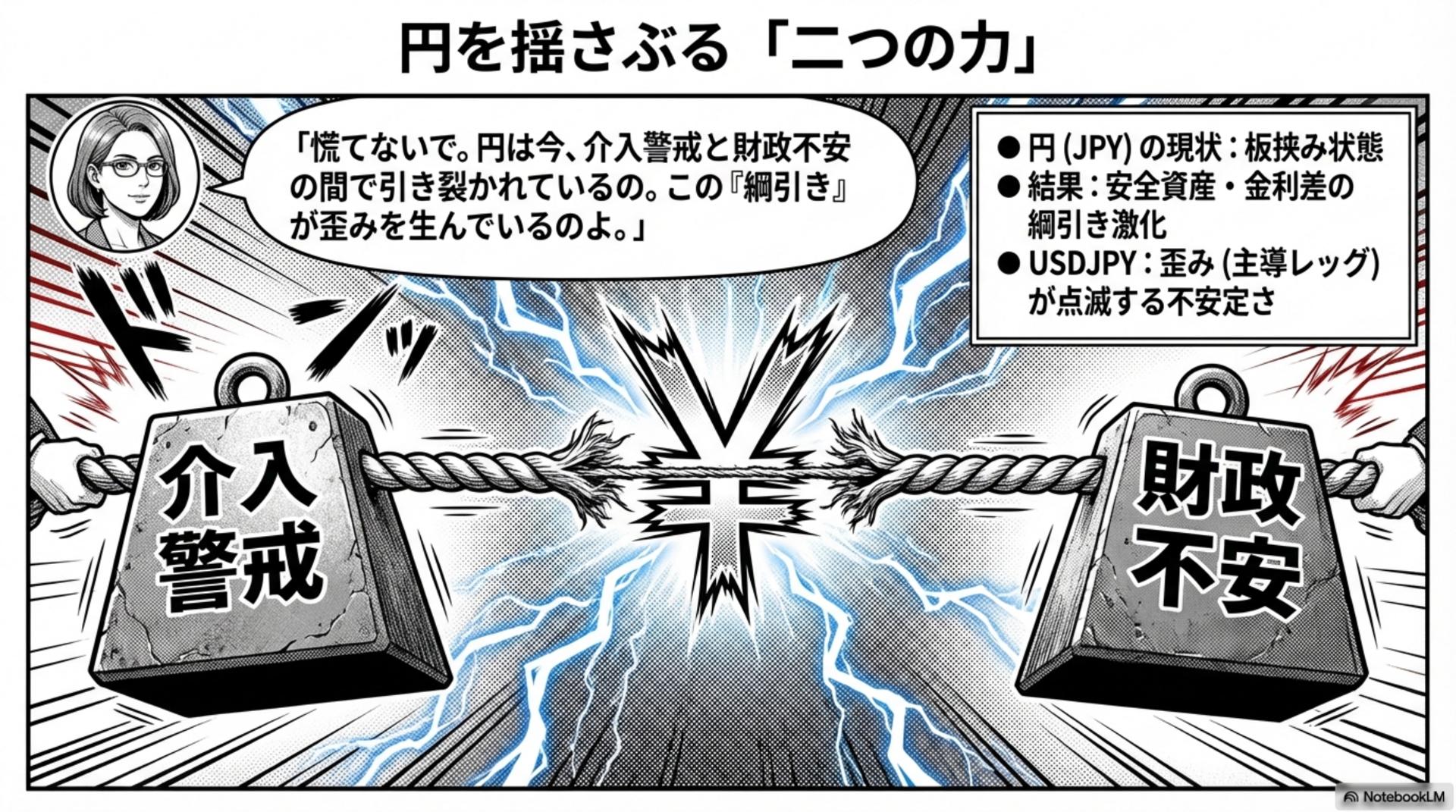

3. The yen is in a tug-of-war. That’s why USDJPY tends to be unstable

The yen tends to be pulled by a tug-of-war between intervention fears and domestic factors (fiscal concerns, etc.),making USDJPY the focal point or fading from focusin some phases.

Key point:

On days when direction changes rapidly,target only the moment when momentum arisesfor safety.

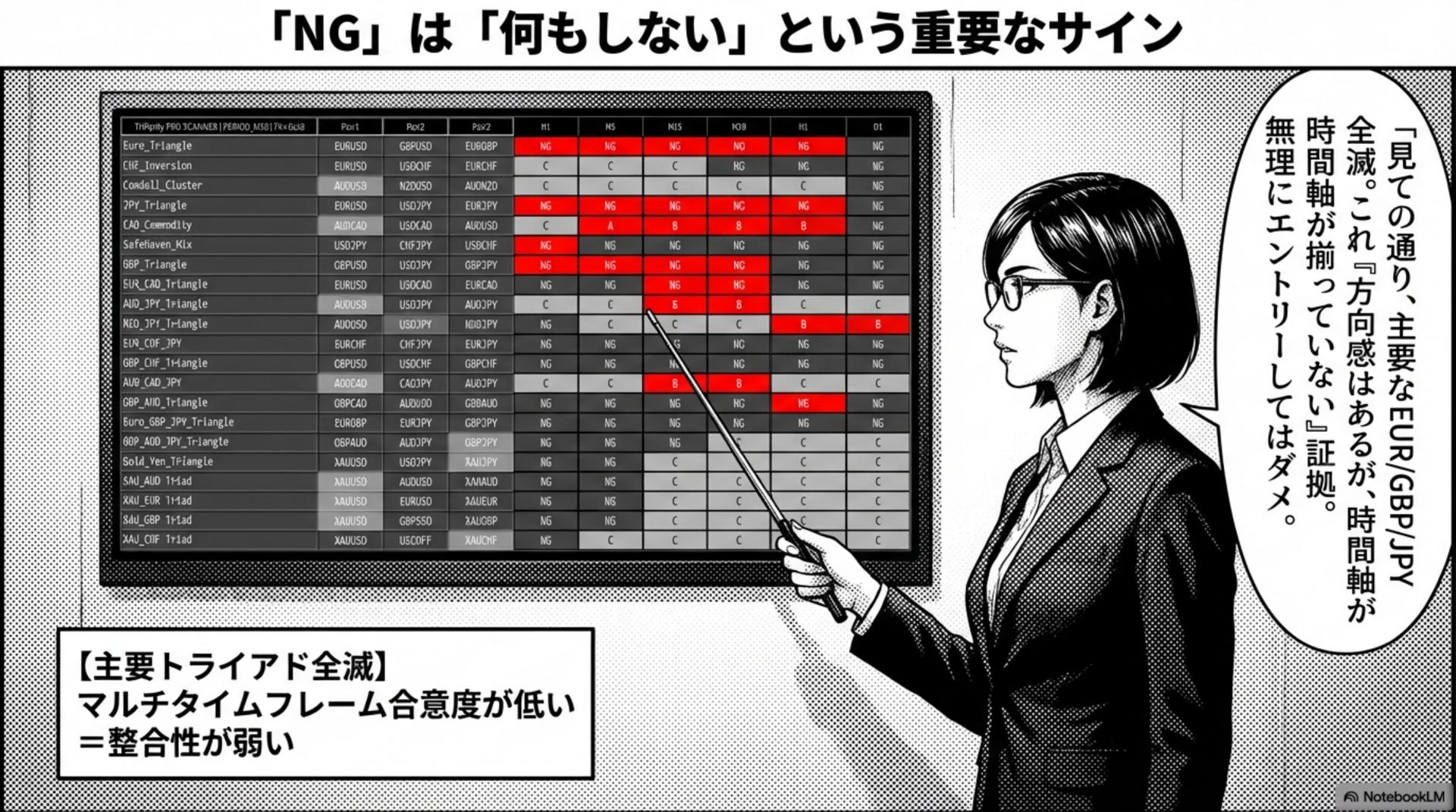

4. NG ≠ zero opportunities; today’s correct action is “do not touch”

NG signals are not a verdict of failure but a sign of condition mismatch. When multiple timeframes do not agree, it’s correct not to enter just to have a reason.

“On days when the market is bad, resting is the job.” — this is the professional’s normal operation.

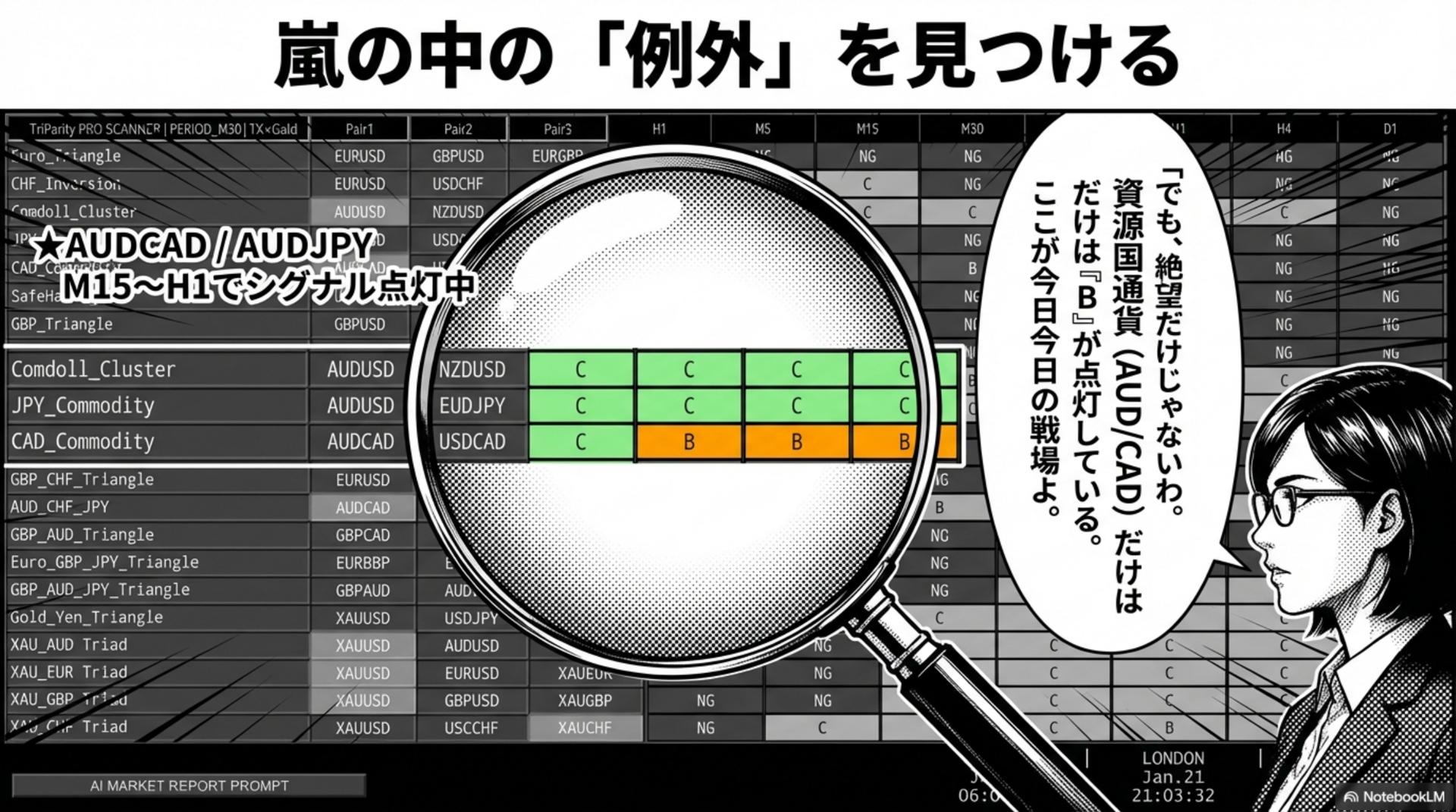

5. The screen may be red, but there are exceptions. Focus only on the relevant zone

A professional’s first task is not to fight the storm, but to find theexceptions (the lit-up spots).

Conclusion:Don’t watch everything. Only watch the lit-up areas.

6. Know in advance when the market-moving switch will be pressed

On days with many indicators or events, evaluations can change rapidly.Do not enter even if alerts go off before/after announcements—this is the rule to avoid accidents.

- Just before/after announcements, stay cautious

- After the calm, confirm whether the same direction continues (avoid false moves)

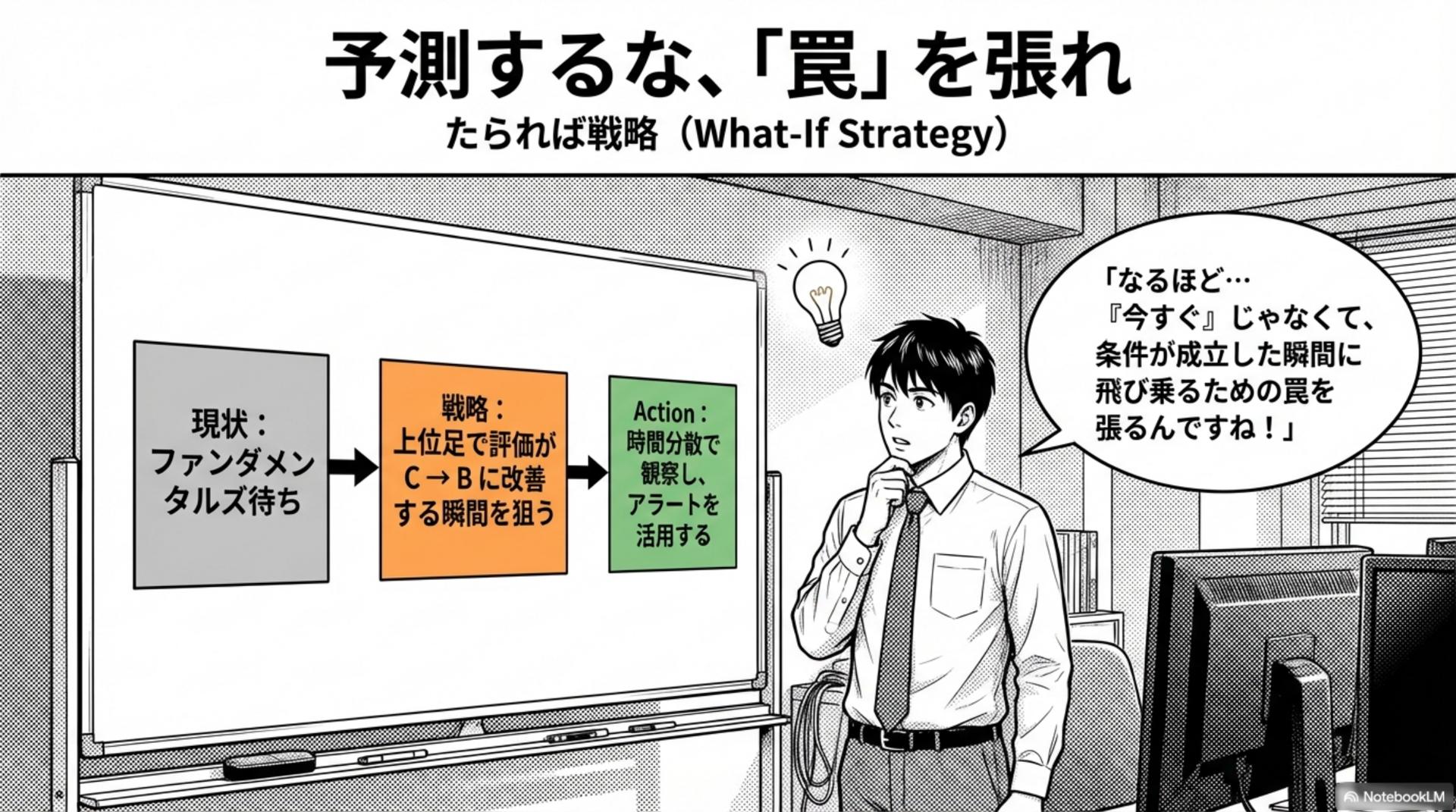

7. Don’t predict. Set traps

What-If Strategy is not about predicting what will happen next, but“If conditions align, this is what I’ll do”—a preplanned waiting strategy.

- Current: waiting for fundamentals(don’t push until materials emerge)

- Strategy: aim for moments of improvement on higher timeframes (C→B or B→A).

- Action: observe with time dispersion + use alerts

8. Scenario 1: AUDCAD (a cross with resources where distortions ease)

- TARGET:AUDCAD

- TRIGGER:Technical evaluation improves (M30 or H1)

- Verification:Dominant remains AUDCAD (the lead hasn’t changed)

- ACTION:Follow the sign of Z_used (align with the tool’s direction)

9. Scenario 2: USDJPY (wait for the moment it returns to the lead)

- TARGET:USDJPY

- TRIGGER:Improvement on H1 or M30

- Verification:Dominant fixed on USDJPY

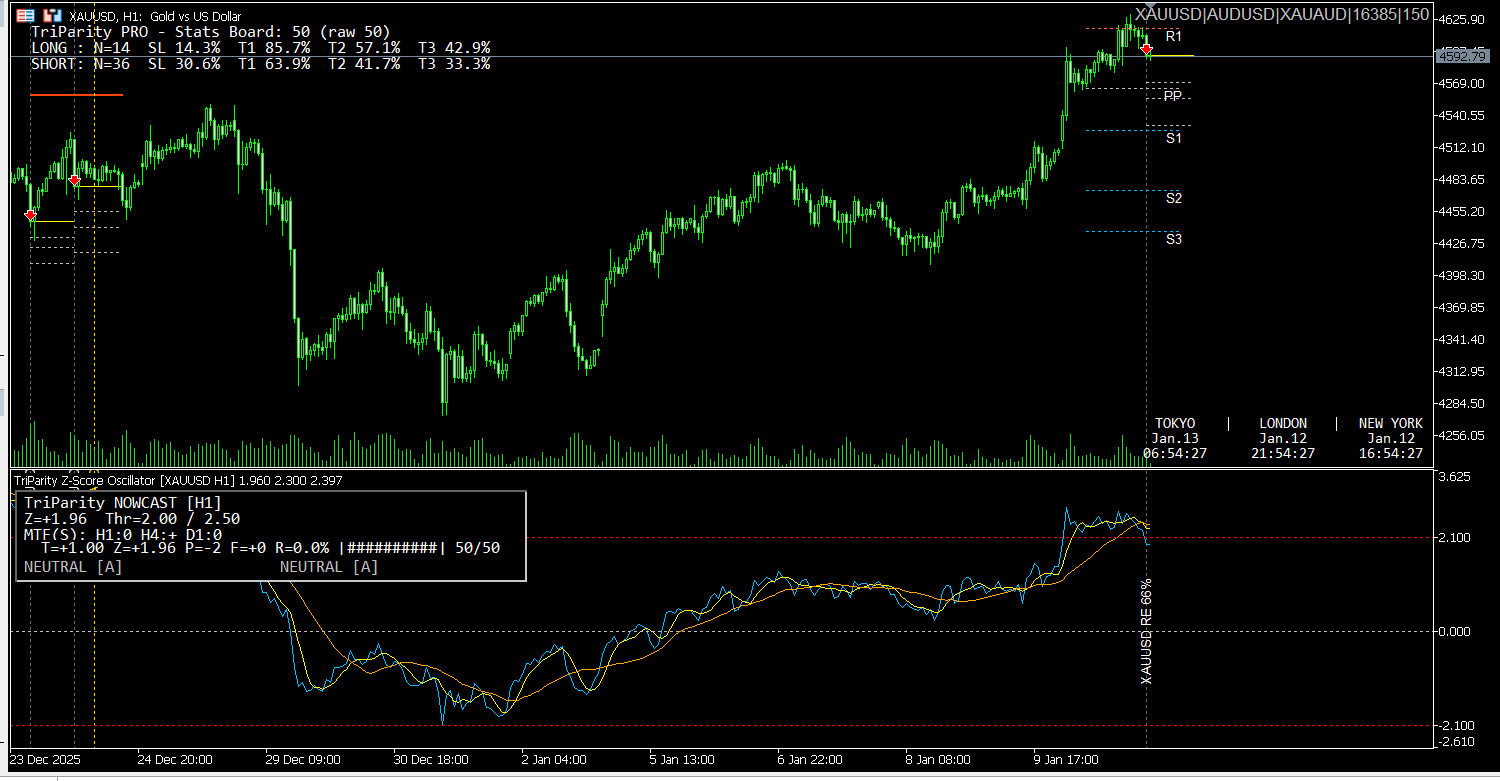

10. Scenario 3: XAUCHF (between safe havens—wait for the move to complete)

Themes that move headlines are safest to evaluate after the move, not exactly at the moment of movement,when the assessment improves and aligns after the move.

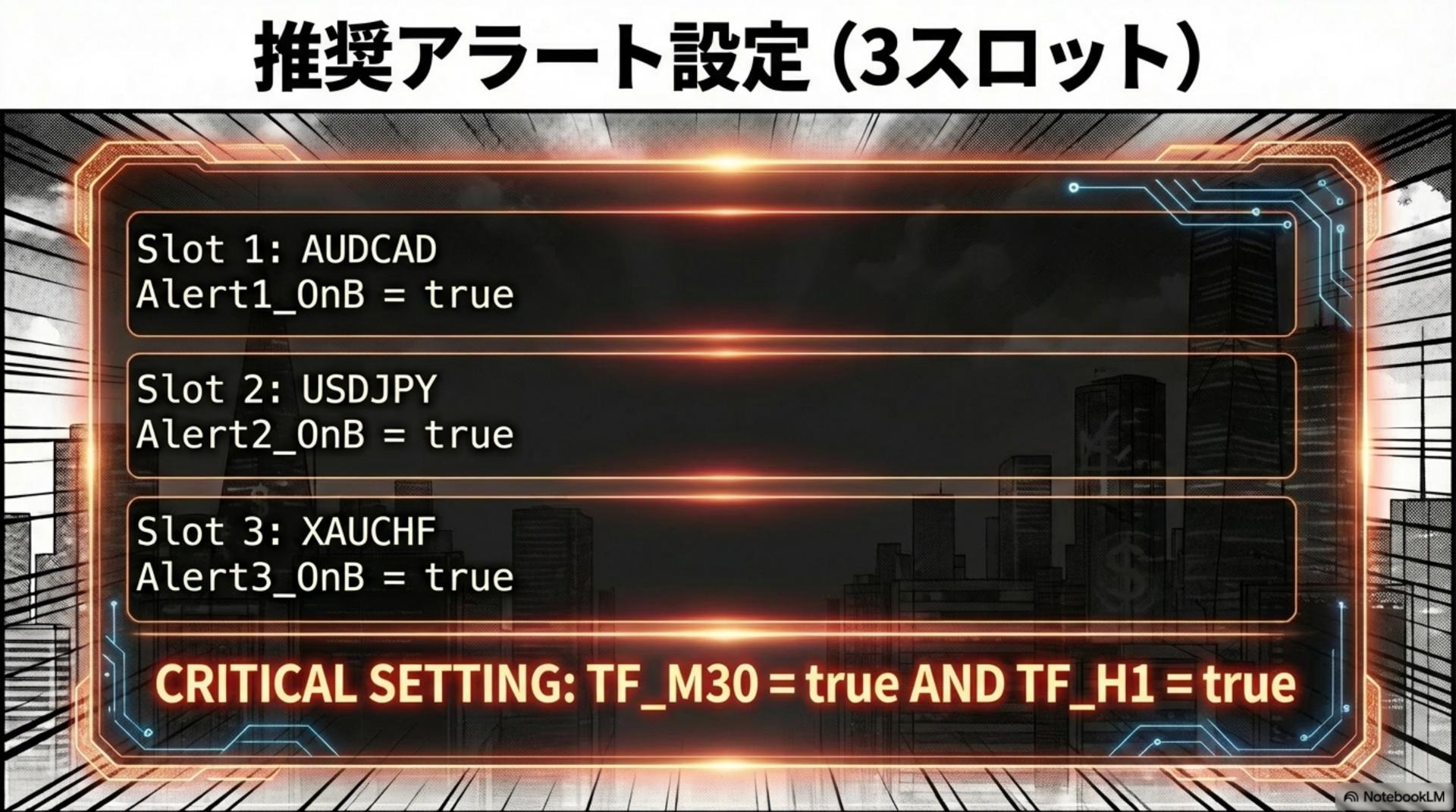

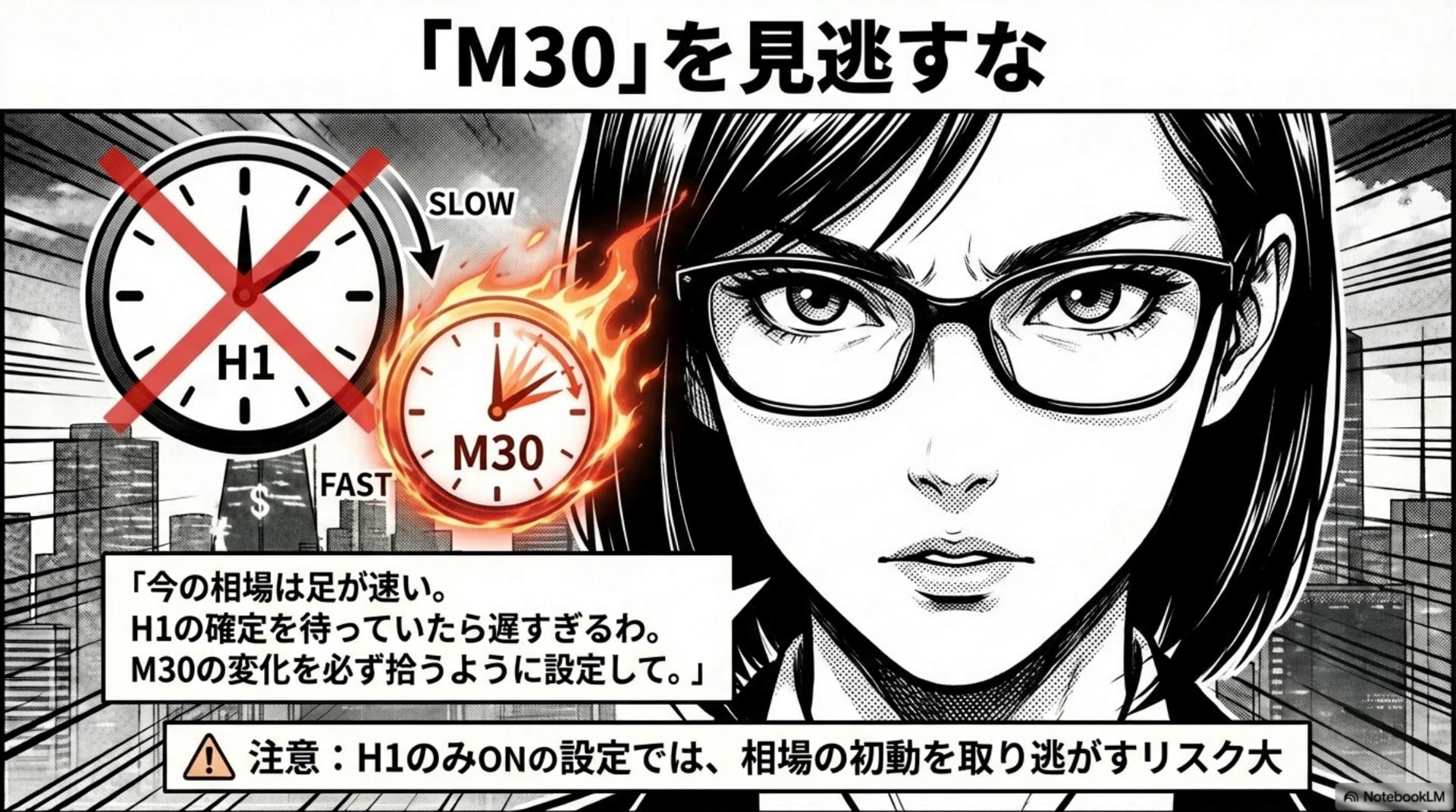

11. Do not wait for H1. Do not miss M30

In a market where the legs are slow, waiting only for H1 can cause you to miss the initial move. Recommended:TF_M30 = true AND TF_H1 = true.

- M30:Catch the spark of the move

- H1:Confirm direction

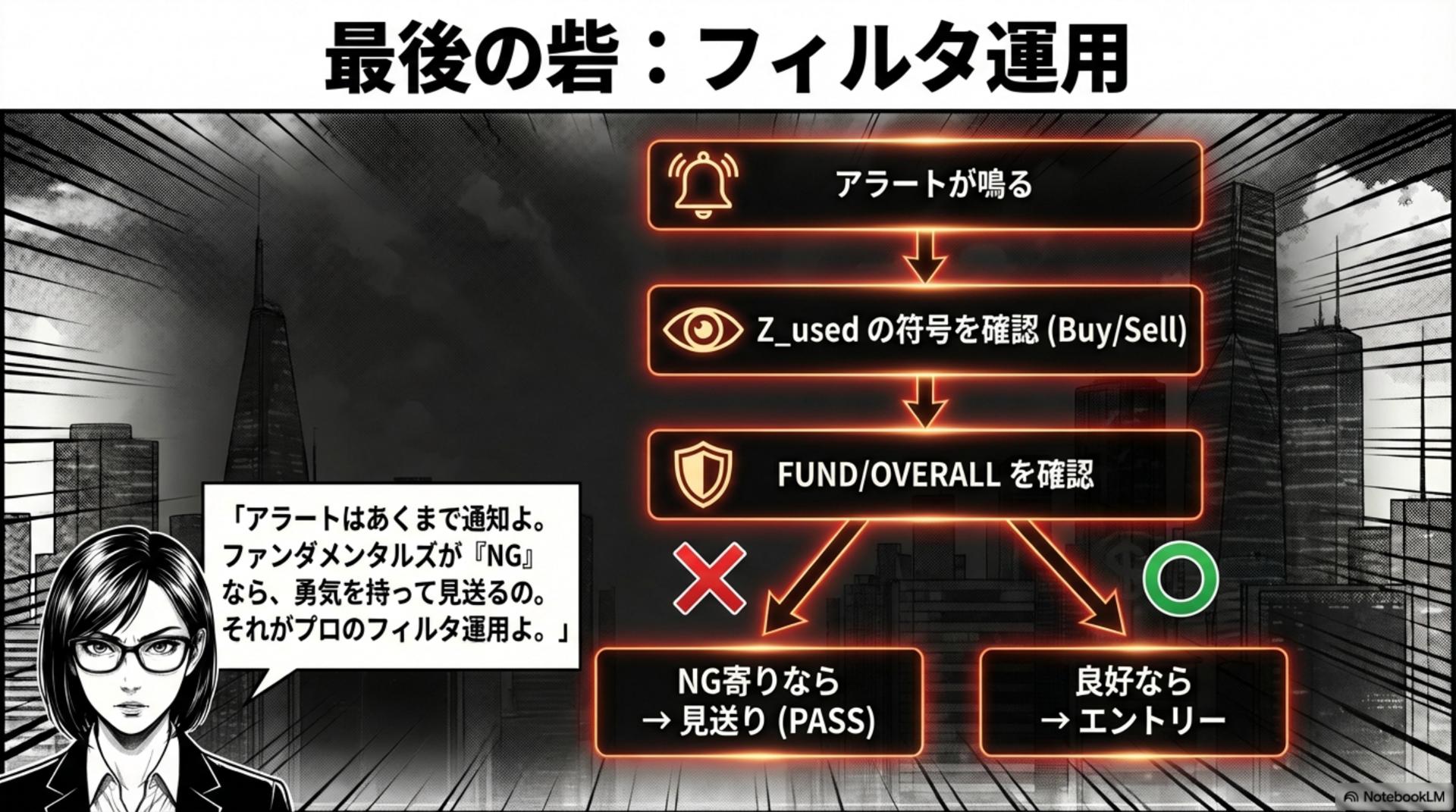

12. Alerts are not commands. Filter at the last line of defense

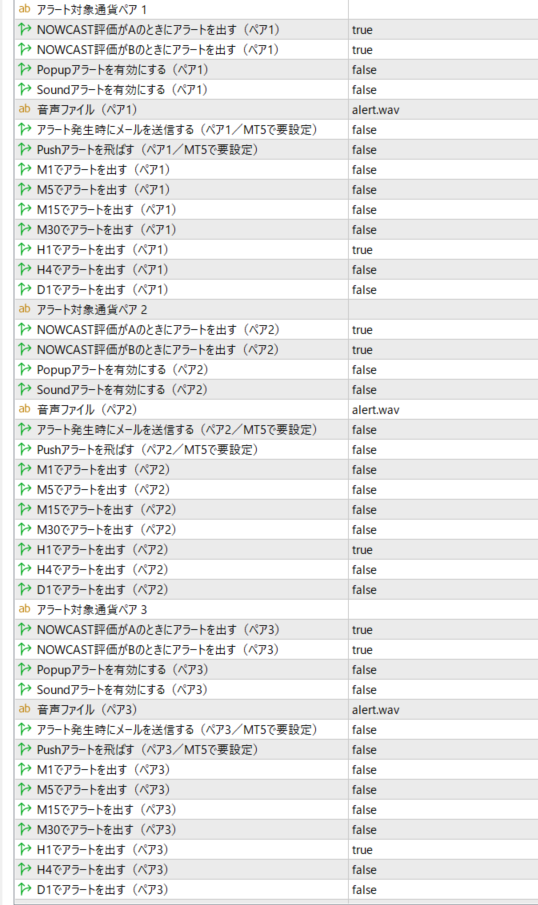

Alerts can be set for up to three currency pairs using the Intervention Ripple PRO_SCANNER indicator parameters.

Alerts are only notifications when conditions align. Always confirm with Intervention Ripple PRO_Catcher (see screenshot below).

- Alerts trigger

- Verify Buy/Sell direction with the sign of Z_used

- Check FUND/OVERALL (if unfavorable, skip)(Individual currency pair AI prompt output available). See article here.https://www.gogojungle.co.jp/finance/navi/articles/107070

- If favorable, enter; if NG, pass

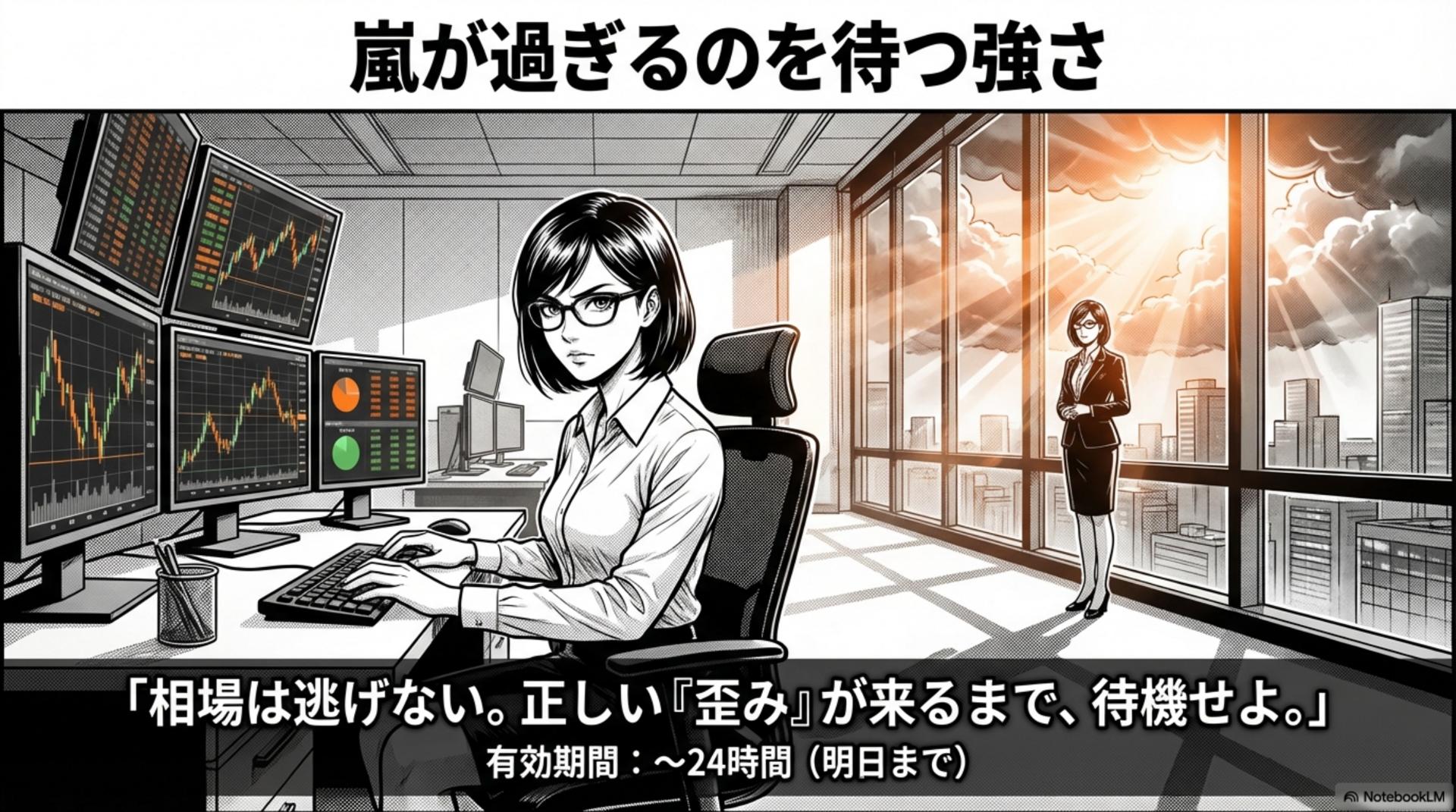

Summary: Strength in waiting for the storm to pass

Trading to weather a difficult market is not about always being in a position. It is a combination of careful preparation, strategic waiting, and disciplined execution.

“The market doesn’t run away. Wait for the correct distortion to arrive.”

Intervention Ripple PRO Campaign is in progress

Product page:https://www.gogojungle.co.jp/tools/indicators/72398

※This document is general information for educational purposes and does not constitute a recommendation to buy or sell any financial instrument. Investment decisions should always be made at your own risk. Signals may change rapidly due to market conditions and indicator announcements.