EA also faced a crushing market! A thorough analysis of why we lost

Dollar-yen, euro-yen, and euro-dollar all had EAs running, but

the results were frankly a big defeat.To be honest, the outcome was a crushing failure.

Why did we lose?

The reason is clear.

My EA is a trend-specialized EA.

It shines when the trend is clearly evident.

However this time,

“The trend seems about to appear”

“Should we go long from here?”

these expectations of mine ran ahead,

and I activated the EA before the market environment was ready.

As a result,USD/JPY moved with a deceptive pattern

and was trimmed by fundamentals.

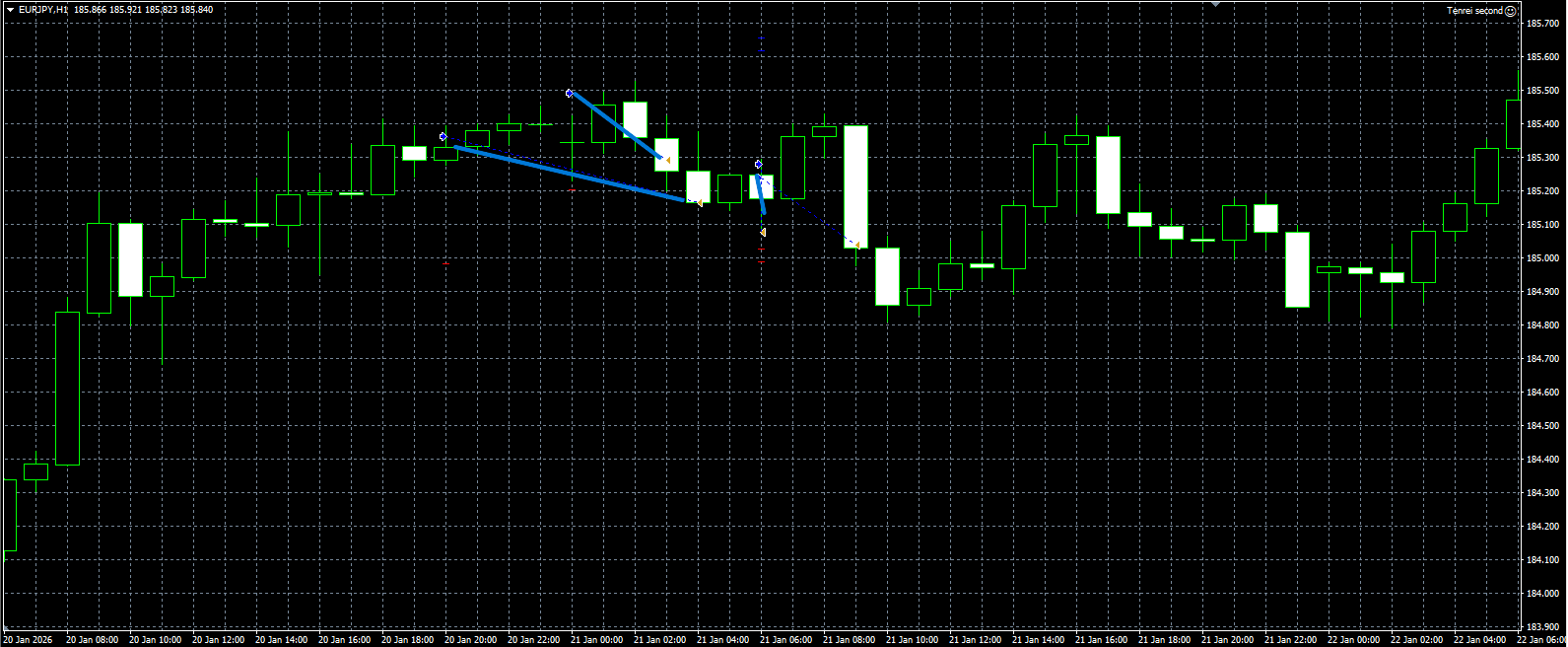

EUR/JPY and EUR/USD saw long positions enter after a sharp riseand then

fell, triggering stop lossesin a sequence of losses.

EUR/USD

As expected, when the market is uncertain, do not run EA.

I reaffirmed that this is a fact that does not change no matter how many times I confirm it.

However this time,

since I set a shallow stop-out width,

I was able to avoid major damage.

If the EA were of the type that takes wide stop-outs,

the market could have led to collapse.

I will calmly reflect,choose the markets carefully,

and continue to accumulate experience.