Trading with only two candlesticks

I am a candlestick FX trader.

Long-term Japanese government bonds yields are rising even further, aren’t they?

By making the consumption tax on foods zero,

there are concerns about Japan's finances,

and it seems government bonds are being sold.

Consumption tax is a stable source of revenue, so

reducing it naturally makes investors concerned about Japan's finances,

which will lead to further yen depreciation and inflation as well.

However, to win elections, perhaps they have no choice but to do it.

Now, I received a question like this the other day.

“I have purchased various signal tools,

but in the end, when selecting signals, discretion is needed,

and I haven't been able to win.

So, is it impossible to win in FX without discretion?”

That is the gist.

We receive these questions quite often,

on the surface we advertise that you just follow the signals, but

in reality, selecting signals often requires discretion,

and many cases demand individual judgment.

Discretion is a decision-making method based on past experience,

so ultimately, unless you have a certain level of experience,

you cannot fully utilize it.

And more troublesome,

markets are always changing,

so there are times when past experience cannot be applied.

If you decide to trade assuming that history will repeat itself simply because it did before,

the market has changed, and it often won’t move the same as before.

In jobs where you worked for a long time at a company, it is common to make discretionary decisions based on individual circumstances,

but in the market, the long-honed discretion can be useless or even counterproductive.

Because of this, I myself am against injecting discretion.

So what should we do? First, we need to understand how price moves.

We must know how the price mechanism works.

Price essentially moves according to the following equation.

If there are more buyers than sellers, the price goes up; if there are more sellers than buyers, the price goes down.

This is what is called supply and demand.

Various people use various technicals and fundamentals to trade,but in essence, price movement can be described by the above equation.

More precisely, this is how price moves.

And now, if you know who buys or sells more,

it will inherently determine which position you should hold.

Historically how price has moved,

how it is technically now,

how fundamentals look,

what the larger timeframes indicate,

these have nothing to do with it.

What matters is who wants to buy or sell now,

which side is larger at this very moment?

That is all that is important.

I trade based on this equation,

so even if the market changes,

I can continue to aim for profits in any market.

And further, this has been distilled into no-discretion logic so that everyone can achieve the same results, which is what is currently offered as our logic.

Moreover, among these, the easiest to learn is

“Ultra-High Win Rate FX Logic”.

This logic follows the above equation and trades purely on supply and demand signals.

You do not need any indicators or large timeframes, nor do you need to consider direction, trend, or range.

It uses only candlesticks for trading, enabling high-win-rate trades.

And to observe supply and demand, it uses only

two candlesticks.

With just these, you can determine which side is larger now and trade with no discretion.

Now, let us see what kinds of trades are actually possible.

This is the market this morning.

In about two hours of trading, I made 6 trades,+351.3 pips.

Profit rate: 100%, all wins.

Entries are determined withtwo candlesticks.

I do not look at indicators at all,

nor do I look at larger timeframes, direction, or environmental recognition-related things,

or anything else like that.

It is all about two candlesticks.

By the way, the exits are also completely discretionary-free,

and here, exits are decided with just one candlestick.

I do not consider market momentum or top signals,

or such things.

I simply look at the shape of one candlestick to exit.

・Entry is two candlesticks

・Exit is one candlestick

That’s all there is to it.

People who have done various market analyses, indicators, or signal tools may find this unbelievable.

But as I mentioned earlier,

if you understand how the price moves,

then indicators and signal tools become unnecessary.

What matters is who wants to buy or sell now, and which side is larger,

that’s all.

If you know that, you can predict the market with high probability thereafter.

And indeed, users who have tried this logic have shared their feedback.

As they say, unnecessary complex analysis is no longer required.

The candlesticks alone can be enough to trade.

Because of this kind of logic, even beginners can quickly aim for profits,

and we have received many more positive testimonials.

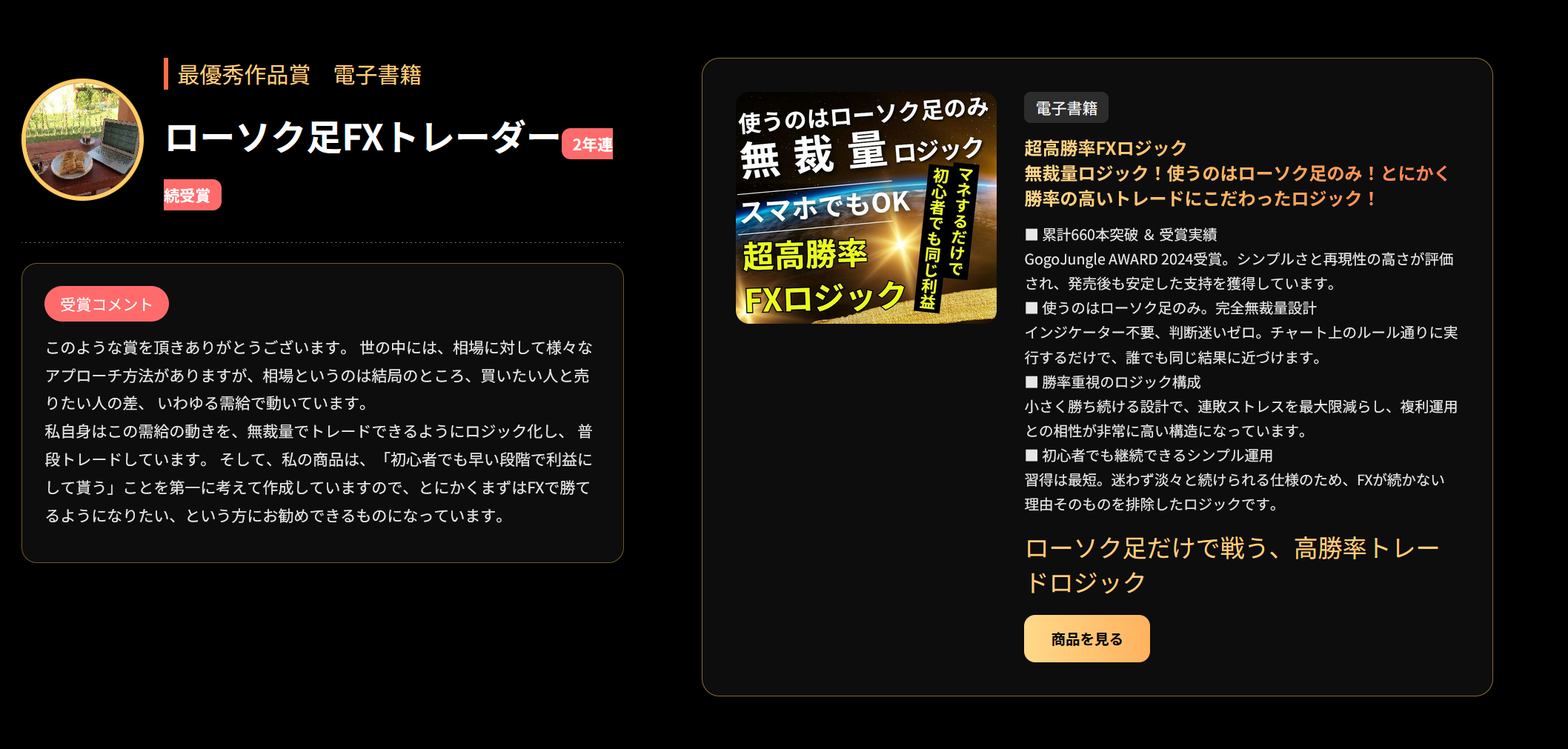

Furthermore,“GogoJungle AWARD 2025”.

.

This logic also received the Best Outstanding Work Award in 2024,,

making it a back-to-back award for two years.

Returning to the initial question,

in markets, winning often seems to require difficult analyses or high discretion,

but that is not true at all,

instead, what matters is

the current market: which side wants to buy or sell more?

which side is larger?

This is what is important.

In fact, that alone is enough.

As markets tend to move, price is governed by the following equation:

If there are more buyers than sellers, the price goes up,

if there are more sellers than buyers, the price goes down.

This is how it moves.

And distilling this to no discretion is what makes

the current.

or using discretionary approaches with environmental recognition,

and still cannot win,

please refer to this article, consider why the market moves,

and how it moves,

and then use this logic,

and I think you will suddenly start winning.

So since you asked about discretion, I have explained in detail.

For more details about the“Ultra-High Win Rate FX Logic”

please see the video below and the free bonus.

In particular, how to maximize compounding is extremely important whether you obtain this logic or not, so please watch!

This is extremely important regardless of whether you acquire the logic.

You will likely discover some surprising facts!

Interview video

https://www.gogojungle.co.jp/info/21975

https://www.gogojungle.co.jp/finance/navi/articles/71349

(The password is provided inside the interview video.)