Release:

01/16/2026 19:15

Update:

01/16/2026 19:15

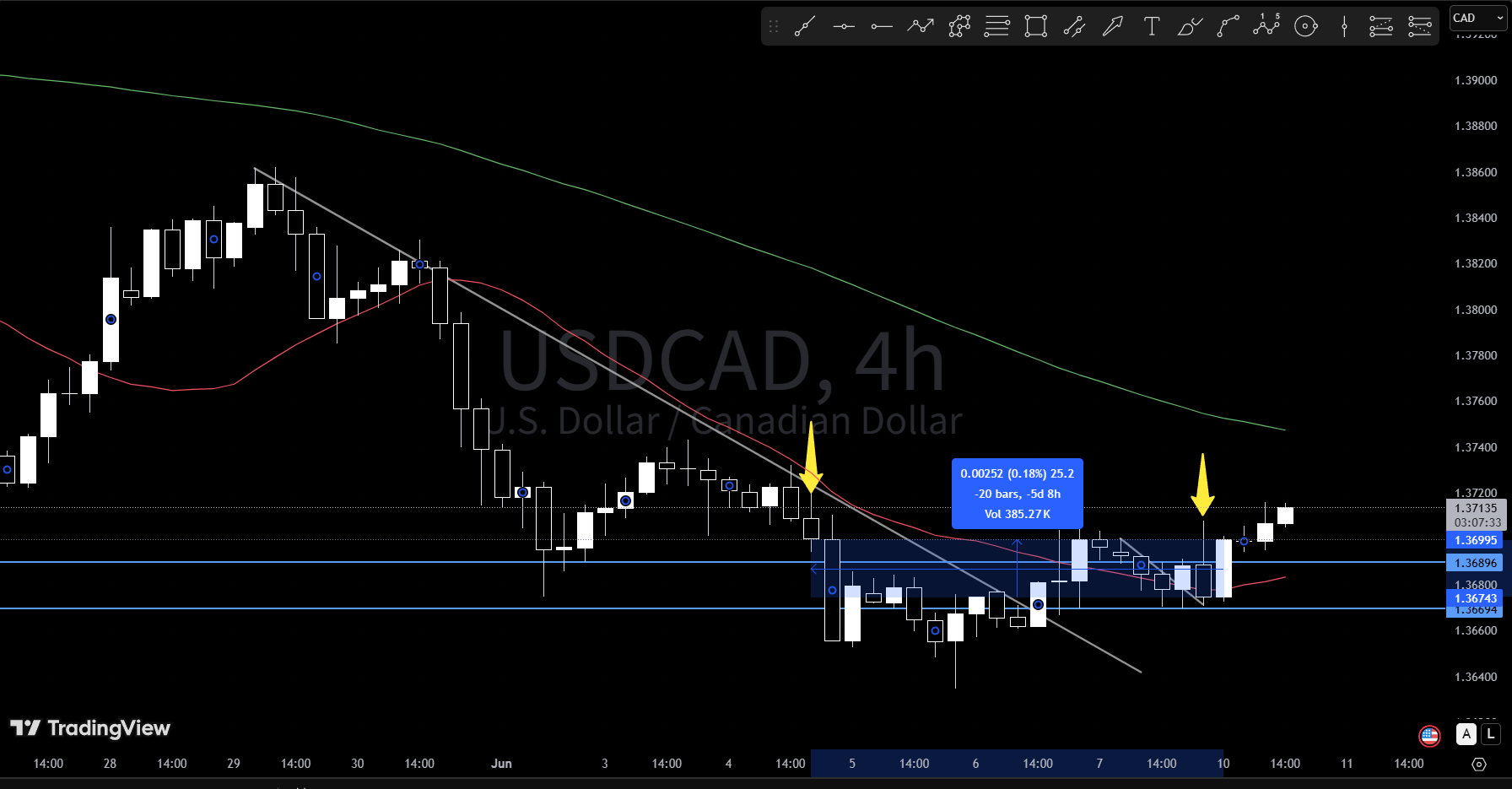

FX Trade History and Basis / Reproducible Buying on Dips and Selling on Rallies [Yoshi - FX]

Daily trading history and rationale (from environmental recognition to entry and exit) are published using trading charts that actually show the history. Naturally, stop-loss and small-profit withdrawals are also disclosed.

Since trading patterns are fixed, once you deeply understand them, it will become a reproducible form of “day trading (a few hours) ~ mid-term trading (holding for a few days).”

—

As you become familiar with environmental recognition and sense of direction, the most important thing will be where to enter and where to exit (taking profit & stop loss) in practice, i.e., concrete maneuvers.

There is no single correct answer in trading, but I hope you treat it as a form of self-check against your own trading, so that in future trades you can engage with the same wave, and make it a daily opportunity to review your trades.

—

This is for reviewing completed trades and learning from them; it does not provide investment advice, and any losses related to investments are entirely your own responsibility. Please use it as one of the resources for improving your trading skills and researching technical analysis.

Monthly subscriptions are only available on the Japanese site.

【Video】1/12~16, FX Real Trade Point Review

× ![]()

From here onward is paid content

Monthly subscriptions are only available on the Japanese site.

Popular articles in the series

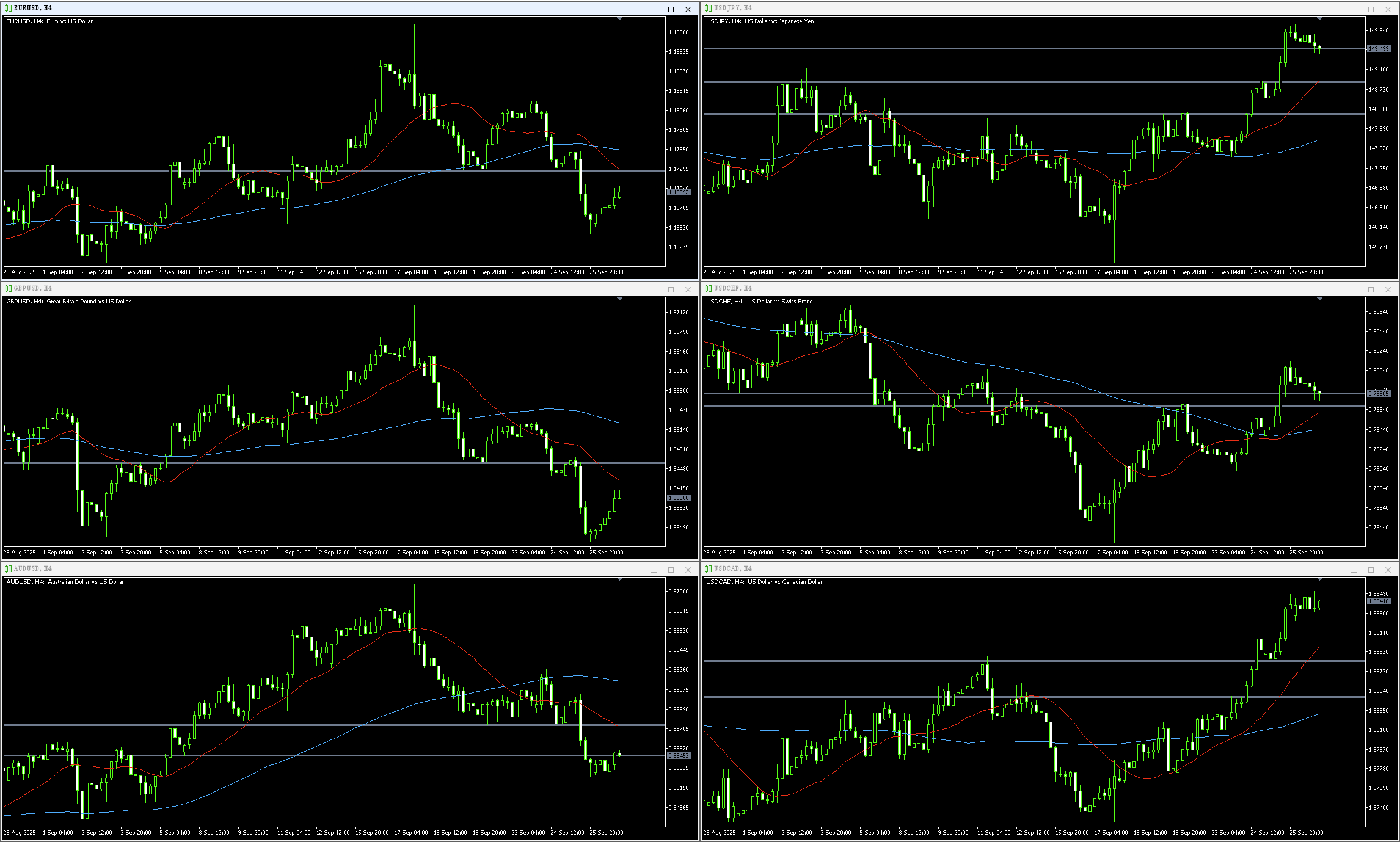

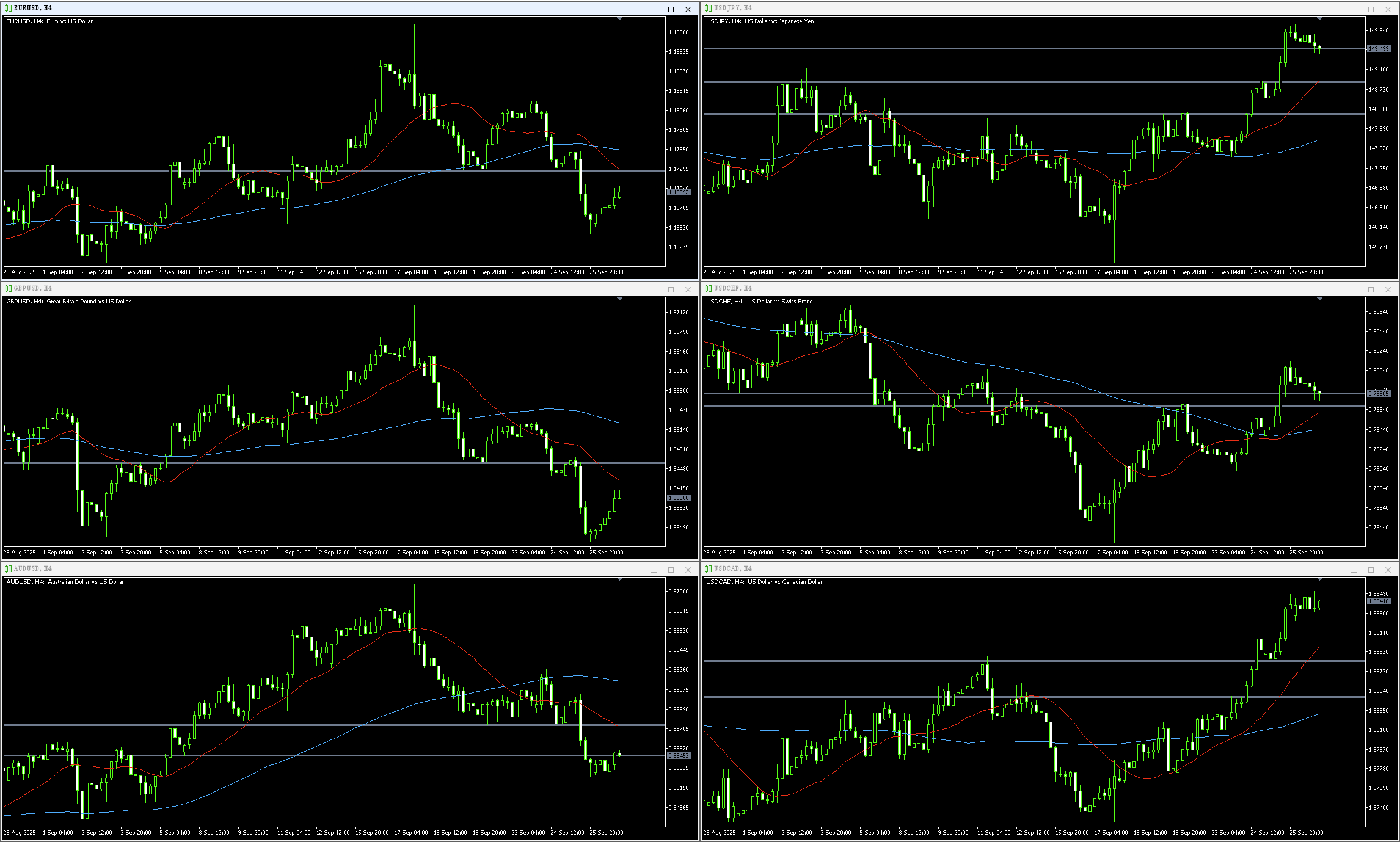

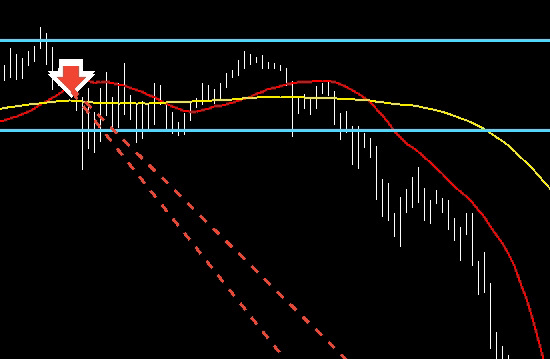

I will introduce the usual flow of environmental recognition.First, I am looking at this screen here

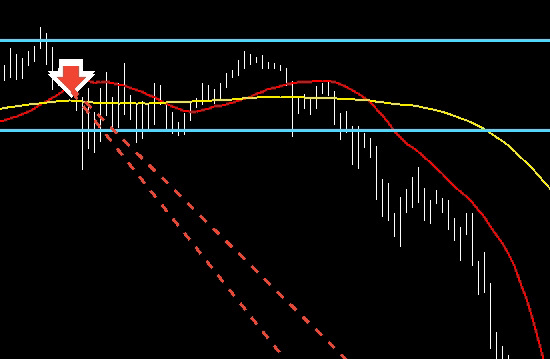

This is not a trade article, but a know-how article.Since the future MA slope can be somewhat antici

I will answer because you asked a question.ーQ Question ↓

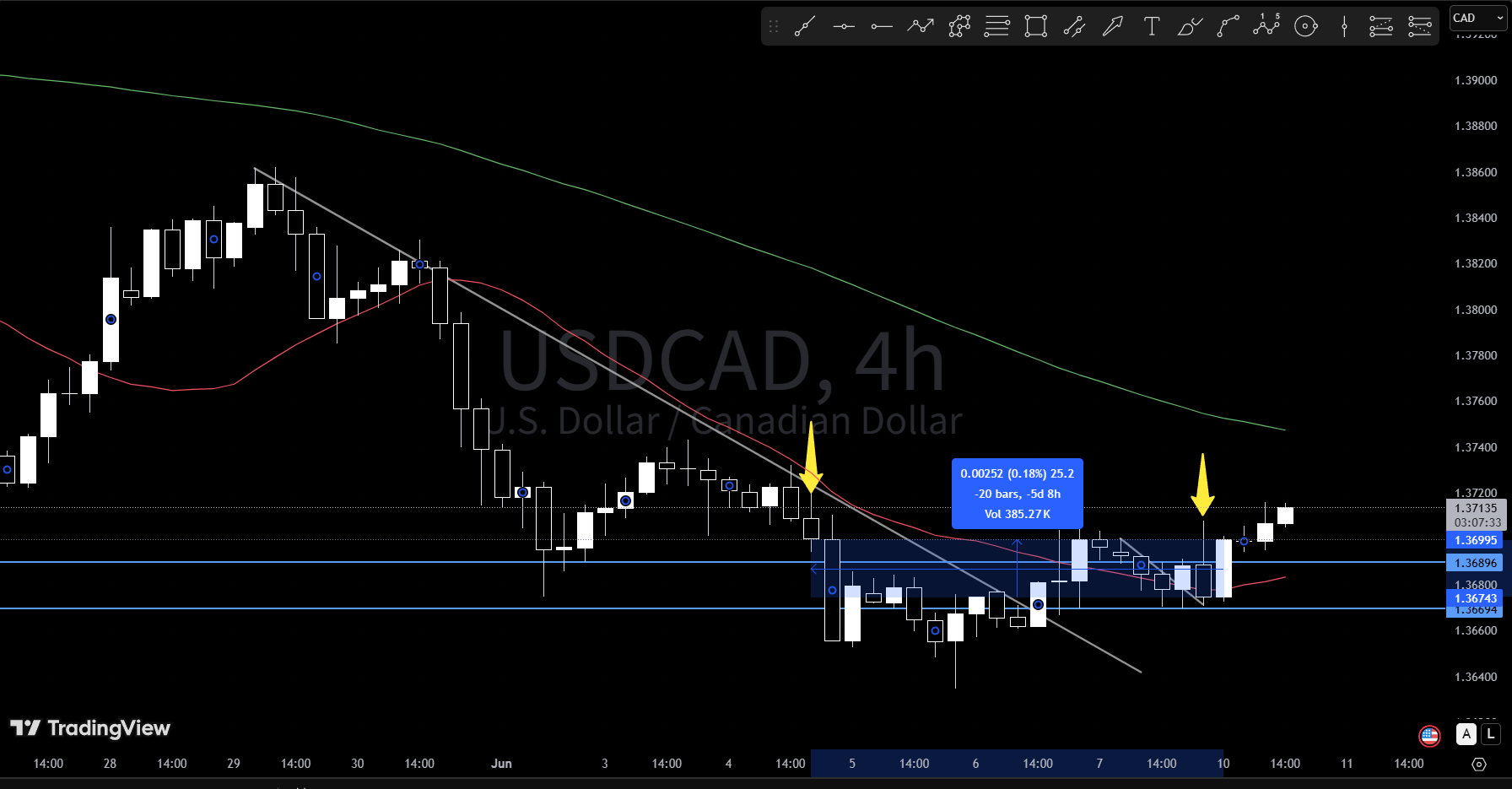

12/6~7 USDJPY Dollar/YenFrom entry to settlement.The moving averages and other notations displayed a

I will introduce the flow of looking at 4h in a simple way through environmental recognition.First,

![]()