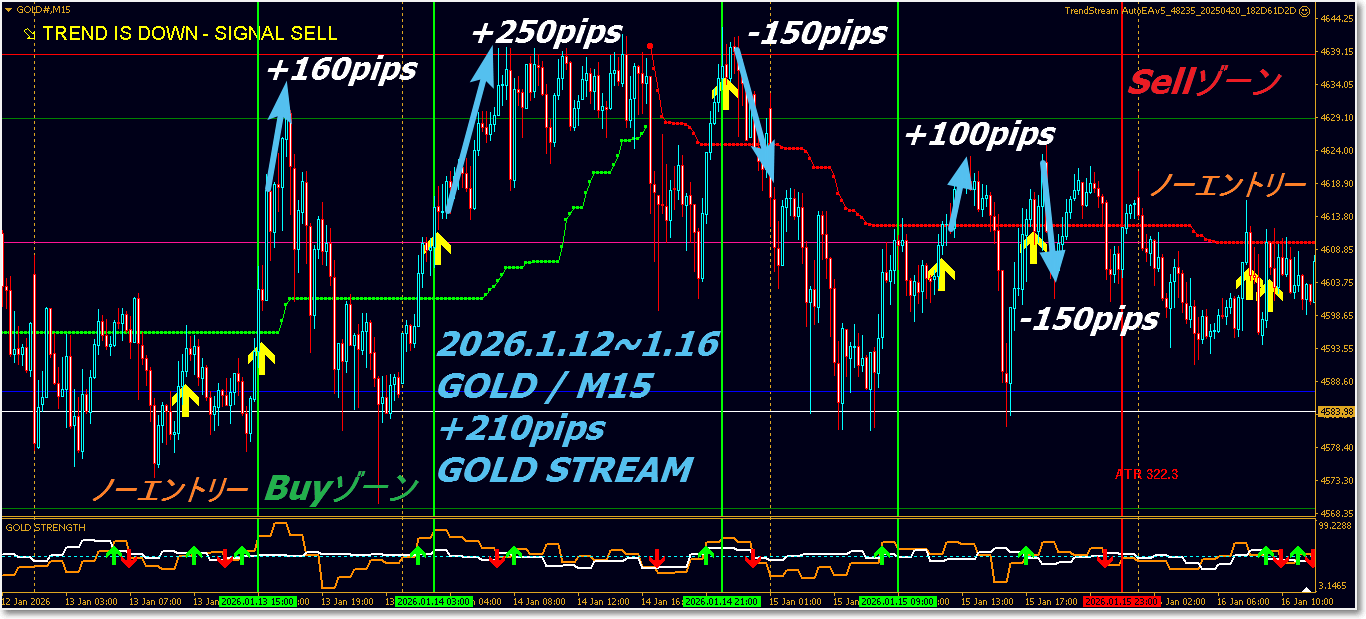

[Last Week's Results] GOLD Day Trading Focused Type "GOLD STREAM" 2026.1.12~1.16

▼【Last Week's Performance】”GOLD STREAM” 2026.1.12~1.16▼

January 12, 2026 (Mon) – January 16, 2026 (Fri)

GOLD (Gold) Market Summary

Price Movement

-

Entering the second week of the year, market participants are becoming more active, but no major trend emerged

-

Aware of the December peak, upside is heavy and downside is limited

-

In the first half of the week, prices softened slightly, but buying on dips supported a rebound

-

Toward the latter half, price movement converged, staying within a narrow range.

-

Volatility was on the decline, making the week lack a clear directional bias

Entering the second week of the year, market participants are becoming more active, but no major trend emerged

Aware of the December peak, upside is heavy and downside is limited

In the first half of the week, prices softened slightly, but buying on dips supported a rebound

Toward the latter half, price movement converged, staying within a narrow range.

Volatility was on the decline, making the week lack a clear directional bias

Demand and Supply / Investment Factors

-

On US monetary policy, new information was scarce, with a cautious wait-and-see mood intensifying

-

Although expectations for a rate cut at the start of the year remain, much has already been priced in

-

Geopolitical risks and concerns over global economic slowdown continue to exist, supporting gold's floor

-

On the other hand, there was no rapid capital inflow into safe-haven assets as risk appetite did not deteriorate sharply

On US monetary policy, new information was scarce, with a cautious wait-and-see mood intensifying

Although expectations for a rate cut at the start of the year remain, much has already been priced in

Geopolitical risks and concerns over global economic slowdown continue to exist, supporting gold's floor

On the other hand, there was no rapid capital inflow into safe-haven assets as risk appetite did not deteriorate sharply

Investment Trends

-

Institutional investors rebalanced positions and showed a stance of avoiding aggressive trading

-

Short-term traders reduced trading frequency as volatility shrank

-

Medium-to-long-term investors remained bullish but were cautious about new entries

-

Overall market sentiment favored a “wait-and-see” attitude

Institutional investors rebalanced positions and showed a stance of avoiding aggressive trading

Short-term traders reduced trading frequency as volatility shrank

Medium-to-long-term investors remained bullish but were cautious about new entries

Overall market sentiment favored a “wait-and-see” attitude

Overall Assessment

-

Gold prices this week were in a consolidation phase after a strong uptrend

-

Downside was solid, but further upside required new catalysts

-

Medium-to-long-term bullish structure remains, but short-term upside potential was limited

Gold prices this week were in a consolidation phase after a strong uptrend

Downside was solid, but further upside required new catalysts

Medium-to-long-term bullish structure remains, but short-term upside potential was limited

AI Answer: Best Trade During This Period

■ Conditions Overview

-

Average true range (ADR) for the week: approximately 700 pips

-

Assumed environment:

-

There is movement, but not a sustained one-way trend

-

A series of pullbacks and corrections

-

Volatility is high, but the difficulty is also high

Average true range (ADR) for the week: approximately 700 pips

Assumed environment:

-

There is movement, but not a sustained one-way trend

-

A series of pullbacks and corrections

-

Volatility is high, but the difficulty is also high

■ Reasonable / Recommended pips Target

◎ Reasonable Line (Pass)

-

+70〜+140 pips

-

Week range 10〜20%

-

Entry without forcing, enabling high reproducibility

+70〜+140 pips

Week range 10〜20%

Entry without forcing, enabling high reproducibility

◎ Recommended Line (Quite Good)

-

+140〜+210 pips

-

Week range 20〜30%

-

Environment awareness and timing both favorable

-

Risk management likely functioning well

+140〜+210 pips

Week range 20〜30%

Environment awareness and timing both favorable

Risk management likely functioning well

◎ Very Excellent

-

+210 pips plus

-

Week range 30% or more

-

Accurate capture of trend initial move and key moments

-

However, validation of reproducibility is essential

+210 pips plus

Week range 30% or more

Accurate capture of trend initial move and key moments

However, validation of reproducibility is essential

■ Why not aim for all 700 pips

-

Most actual price movements are

-

Sudden spikes

-

Indicators / breaking news

-

These can lead to

-

Slippage

-

Adverse riskmaking consistent profits difficult

Most actual price movements are

-

Sudden spikes

-

Indicators / breaking news

These can lead to

-

Slippage

-

Adverse riskmaking consistent profits difficult

Profitable to secure only 20–30% of price range safely

■ Trading stance recommended during this period

-

Do not chase after a move is extended

-

Wait for pullbacks and retracements

-

Focus on 1–2 high-probability trades

-

Don't overextend, evaluate weekly total

Do not chase after a move is extended

Wait for pullbacks and retracements

Focus on 1–2 high-probability trades

Don't overextend, evaluate weekly total

■ Overall Conclusion

-

In a 700-pip price movement environment,

-

taking around 100 pips is already reasonably valid

-

taking 150–200 pips is a strong performance worth recommending

-

There is no need to target more every week,

whether you can consistently lock in profits is the most important

In a 700-pip price movement environment,

-

taking around 100 pips is already reasonably valid

-

taking 150–200 pips is a strong performance worth recommending

There is no need to target more every week,

whether you can consistently lock in profits is the most important

Trade Result Analysis

Last week's GOLD STREAM trade aligns with the AI's evaluation,It is a max scenario,“◎ Recommended Line (Quite Good)corresponding to +210 pips.

SILVER Market Summary

Silver, like gold, lacked a clear direction, continuing the consolidation after December’s sharp rise. Price action settled into a range with a market environment focused on short-term trading. While industrial demand supported a floor, heightened high-price caution prevented a strong upside breakout.

▼【Last Week's Performance】”GOLD STREAM” 2026.1.12~1.16▼

GOLD / M15 Day Trading-Focused

What is GOLD STREAM?

Main Features of GOLD STREAM

1. Designed for GOLD (XAUUSD) only

GOLD STREAM is optimized for GOLD's volatility characteristics and correlation structure

a dedicated short-term day-trading system.

It emphasizes responsiveness and consistency that are hard to achieve with generic tools.

2. Two-stage notification: Ready → Signal

-

Ready (Preparation) notification

Notifies in advance when conditions are starting to align -

Signal (Confirmation) notification

Notifies when entry decision conditions are met

This prevents missed signals and impulsive actions, enabling calm execution after preparation.

3. "Strength / Correlation" analysis integrated into a sub-window

What GOLD traders need

-

Relative strength

-

Confirmation of correlation direction

-

Signal strength

is displayed in a sub-window without repainting for quick confirmation.

No need to open other charts or apps.

4. Pivot Line Auto Display

Pivot Line display clarifies price targets.

-

Day trading: based on daily pivot

-

Targets for range-trading opportunities: based on weekly pivot

Based on GOLD's unique price movements, you can visually grasp realistic take-profit levels.

5. ATR-based automatic exit logic (Trailing TP/EA)

Free trailing EA automatically sets optimized TP based on ATR (Average True Range).

-

Basic risk-reward target of 1 : 2 or better

-

In range-bound markets, auto trailing preserves unrealized profits

Greatly reduces decision fatigue from discretionary exits.

6. Supports mobile entries

Entries: possible on mobile

-

Exits: trailing EA handles TP / SL / trailing automatically

After entry, profit-taking and stop decisions are delegated, enabling steady trading.

7. Design to Support Skill Mastery in Trading

GOLD STREAM aims not only for short-term results but also

-

identifying advantageous market moments

-

developing proper risk-reward sense

-

suppressing unnecessary entries

This design aims to establish the essential trading skills needed to keep winning.