USD/JPY remains firm around the 158 level following solid U.S. economic data.

【1/15Market Overview

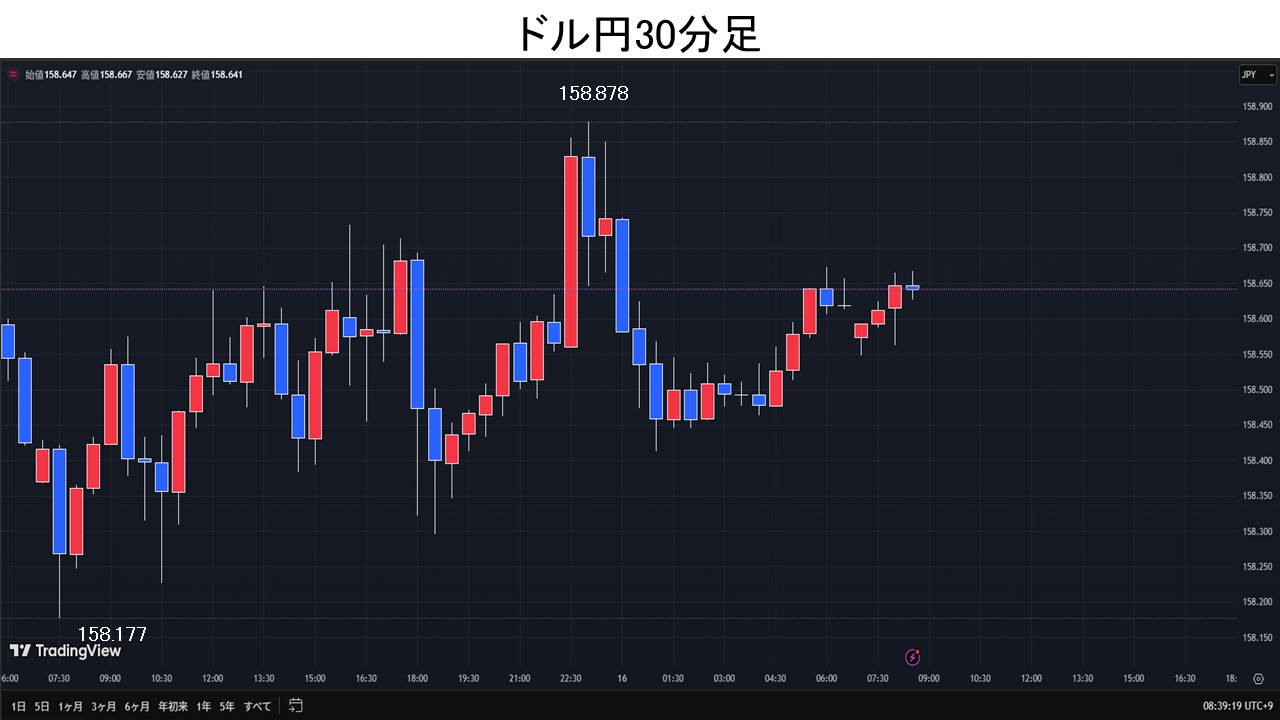

During Tokyo time, when the U.S. Treasury announced that "U.S. Secretary of the Treasury Yellen mentioned in a meeting with Finance Minister Kasuyama that 'excessive exchange rate fluctuations are undesirable,'" the dollar/yen briefly fell to158.17yen. After that, it recovered with no clear direction to158.65yen. In European trading hours, reports that the Bank of Japan is increasingly wary of the yen’s depreciation affecting prices and the economy, and that while next week’s BOJ Monetary Policy Meeting is expected to keep policy unchanged, further yen depreciation could quicken the pace of future rate hikes, led to yen buying and dollar selling, pushing the dollar/yen to158.30yen. In the NYtime,1month U.S.NY Fed Manufacturing Index for January and the Philadelphia Fed Manufacturing Index for January exceeded expectations, and U.S. initial jobless claims for the previous week were stronger than expected, leading to dollar buying and pushing the dollar/yen to158.87yen. After a round of buying, concerns over possible government and BOJ currency intervention led to profit-taking and rebound selling, pushing the pair down to158.41yen.

【1/16Market View