【January 14, 2026】Ten to Chi Series: 3 Types × Chart Verification (EUR/JPY)

This time, EURJPY (EURJPY) chart validation will be explained. For environment recognition, we will mainly explain the DaySwing chart and for entry triggers, the Prime Combo Signal.

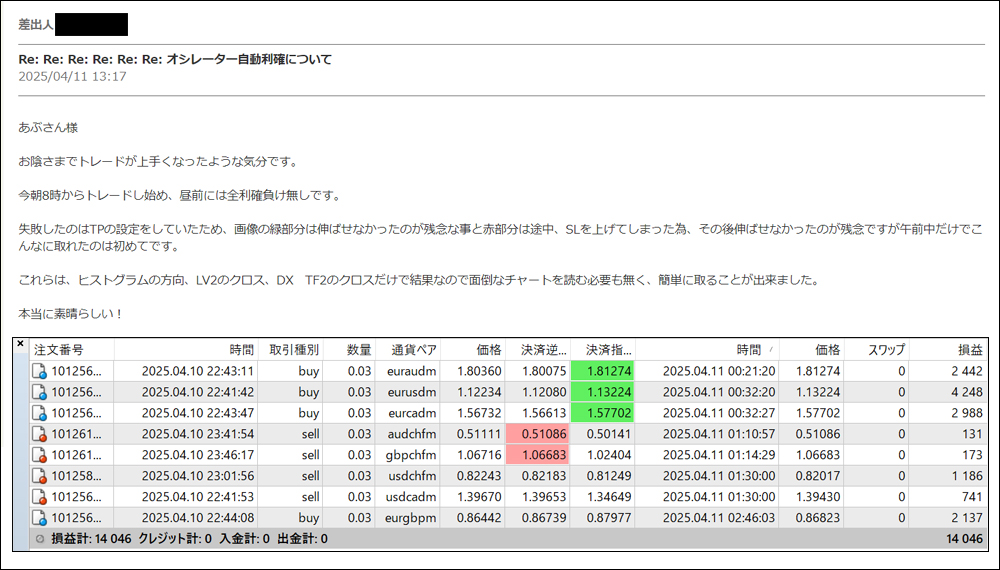

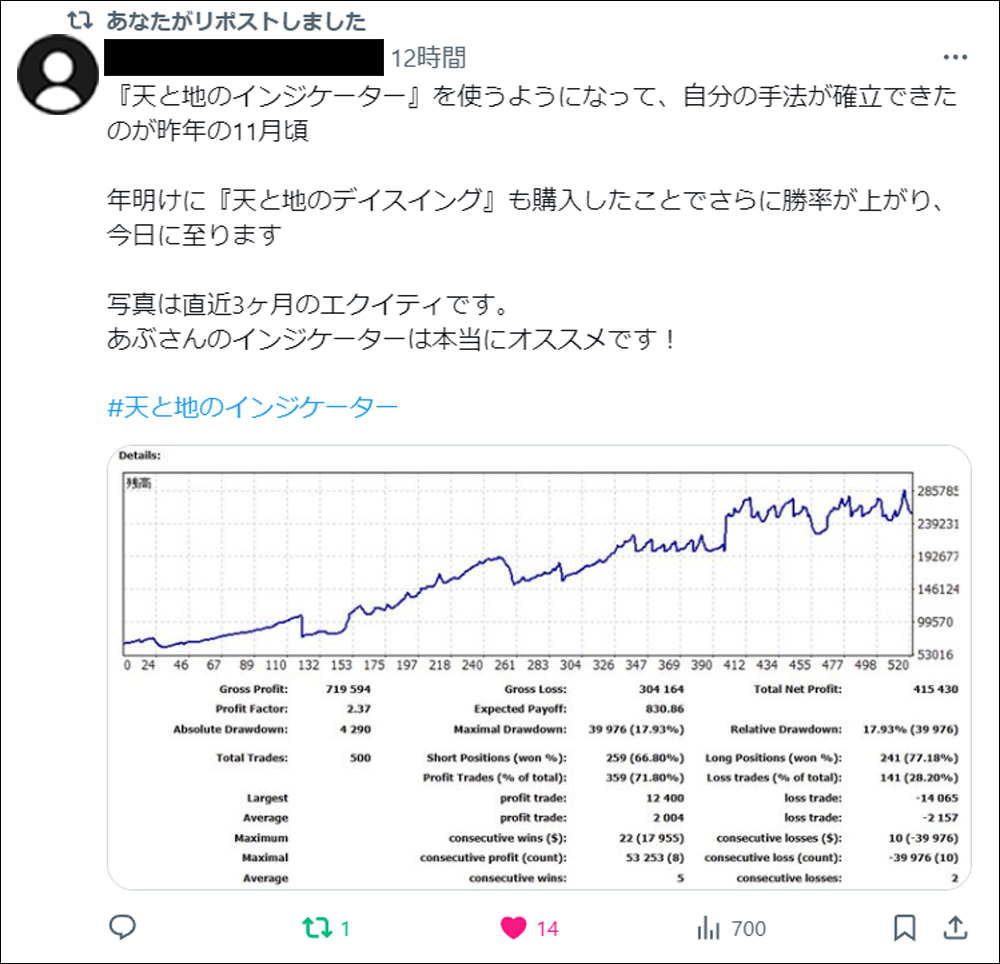

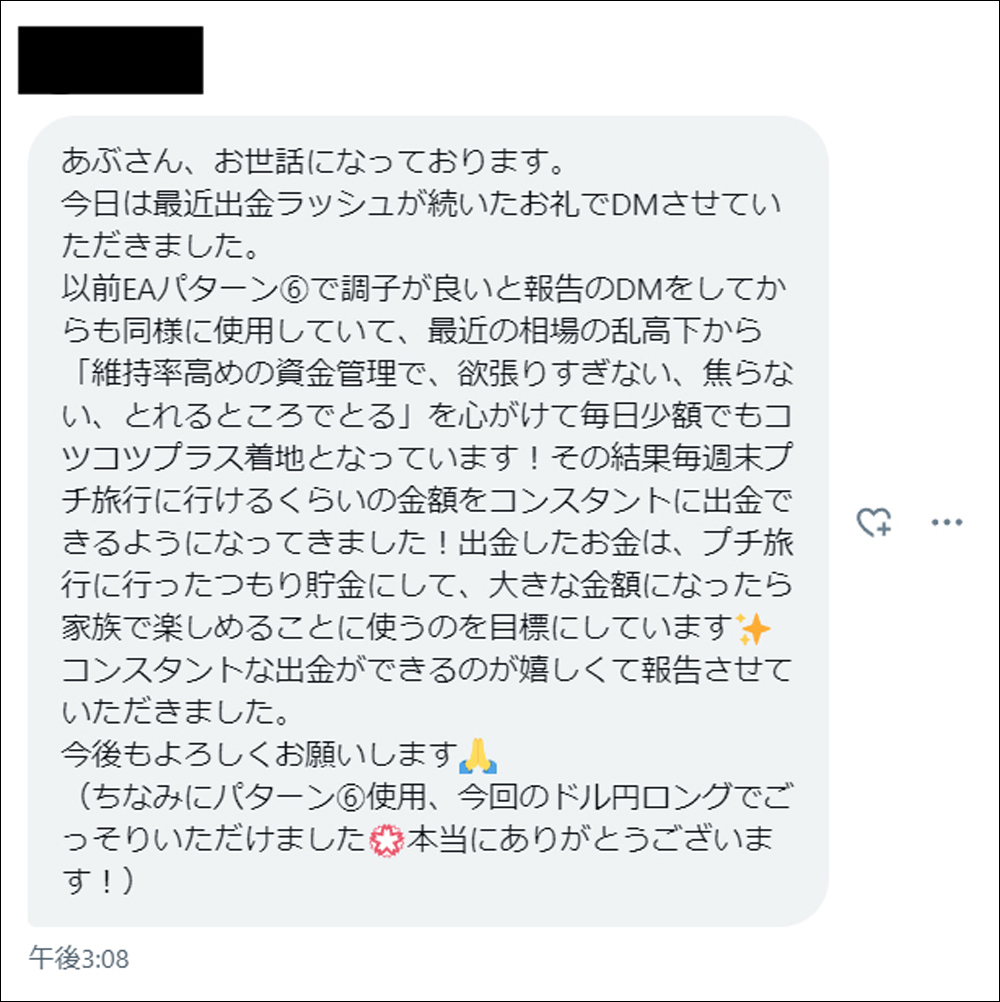

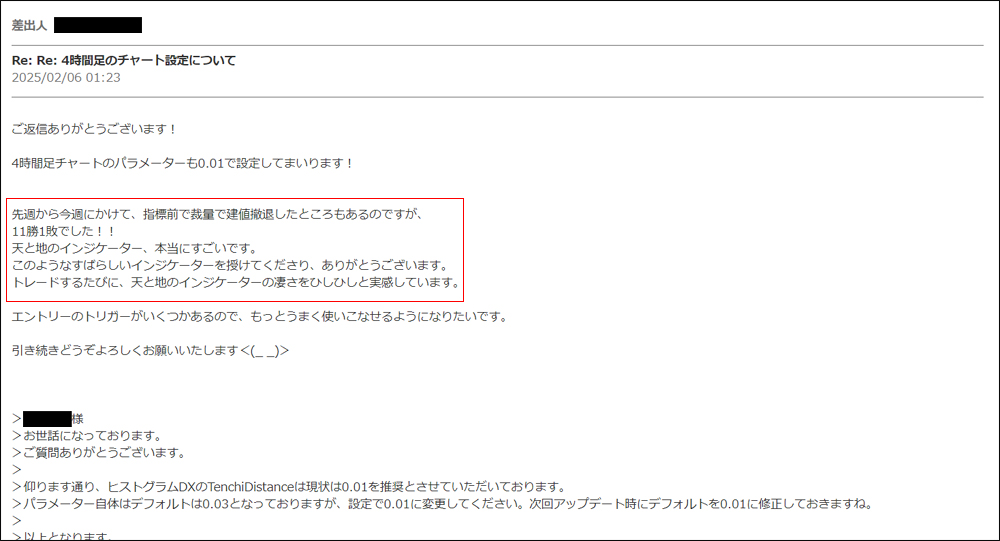

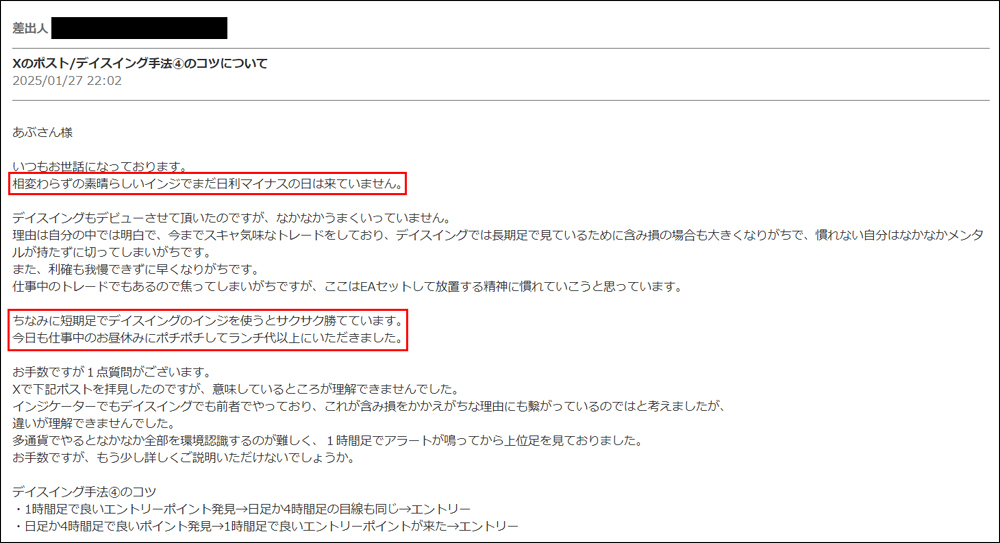

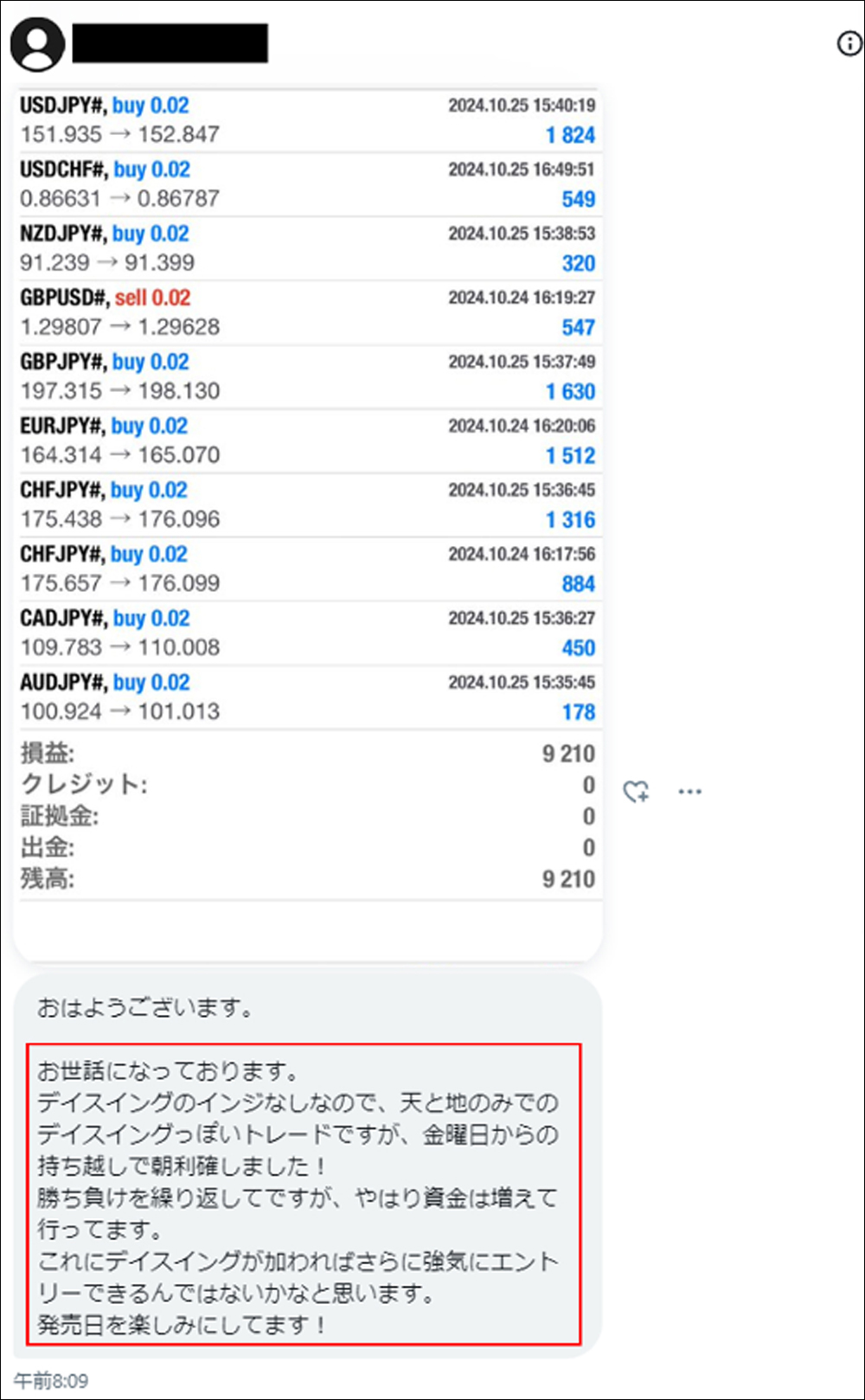

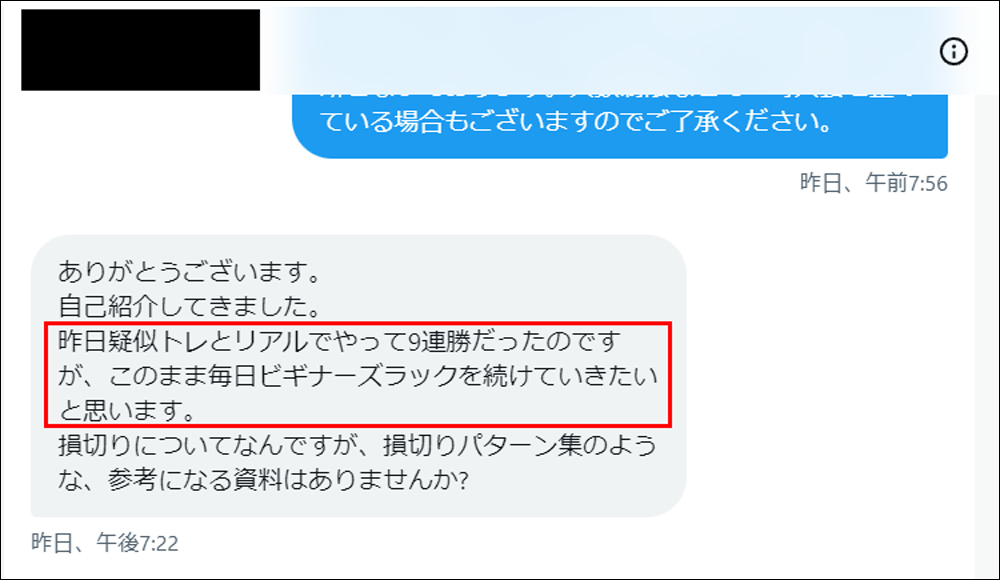

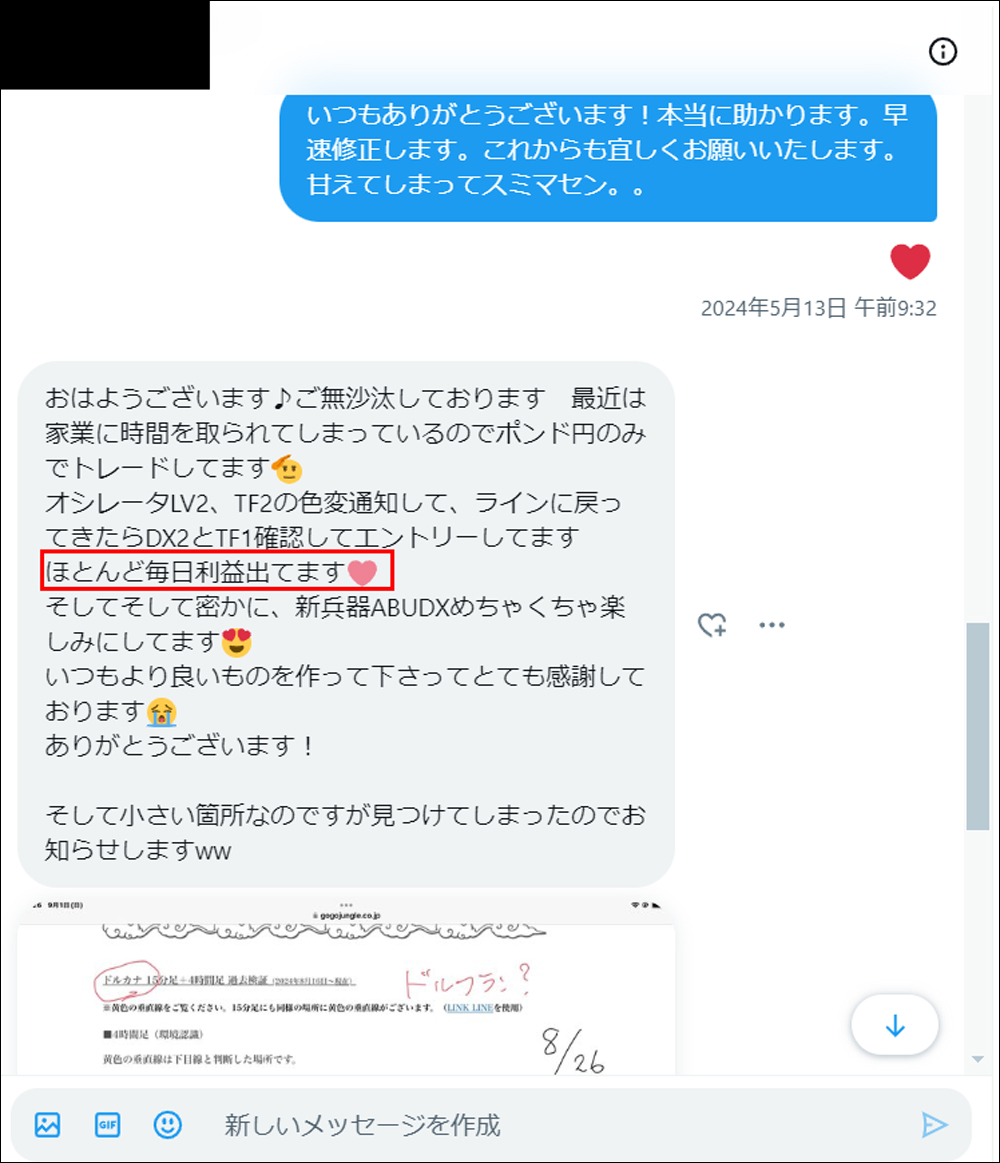

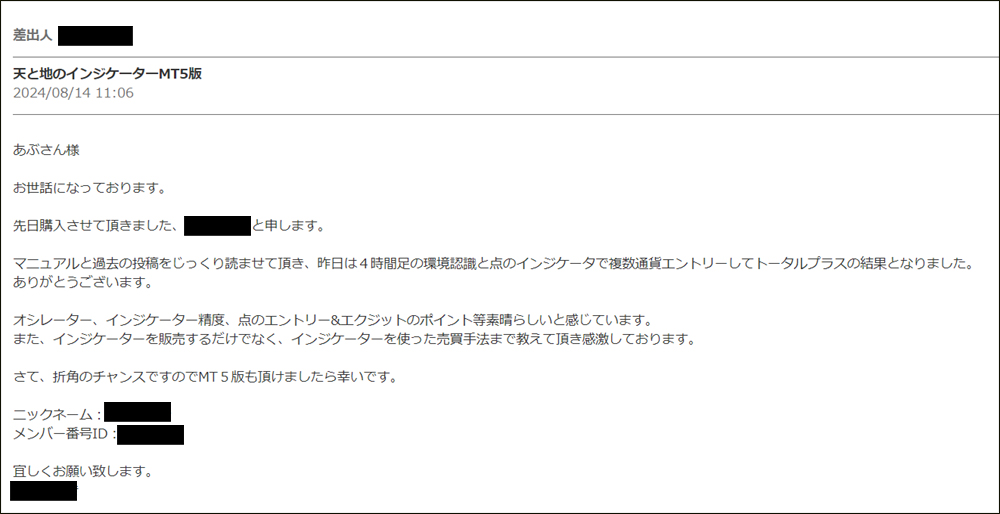

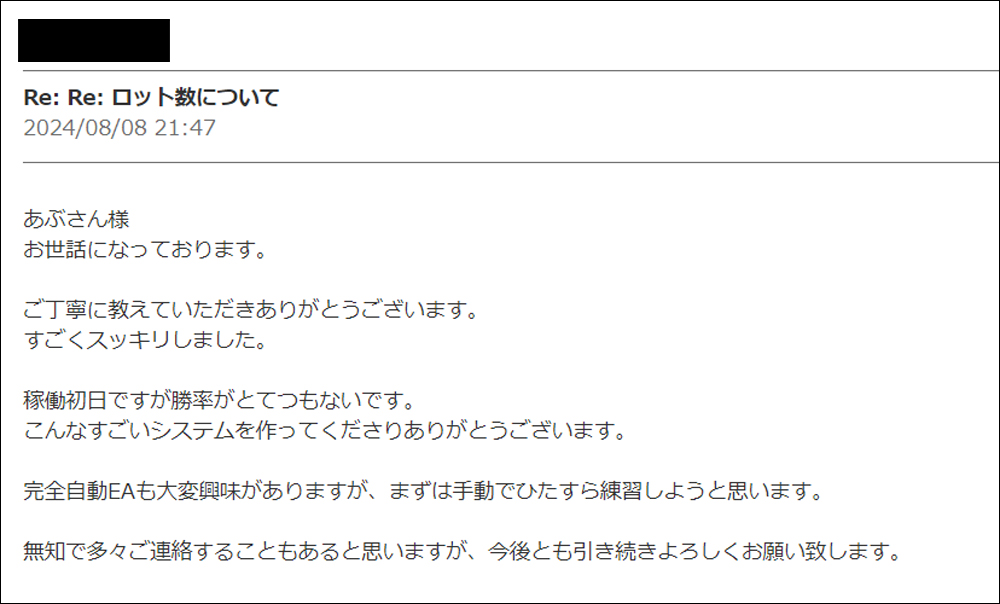

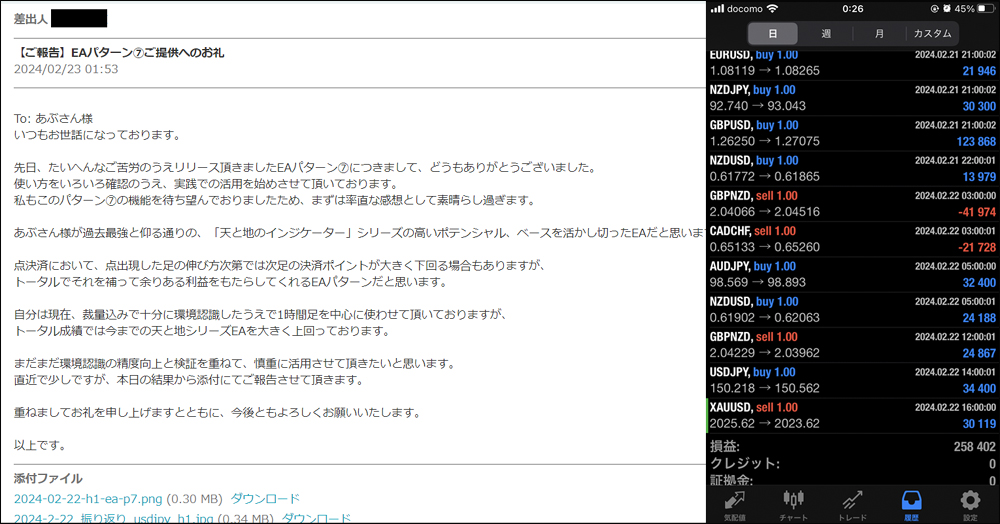

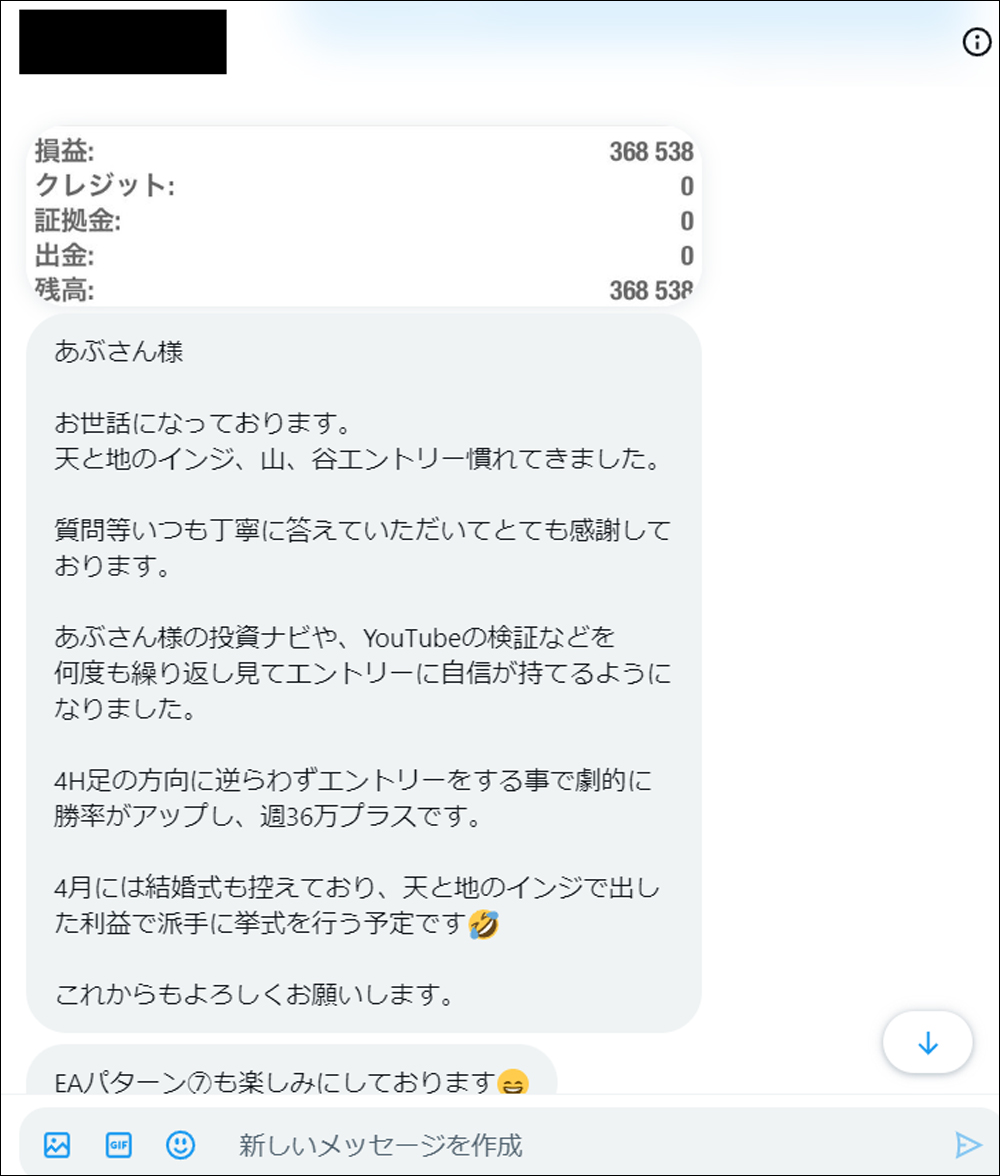

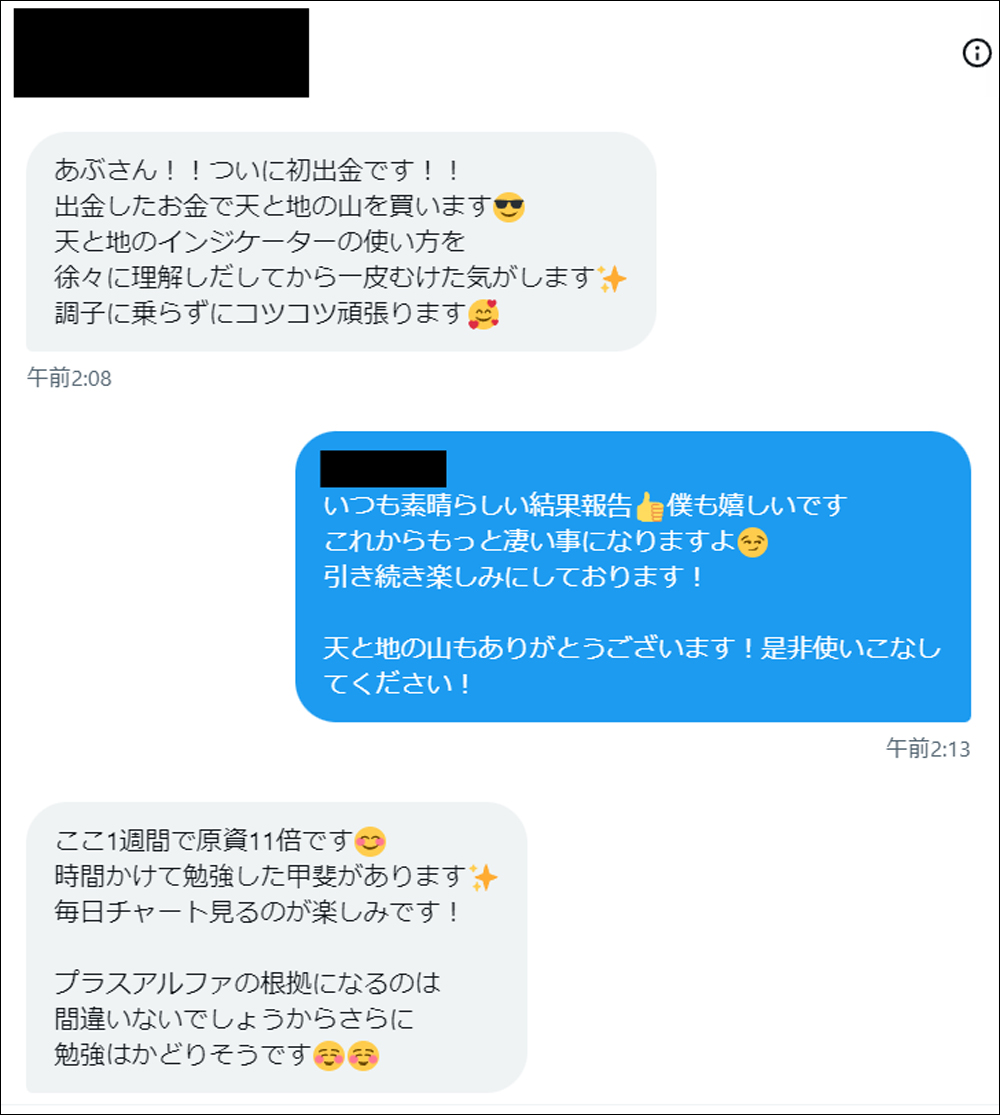

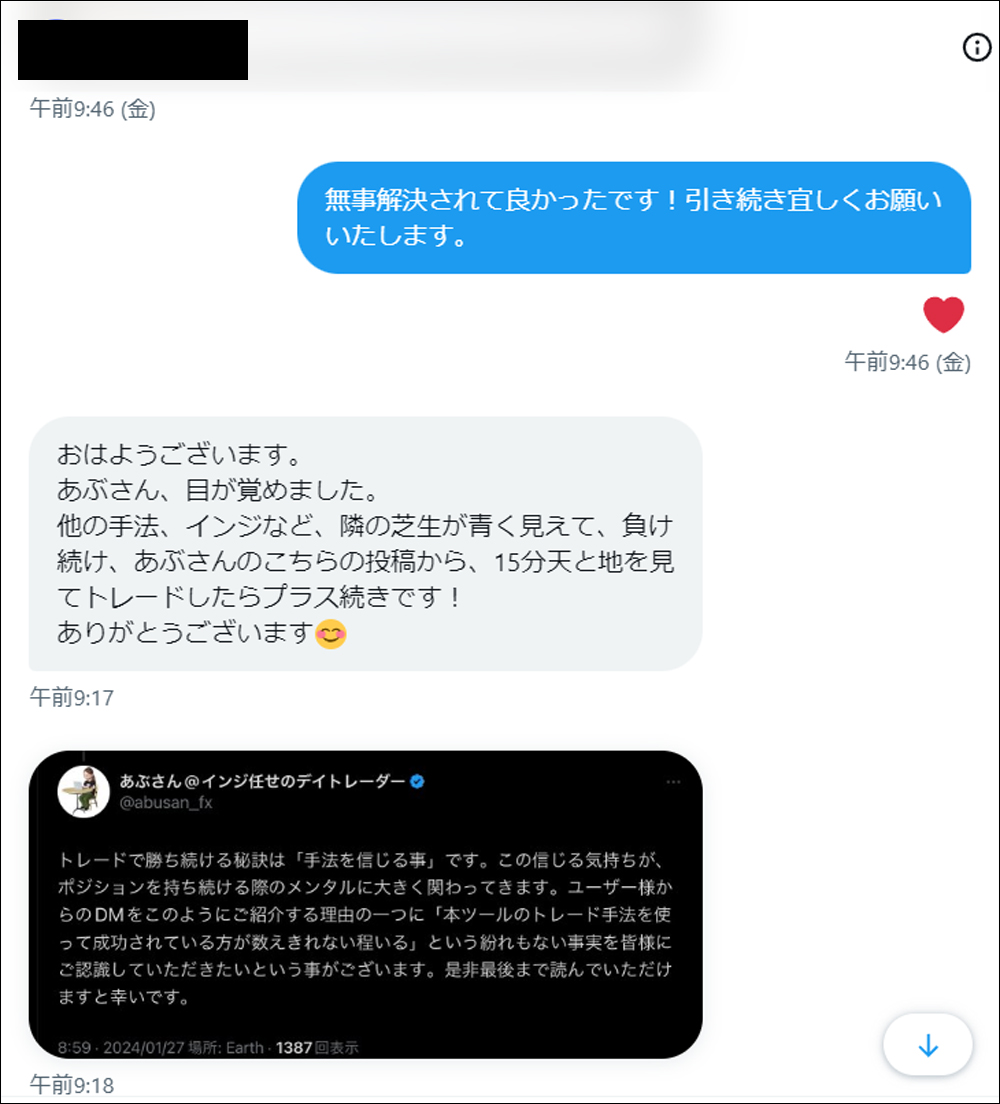

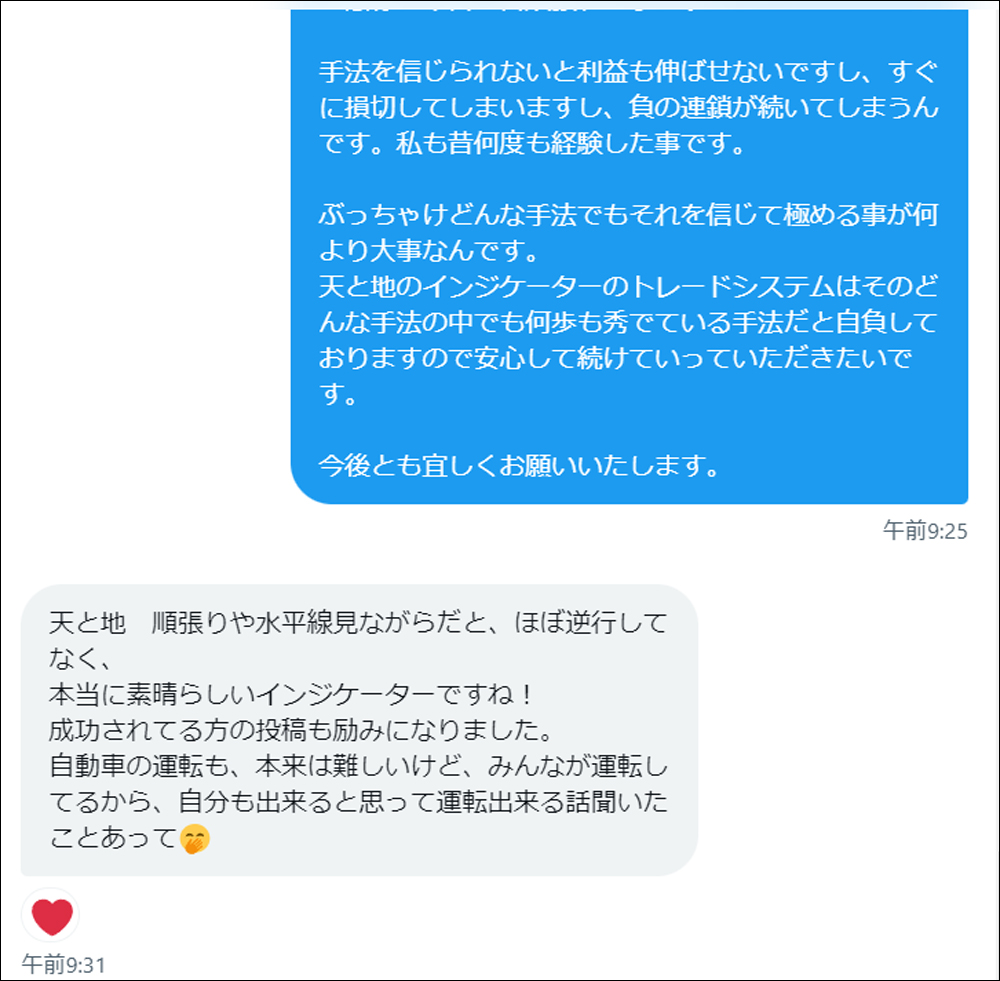

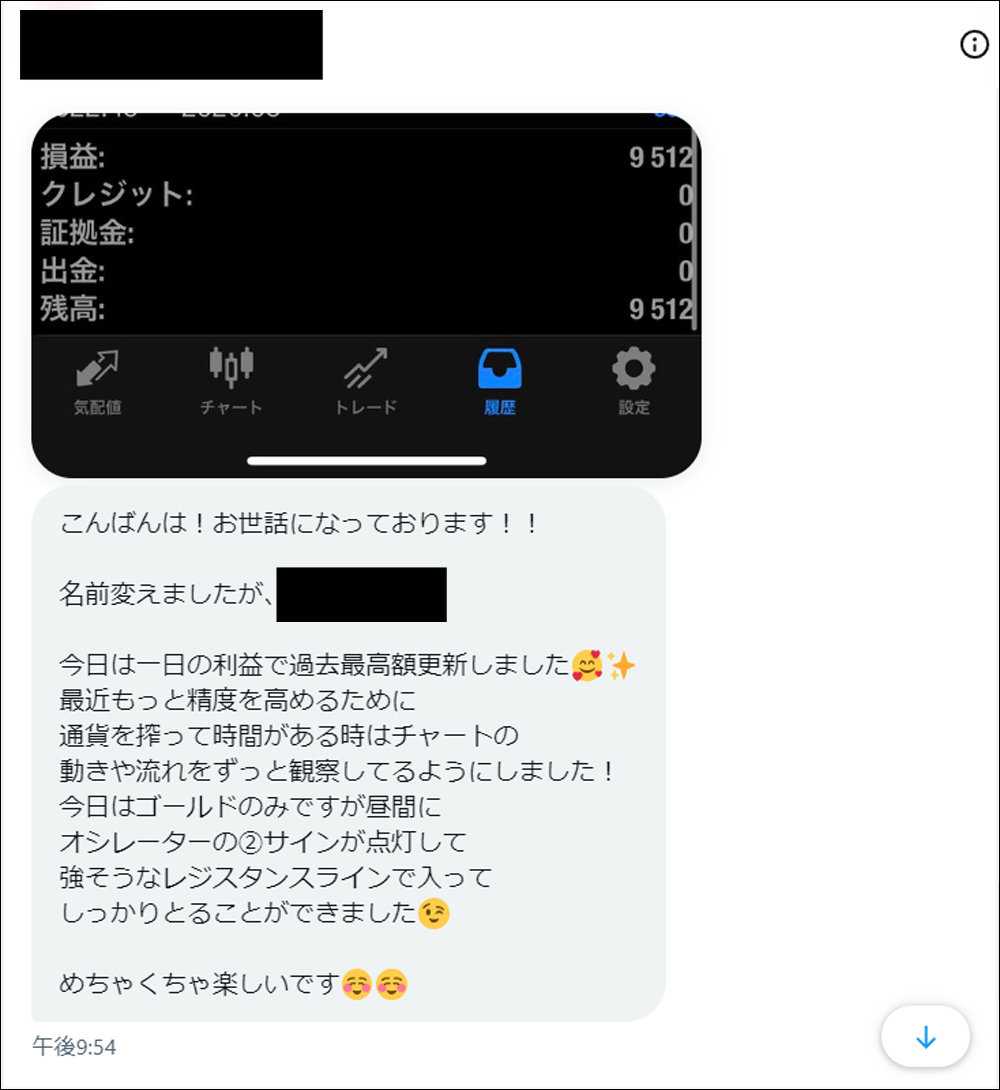

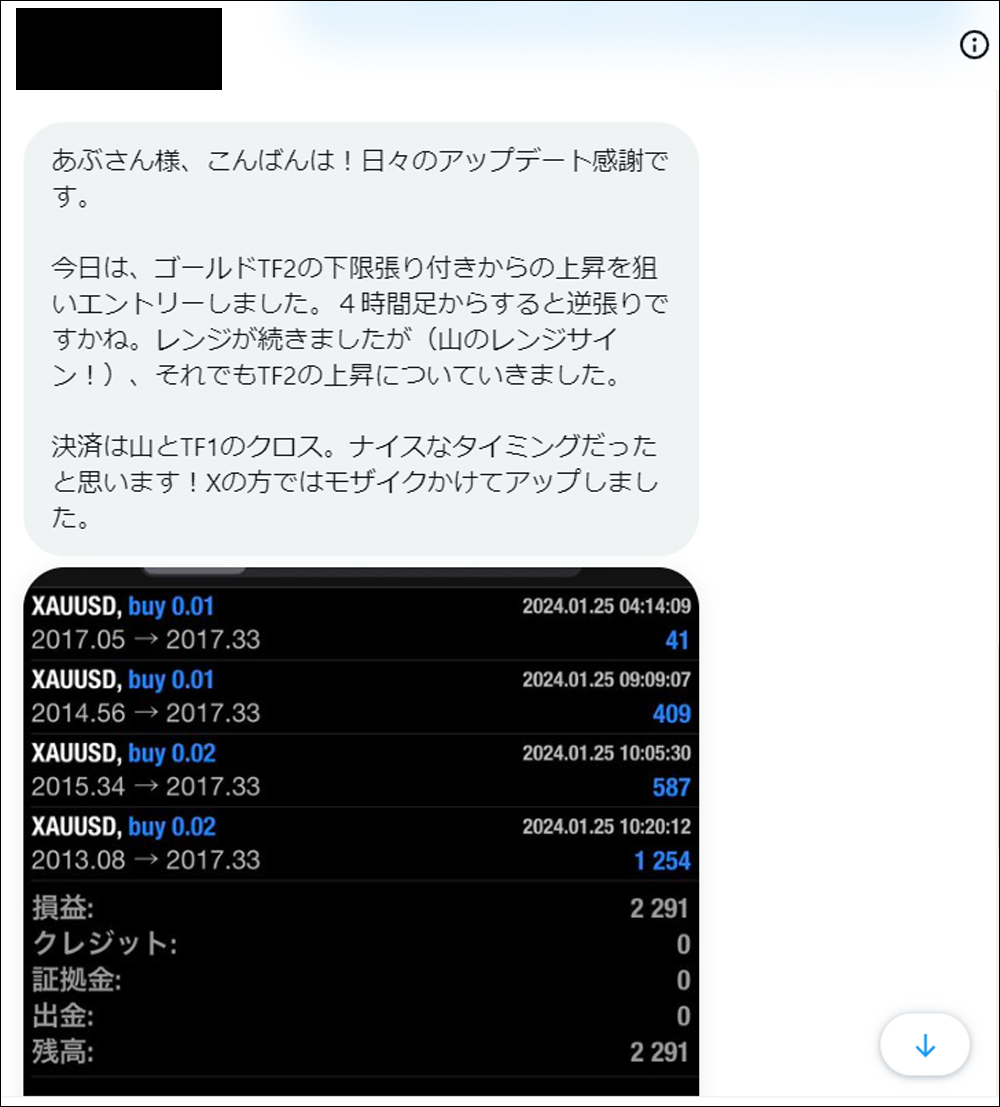

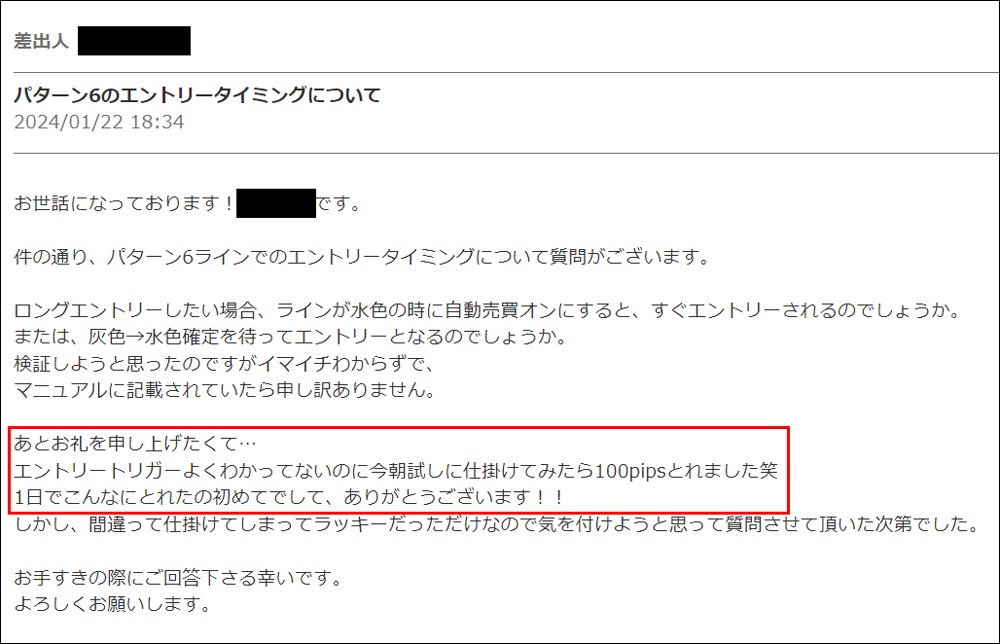

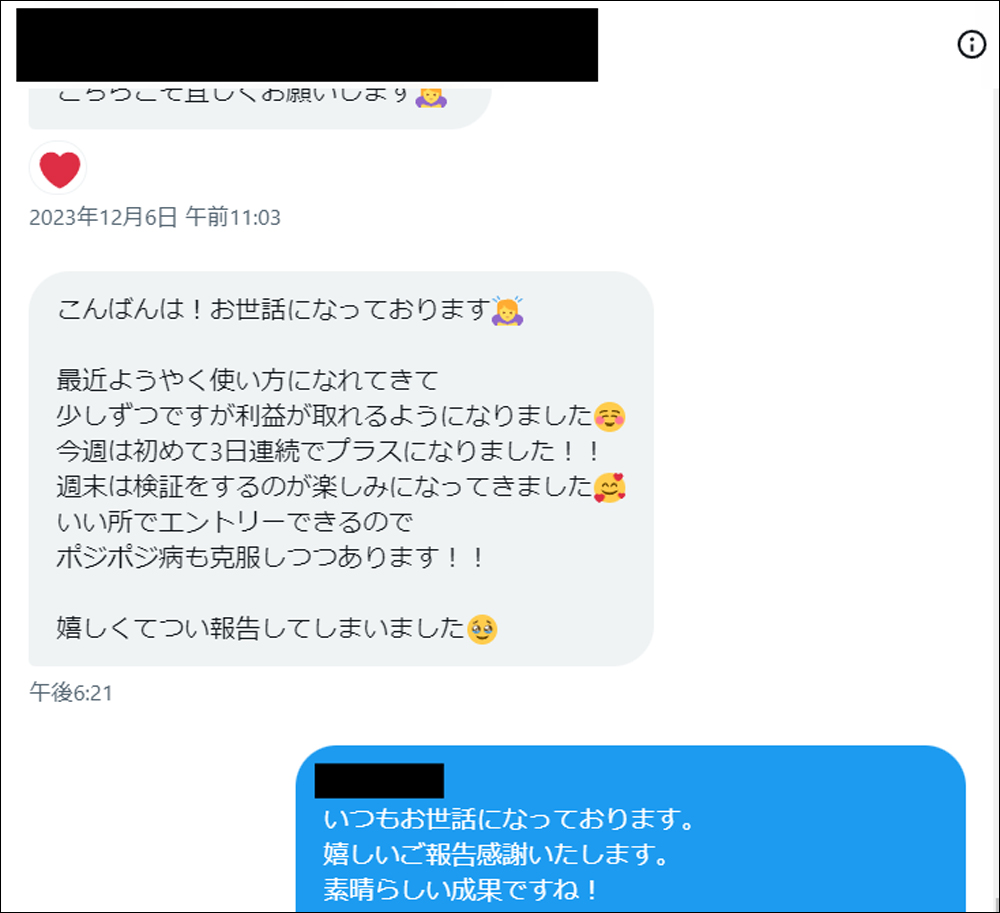

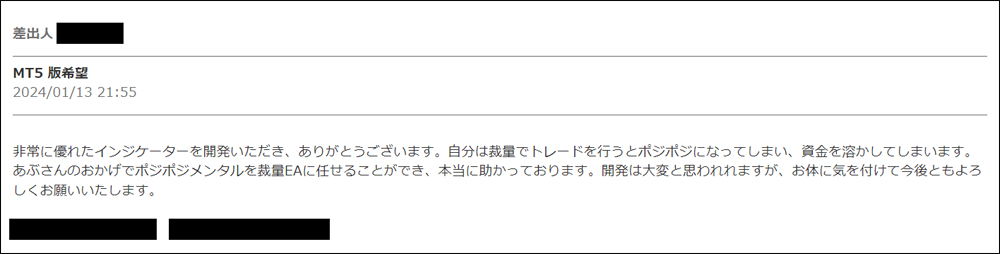

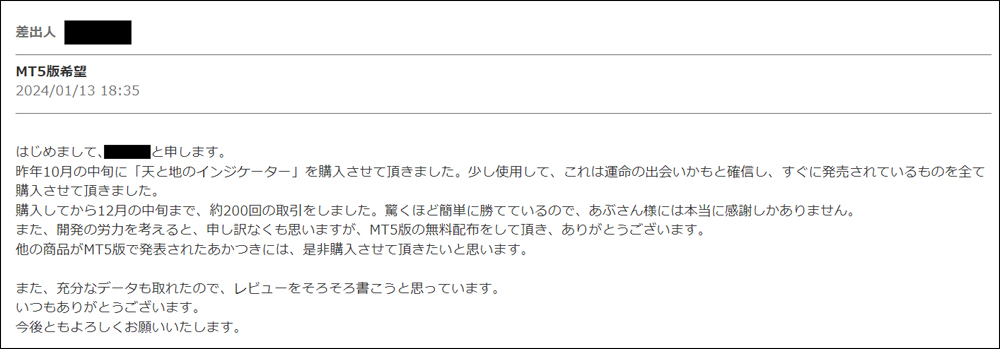

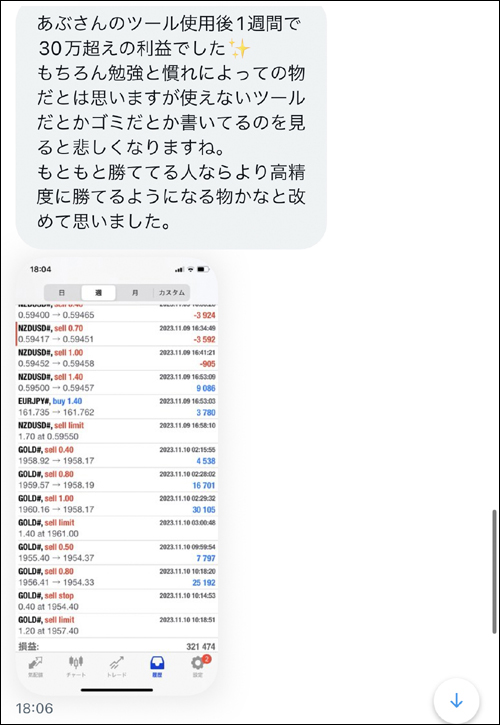

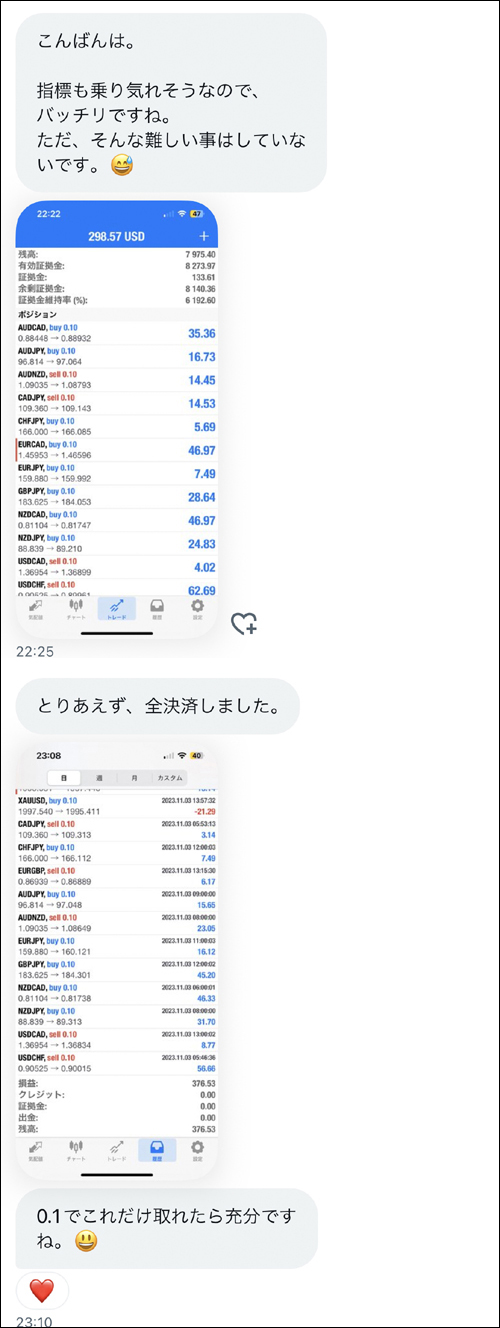

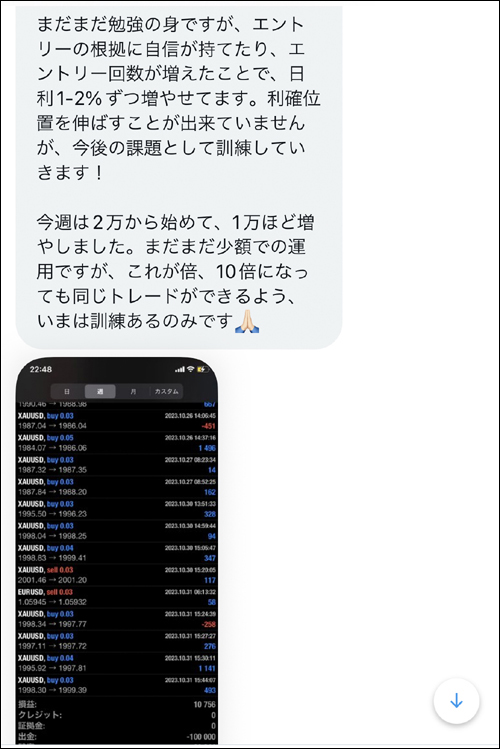

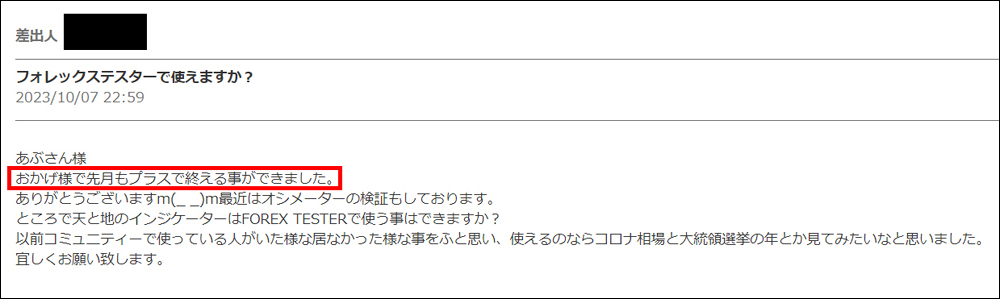

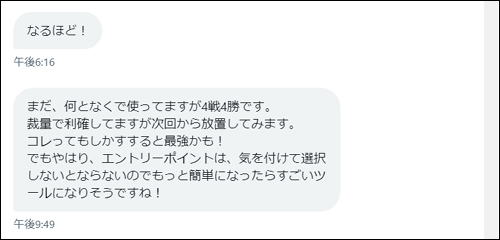

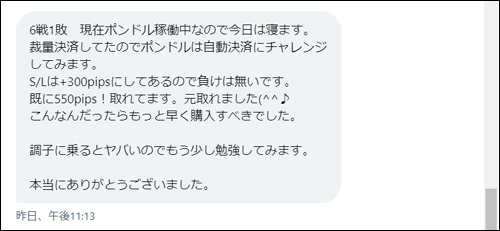

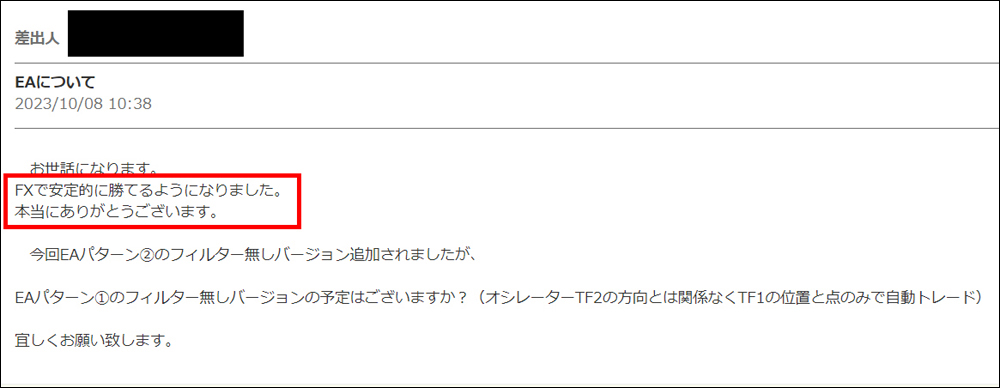

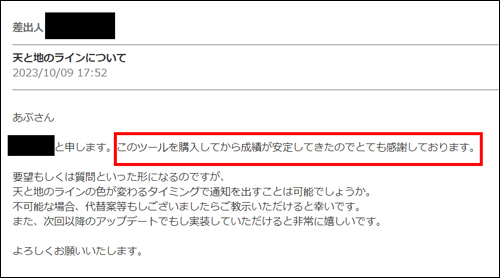

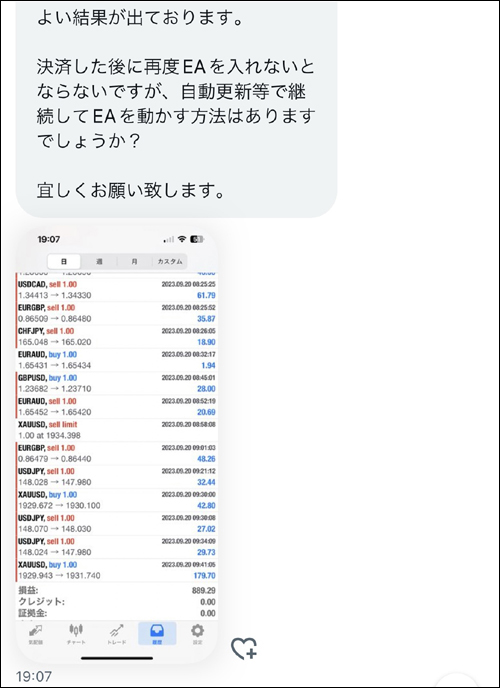

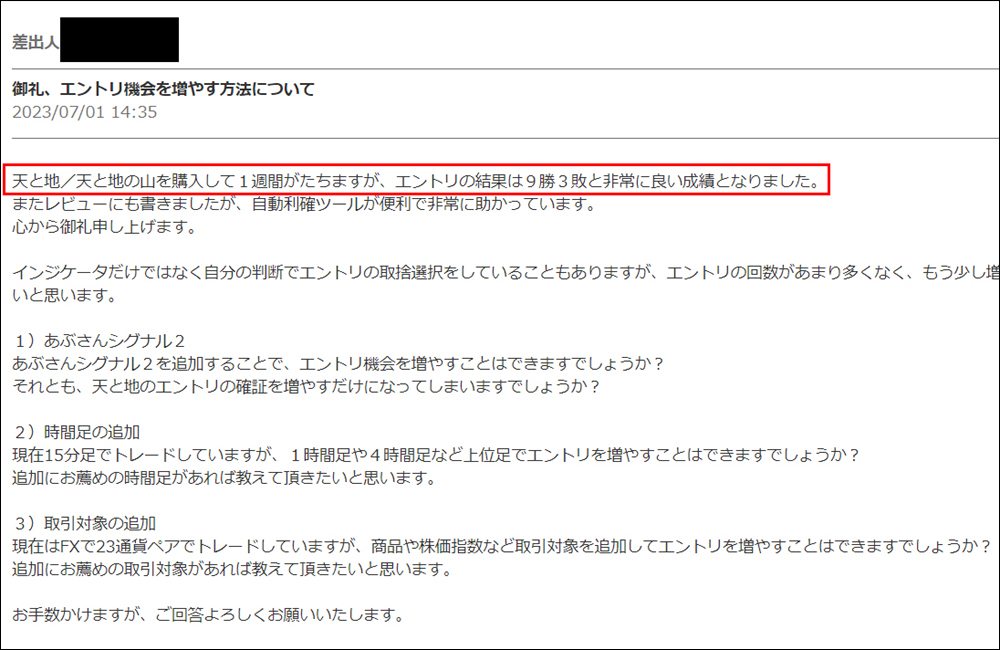

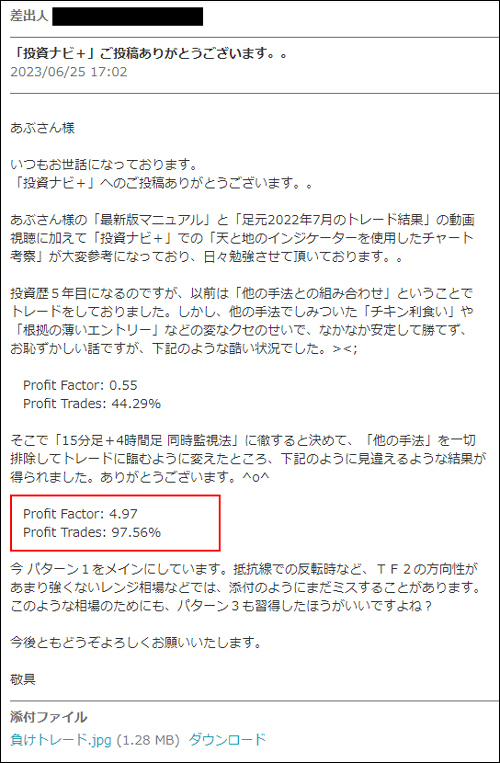

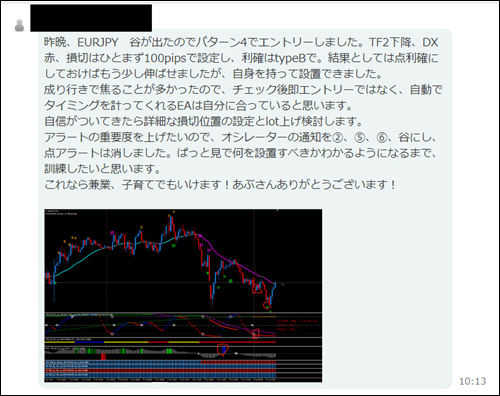

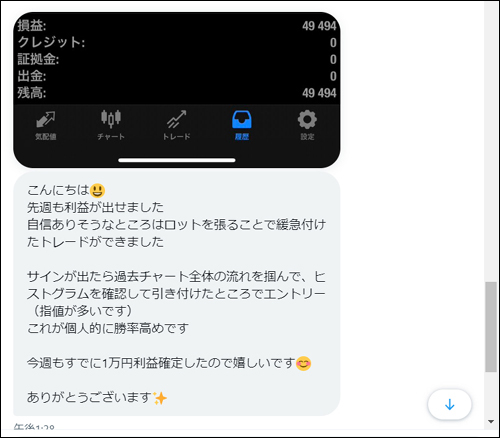

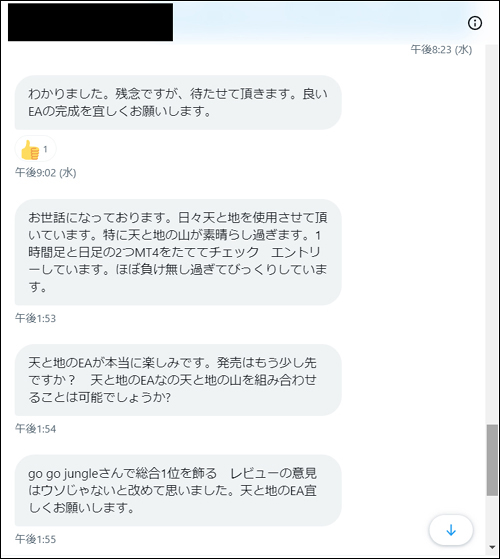

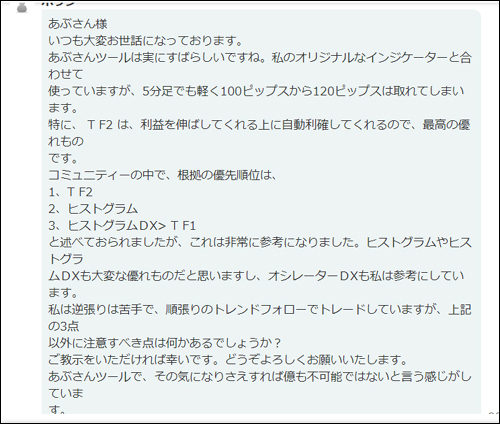

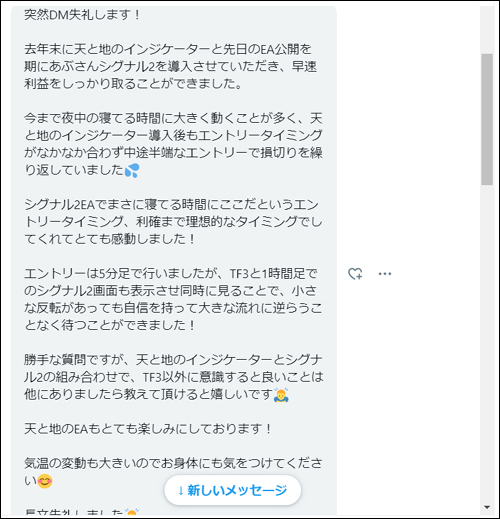

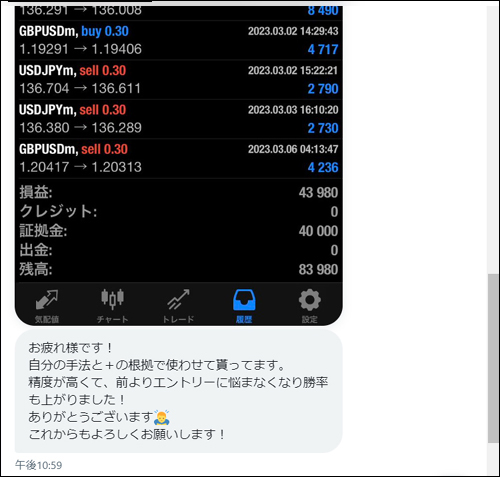

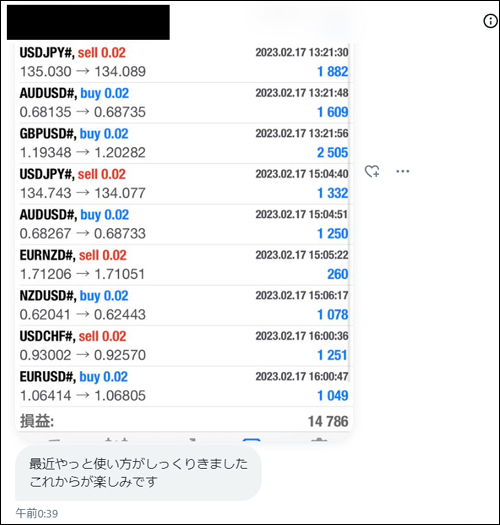

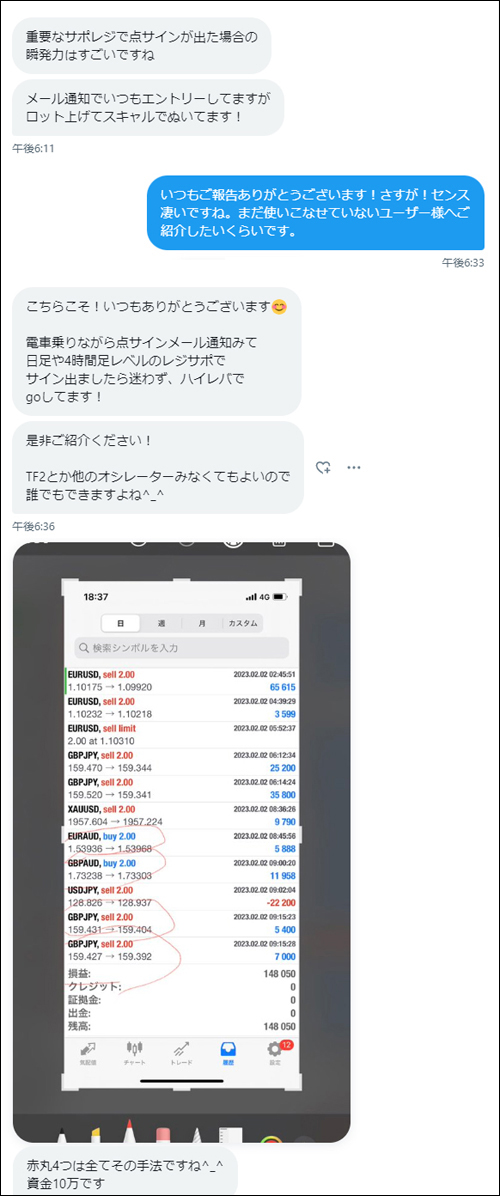

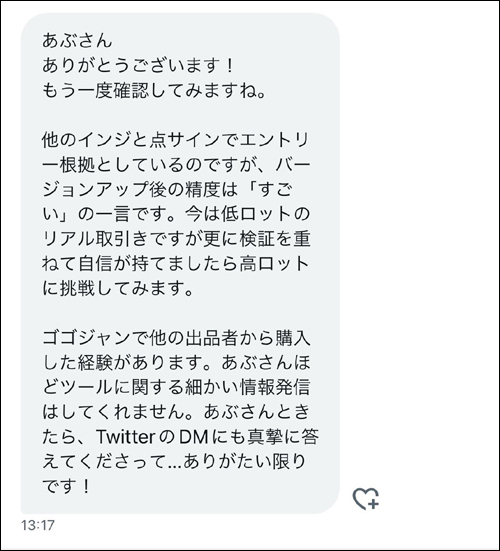

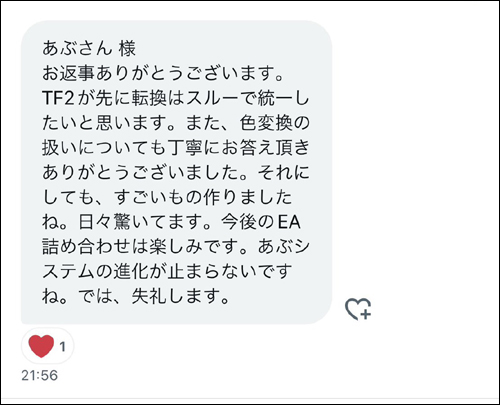

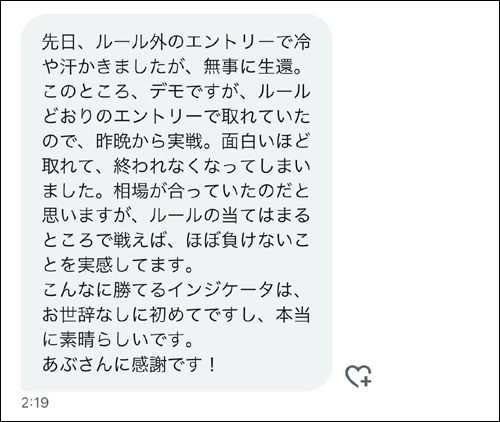

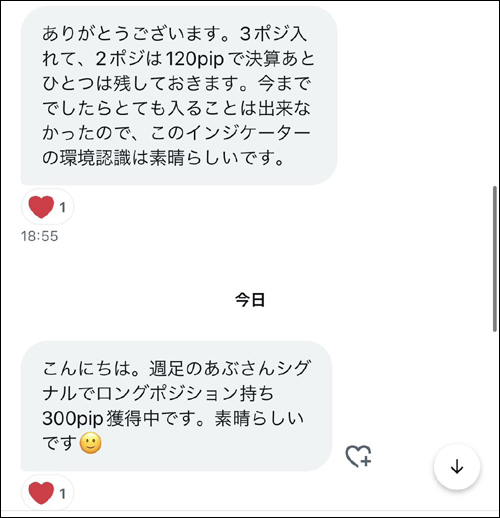

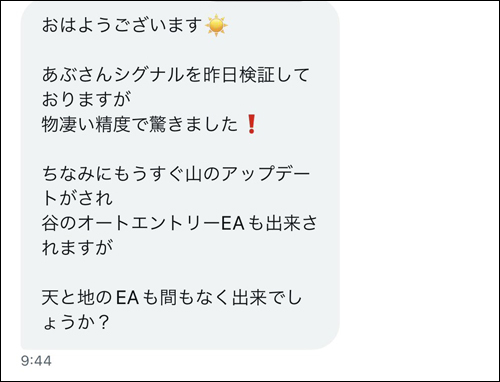

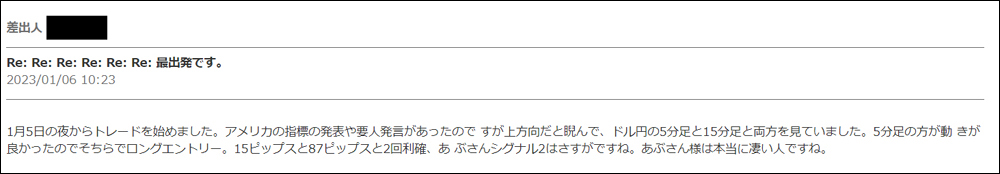

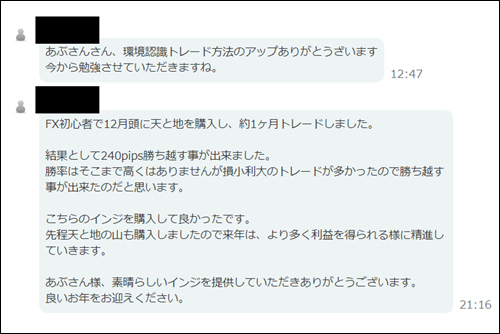

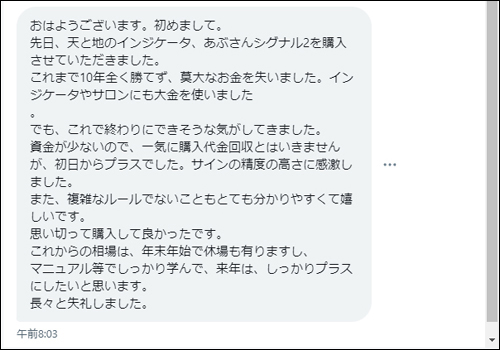

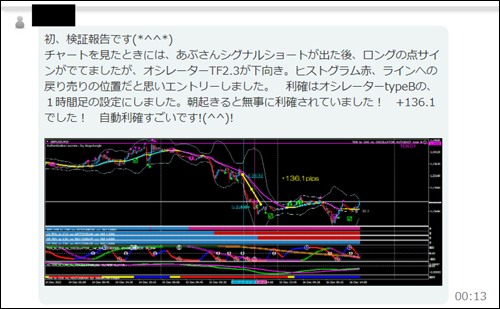

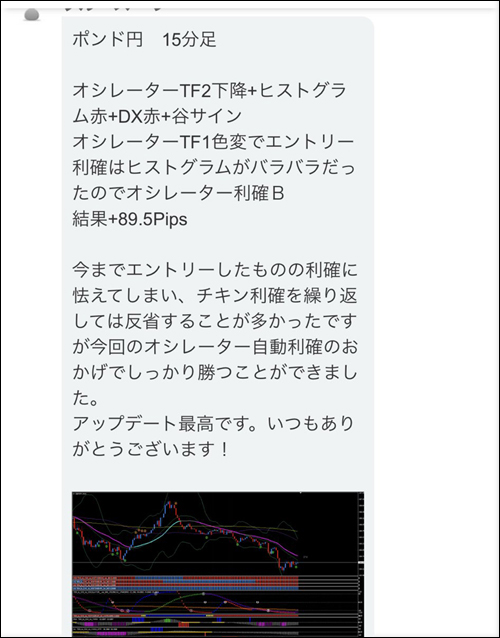

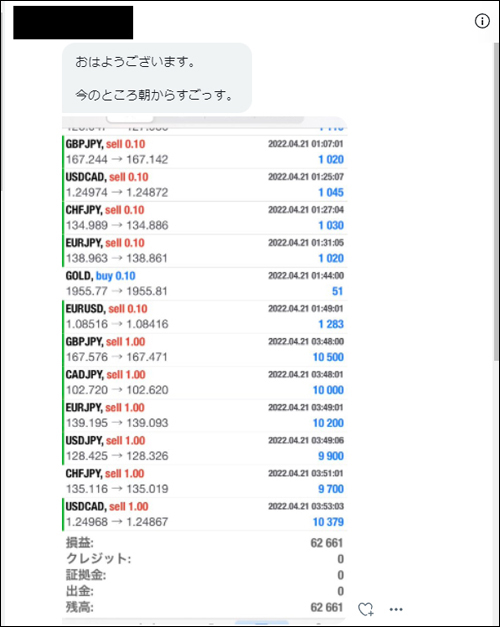

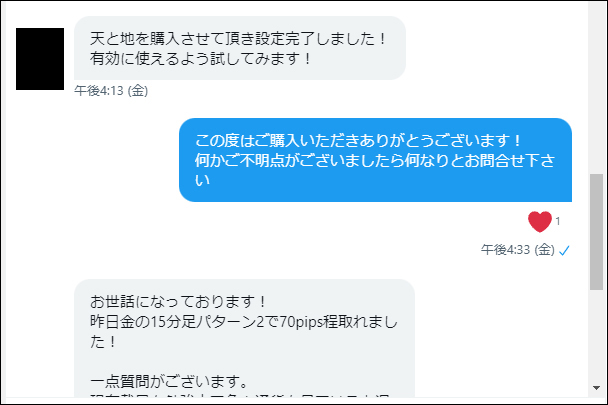

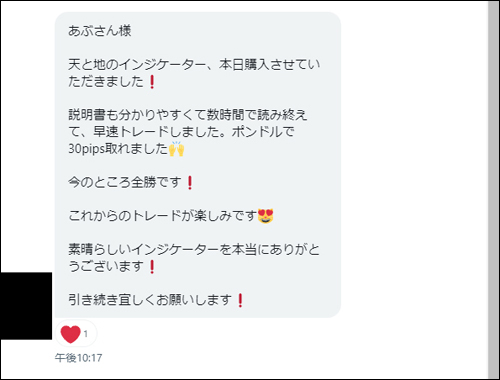

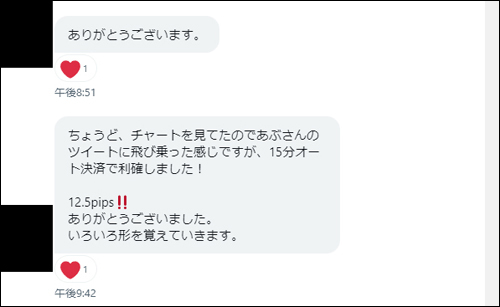

・Voices from those who have actually used Prime Combo Signal

・In the articles linked below, we introduce valuable DMs, reviews, posts, etc. from users and monitors. We curate winning reports and other beneficial messages, so I’m sure they will be useful to everyone. It is updated regularly, so please take a look when you have time.

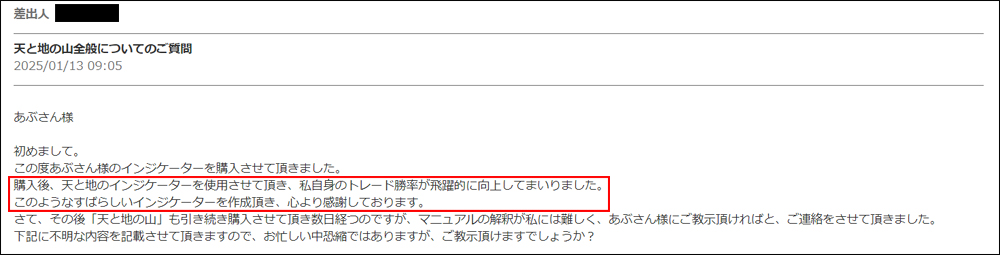

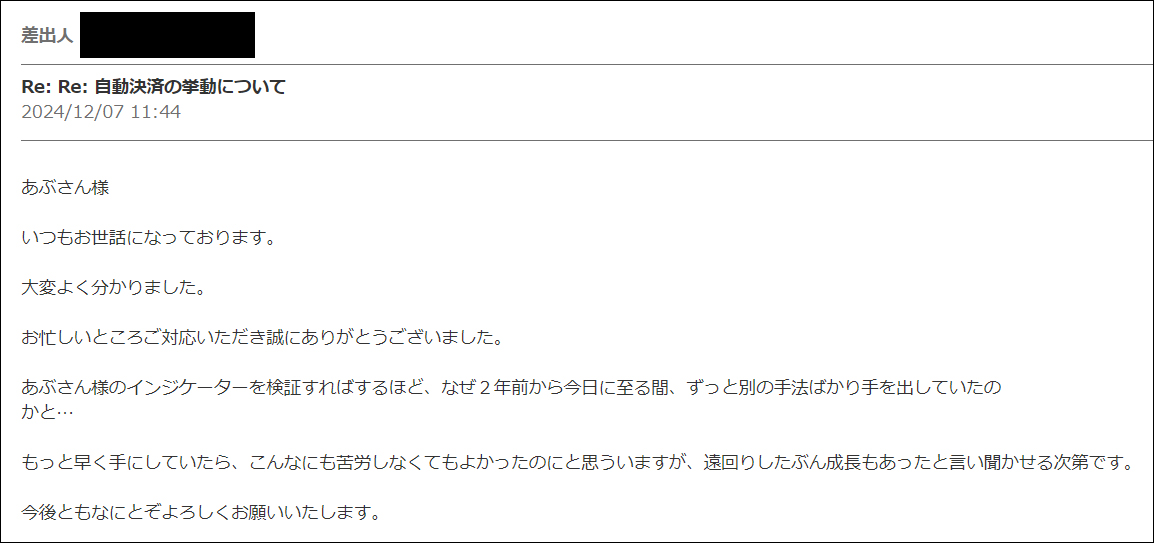

・Impressions from users who actually used Tenshiki indicators (Review version)

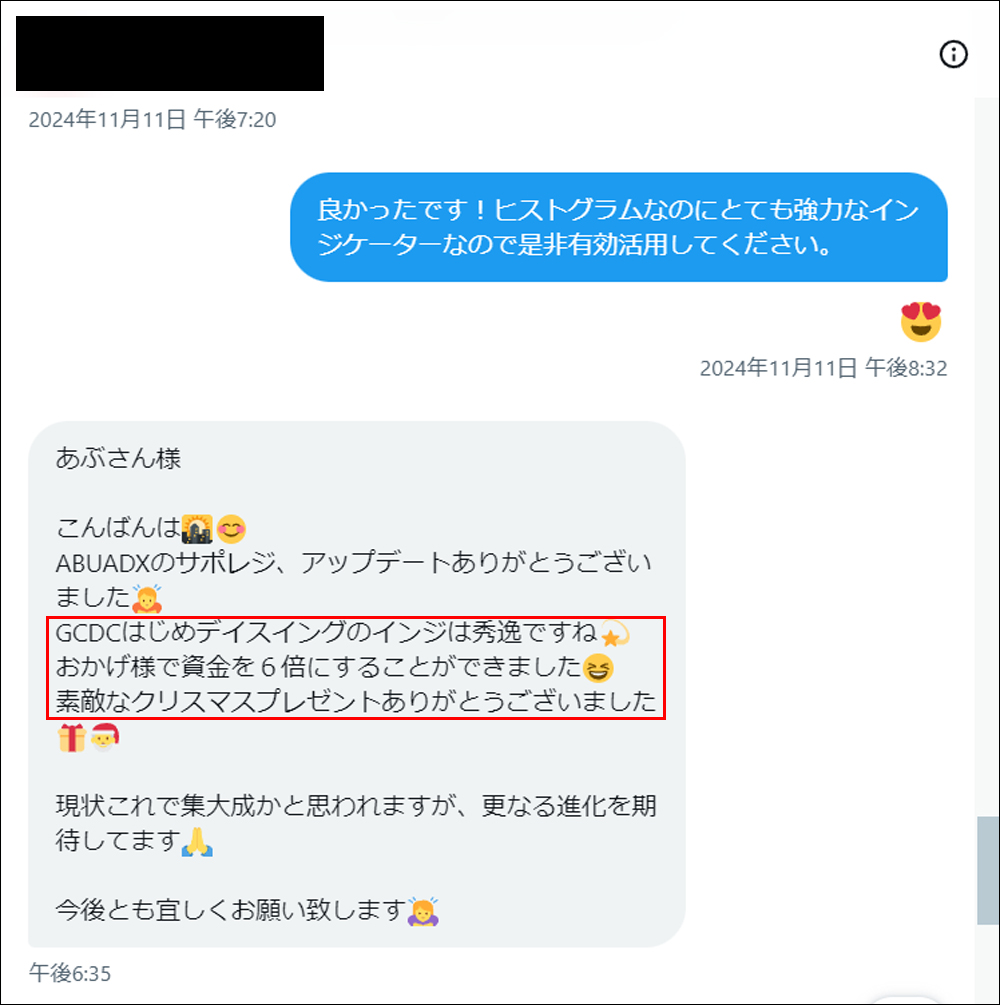

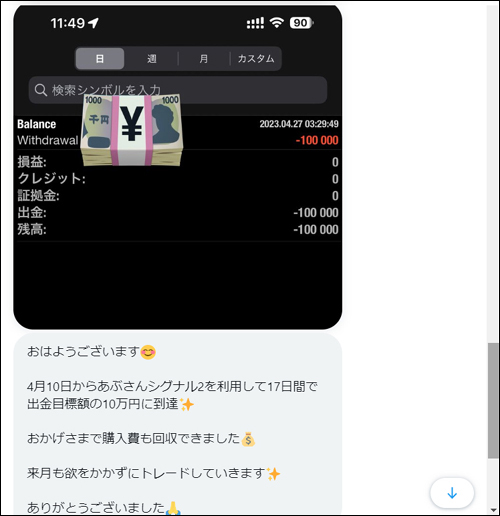

・Impressions from users who actually used Tenshiki indicators (DM version)

・“I searched for ‘Tenshiki Indicators’”

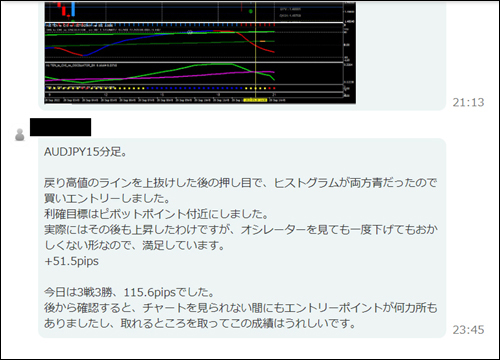

・We introduce posts from monitors who actually used DaySwing

・The Tenshiki Indicator is an original indicator-based trading method developed by me, Abusan, released in February 2022.Thanks to everyone's support「GogoJungle Award 2022, 2023, 2024, awarded for three consecutive years.

・In this article,“Tenshiki Indicator” is used,for the method of validating and considering theTenshiki DaySwing, together with the entry trigger “Prime Combo Signal. We will also explain this.

For the basic trading method of the Tenshiki Indicator, please refer toarticles before August 2024.

【Abusan / Special Video Vol.1】Over 3,200 enthusiasts use it! Are you still trading FX without “Tenshiki”? Would you like to relax while earning?

【Abusan / Special Video Vol.2】Actually, the difference is not skill but equipment. If you don’t use this, the gap is immense.

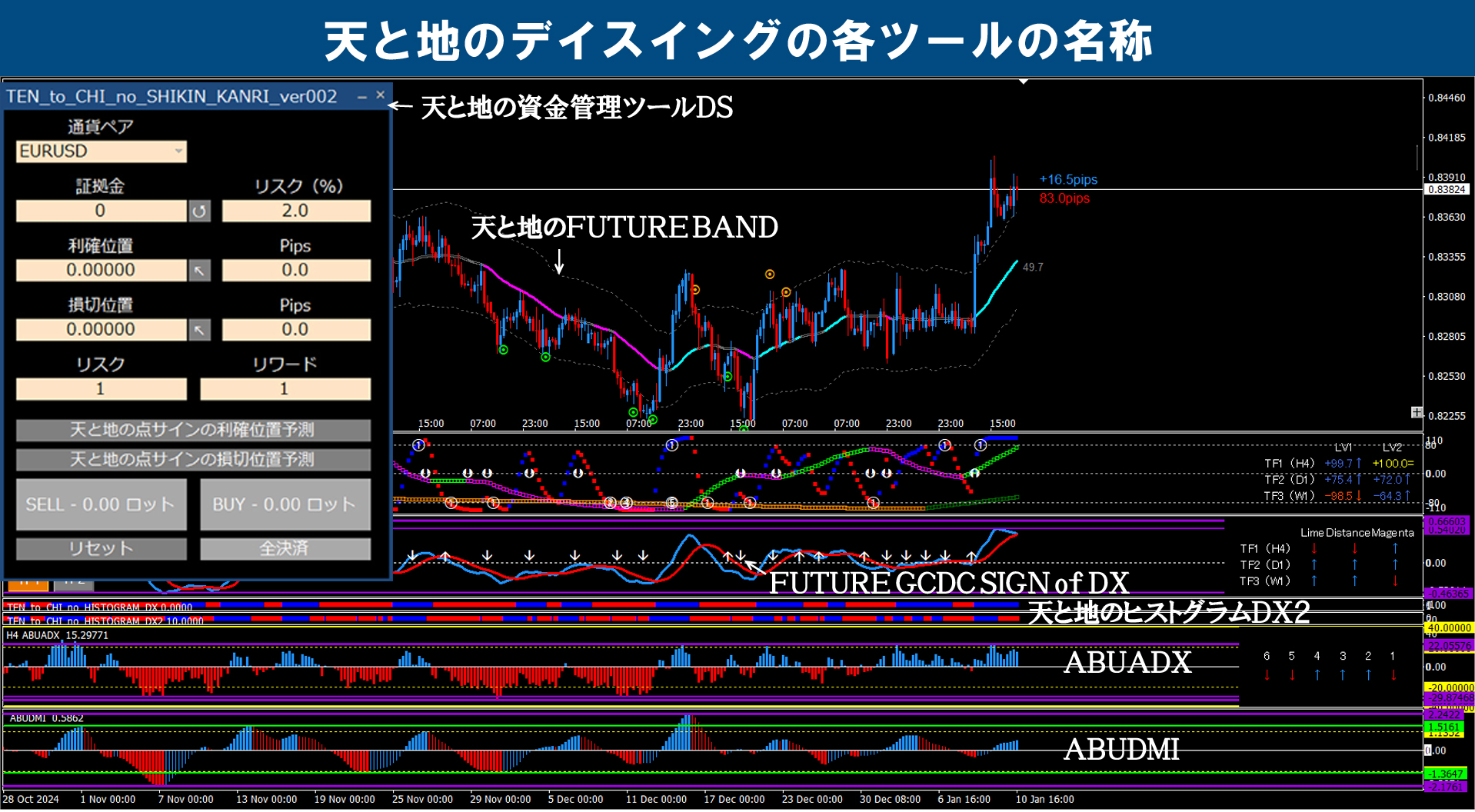

※Regarding specialized terms used on this blog,please refer to the image below.(All images become larger when clicked)

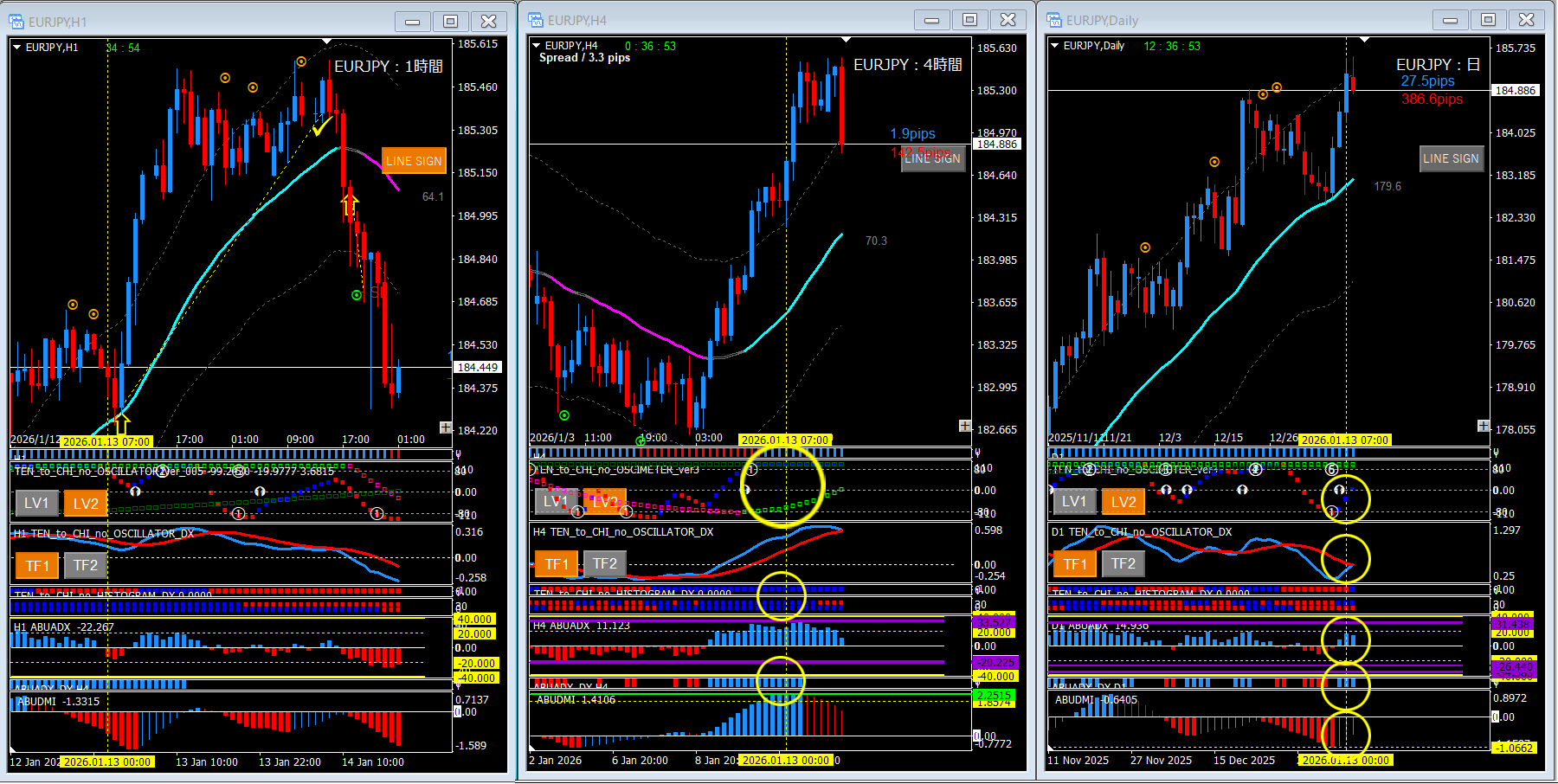

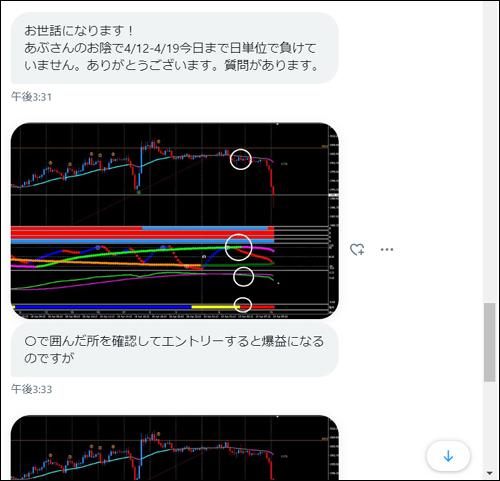

EURJPY / 1-hour + 4-hour + daily past validation

※ Yellow dotted lines are drawn across all timeframes at the same location.

※ Yellow circles indicate important points.

- Clicking the chart will enlarge it.

■ 1-hour (left: entry timeframe)

・ Prime Combo Signal

※ The parameter settings for this P-C are described below

■ 4-hour (center: environment recognition timeframe)

・ Oscillator TF1, TF2 (uptrend pattern)

・ Histogram DX2 (all blue)

・ ABUADX_DX (lit: confirmed)

■ Daily (right: environment recognition timeframe)

・ All-direction alignment signal

・ Oscillator DX (just before upcross)

・ ABUADX (zero-line cross)

・ ABUADX_DX (lit: confirmed)

・ ABUDMI (color change)

■ Summary

On the daily and 4-hour charts, multiple very good patterns can be confirmed. Among them, we aim for confirmation of ABUADX_DX on the daily chart and set Prime Combo Signal on the 1-hour chart.

Typically, MTF (Multi-Time-Frame) is not used much because the required number of confirmations increases when moving to a lower timeframe (e.g., 4-hour chart when using 1-hour). However, when the daily chart’s environment recognition is solid as in this case, you may use it without issue.

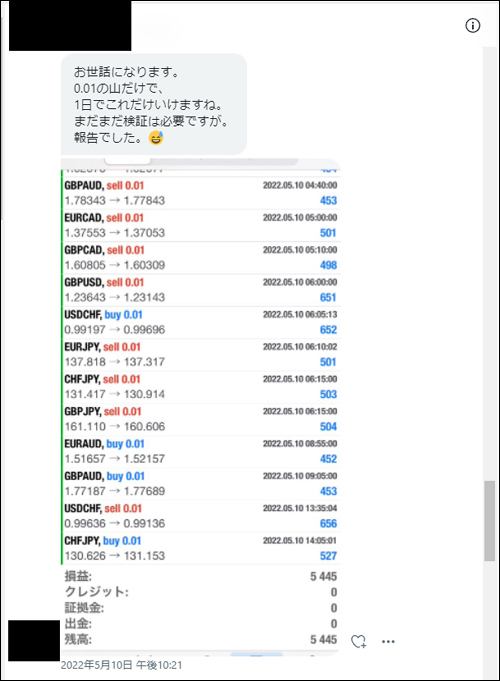

■ If you use DSATEA

Because I judged the lower direction at the yellow dotted line, I will enter on the 1-hour chart with DSATEA set to short-only at this point.

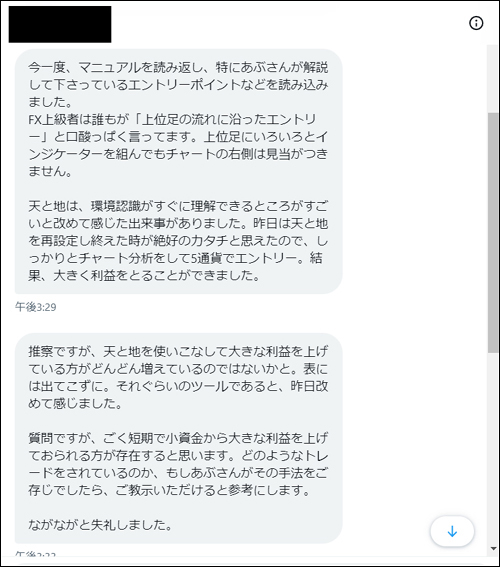

■ Prime Combo Signal – Tenshiki Overall Sign – Parameter settings

※ Clicking the chart enlarges it.

※ These are the parameters used for this chart validation.

| Judgment count | Entry | Filter | Take profit | Stop loss |

| 1000 | Line touch (confirmed) | ABUADX_DX (1 day) | Dot sign (1.0) | ABUATR (2.0) |

We hope this is helpful to everyone, even a little.

If you press the GOOD mark, it will give us more motivation. We would appreciate your cooperation for further improvements as well.