Everyday Nikkei 225: 2026/1/12

Analysis Tool Details Link

Note: We have consistently received positive feedback.

■ Expert Trendline Drawing Indicator "Invincible Sword"

https://www.gogojungle.co.jp/tools/indicators/54499?via=users_products

■ Indicator Pack MT4/5 version - Monthly

"Unrivaled" Synchronization System

https://www.gogojungle.co.jp/tools/indicators/50319

Trial version・Ultimate・Sync System Monthly

https://www.gogojungle.co.jp/tools/ebooks/50353

Below: Current Analysis Article

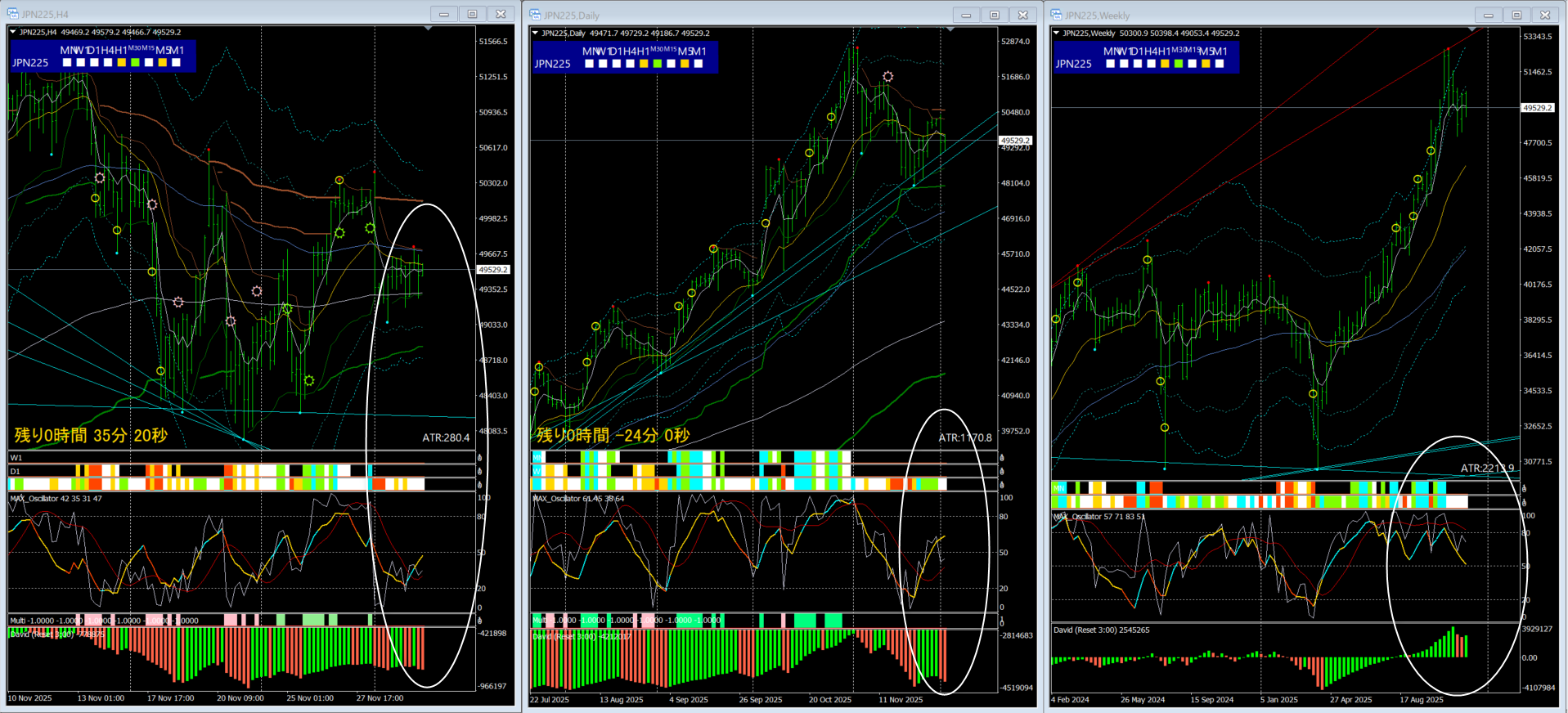

One-line comment: The overall trend is still up, but be careful with retracements.

Daily chart:MAX Oscillator: Sync Band“WeakRise”

4-hour chart shows weak“Neutral” indicating potential

※“StrongRise”Implication

Daily MAX Oscillator and Sync Band currently show “weakRise” changed

On the other hand,Weekly chart MAX Oscillator and Sync Band indicate“StrongRise”

※Daily chart signals have changed to a weak rise

After adjustment to noEMA20 on daily chart, price rises sharply.

Viewed on weekly chart, the overall trend may still be up, but

the position of the MAX Oscillator on daily chart is high, and the weekly MK Channel deviation is close to 3x

apart, so be careful not to chase too deeply; wait for a good pullback

Price movement can become extremely volatile depending on the time of day

If you feel it's dangerous, better to exit quickly and manage risk

Caution remains essential.

Do not ignore near-term developments; stay flexible to short-term waves

Be alert to sudden drastic changes!

※ Important Considerations

Volatility is considerable, so manage your capital carefully.

Notes

Original indicator providesCurrent analysis commentsand does not

recommend buying/selling or guarantee future movements.

Special interview video

Introduced by Gogojungle in the form of a video interview.

If you haven't watched yet, please take a look.

Part 1

https://www.gogojungle.co.jp/info/22070

Part 2

https://www.gogojungle.co.jp/info/22078

Part 3

https://www.gogojungle.co.jp/info/22089

※ In order to return to the original concept of “for existing users,”

the free service page in the above video has been closed.