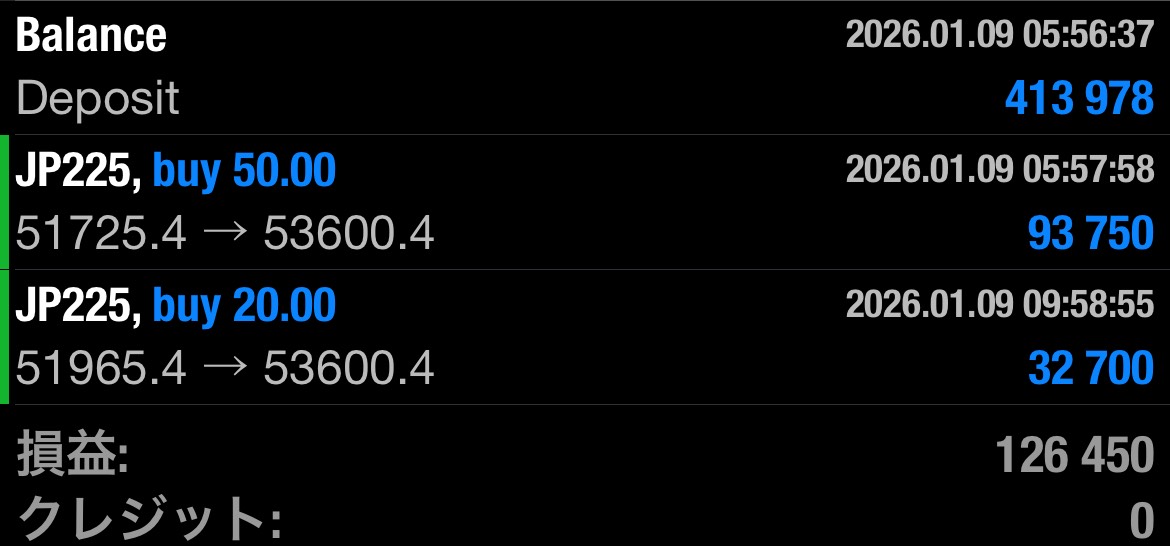

【Profitable Victory!!】Nikkei futures gained 1900 yen in profit!! Entry was surely made with the Tengen indicator!!

Background of the Nikkei 225 moving sharply (Dissolution of the House of Representatives coverage)

This rise in the Nikkei average and Nikkei futures this time may have been largely influenced by domestic political developments.

According to reports such as from Yomiuri Shimbun,the Takai administration is considering dissolving the House of Representatives at the opening of the ordinary Diet session, and in the foreign exchange market the yen came under selling pressure, with the dollar/yen moving toward the vicinity of 158 yen, signaling a depreciation of the yen. This is seen as rippling into the stock market and the Nikkei average, intensifying buying pressure.

In general, the flow from “Dissolution of the House of Representatives → General election” is often perceived positively in the short term for the stock market because it can push for earlier policy implementation and economic measures (an anomaly/experiential rule based on past stock price trends that dissolution tends to lead to gains until the voting day).

Thus, news of a higher likelihood of dissolution of the House of Representatives triggered yen depreciation, and the movements in the Nikkei average and Nikkei futures became more activeas one of the possible background factors.

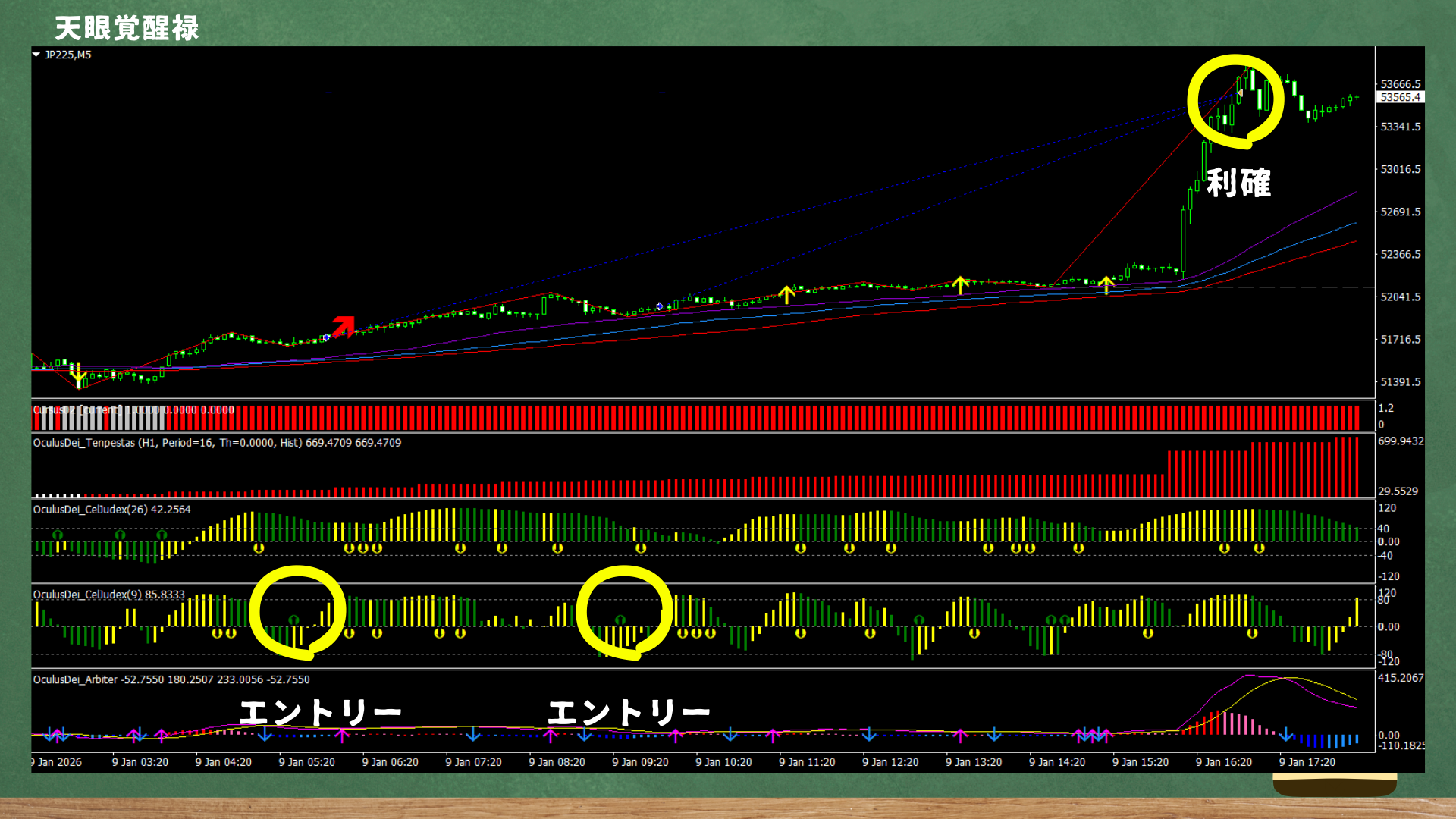

? Signals of “rising trend” confirmed by the Tenkan Eye Indicator

This entry decision is based not on chasing headlines, but on the “rising trend signals” indicated by the Tenkan Eye Indicator.

.The Tenkan Eye Indicator showed the following signals of rising trend;

-

Compared with the previously calm price action,

early signs of rising volatilityappeared first -

In a phase after the decline,

a price range where buying tends to come in was observedas a confirmed reaction -

In relation to the expected stop-loss width,

there was a sufficient upward price range (risk-reward) expected

These aligned at the same time,

enabling the judgment, “If it moves, this is the timing.”

As a result, news and other materials about the dissolution of the House of Representatives helped push the market,

and price movements accelerated rapidly.

From the signals that were perceived, this led to a large price rangeas the outcome.

In addition, the signals were clearly confirmed not only on the short-term chart but also on the 4-hour long-term chart.

There is a detailed explanation in the “Long-Term Chart Strategy Guide” included in the product, so please refer to that.

Since the Order Book was unclear for profit-taking, I decided based on the recent rise on the 4-hour chart.

It might have been fine to take profit when the volatility momentum weakened on Tempestas.

■ The Tenkan Eye Series that Visualizes Market “ Waves”

As in this trade,

“Where are the dips and pullbacks likely to appear?”

“Is volatility riding on the current price movement?”

Being able to make these judgments greatly increases the number of high-expected-entry opportunities.

The Tenkan Eye indicators provide in-chart clarity on

Strength of the trend

Temporary acceleration

Propensity for price range expansion

Possibility of reversal points

These kinds of “grounds for judgment” are laid out clearly on the chart, so

they make it easy to ride the wave in today’s market environment without hesitationas a big feature.

“When the market moves, you can jump on immediately”

“Conversely, when it doesn’t move, you don’t enter”

This clarity is a real strength for short-term traders.

▶ Why it is suitable for those who want to stabilize the quality of their trades

High reproducibility of entry points

Alerts tell you even if you’re not watching

When volatility is low, it’s easy to decide not to act

Hard to miss the moment when riding the wave

After reading this article,

you might think, “I want to enter at a timing like this, but I’m actually hesitating…”

If so, this system could be a good fit for you.

? Tenkan Eye Indicator Details