It seems everyone is looking at the same chart, but in fact each person is trading on a completely different chart. "If you change yourself, the world changes."

Good morning! Market is closed.

I’m Takashi, a former accountant, psychologist counselor, and trader.

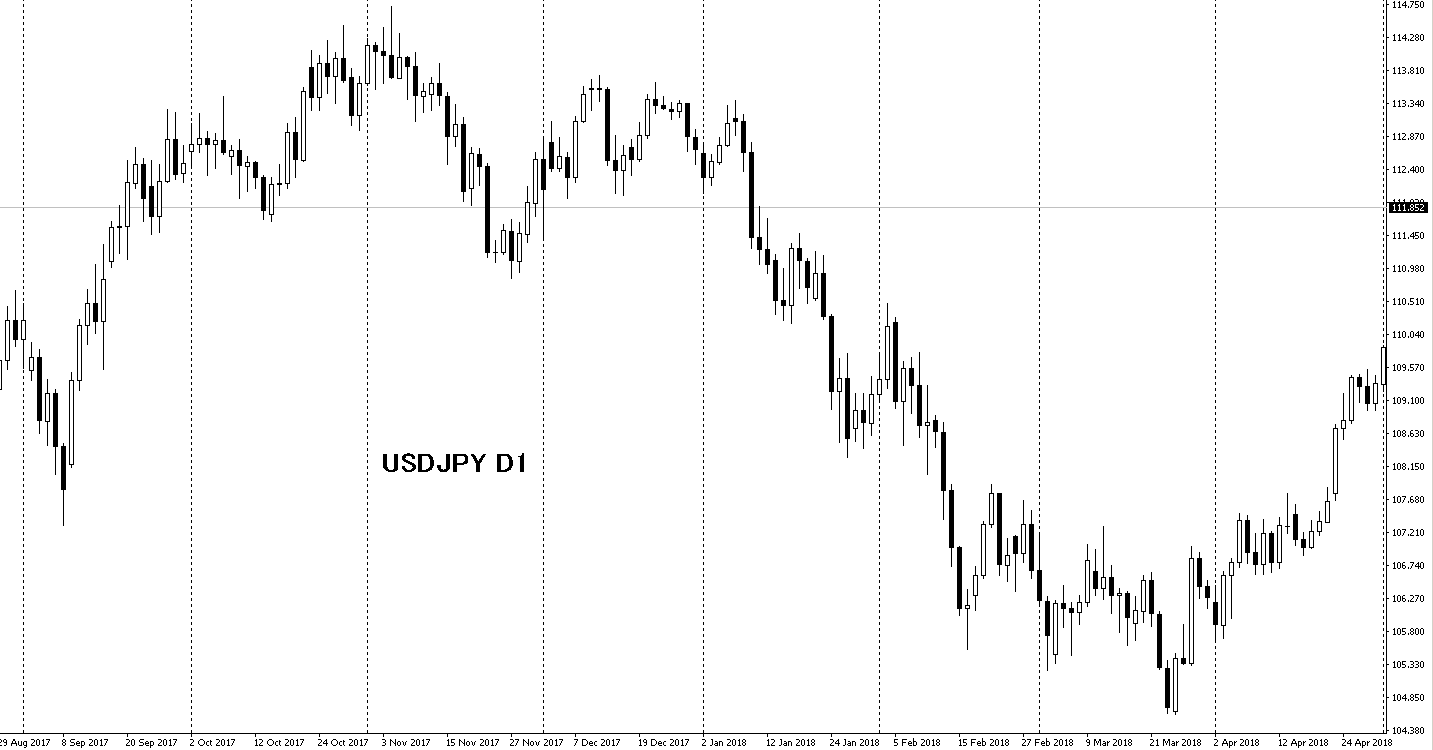

USD/JPY chart.

It’s a chart familiar to people who trade, but when you first look at a chart and then look after studying for a while, it will look completely different.

Even with the same chart, the amount of information you receive is different.

For example, after learning Dow Theory, when you look at a chart you can receive the information that “the highs and lows are moving lower, so it’s a downtrend.”

When you first see it, a chart that seems to move randomly will start to reveal a flow, such as “it came down from a range.”

The chart hasn’t changed. You have changed, so it looks like something else.

This is not limited to charts; it happens in daily life as well.

If you change yourself, the world will look different.

We live in a world of subjectivity. How you see this world depends on you.

From a consultant’s perspective.

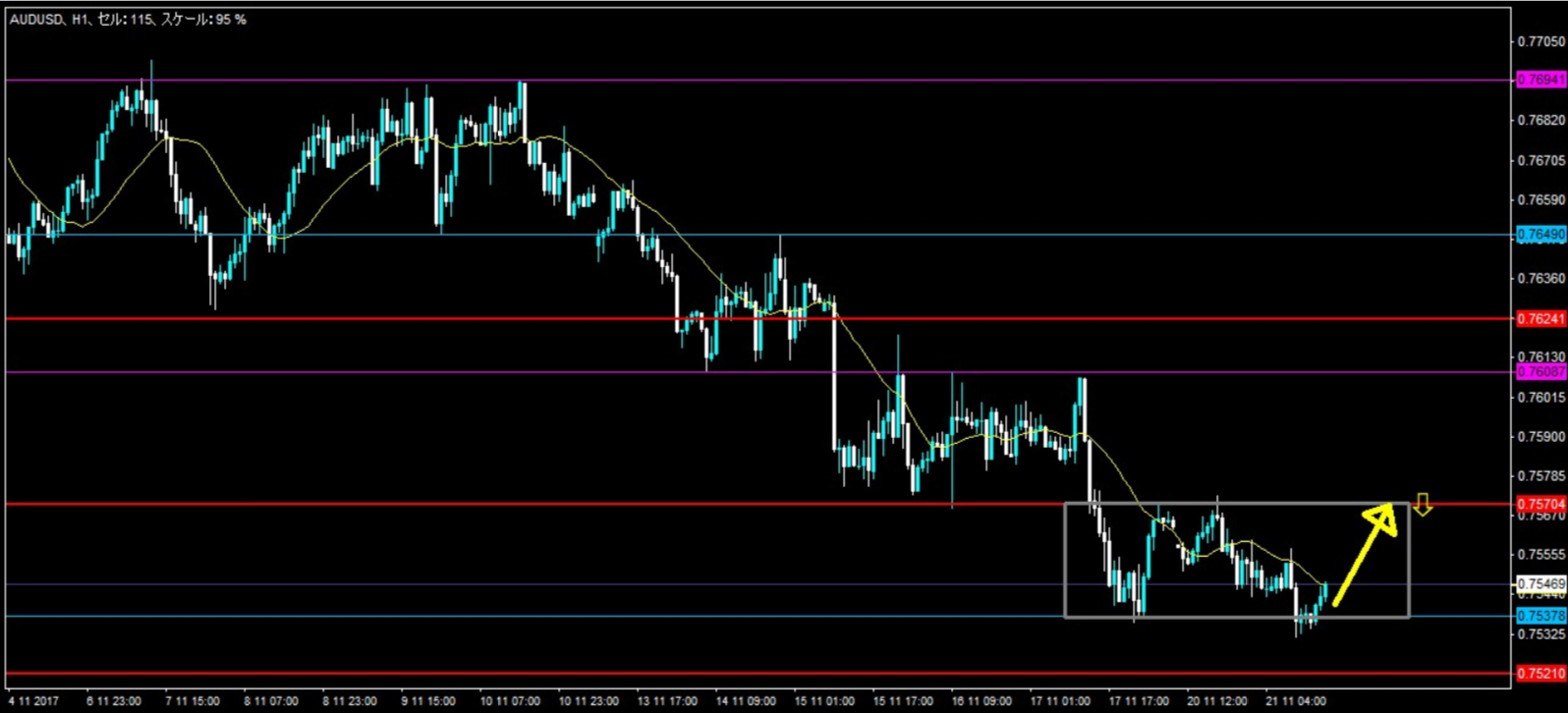

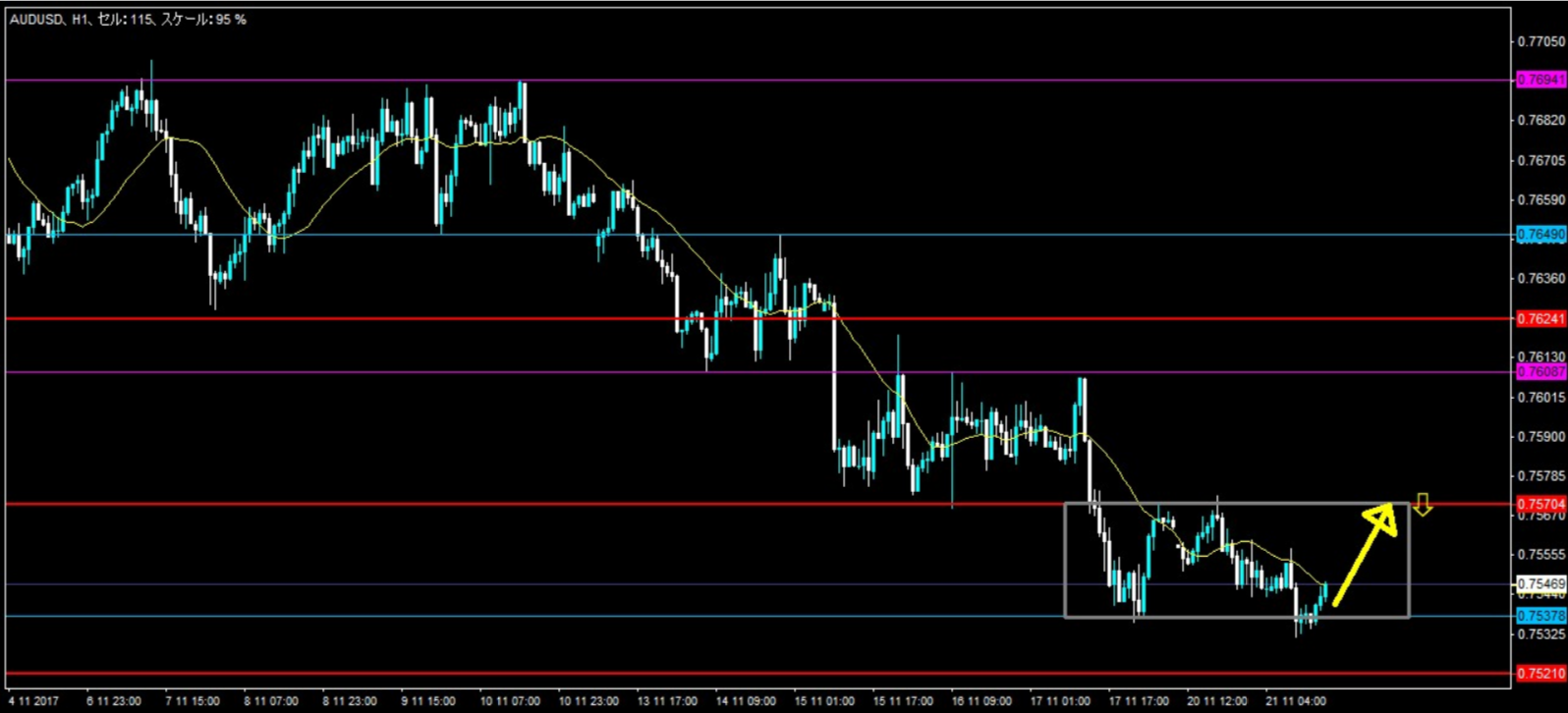

Buying from the bottom (yellow arrows). Image ①

In trade diary editing, I marked this as NG (not good).

However, the person who made this trade says they used to be able to enter in the same shape and be OK.

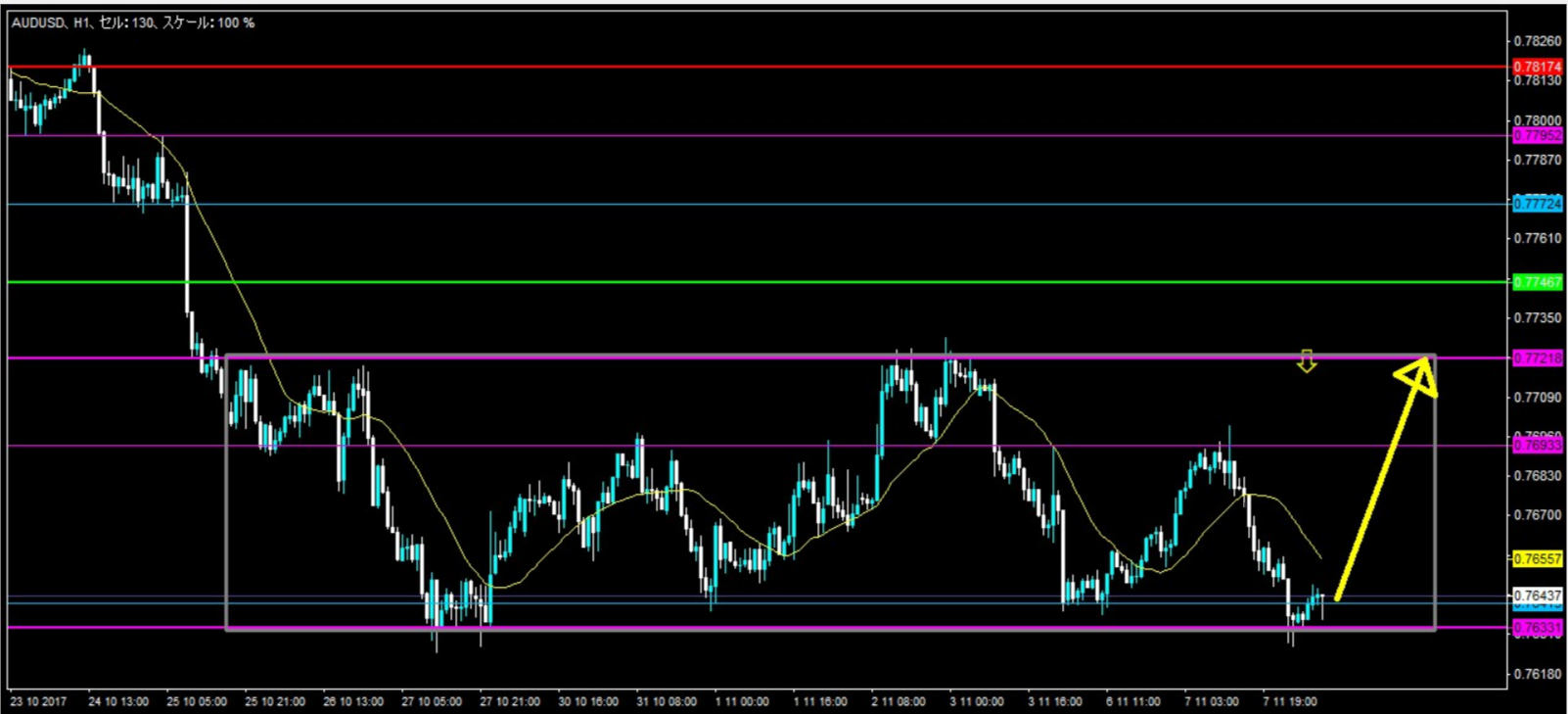

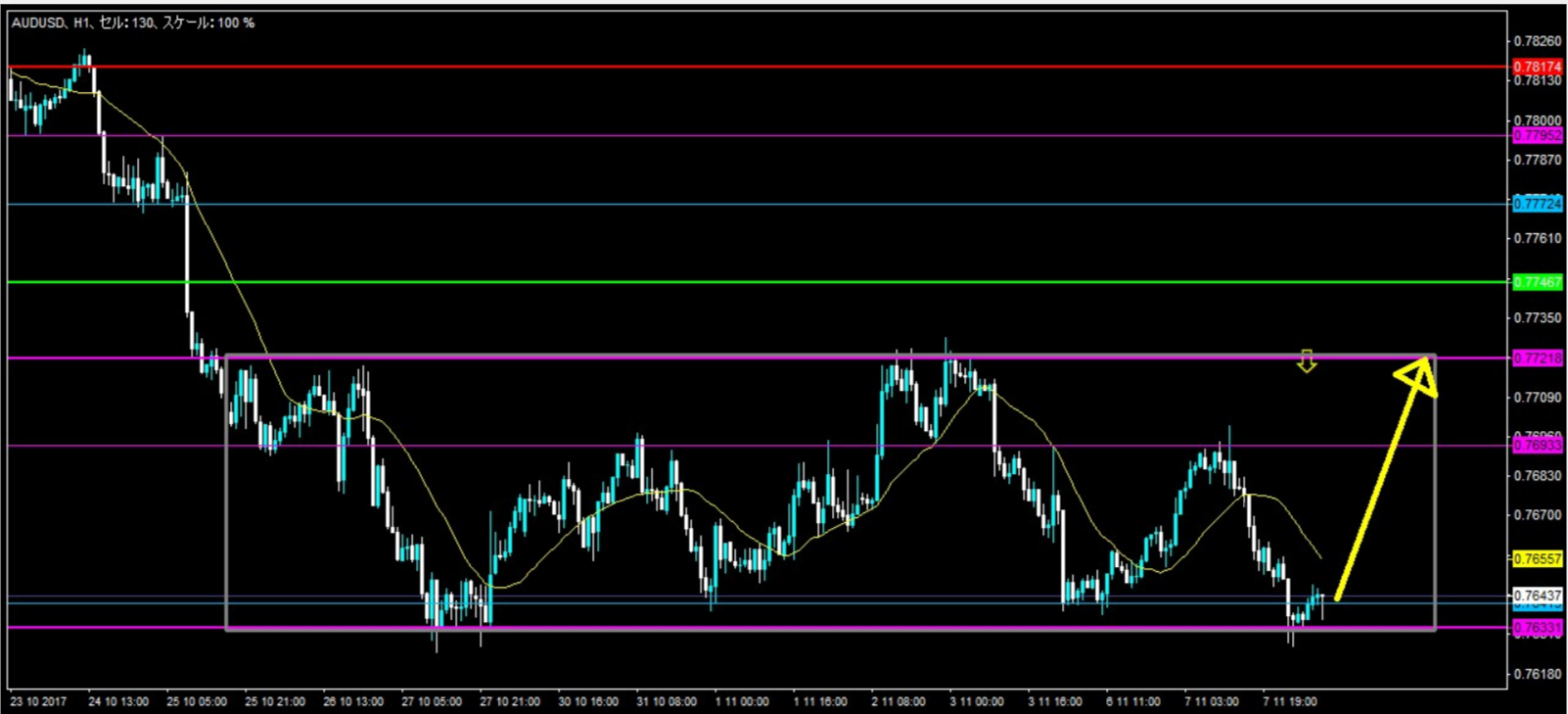

Image ②

To me, the charts in images ① and ② look completely different.

Being able to recognize that I see them differently means I am receiving more information.

We should be looking at the same chart, but one person says it’s the same and another says it’s different.

Everyone seems to be trading while looking at the same chart,

but actually they are trading on completely different charts.

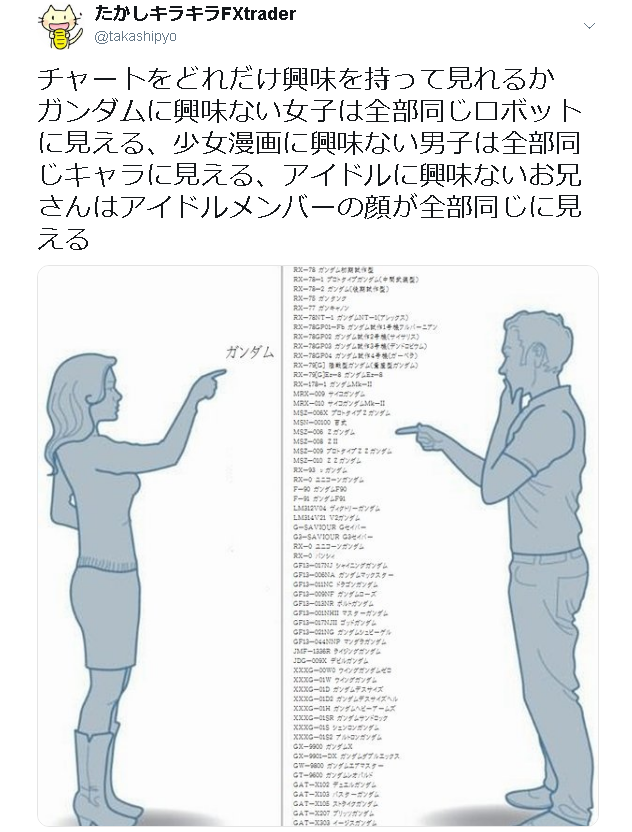

The woman who looks at the same Gundam has less information.

There was a similar story last year as well.

There were people who posted a chart image and explained it on Twitter.

“I should have shorted at the red circle, but with this kind of chart it’s possible to win, while in real life I can’t.”

People who are winning with this kind of trade trade with a setup that involves deception.

If you want to take this kind of trade, you need a mental state that can withstand repeated deceits without getting discouraged.

The pattern being explained here is a pattern I’m proficient at.

It has a high win rate and is a rock-solid pattern.

I was surprised that it involved repeated deceits.

At that time, I had a very high win rate and didn’t even remember when I last cut a loss.

That was when I was teaching for free on a limited blog.

I was explaining this pattern as well.

I even recorded videos and showed that you could actually enter on charts that were moving.

I hadn’t interacted with the person tweeting above, but I was curious and sent a direct message.

They explained various things, but it was only an explanation in words like “this will trigger a stop loss if this movement occurs.”

Of course, no matter which pattern you enter, there are times when the price moves against you.

What I wanted to know was, in actual charts, where did the “deception pattern” appear?

Whether there are charts that frequently move against you with this pattern?

I asked stubbornly, even if it was a shot in the dark.

Then, they went to the trouble of finding and clipping charts for me. Thank you.

They brought a few charts, but

they were all different from the chart patterns I trade.

That person saw everything as the same, didn’t they?

I understood why there could be repeated false breaks.

Even if I see a different pattern and don’t trade it, if I did trade it, I would understand that stop-losses would occur repeatedly.

Even if I analyze a chart and trade it, I may not convey it accurately.

This is the difficult part and also the interesting part of charts, I think.

Yes, this time,

it seems everyone looks at the same chart, but in fact they trade on completely different charts.

That was the discussion.

Do you see the same chart pattern, or do you see different chart patterns? I plan to write my explanation in the members-only blog.

You cannot see beyond your own ability.

If you change yourself, the world will look different.

We live in a world of subjectivity. How you see this world depends on you.

RTs and likes! Thank you as always. It gives me motivation to keep writing!

If you found this article interesting or want to read more, I’d be happy if you share it on Twitter or RT.

Things I think are good or interesting, let’s share them with everyone. It makes both you and those around you happier.

Past articles index ↓

https://www.gogojungle.co.jp/finance/navi/699/11076