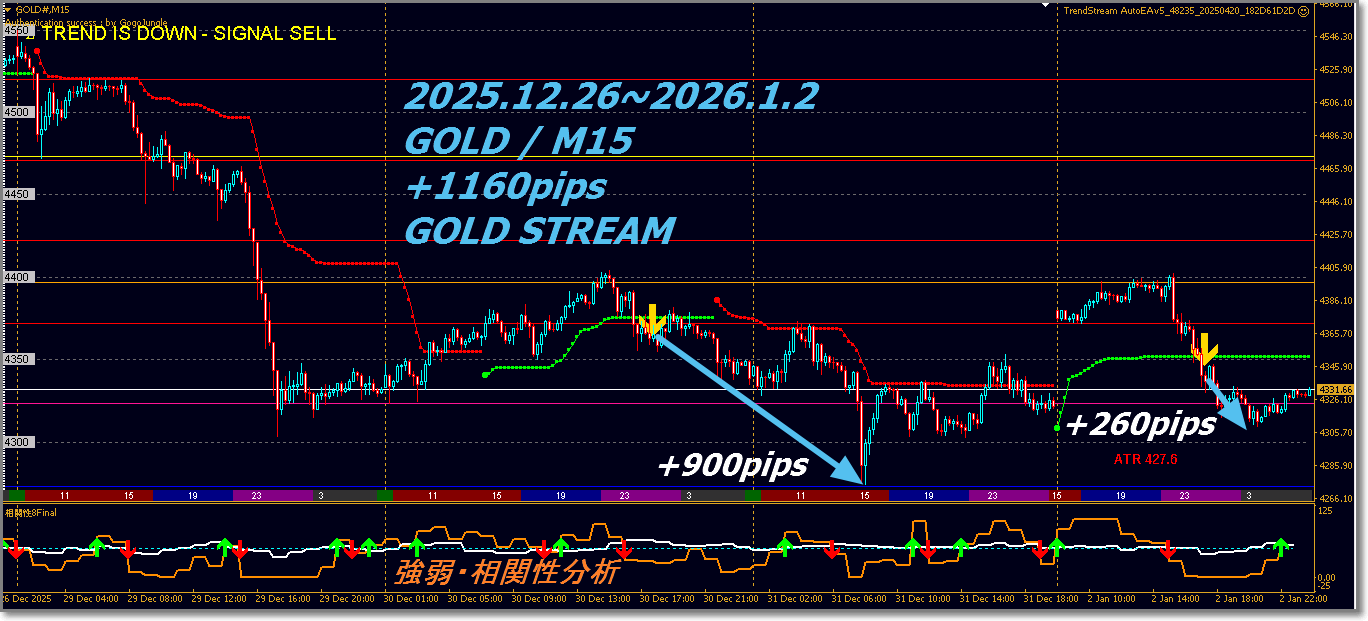

[Last Week's Results] GOLD Day Trading Focused Type "GOLD STREAM" 2025.12.29~2026.1.2

▼【Last Week's Performance】”GOLD STREAM” 2025.12.29~2026.1.2

(MAX Calculation)▼

2025.12.31 Distribution

2026.1.2 Distribution

Price Trend (12/29〜1/2)

-

Year-end holidays overlapped, major markets were thinly traded.

-

From late December reaching near historical highs, range-bound around highs was the focus

-

There were moments of short-term profit-taking, but declines were limited

-

Overall, the market remained in a high-price range with stable movement, and no clear trend reversal was observed

Year-end holidays overlapped, major markets were thinly traded.

From late December reaching near historical highs, range-bound around highs was the focus

There were moments of short-term profit-taking, but declines were limited

Overall, the market remained in a high-price range with stable movement, and no clear trend reversal was observed

Supply-Demand and Investment Factors

-

The ongoing expectation of U.S. rate cuts provides mid- to long-term support.

-

Geopolitical risks and global economic uncertainty persist, driving safe-haven demand.

-

In the FX market, dollar direction was lackluster, and gold stayed within a range

-

Year-end position adjustments added some market instability

The ongoing expectation of U.S. rate cuts provides mid- to long-term support.

Geopolitical risks and global economic uncertainty persist, driving safe-haven demand.

In the FX market, dollar direction was lackluster, and gold stayed within a range

Year-end position adjustments added some market instability

Investment Trends

-

Institutional investors refrained from building new positions, adopting a wait-and-see stance was dominant

-

Conversely, medium- to long-term investors continued to buy on pullbacks

-

Compared with short-term trading, the market showed more activity waiting for next year's catalysts

Institutional investors refrained from building new positions, adopting a wait-and-see stance was dominant

Conversely, medium- to long-term investors continued to buy on pullbacks

Compared with short-term trading, the market showed more activity waiting for next year's catalysts

Overall Assessment

-

Gold prices around year-end and New Year were in a consolidation near the highs

-

However, the downside remained firm, and the bullish stance persisted

-

From the new year onward, depending on monetary policy and macro factors, there is a high likelihood of renewed movement

Gold prices around year-end and New Year were in a consolidation near the highs

However, the downside remained firm, and the bullish stance persisted

From the new year onward, depending on monetary policy and macro factors, there is a high likelihood of renewed movement

SILVER Market Overview Summary

Silver traded with thin volume around year-end, after the December surge it entered a correction phase. While short-term profit-taking is likely, future industrial demand and the high price level of gold support a solid floor. Overall, prices remained in a high-range and are waiting for new catalysts at the start of the year.

Silver traded with thin volume around year-end, after the December surge it entered a correction phase. While short-term profit-taking is likely, future industrial demand and the high price level of gold support a solid floor. Overall, prices remained in a high-range and are waiting for new catalysts at the start of the year.

GOLD / M15 Day-Trading Focused

What is GOLD STREAM?

Main Features of GOLD STREAM

1. Designed specifically for GOLD (XAUUSD)

GOLD STREAM is optimized for GOLD’s volatility characteristics and correlation structure

as a dedicated short-term day-trading system.

It emphasizes immediacy and consistency that generic tools struggle with.

2. Two-stage notification: Ready → Signal

-

Ready (Preparation) notification

Warns when conditions are starting to align -

Signal (Confirmation) notification

Notifies when conditions for entry are met

This prevents missing signals or careless mistakes, allowing calm execution after preparation.

3. Integrated display of “Strength/Correlation” in a sub-window

GOLD trading needs

-

Relative strength

-

Correlation direction check

-

Signal strength

displayed in a sub-window without repainting, allowing instant confirmation.

No need to open other charts or apps anymore.

4. Automatic Pivot Line display

To clearly indicate target price levels, Pivot Line can be shown.

-

Day trading: based on Daily Pivot

-

Operation aiming for price range: target Weekly Pivot

Based on GOLD’s characteristic price moves, you can visually grasp realistic take-profit levels.

5. ATR-based automatic exit logic (Trailing EA)

Free trailing EA automatically sets optimal TP based on ATR (Average True Range).

-

Basic risk-reward maintained at 1 : 3.

-

In ranging markets, trailing helps protect unrealized gains

Significantly reduces discretionary exit decision fatigue.

6. Also supports mobile entry

Entry: possible on mobile

-

Exit: Trailing EA automatically handles TP / SL / trailing

After entry, profit-taking or stop-loss decisions can be entrusted, enabling calm trading.

7. Design to reinforce trading techniques

GOLD STREAM aims not only for short-term results but also for

-

identifying advantageous market conditions

-

maintaining proper risk-reward sense

-

limiting unnecessary entries

This is a design to establish essential trading skills for continued success.

▼【Last Week's Performance】”GOLD STREAM” 2025.12.29~2026.1.2

(MAX Calculation)▼

2025.12.31 Distribution

2026.1.2 Distribution

Backtesting Included

↓ This automated settlement EA is included (free bonus)! ↓

▼”MaximumPro EAv2” Details & Product Page▼