I’m going to quit now

I am a candlestick FX trader.

It’s New Year’s Eve!

How will you spend this year-end and New Year?

As this season arrives, forecasts for the market next year pop up everywhere.

What will happen to the Nikkei average, what will happen in the forex market,

what will happen to gold prices, and so on—

many people are making various predictions.

I have an acquaintance who is an economic analyst,

and even he says that making predictions for next year is futile and cannot be trusted,

and that it’s meaningless.

But why is it that the media can present predictions from various analysts for next year?

Because they are watched.

So, reluctantly, he also feels obliged to provide reasons and

explain next year’s forecasts.

Most viewers want to know whether the Nikkei will go up or down next year,

how high it will rise,

whether the yen will weaken further,

whether gold will rise further.

That is what people want to know.

In short, most viewers are beginners.

To increase ratings,

even though they know predictions can’t be accurate,

the program feels compelled to present them.

Until now, I have told you repeatedly that forecasting is futile.

Exactly one year ago, at this time,

various people were making forecasts,

but were there any who actually turned out to be correct?

There was the Trump tariff shock in April;

was there anyone who could have forecasted it in advance?

Not only for gold but also silver and platinum,

who could have predicted they would rise this much?

Of course some people hit the mark by chance,

but silver and platinum,

China’s influence has been significant,

and regarding the rise in gold, especially since the Takatsu administration,

it has been largely driven by concerns about inflation from expansive fiscal policy,

so predicting that a year ahead was impossible for anyone.

Since we cannot accurately predict the ascent of the market while it’s unpredictable who will become prime minister, Takatsu or otherwise,

we cannot predict market movements accurately.

Also, if you go into details,

the events that can be forecast at this stage have already been priced in the market.

If the US cuts rates or the BOJ raises rates,

these trends have been understood since last year.

Sometimes people base predictions on this to forecast USD/JPY falling, but

even doing so won’t let you ride the market’s moves.

Because,

the US cutting rates and the BOJ raising rates

were already priced in to the market.

As expected, this year USD/JPY did not fall dramatically; instead it has moved toward further yen depreciation.

When the market has already priced something in, even if it happens as forecast,

it does not move strongly in that direction from there.

Rather, as during the BOJ meeting in December,

considering what’s priced in and Ueda’s statements,

even though rates were raised, the yen still weakened.

Prices move only when something unexpected occurs.

Therefore forecasts announced at the start of the year,

or more precisely, everything that could be foreseen,

has already been pre-positioned in advance.

Even if the public watches forecasts,

the public is already holding positions toward them,

so the current price already includes those contents.

Thus, only when something new and hardly forecasted occurs will prices move in that direction.

Also, these forecasts are biased by expectations.

People who want the Nikkei to fall tend not to be among the majority except for those briefly shorting futures.

Most people want to believe the Nikkei will rise.

And the analysts who make such predictions gain popularity.

People listen with interest.

Conversely, those who expect a decline are criticized.

Some are even labeled traitors to the country.

This seems true for YouTube as well.

YouTube channels bullish on Japanese stocks or videos like that tend to get more likes.

With such biases, people who forecast market moves present analyses,

so forecasts themselves become entertainment.

Therefore, listening to forecast-based speculation or trading on it is a waste,

and you should stop doing so immediately.

I, too, used to trade after making various forecasts,

but none of them worked well.

In fact, forecasts are futile because always something unforeseen happens,

so you’re forced to constantly revise your forecast.

This only makes you be driven by the market and prevents good results from emerging.

Instead of making strange forecasts,

observe what current market participants think,

see what positions they are making,

and understand supply and demand to judge more accurately.

Supply and demand means the price is determined by the difference between buyers and sellers.

Various analyses show there are buyers and sellers in the market.

If there are more buyers, prices go up;

if more sellers, prices go down.

It’s as simple as that.

The mechanism for price movement is just that.

Forecasts in advance change as new information appears.

So market moves in line with forecasts are impossible in themselves.

For this reason, I have stopped forecasting altogether and

focussed only on what is happening now.

By doing so,

I started to win.

So, specifically, how should one trade?

So that beginners can trade without confusion and without discretion,

I have developed seven logic systems that are now being offered.

And because I have publicly shared these logics,

many people have told me they have started winning,

beginners have started profiting at an early stage,

and I have received many such voices.

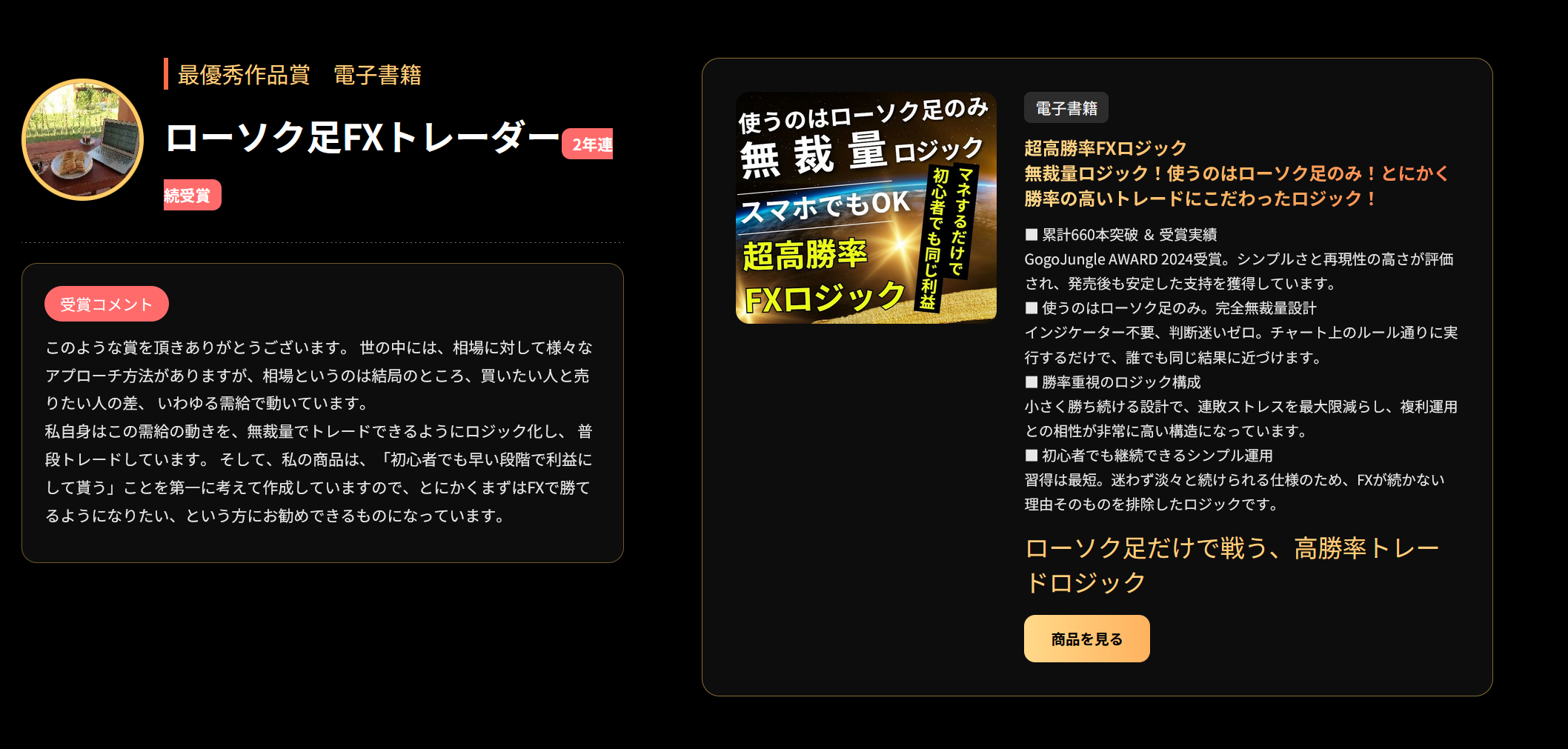

And recently announced,“GogoJungle AWARD 2025”where

Best Work Awardwas awarded to us.

The特徴 of my logics are,

“Even beginners can profit quickly”

as the top priority in product development.

And although I currently offer seven logics,

each iscandlestick-basedand a very simple logic.

Therefore, the charts are very simple,

and you can trade on smartphones as well.

Thus,discretion-less

and for those busy, a logic that can be traded on a smartphone while on the go

is offered.

If you want to trade in the same way,

by obtaining my logic,

you can trade without predicting the market and

you can continue for a long time in any market.

Because the logic is simple,

it will continue to be effective no matter how markets change.

And among the seven logics,

their features differ, so

I summarize them below.

“Candlestick FX Logic”

The main feature of this logic is

more entry opportunities in an discretionary logic.Entries and exits are determined only by candlesticks.

It works from 1-minute to daily charts, suitable for scalping, day trading, and swing trading,

so you can operate in your preferred trading style.

For those who want to know more, please view the following video and free bonuses.

Key points to win at FX

Password

“Ultra-High Win Rate FX Logic”

This is a logic that emphasizeshigh win rate

This is especially recommended for beginners who want to start making profits first.

Among the five logics, it is the easiest to learn.

For more details, please view the following video and free bonuses.

How to maximize performance with minimal effort

Password

“Breakout FX Logic”

Aiming for profits to the utmostis the purpose of this logic.

Again, it is a candlestick-based trade.

For more details, please view the following video and free bonuses.

How to pursue profits relentlessly without forecasting

Password

“Ultra-Fast FX Logic”

A logic specialized for 1-minute scalping.

In effect, a single trade completes in a few minutes.Rather than chasing large trends,

it aims to grab small profits of around 10 pips frequently.

“Trend Scalping FX Logic”

Scalping on the 1-minute chart, but if a trend appears, you aggressively pursue profits.

Keep the position until the trend ends,

and even on a 1-minute chart, profits can exceed 400 pips at times.

In particular,for those who want to achieve large profits in a short timethis is a recommended logic.

For more details, please view the following video and free bonuses.

How to aim for large profits in a short period

Password

“Auto FX Logic”

A method to automate trading from entry to exit.

No matter how the market changes in the future,

you can respond flexibly with no discretion, and automate it as well,

a logic that can yield the same profits for beginners.

For more details, please view the following video and free bonuses.

Password

“TACO Trading FX Logic”

A logic specialized in aiming for large profits in a very short time.

It targets rebounds from market overshoot, and

this movement will work in any future market or any market situation.

Of course, it also allows discretionary-free trading,

so beginners can immediately start practicing.

For more details, please view the following video and free bonuses.

How to forecast future price movements

And now, in order to help as many people as possible become profitable in FX,

we are

significantly discounting

During year-end and New Year, markets are relatively quiet,

so by devoting time to learning new logics for the new year,

you can start the year with a great footing.

Please stop relying on strange forecasts,

and stop forecasting in a weird way,

and simply follow the market’s movements to increase your profits.

I hope you will join me in stopping forecast-based trading.

If even a few more people adopt this,

I thought I’d write this article at year-end.

Thank you for all your support this year as well.

Wishing you all the best next year as well!

Have a wonderful New Year.