[Beginner's Read] "The story that FX seems easy but is not easy."

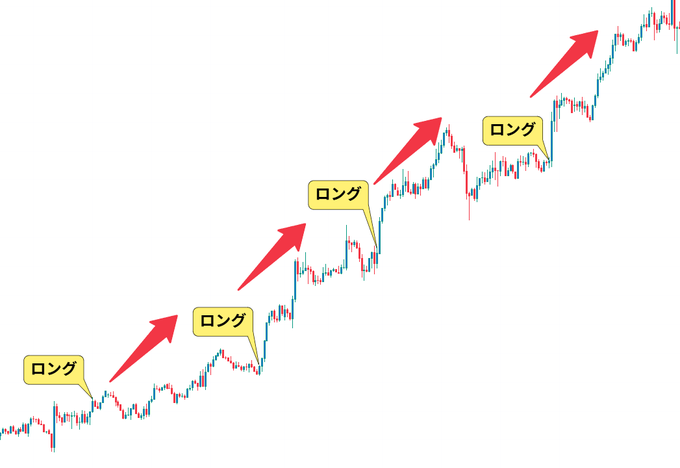

If it goes down, you just long it, right? It seems that way

From this view, it looks easy, doesn’t it!

Now, to the main topic

In FX,

“There are selling and buying pressures, so the win rate is 50%”

That is what people tend to think.

But that’s a complete misconception.

If it were a coin toss, it would indeed be 50%.

But FX is

a game where the moment you participate without thinking, the rate becomes “below 50%.”

The reason is simple.

- Spread

- Slippage

- Fees

- Emotions

- Rule-breaking

At this point,

you are from the start in the red.

Entering without thinking

in terms of “will it rise or fall” puts you at a disadvantage.

So,

what are the winning traders doing?

They don’t try to predict the direction.

What they watch is,

- where you are less likely to lose

- where entering makes it easy to exit

- where damage is small if it goes wrong

In other words,

they design for “how to lose” rather than win rate.

For example,

price action near the resistance band.

clear horizontal lines.

a position where you can retreat immediately if it breaks.

Trades taken here are,

they grow if they hit,

end small if they miss.

At this point,

the idea of 50% is already gone.

Many people think like this.

“I want to increase win rate”

“I want to hit more often”

“I want to improve accuracy”

But the reality is the opposite.

The more you try to hit, the bigger your losses become.

FX is,

not a “50% game of selling and buying.”

“A game where only those who can keep losses small survive.”

Win rate doesn’t need to be high.

You don’t need to win streaks.

- Don’t crumble when you lose

- Can continue the same actions

- Emotions don’t break

Only those who can do this

will ultimately be on the winning side.

Please remember.

In FX, the winner isn’t the one who hits accurately.

The winner is the one who didn’t break down.

From the moment you adopt this perspective,

the way you view the market will change.