That monitoring method is dangerous! The "loser mentality" that FX beginners fall into and how to break out of it

Most people who start trading think this at first.

“If I watch the charts properly, I should be able to win.”

But the reality is...

Most people deplete their funds and exit after a few months.

Why is that?

That’s because they are trapped in the“loser’s thinking/behavior patterns”.

● Typical loser’s thinking/behavior patterns ●

・Only a few currency pairs are monitored

・Just casually observe whether a trend is forming

・Bored, so they stray from the rules

・Before they know it, entries are late and stop-losses pile up

…how about that.

If even one applies to you,

you already have one foot in the “loser’s thinking/behavior patterns.”

Especially dangerous are “insufficient monitoring” and “scattered monitoring.”

You cling to the screen because you don’t want to miss a chance,

but you can’t follow the rules, and you end up doing nothing…

Conversely, if you monitor while doing other tasks,

only when you are about to miss a rule will it line up perfectly, and you’ll still miss it…

Repeating this leads to unnecessary fatigue, breaking the rules, and accumulating losses.

This is a typical losing pattern.

● Winners optimize monitoring with a system

Meanwhile, winning traders think differently.

They don’t simply monitor charts aimlessly.

Staring at charts without a plan only fatigues your judgment.

They have a“system to make monitoring efficient”.

That’s why they can calmly follow the rules and aim only for major trends.

So, how can you move from being a loser to a winner?

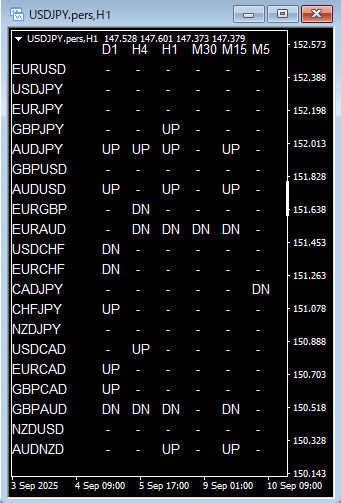

One answer is TrendList.

・Up to 20 currency pairs

・6 timeframes

・Monitor 120 trends simultaneously

Just set this on the edge of MT4’s screen.

There’s no need to switch currency pairs to check anymore.

There’s no need to curse yourself for missing it anymore.

What you will see is“UP (rise)”“DN (fall)”“— (no trend)”

There is no room for hesitation, so you can act according to the rules.

● Do you still want to continue with “loser’s thinking/behavior”? ●

Loser traders always offer the same excuses.

“Today just happened not to move”

“If I had watched another currency pair, I would have won”

“If I had been more focused…”

But that’s just self-justification.

The real cause is“inadequate monitoring.””

Winners solve this with a system.

Losers try to solve it with willpower and end up crushed.

Which side will you choose?

If you introduce TrendList —

・Zero misses due to insufficient monitoring

・Prevents wasted entries

・Mental ease and adherence to the rules

It will break the loser’s patterns you had and bring you closer to a winner’s thinking.

What you need to grow capital in trading isn’t talent or luck.

What you need isto create the right environment.

× ![]()