Summary of the 2025 USD/JPY exchange rate

As of December 26, 2025 (Friday), here is a summary of this year's USD/JPY (Dollar/Yen) market.

2025 was a year of fundamental shifts in the日米 interest rate differential narrowing and political factors such as “Trump administration (second term) trade policy and dollar strength pressure” pulling in opposite directions, making it a volatile and complex year.

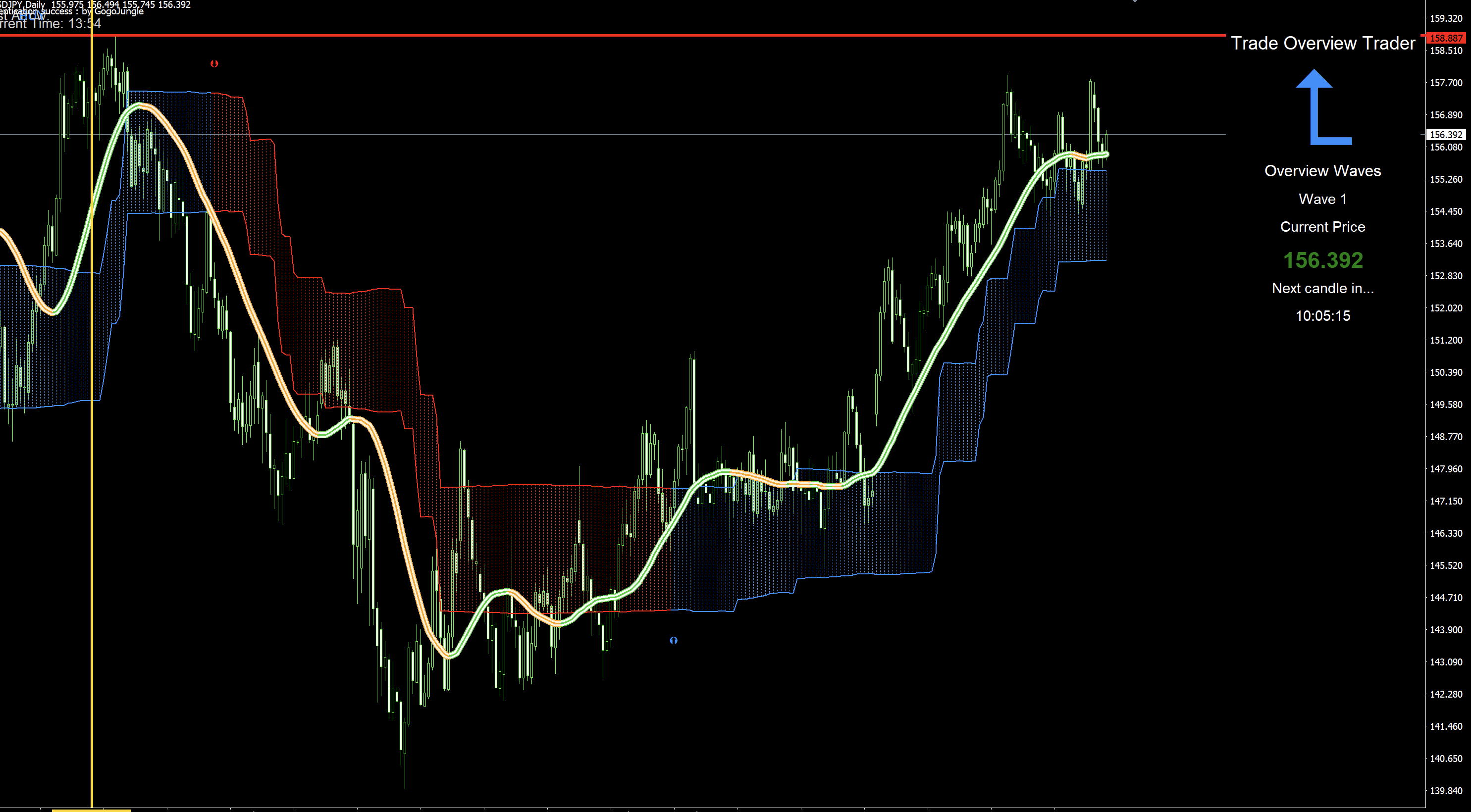

In short, the Bank of Japan implemented a historic rate hike (to 0.75%), while the Fed began cutting rates, but at year-end the market was in the 156–157 yen range, still poised to end the year at a historically weak yen level.

Highlights of 2025 Market

Key events, themes, and market moves (USD/JPY) Start of year (January) Bank of Japan raises rates to 0.50% (the first time in 17 years). It fell briefly from around 158, but found a solid floor.

Spring to early summer (April–June)Concerns about a slowdown in the U.S. economy and rising expectations of Fed rate cuts.Down to the 143 yen rangeas yen strengthened to near annual lows.

Fall (September–November)Impact of U.S. presidential election and Mr. Trump (concerns about tariff policy). Yen rose again into the 150s. From “If Trump” to “Trump Trade.”

Year-end (December) Bank of Japan adds another rate hike to 0.75%(Highest in about 30 years). The Fed cuts rates three times in a row (to around 3.6%). With factors exhausted and awareness of U.S. tariff risks, the yen weakened again to156–157 yen rangeagainst the dollar.

Three major trends of the year in summary

1. The Bank of Japan’s “normalization” and Governor Ueda’s decisions

This year marked a historic turning point for the BOJ.

January rate hike (0.25% → 0.50%): Consolidated the first step after the removal of negative rates.

December rate hike (0.50% → 0.75%): Dec. 19 meeting decision. Amid whispers of political tension with Prime Minister Sanao Prime Minister (pro active fiscal policy and ease), Governor Ueda pressed ahead with a rate hike citing “sustained inflation target achievement.” Demonstrated independence.

However, the market treated this as “already priced in,” showing a ‘sell the fact’ reaction with yen selling immediately after the rate hike announcement.

2. The Fed Pivot and the “Trump 2.0” dollar strength

The Fed entered a rate-cut cycle in the latter half of the year, lowering the policy rate from the 4% range to the mid-3% range. Normally this would be dollar bearish (yen bullish), but the dollar was supported by the following factors.

Trump administration tariff policy: Expectations of higher U.S. import tariffs fueled thoughts of “import price inflation (reaccelerating inflation) → less room for Fed rate cuts,” hindering U.S. yields from falling.

Resilience of the U.S. economy: Although some employment metrics softened, recession was avoided, sustaining dollar preference.

In textbook terms, “narrowing U.S.-Japan rate differentials should mean yen appreciation,” but 2025 did not follow that logic straightaway.

While the rate gap narrowed, the absolute gap remained large (U.S. 3.6% vs Japan 0.75%), so carry trades (yen selling, dollar buying) were only modestly unwound.

Structural yen selling pressure from Japan’s trade deficit and overseas investment via the new NISA (e.g., all-accounts) continued to support the market’s floor.

Outlook for next year (2026)

The current level around 156 yen acts as inflationary pressure through imported prices for the BOJ, so further rate hikes will remain a focus in 2026.

Path to neutral rate: Markets expect the BOJ’s terminal rate to be around 1.0%–1.25%, with emphasis on whether additional hikes occur within 2026.

Friction with the Trump administration: How U.S. trade policies affect Japan’s export industries and whether foreign exchange terms will press for yen adjustments remain the biggest risk factors for the market.

Only a few days remain this year, so please be mindful of potential rapid moves (flash crashes) during thin year-end trading.

The trend is strongest in the aligned-with-the-trend direction—aim for a heroin trade despite the market’s volatility!

Many victories already achieved! Billionaire traders rise

https://gogojungle.co.jp/re/82bZpYuxQSgWCPg

Ideal for practice and verification during holidays

Practice-kun Premium and Special Bonus Indicator