Isn't that indicator merely a coincidence that happened to “fit” the environment?

● Overwhelming validation proves the unique reproducibility

When talking about the reliability of trading logic,

“validation period” and “number of validation cases (sample size)” are the most important indicators.

Because the forex market is constantly changing due to seasonal factors, interest rate policies, geopolitical risks, and volatility fluctuations,

it is a non-stationary environment with no consistency in market conditions.

Therefore──

With only the most recent 1–2 months and a few dozen to several hundred validations,

you cannot detect merely by chance whether the environment happened to fit, or whether there is overfitting (curve fitting) to past data.

In that case, it cannot be said that there is statistically significant edge.

① A reliable logic meets the following conditions.

✓Sufficient long-term validation (at least several years to over a decade)

✓Validation cases in the thousands to hundreds of thousands (= statistically meaningful population)

Validation is the process of“checking whether the rule consistently works across various market environments.”

A logic with a short validation period and few samples inevitably lacks reproducibility and reliability.

② To establish a statistically based trading approach, the following three elements are indispensable.

✓Long-term continuous validation

✓Statistical backing with a sufficient sample size

✓Consistent “completely non-repainted” data across past and present

Only when all three conditions are met

can you speak of the logic’s reproducibility, expectancy, and edge as a basis for investment decisions.

And──

All of these conditions are fulfilled by this Sign Indicator.

Consistent edge backed by vast validation data is

this sign indicator’s greatest strength and the only true “proof.”

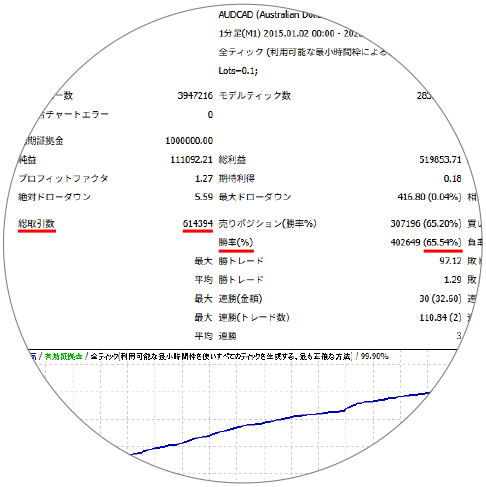

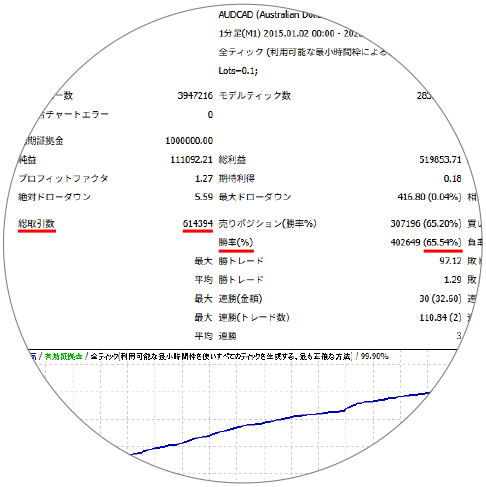

↑Even with just a single currency pair, the total number of trades exceeds 600,000 (= number of validations).For details, please check the validation data in the section “● Proof over Theory.”

When talking about the reliability of trading logic,

“validation period” and “number of validation cases (sample size)” are the most important indicators.

Because the forex market is constantly changing due to seasonal factors, interest rate policies, geopolitical risks, and volatility fluctuations,

it is a non-stationary environment with no consistency in market conditions.

Therefore──

With only the most recent 1–2 months and a few dozen to several hundred validations,

you cannot detect merely by chance whether the environment happened to fit, or whether there is overfitting (curve fitting) to past data.

In that case, it cannot be said that there is statistically significant edge.

① A reliable logic meets the following conditions.

✓Sufficient long-term validation (at least several years to over a decade)

✓Validation cases in the thousands to hundreds of thousands (= statistically meaningful population)

Validation is the process of“checking whether the rule consistently works across various market environments.”

A logic with a short validation period and few samples inevitably lacks reproducibility and reliability.

② To establish a statistically based trading approach, the following three elements are indispensable.

✓Long-term continuous validation

✓Statistical backing with a sufficient sample size

✓Consistent “completely non-repainted” data across past and present

Only when all three conditions are met

can you speak of the logic’s reproducibility, expectancy, and edge as a basis for investment decisions.

And──

All of these conditions are fulfilled by this Sign Indicator.

Consistent edge backed by vast validation data is

this sign indicator’s greatest strength and the only true “proof.”

↑Even with just a single currency pair, the total number of trades exceeds 600,000 (= number of validations).For details, please check the validation data in the section “● Proof over Theory.”

× ![]()