[Winning Mindset] Act on Facts, Not Predictions [Line Trade]

February 27, 2019 (Wednesday)

From the morning, I tweeted about this kind of thing. I tried to imitate it a little.

With the pound rising, I was thinking about aiming to buy.

○When it’s rising, I think about where to buy

×When it’s rising, I think about where to sell

↑

This is a line borrowed from the manga Akagi.

When playing mahjong, opponents cheat or team up with partners and devise various strategies.

At that time, Akagi said a line

“You’re pulling off such a elaborate imitation, Mr. Yagi

I’ll go more straightforwardly…!”

In trading as well, many people try to hit a reversal with various tactics.

Using different oscillators to say it’s overbought and that a reversal is near,

Buying tools that predict reversals,

Gluing together information and saying it’s oversold or overbought due to fundamentals, or that there’s no catalyst for a rise, so a reversal is imminent.

People do very difficult things from time to time.

It’s not simple.

JoJo... Humans have limits to their abilities. What I learned in a short life is

The more you try to outthink a plan, the more it collapses due to unforeseen circumstances!

@JoJo's Bizarre Adventure

I will honestly and simply buy what’s rising.

I sold when I saw the glittering red line stop me with a take-profit.

If it still goes up,Confirm the fact that it went upthen buy again.

Last week and this week, I explained the same thing twice.

And as it rose again, I bought again and took profits again.

I’ll buy even at a price higher than the first trade.

But just follow it straightforwardly. It’s a very simple way of thinking.

to cis

When investors or beginners ask me, “Please give me some advice,”

I often say, “What goes up will keep going up, and what goes down will keep going down.”

I mainly talk about the basic principle being trend-following.

Right now

It’s going up because it’s being bought,

It’s going down because it’s being sold

That is a clear fact there.

So, acting in line with the market trend gives the highest chance of winning.

Following this core principle allowed me to build my current assets.

Also, timing of buying and where to place stops are important.

Like this time, due to timing and stop width, there are days I can only enter 10 lots, not more.

Just because it’s rising, buying aimlessly is dangerous, isn’t it?

The core principle that cis speaks of, and the way my trading teachers have taught me, is the same, but the concrete methods and rules differ.

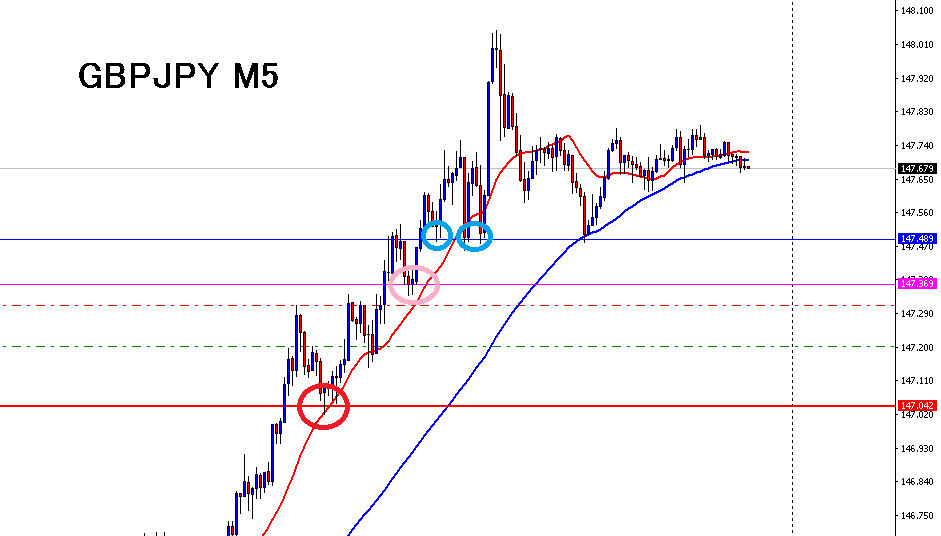

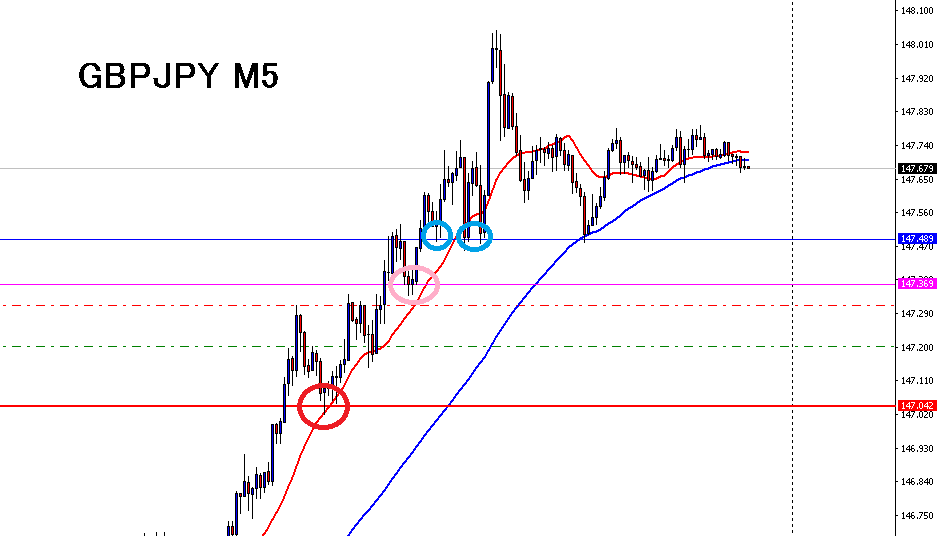

I use horizontal lines for entry and exit criteria. This is called line trading.

There are lines of many colors. We call them glitter lines.

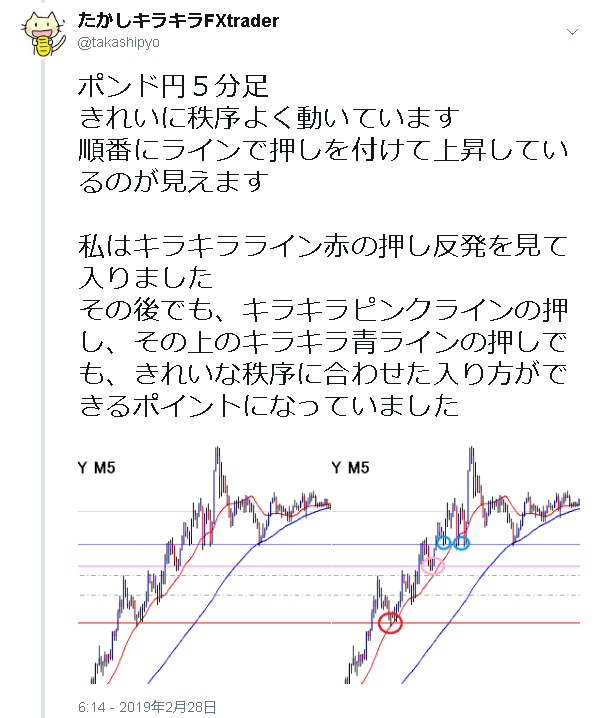

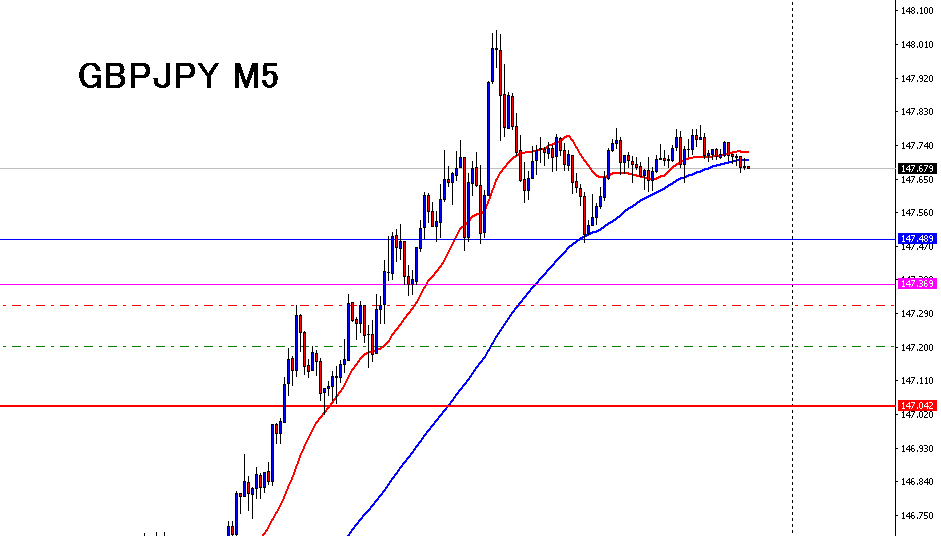

Can you see the orderly movement?

It’s easier to see if you circle them.

When price moves along a line and bounces, then moves to the next higher line and bounces again, you can see it moving in a regular pattern.

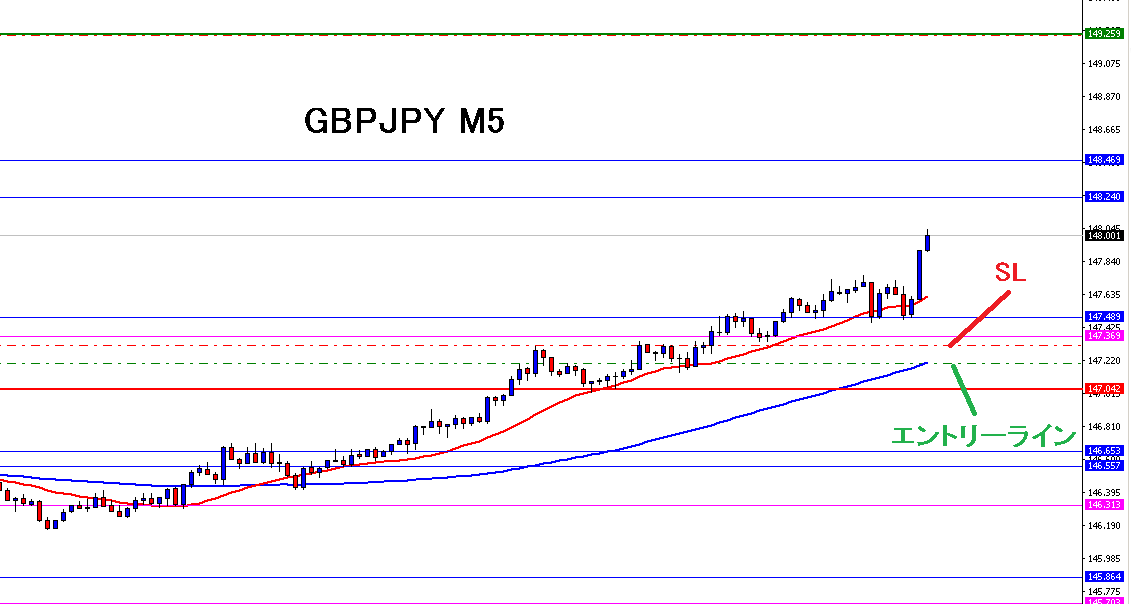

I don’t draw these lines after the fact; I draw them in advance. You can tell by looking at the entry chart.

During an uptrend, you should buy based on lines drawn in advance.

The entry point is simple and easy to understand. Oscillators are not necessary.

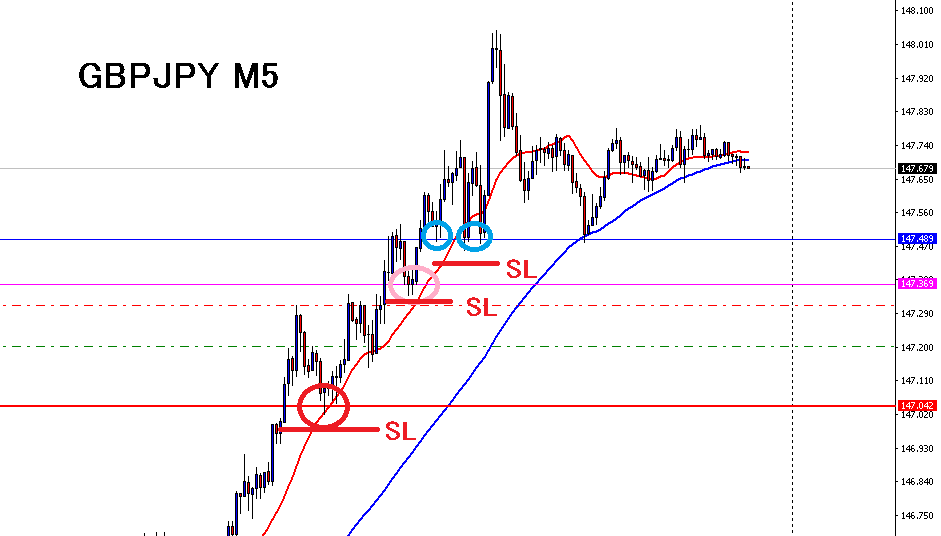

And, stops (stop-loss orders) should be placed below the line as a basic rule.

The stop loss is simple and easy to understand, isn’t it.

Since you ride the wave that bounces off the line and goes up, if the price breaks that line, the movement is different than expected, so there’s no point in holding, you must stop out.

Enter and then immediately place a stop-loss order.

That way you won’t suffer large losses (depending on your capital and lot size).

You won’t be lying awake with unrealized losses.

If you raise the stop a bit after the price has risen, even if it falls, you won’t lose.

Some people are surprised by how small their stop widths are.

“With such a small stop width you’ll be stopped out quickly.”Some say that.

That happens when price movement isn’t clean or there’s no clear sense of direction, meaning you might have entered in such conditions.

If you ride the upward trend as in this case, the lows get raised steadily.

Even if you enter and place an SL below the recent low, it won’t touch it.

Riding the trendis a key point, I think.

I received a reply.

When you say it went as you expected, it gives an impression of “as predicted.”

If you bet on a forecast and it hits, it feels like “as predicted” or “as read.”

However, I didn’t expect the price to rise, nor did I read it that way.

I just acted on the fact that it was rising. It may continue rising or may reverse; I don’t know.

Both are possible, I anticipate both.

In that sense, rising or falling, you could say it’s “as predicted.”

Rather than looking into the future (predicting), I act on the facts that exist now.

The first take-profit on pounds/dollars wasstopped by the line as a fact, so I closed the trade.

When buying again, I thought in advance: “If it goes higher,confirm the fact that it went higherand then buy again.”

I’m always following the current factsonly.

That cis who earned 23 billion yenstarted out by losing.

He says that because he wasn’t facing the facts directly.

cis

I hadn’t understood this core principle, so in the first two and a half years after opening my account,

I just melted away the 3 million yen starting capital, reducing it to 1.04 million yen.

I prioritized what I thought “should be,” and didn’t face the actual current state.

For example, people who say, “It’s risen too much, so I’ll sell.”

This is the belief that “it should fall because it has risen too much.”

They aren’t looking at the fact that it’s currently rising.

People who gather fundamental materials and say, “There’s no catalyst that would push it this high, so it should fall,”

This is the idea that “there’s no material to justify this rise, so it should fall.”

cis

“I’m sure there won’t be stocks that rise forever, so it should eventually fall,” and you end up predicting when it will reverse.What’s certain is the fact that it is rising now.No one knows how high it will rise.I don’t make arbitrary predictionsI am basically a fundamentals-ignored technician, but I don’t analyze to predict the future.I do it to verify what is happening now, the facts.In the long term, is it rising or falling now? In the mid-term, how about? In the short term?Whether it will go up or down from here is not an analysis to predict.I verify the present facts without forecasting. I grasp the current environment. Situation awareness.cisNo one knows where it will reverse.Trying to predict the timing and price of that reversal is merely applying a guess.In the market, you have to ask the market.I received a reply.It’s nice that random forecasts no longer come out.I’m very glad to see results.Yesterday, the pound rose sharply, and some people who were selling probably got hit.So some people may say the pound is scary.However, the scary thing is trading against the trend based on arbitrary forecasts.Because the pound-yen is rising, you buy.And it continues rising as is, in a straightforward, orderly way.How clean and well-ordered it’s rising.What a nice, obedient child it is.Pongo is a very obedient and good child.There was a question.I don’t always adjust the line, but I might not do it on a five-minute chart level.Besides, my glitter lines work very well! (not guaranteed)If you don’t adjust enough and it bothers you, you might need to rethink how you draw the line in the first place.By the way, how I draw glitter lines and how I script scenarios is posted on the FX member blog.[Tutorial video] How to draw lines, how to script scenariosSome people think, “I can pre-know my entry point!” because I say that, and they mistaken it for a signal service.This is stated that way to clearly convey in one line. It’s also a selling point that I show beforehand.The FX member blog isn’t about cheating to make money; I want you to use it to learn to earn on your own.How to use it:First, watch the videos on how to draw lines and script scenarios and practice.Practice with past-backtesting software. Practice a lot.In real-time charts, draw your own lines and scenarios first, then check by comparing with my model.Since I also explain my own trades, you can watch and imitate to learn.I do consultancies, but there’s no secret information taught only in consultations.I write all the methods and ways I use on the FX member blog.If you want to learn my trading, please consider purchasing it.And, to avoid wasting that money, study repeatedly through the videos and trade analyses.Practice again and again.If you’re a complete beginner, first draw all the lines I draw on your own chart and observe the subsequent price movement for discoveries.You’ll be surprised how clean and orderly price movement can be along lines.Of course, it doesn’t always move perfectly in order.Find order within chaos.Look for order within charts that appear random and chaotic at first glance.Hope everyone can win.Trading videos are up:Trading that turned 100,000 into 1,000,000 JPYI’m on Twitter:https://twitter.com/takashipyoYou can pre-know my entry points:FX Member Blog SeriesNote: Subscribing to the FX member blog is only via card payment.If you prefer other than card payment, please contact me via email or Twitter DM.takashipsychology@yahoo.co.jp

What’s certain is the fact that it is rising now.

No one knows how high it will rise.

I don’t make arbitrary predictions

I do it to verify what is happening now, the facts.

In the long term, is it rising or falling now? In the mid-term, how about? In the short term?

Whether it will go up or down from here is not an analysis to predict.

I verify the present facts without forecasting. I grasp the current environment. Situation awareness.

cis

No one knows where it will reverse.

Trying to predict the timing and price of that reversal is merely applying a guess.

In the market, you have to ask the market.

I received a reply.

It’s nice that random forecasts no longer come out.

I’m very glad to see results.

Yesterday, the pound rose sharply, and some people who were selling probably got hit.

So some people may say the pound is scary.

However, the scary thing is trading against the trend based on arbitrary forecasts.

Because the pound-yen is rising, you buy.

And it continues rising as is, in a straightforward, orderly way.

How clean and well-ordered it’s rising.

What a nice, obedient child it is.

Pongo is a very obedient and good child.

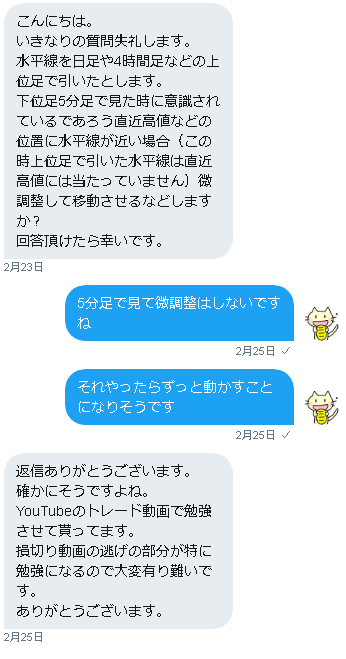

There was a question.

I don’t always adjust the line, but I might not do it on a five-minute chart level.

Besides, my glitter lines work very well! (not guaranteed)

If you don’t adjust enough and it bothers you, you might need to rethink how you draw the line in the first place.

By the way, how I draw glitter lines and how I script scenarios is posted on the FX member blog.

[Tutorial video] How to draw lines, how to script scenarios

Some people think, “I can pre-know my entry point!” because I say that, and they mistaken it for a signal service.

This is stated that way to clearly convey in one line. It’s also a selling point that I show beforehand.

The FX member blog isn’t about cheating to make money; I want you to use it to learn to earn on your own.

How to use it:

First, watch the videos on how to draw lines and script scenarios and practice.

Practice with past-backtesting software. Practice a lot.

In real-time charts, draw your own lines and scenarios first, then check by comparing with my model.

Since I also explain my own trades, you can watch and imitate to learn.

I do consultancies, but there’s no secret information taught only in consultations.

I write all the methods and ways I use on the FX member blog.

If you want to learn my trading, please consider purchasing it.

And, to avoid wasting that money, study repeatedly through the videos and trade analyses.

Practice again and again.

If you’re a complete beginner, first draw all the lines I draw on your own chart and observe the subsequent price movement for discoveries.

You’ll be surprised how clean and orderly price movement can be along lines.

Of course, it doesn’t always move perfectly in order.

Find order within chaos.

Look for order within charts that appear random and chaotic at first glance.

Hope everyone can win.

Trading videos are up:Trading that turned 100,000 into 1,000,000 JPY

I’m on Twitter:https://twitter.com/takashipyo

You can pre-know my entry points:FX Member Blog Series

Note: Subscribing to the FX member blog is only via card payment.

If you prefer other than card payment, please contact me via email or Twitter DM.

takashipsychology@yahoo.co.jp