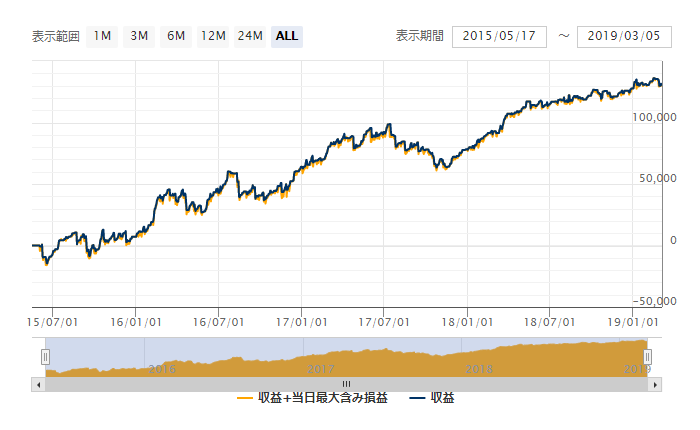

CounterQ: accumulate profit and loss by keeping losses small and gains large

About four years since operation began, the win rate and PF show little divergence between forward testing and backtesting.

24-hour-running EA 'CounterQ' for the USD/JPY currency pair

【CounterQOverview】

通貨ペア:[USD/JPY]

取引スタイル:[Day tradingScalping]

Maximum number of positions:1

Maximum lot size:0.1

Used time frame: M5

Maximum stop loss:120

Take profit:25

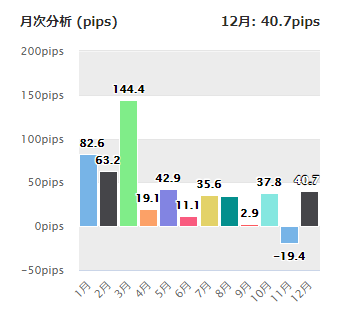

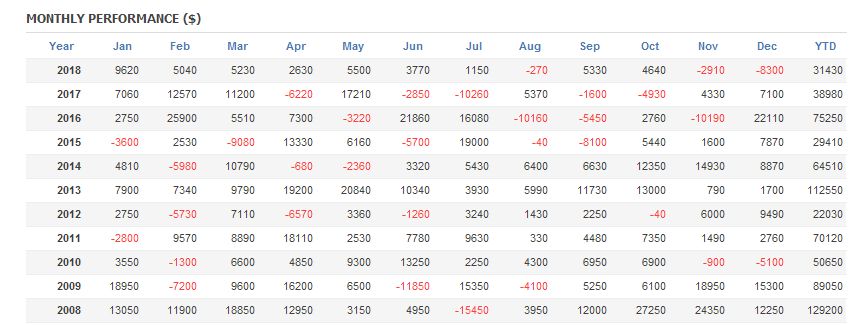

■2018 Monthly Analysis

2018年の月次は1月から3月にかけて大きく勝ち越しています。4月、6月、9月に落ち込んでいますが、5月、7月、8月、11月は戻しています。11月は唯一の損失となりましたが、12月にはプラスと持ち直しており。全体ではプラスの収益となっています。

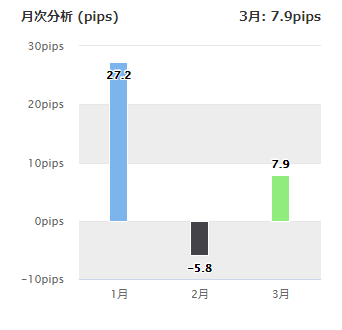

■2019 Monthly Analysis

This year's monthly analysis goes up to March; January was strong. February seemed weak, but March appears to be recovering. Depending on conditions, there may be months with negative results.

PFisthe win rate is70% and I think it is an excellent EA.

Basically operates 24 hours, so risk increases during events such as indicator releases.

In particular, during times when operators cannot respond, such as overnight, if there is event risk of large price moves, it is best to stop the EA.

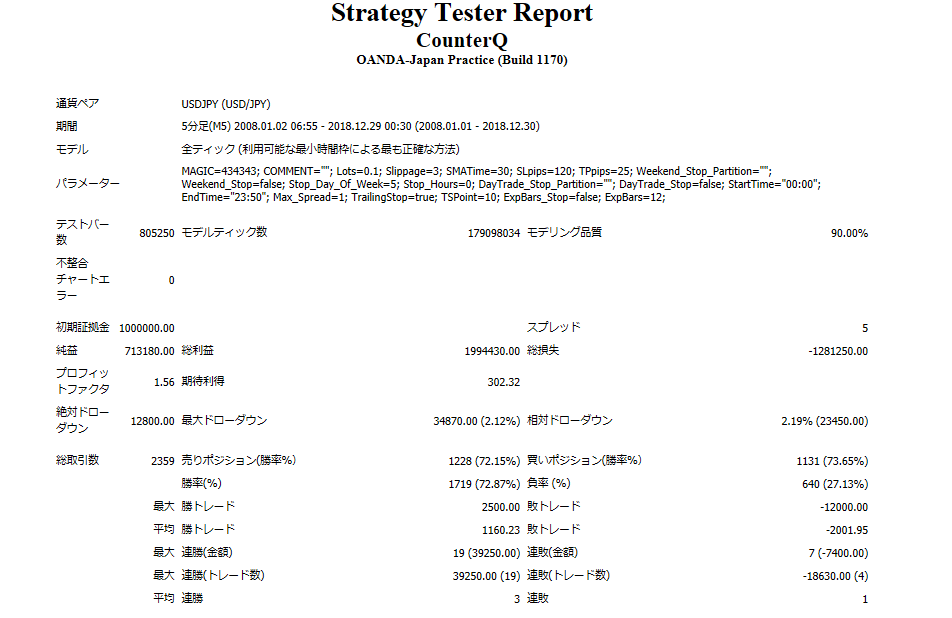

■Backtest

2008.01.01‐2018.12.30

Spread1

Net profit +71.3万円(annual average 6.5万円)

Maximum drawdown 3.5万円(2.12%)

Total trades 2359回(annual average214回)

Win rate 72.87%

PF1.56

What stands out is the low maximum drawdown.

The risk is in the low single digits around 1%, making it beginner-friendly.

Recommended margin is0.1 lots,

(4.5)+(3.5×2)=11.5(ten-thousand yen) result.

Expected annual return is 56%.

■Monthly and yearly profit/loss

Looking at the monthly results, the total is positive, but there are periods of significant losses.

When comparing forward and backtests, there isn't a big difference, but the drawdown percentage is larger in the forward test, so you should be careful when actually operating. Since the margin and drawdown amounts are small,24-hour operation riskshould be easy for EA beginners to understand and use.