Explain the winning mindset that earned 23 billion yen in actual trading [stop loss] [big-picture view]

Good morning. Hello. Good evening.

I’m Takashi, a former accountant, psychological counselor, and trader.

The “2.3 billion yen winning mindset” comes from cis’s book.

Since I trade with a similar mindset in some aspects, I’ll explain it from my own trading experiences.

Quoted passages from the book will be written in blue bold.

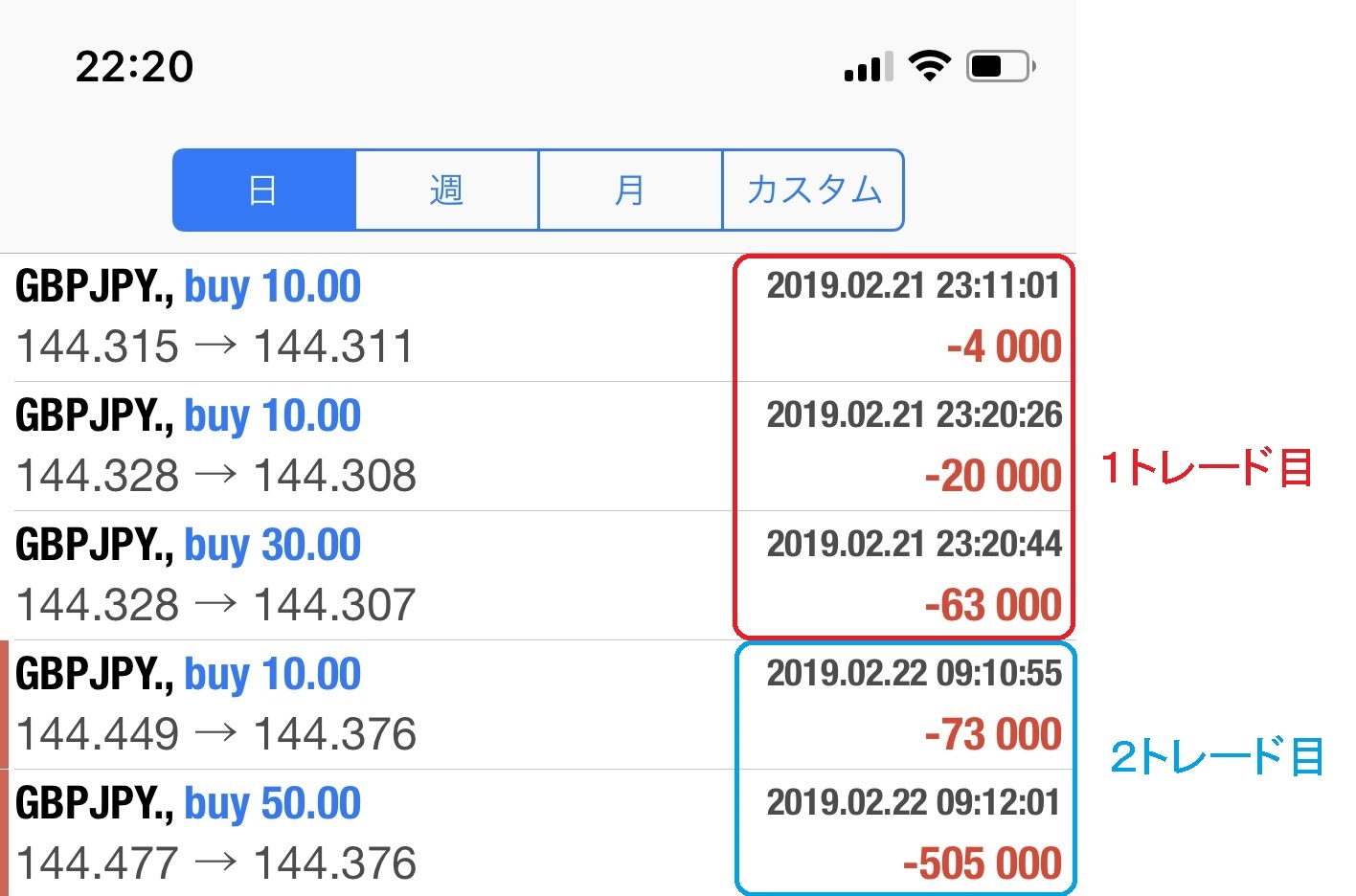

Let’s look at the trades on February 22 (Friday).

It started with a stop-loss.

It became an 87,000 yen loss.

Commentary article⇒20190222 (Fri) Pound-Yen Trade ~ Morning

As I followed the scenario, I escaped with only a small loss, so there’s no problem at all.

After one trade’s stop-loss, I wrote the next scenario. I had posted the forward-looking scenario in the article above.

Then again I bought Pound-Yen, and it hit the stop-loss. Two consecutive losses.

There is also a video of the stop-loss.

In the first trade, I bought Pound-Yen at 144.315–144.328 and stopped out.

In the second trade, I bought Pound-Yen at 144.449–144.477 and stopped out.

In the first trade I stopped out, and then I bought again at a higher price after it rose.

cis

When a stock you bought falls and you stop out, and then it starts rising as if to mock your stop,

can you buy it as a rising stock?

This is also a major point.

First, by the time you take a stop-loss you admit your defeat.

It means acknowledging that buying was a mistake and withdrawing.

After that, if you try to buy again at a price higher than what you sold for,

you are doubly admitting that the stop-loss was wrong.

Some people may feel resistance there.

But I don’t mind it. I do it calmly all the time.

There’s no resistance because I don’t think in terms of win/lose for each trade.

If a stock I bought goes down, I’ll sell it; if a stock is rising, I’ll buy it.

That’s the basics, and there’s no other way but to repeat it over and over.

What’s being discussed here reflects the morning trades I did; exactly that.

First, buy Pound-Yen and take a stop loss.

Then buy again at a higher price.

Some may feel resistance to this, but cis is calmly buying again.

I can also buy calmly.

After the first trade’s stop-loss, I also wrote the next scenario here. ⇒20190222 (Fri) Pound-Yen Trade ~ Morning

In the article, it was written like this.

「I exited the long position, but if it goes up again I’ll buy it back.

Buying again when it goes up means buying at a higher price than where I exited.

「If I close this position now and it goes up later, I’ll only be able to buy at a high price. I won’t be able to buy at the price I already hold.」

I’ve heard people say this.

I don’t look at the price. When I review it now, it feels like I would have bought back around 15 pips higher than the stop-out price.

The price at which I bought and the price at which I stopped out in the previous trade have nothing to do with the next trade, so there’s no need to know that price.

As cis says, this is all there is.

If you buy a stock and it goes down, you sell; if it goes up, you buy.

I bought Pound-Yen but it went down, so I stopped out.But it went up again, so I bought again. (I had posted the scenario in advance and just did it accordingly.)>That’s the core, and you must repeat it as many times as needed.>Because you don’t think in terms of win/loss for each trade, there’s no resistance.Another way to think about this is that even with a 30% win rate, you won’t lose overall.20190222 (Fri) Pound-Yen Trade ~ Afternoon [I Lost 580,000 Yen]Even with about a 30% win rate, you can stay overall not losing.Think in total terms.By thinking broadly like this, even after losing many in a row, you keep mental composure and trading remains favorable.cisFocusing on local wins and losses isn’t very meaningful.What’s important is to think in the grand scheme.Then you’ll find it easier to cut losses without resistance.Some people say, “My mental state is weak, I can’t cut losses.”However, the mental state cannot be truly trained.Top performers aren’t able to cut losses because their mental state is stronger; rather, they think differently, which allows them to cut losses.Your mindset and thinking shape whether you can cut losses without resistance.cisThere’s no meaning in counting wins and losses.What matters is the absolute amount of overall profit or loss, not the win rate.cis apparently also exits positions quickly.In terms of stop-loss speed, I’d say I’m among the top traders.Regardless of the price at which I bought, whether I’m ahead or behind, if I think it will drop soon, I’ll sell immediately.Beginners tend to stumble because they can’t cut losses quickly.“I don’t want to lose, I don’t want to admit a loss” is a human emotion that leads to defeat in the market.Prompt cutting losses is extremely important. This is more about mindset than technique.Everyone knows cutting losses is crucial, right?But many find it difficult to actually do it.To make it easier to cut losses, think in totals and don’t cling to a single result.Think broadly. I believe that kind of thinking becomes important.cisThe most important thing is rapid stopping.You must not run away from mistakes; acknowledge them as mistakes and minimize the damage.In my case, if I consider each stock’s wins and losses, only about 30% of trades are profitable.Most of the rest are break-even or slightly negative.The idea is to accumulate small losses while occasionally achieving large gains.The Secret to Big Wins“I’m good at losing. Everyone talks about winning, but what’s crucial is how you lose. Everyone’s bad at losing.”cisIf the stock you expect to rise ends up falling, that’s a failure, but that’s normal.Even the most skilled traders can’t avoid this.Stop-losses in trading and missteps in mahjong share this inevitability.It’s something no expert can completely avoidto acceptand move on.My two-trade history.In hindsight, if I had held the initial position at 144.328 without stopping out, it would have risen and I could have taken profit.Some people reflect like this, but that’s hindsight.At the moment of stopping out, no one knows whether it will go up or down afterward.cisWhether it goes up or down is unknown.If we could always know, we could easily earn like Japan’s national budget.There is no absolute answer as to whether it will go up or down at any moment.What’s unknown becoming known is truly satisfactory. This is a winning mindset as well.Even if after stopping out it moves in your favor, there’s no need to remorse or regret.Because the future is something no one can know.Yesterday, someone who is a member reader of my blog sent me this feedback.> When the chart moves even a little,> I become preoccupied with why I didn’t take that part, and I think, what rules would let me take that portion?This way of thinking is a totally different approach.Looking at the result, perhaps there was a way to take something, or was there something that could have predicted this move? Or so forth.Even cis who earned 230 billion yen cannot predict it.BNF, known as the Java man, also cannot predict it.Even Tony Oz, the world’s top day trader, cannot do so.Therefore, stop-losses cannot be avoided by anyone, andit is not possible to know afterward what would have been better at past points, and to regret or reflect on it is not useful.And it can also be said:No one can predict, but you can still win in trading without predicting.BNFYou don’t have to guess whether it will rise or fall.Realize that quickly.No amount of plausible reasoning can predict the futureThe 5% of investors who win in the market understand that stock prices cannot be predicted as a given.The success or failure of stock investment is largely determined by this realization.Accept that you cannot predict the impossible.cisWhat matters is not avoiding losses, but avoiding big losses.I built my current wealth with a policy of not taking big losses.【Day Trading Oliver Beless】Control of losses is a key professional way to lose, an important hook.We must learn the professional way of losing.Professional losses are always small in amount.If you learn to lose properly, dreams become reality.Future predictions are impossible, and price movement cannot be controlled.However, losses can be controlled by you.Accept what you cannot control, and focus your attention on what you can control.This is important not only in trading but also in life.Oxford University Center for Emotional Neuroscience, ProfessorPsychologist, Neuroscientist Helene FoxLife has many things you cannot control.Focus on what you can control rather than what you cannot.> The important thing is not to avoid losses, but not to incur large losses.Avoiding losses is impossible; this is something to accept.Not incurring large losses is something you can control.The amount of loss is something you can control.> I built my wealth by not taking big losses.By focusing on what I can control, I’m avoiding large losses.I had two consecutive losses, but since I can control my losses, I considered it completely fine.【Day Trading Oliver Beless】Whether market participants survive depends on the ability to minimize losses.Let’s acknowledge this fact.Anyone can win by luck at times.Prices move up or down.As a result, the probability of winning becomes around 1/2.However, only professional traders can keep losses to a minimum.If you look at professional traders’ results, you’ll see their losses are extremely small.Conversely, beginners’ losses are likely to be very large.Small losses are the mark of professional traders.This has become long, so that’s all for now!Two trades, with stop-losses, two consecutive losses.Looking at it this way, some may think it looks terrible and very red.Some may think the second trade looked bad because I bought again at a higher price.But as I wrote, the mindset of winning is to be able to buy calmly even if it goes up after stopping out.Of course, it’s not just chasing price.In my case, I posted a scenario on my members’ blog to buy again if it rose after the first trade’s stop-out.And I entered and stopped out according to the plan (stopping out within this loss amount).It wasn’t emotional trading; it was all according to the plan.The stop-out was also within the plan.For me, that was a wonderful trade.What matters is not the result but the content.The result of each trade doesn’t matter; what matters is that, if you continue, you’ll have a total profit strategy and a big-picture view.Move on to the next scenario’s trade in a good state.Two losses in a row are acknowledged, but I had pre-published the next scenario on my member blog, and I’ll aim for that.That will be written in the next issue.Trading videos are up:The trade that turned 100,000 yen into 1,000,000 yenI’m on Twitter:https://twitter.com/takashipyoYou can preview my entry points in advance:FX Members Blog Series※The FX Members Blog subscriptions are only via card payment.If you prefer other payment methods, please contact me via email or Twitter DM.takashipsychology@yahoo.co.jpSomeone made a bot that tweets my words. Thank you.https://twitter.com/FX_trader_bot

But it went up again, so I bought again. (I had posted the scenario in advance and just did it accordingly.)

>That’s the core, and you must repeat it as many times as needed.

>Because you don’t think in terms of win/loss for each trade, there’s no resistance.

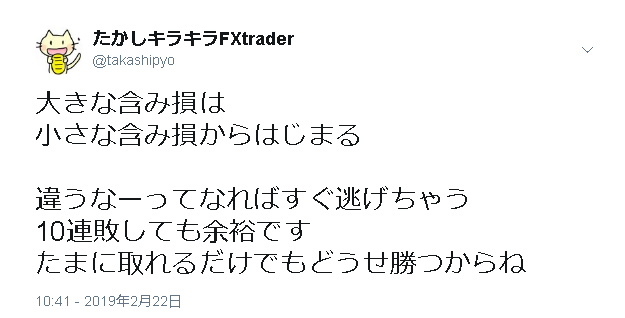

Another way to think about this is that even with a 30% win rate, you won’t lose overall.

20190222 (Fri) Pound-Yen Trade ~ Afternoon [I Lost 580,000 Yen]

Even with about a 30% win rate, you can stay overall not losing.

Think in total terms.

By thinking broadly like this, even after losing many in a row, you keep mental composure and trading remains favorable.

cis

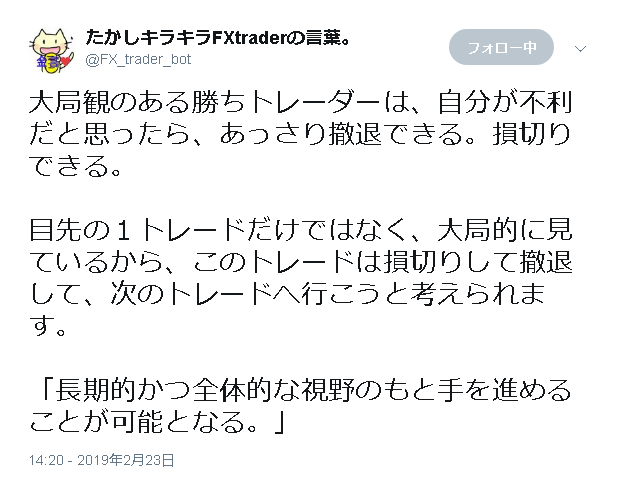

Focusing on local wins and losses isn’t very meaningful.

What’s important is to think in the grand scheme.

Then you’ll find it easier to cut losses without resistance.

Some people say, “My mental state is weak, I can’t cut losses.”

However, the mental state cannot be truly trained.

Top performers aren’t able to cut losses because their mental state is stronger; rather, they think differently, which allows them to cut losses.

Your mindset and thinking shape whether you can cut losses without resistance.

cis

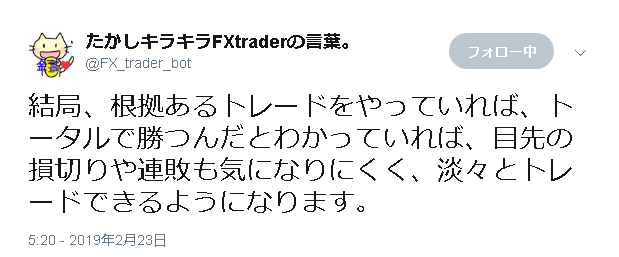

There’s no meaning in counting wins and losses.

What matters is the absolute amount of overall profit or loss, not the win rate.

cis apparently also exits positions quickly.

In terms of stop-loss speed, I’d say I’m among the top traders.

Regardless of the price at which I bought, whether I’m ahead or behind, if I think it will drop soon, I’ll sell immediately.

Beginners tend to stumble because they can’t cut losses quickly.

“I don’t want to lose, I don’t want to admit a loss” is a human emotion that leads to defeat in the market.

Prompt cutting losses is extremely important. This is more about mindset than technique.

Everyone knows cutting losses is crucial, right?

But many find it difficult to actually do it.

To make it easier to cut losses, think in totals and don’t cling to a single result.

Think broadly. I believe that kind of thinking becomes important.

cis

The most important thing is rapid stopping.

You must not run away from mistakes; acknowledge them as mistakes and minimize the damage.

In my case, if I consider each stock’s wins and losses, only about 30% of trades are profitable.

Most of the rest are break-even or slightly negative.

The idea is to accumulate small losses while occasionally achieving large gains.

“I’m good at losing. Everyone talks about winning, but what’s crucial is how you lose. Everyone’s bad at losing.”

cis

If the stock you expect to rise ends up falling, that’s a failure, but that’s normal.

Even the most skilled traders can’t avoid this.

Stop-losses in trading and missteps in mahjong share this inevitability.

It’s something no expert can completely avoidto acceptand move on.

My two-trade history.

In hindsight, if I had held the initial position at 144.328 without stopping out, it would have risen and I could have taken profit.

Some people reflect like this, but that’s hindsight.

At the moment of stopping out, no one knows whether it will go up or down afterward.

cis

Whether it goes up or down is unknown.

If we could always know, we could easily earn like Japan’s national budget.

There is no absolute answer as to whether it will go up or down at any moment.

Even if after stopping out it moves in your favor, there’s no need to remorse or regret.

Because the future is something no one can know.

Yesterday, someone who is a member reader of my blog sent me this feedback.

> When the chart moves even a little,

> I become preoccupied with why I didn’t take that part, and I think, what rules would let me take that portion?

This way of thinking is a totally different approach.

Looking at the result, perhaps there was a way to take something, or was there something that could have predicted this move? Or so forth.

Even cis who earned 230 billion yen cannot predict it.

BNF, known as the Java man, also cannot predict it.

Even Tony Oz, the world’s top day trader, cannot do so.

Therefore, stop-losses cannot be avoided by anyone, andit is not possible to know afterward what would have been better at past points, and to regret or reflect on it is not useful.

And it can also be said:

No one can predict, but you can still win in trading without predicting.

BNF

You don’t have to guess whether it will rise or fall.

Realize that quickly.

No amount of plausible reasoning can predict the future

The 5% of investors who win in the market understand that stock prices cannot be predicted as a given.

The success or failure of stock investment is largely determined by this realization.

Accept that you cannot predict the impossible.

cis

What matters is not avoiding losses, but avoiding big losses.

I built my current wealth with a policy of not taking big losses.

Future predictions are impossible, and price movement cannot be controlled.

However, losses can be controlled by you.

Accept what you cannot control, and focus your attention on what you can control.

This is important not only in trading but also in life.

Life has many things you cannot control.

Focus on what you can control rather than what you cannot.

> The important thing is not to avoid losses, but not to incur large losses.

Avoiding losses is impossible; this is something to accept.

Not incurring large losses is something you can control.

The amount of loss is something you can control.

> I built my wealth by not taking big losses.

By focusing on what I can control, I’m avoiding large losses.

I had two consecutive losses, but since I can control my losses, I considered it completely fine.

【Day Trading Oliver Beless】

Whether market participants survive depends on the ability to minimize losses.

Let’s acknowledge this fact.

Anyone can win by luck at times.

Prices move up or down.

As a result, the probability of winning becomes around 1/2.

However, only professional traders can keep losses to a minimum.

If you look at professional traders’ results, you’ll see their losses are extremely small.

Conversely, beginners’ losses are likely to be very large.

Small losses are the mark of professional traders.

This has become long, so that’s all for now!

Two trades, with stop-losses, two consecutive losses.

Looking at it this way, some may think it looks terrible and very red.

Some may think the second trade looked bad because I bought again at a higher price.

But as I wrote, the mindset of winning is to be able to buy calmly even if it goes up after stopping out.

Of course, it’s not just chasing price.

In my case, I posted a scenario on my members’ blog to buy again if it rose after the first trade’s stop-out.

And I entered and stopped out according to the plan (stopping out within this loss amount).

It wasn’t emotional trading; it was all according to the plan.

The stop-out was also within the plan.

For me, that was a wonderful trade.

What matters is not the result but the content.

The result of each trade doesn’t matter; what matters is that, if you continue, you’ll have a total profit strategy and a big-picture view.

Move on to the next scenario’s trade in a good state.

Two losses in a row are acknowledged, but I had pre-published the next scenario on my member blog, and I’ll aim for that.

That will be written in the next issue.

Trading videos are up:The trade that turned 100,000 yen into 1,000,000 yen

I’m on Twitter:https://twitter.com/takashipyo

You can preview my entry points in advance:FX Members Blog Series

※The FX Members Blog subscriptions are only via card payment.

If you prefer other payment methods, please contact me via email or Twitter DM.

takashipsychology@yahoo.co.jp

Someone made a bot that tweets my words. Thank you.

https://twitter.com/FX_trader_bot