HFTだけが知るFXの「物理法則」- 個人トレーダーが見逃している5つの市場の真実

Hello!TriParity Labs TokyoのKazです。この記事では、プロの世界では常識とされている、FX market's five truths that dominate the marketを解説していきたいと思います。この記事を読めば、きっとあなたのチャート分析は二度と同じものには見えなくなるでしょう。

「監視する通貨ペアが多すぎて、結局チャンスを逃してしまった」

「プロのトレーダーは一体何を見て判断しているのだろう?」

Many individual traders have probably felt this kind of concern at least once. Facing countless charts and feeling overwhelmed, or regretting after you later learn there was a big move—this is by no means rare. (That happened to me as well...)

However, ifFXmarket“laws of physics”exist as absolute rulesandprofessionals operate under those rules as a fundamental premisehow would that look?

In fact,they look not only at the candlestick shapes we see, but also at theunderlying market “structure”behind them。

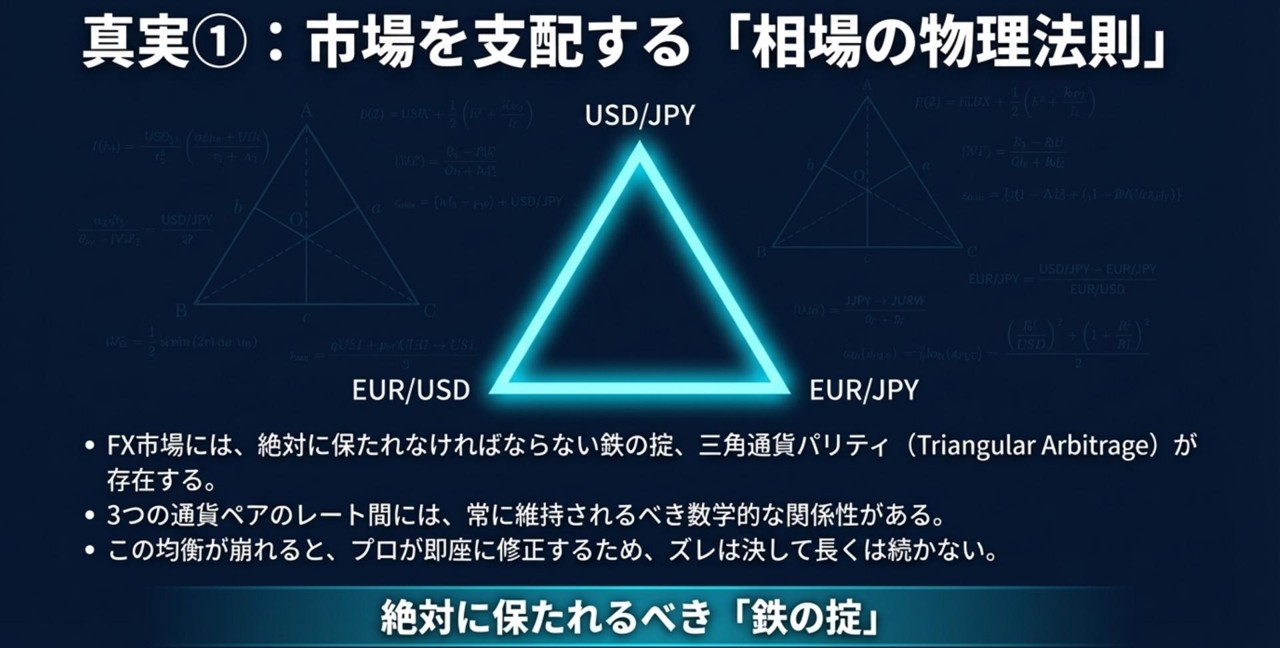

1. The true nature of the “physical laws of the market” that govern FX

In the FX market, there exists an absolute rule known as theTriangular Currency Parity(Triangular Arbitrage)that must be maintained.“iron law”This is the mathematical relationship among three currency pairs.

For example, if you know the rates for USD/JPY and EUR/USD, you can derive the theoretical rate for EUR/JPY. The actual EUR/JPY rate traded in the market must always match this calculated rate.

If this relationship were to break even slightly, it means there is a potential opportunity to gain profits without risk. The reason the “physical laws of the market” are not just a metaphor is that if this condition is broken, someone will act to profit, and the mispricing will be corrected immediately, so it never lasts long.professional traders such as banks and HFTs (high-frequency traders) will move in with ultra-fast systems to correct the mispricing instantly.

This ongoing monitoring and correction by professionals is what continuously keeps market prices fair.

“The physical laws of the market”

The existence of these laws explains why FX rates you see every day remain consistently coherent.

2. Behind the price you see, there is a “millisecond-scale war” taking place

Arbitrage opportunities arising when the “physical laws of the market” break are a target of fierce competition in the professional worldand are the subject of intense competitionon a scale far beyond what individual traders imagine. It is a race at the speed of milliseconds (one-thousandth of a second).

- Colocation: By placing their own servers in financial data centers where exchange servers are located, such as London LD4 or NY4, they minimize physical distance and communication latency to the extreme.

- Ultra-low latency networks: Using microwave links rather than optical fiber to take straighter routes, they shave data transmission speeds between cities down to the millisecond level, achieving 25–30% faster speeds than fiber in some cases.

Hearing that there is “no-risk profit” may sound appealing, but the reality of arbitrage opportunities is far from the common image. Academic studies report that the opportunities are extremely small and short-lived.

- Frequency of occurrence: price distortions that could be arbitrageable occur in only about 6.4% of all times (about 90 minutes per day).

- Duration: of observed distortions,95% disappear within 5 seconds, and60% disappear within just 1 second.

- Profit margin: about94% offer around 1 basis point(profit of $100 on a $1,000,000 trade)—a very small margin.

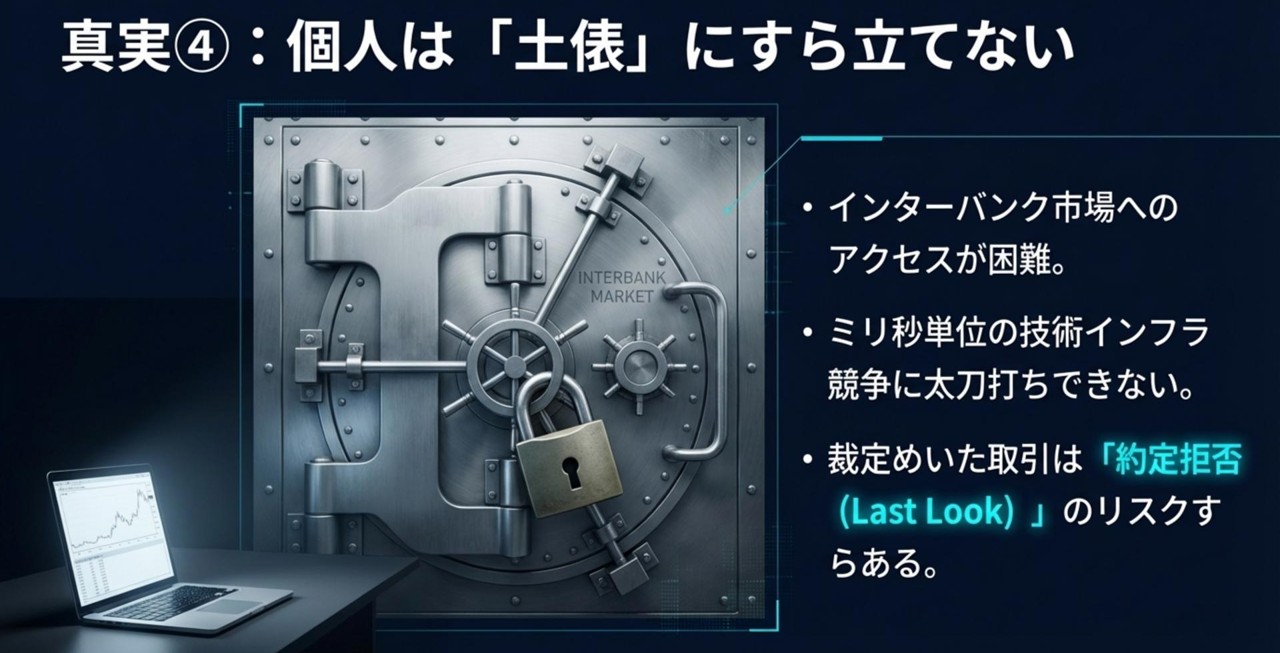

From the above, you may have realized how unrealistic it is for individuals to engage in arbitrage trading using the same methods as professionals.

- Individuals have difficulty accessing the interbank market where professionals trade directly.

- They cannot hope to compete in the millisecond-scale technical infrastructure race conducted by HFTs.

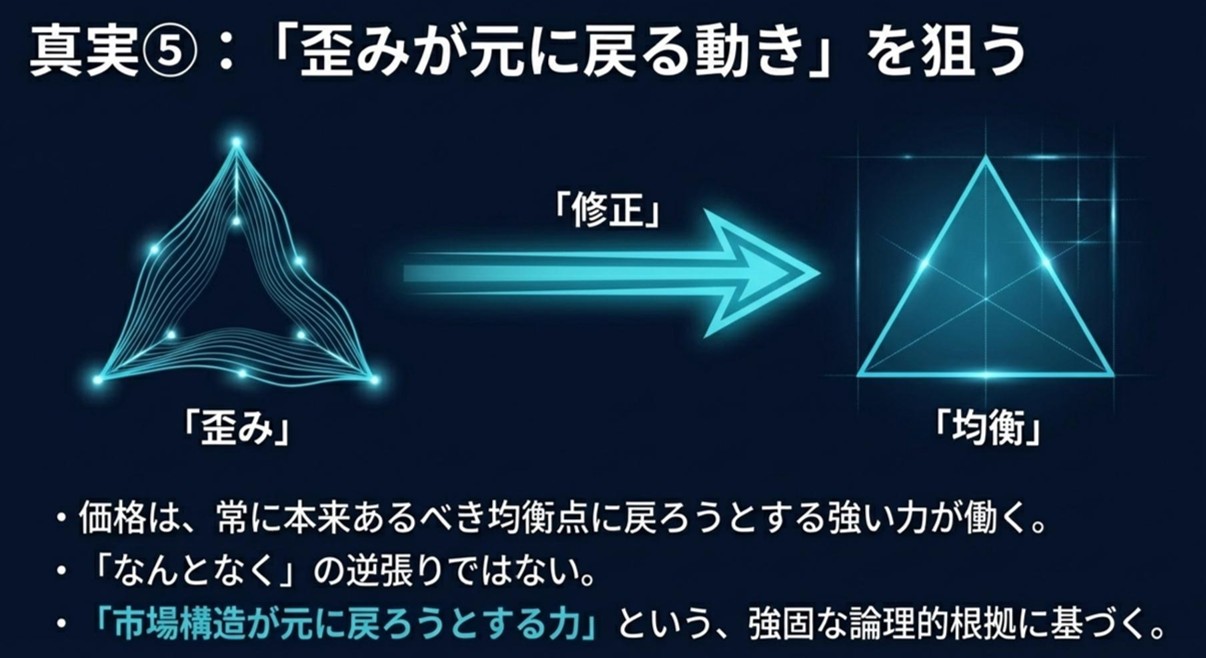

When professionals instantly correct price distortions, viewed differently, it means“Prices are always driven back toward their natural equilibrium point (parity)”.

This market structure itself can be applied to individual traders’ strategies.

Suppose a currency pair shows an overshoot relative to the other two currencies (a distortion). Immediately after, professional arbitrage moves to correct that distortion, i.e.,“reversion toward the original equilibrium”is more likely to occur.

This can be applied as an “edge from distortion to equilibrium” contrarian strategy for individual traders.

This approach distinguishes itself from traditional, intuitive contrarian trading like “sell because it rose too much.” Its basis is not candlestick shapes butthe market structure’s tendency to revert to its baseline—a more logical and robust reason..

develops“Intervention Ripple MT5 Indicator Series”is precisely this“visualizing the distortions of the tri-currency parity”, enabling individual traders to apply pro perspectives like “do not chase extended price moves; wait for distortions to revert to equilibrium” to their own trading..

【Intervention Ripple Pro】Three-Currency Parity Analysis Indicator Set (Scanner + Catcher + Nowcast MTF) for MT5(Product Link)

【Intervention Ripple Scanner】Three-Currency Parity MTF (M1~D1) Distortion Heatmap for MT5(Product Link)

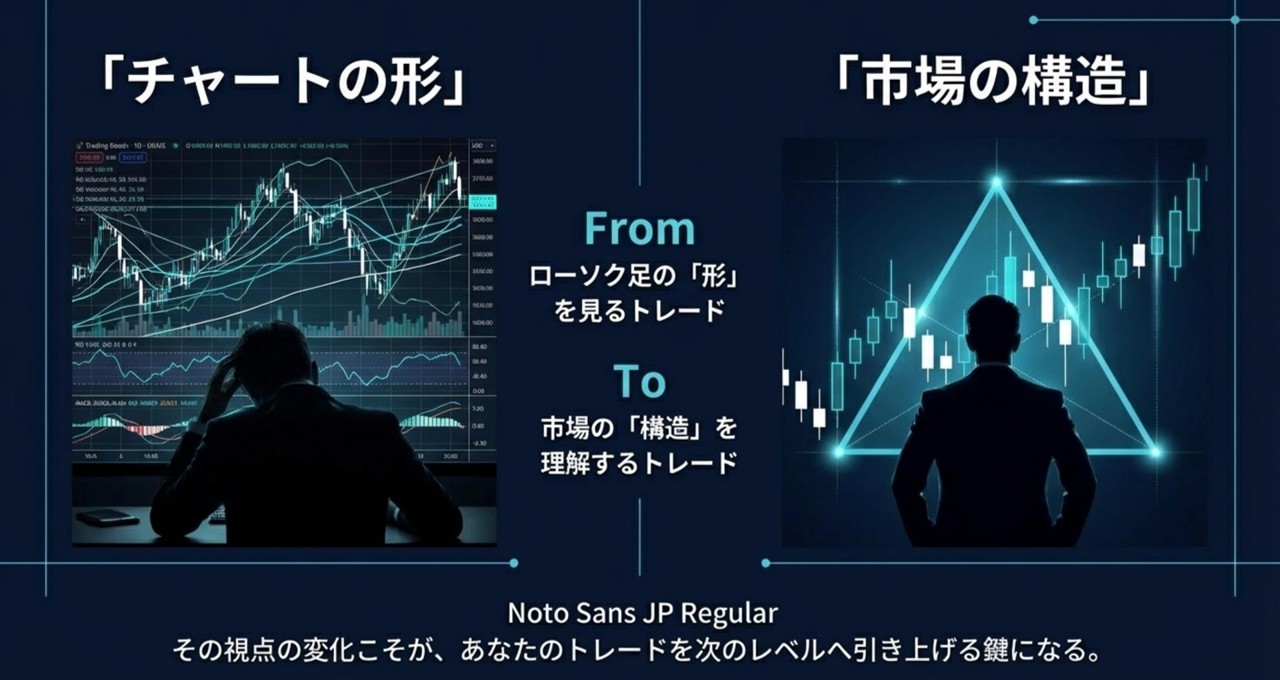

Summary: From chart shapes to the market’s “structure”

The five truths discussed herein weave one story.

First, in the FX market there exists an absolute physical law known as the“Triangular Parity”. This rule creates only a tiny profit opportunity, and in the professional world, a millisecond-scale technical war unfolds.

As a result, arbitrage opportunities are fleeting and tiny, vanishing in less than a second, making it impossible for individuals to profit directly. Yet that is precisely where the traces of the “return-to-origin” movement created when professionals fix distortions hold strategic hints for individual traders to apply.

Professionals do not trade by looking only at chart shapes. They constantly consider the market’s underlying structure, i.e., the “physical laws.”If your next trade is based not on candlestick shapes but on the market’s distortions and their corrections as structural grounds, what would change? That shift in perspective may be the key to taking your trading to the next level.