FX Gold: Is it possible to scalp while watching YouTube or dramas?

Simple Logic FX Sales Page

Simple Logic FX Gold Edition Sales Page

Auto Click Sale Page

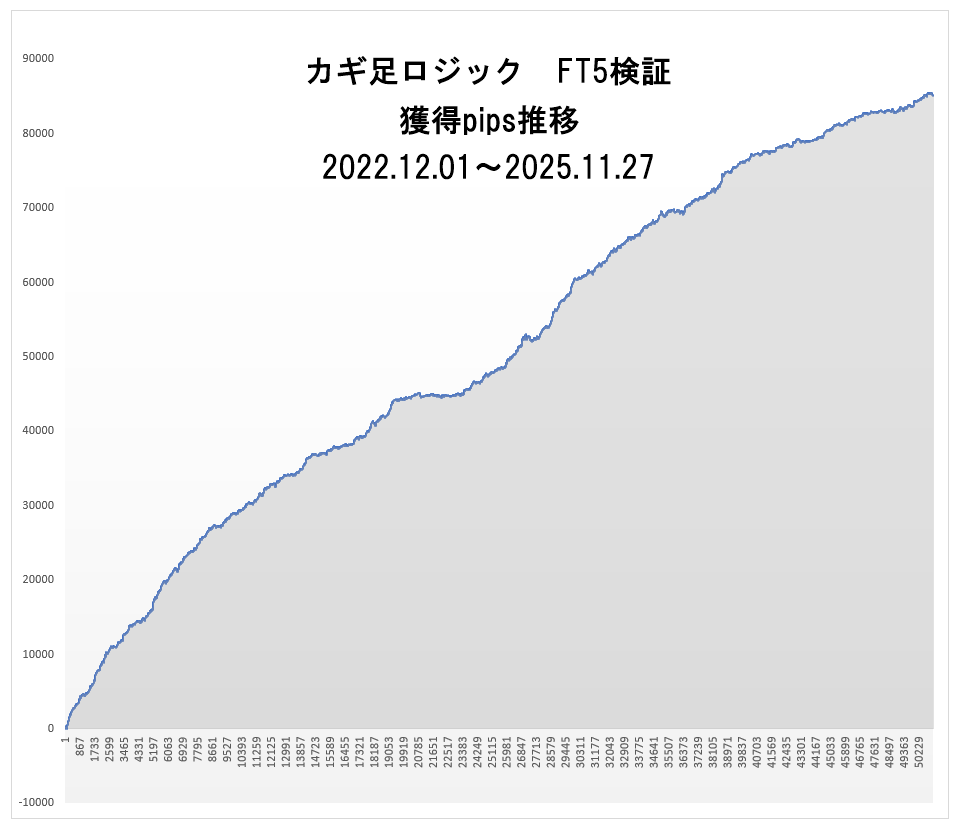

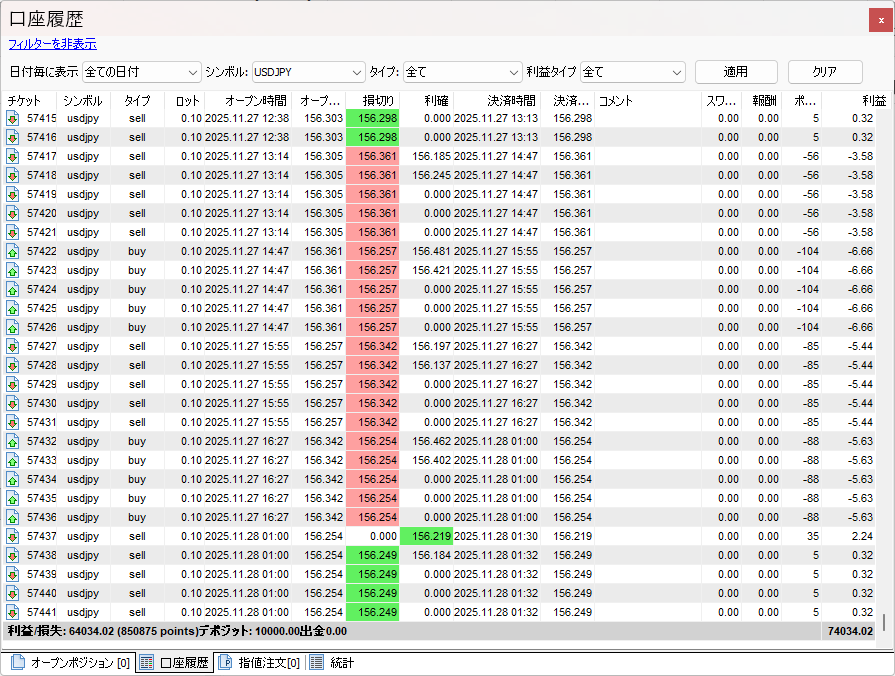

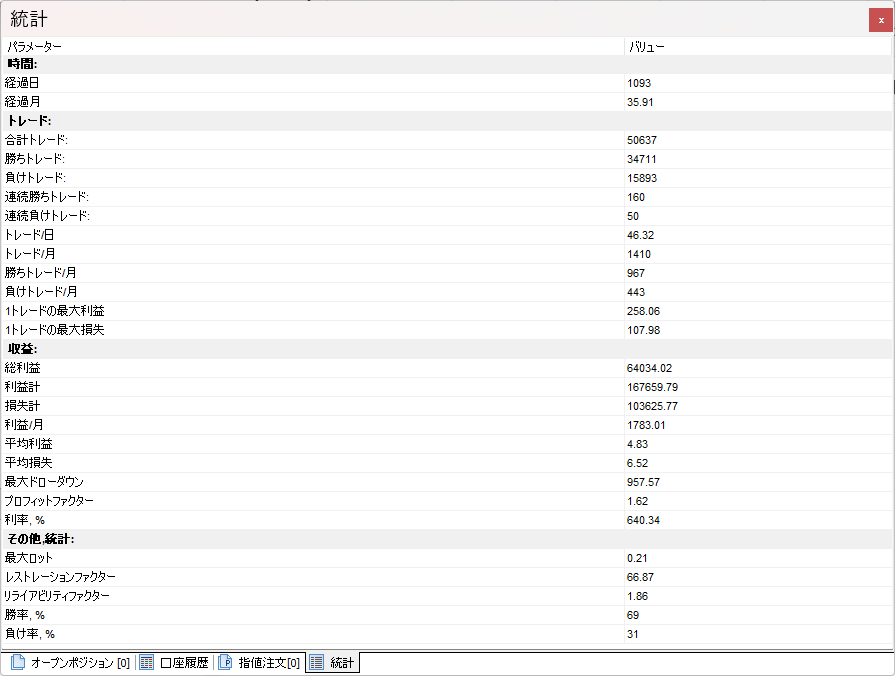

USD/JPY System A (Key Foot Logic) This Week's FT5 Verification Results

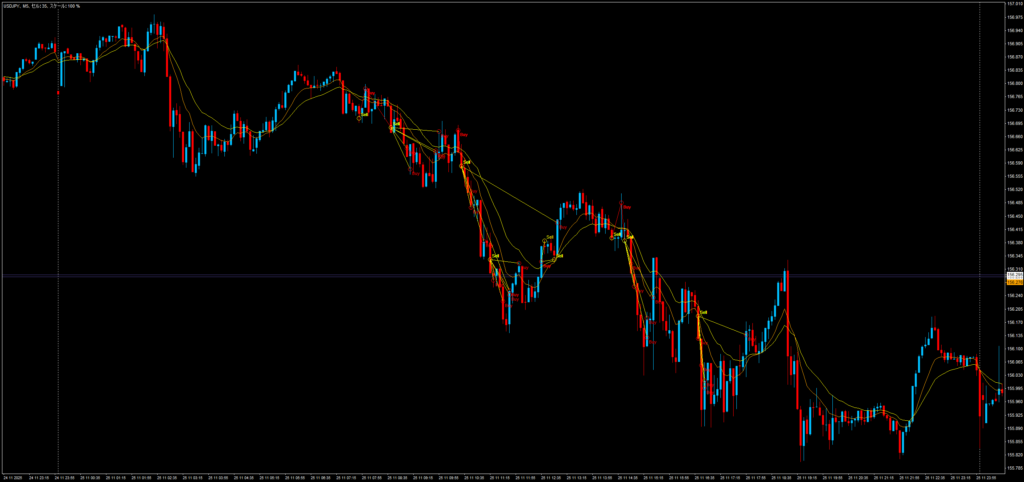

This week, in the second half, volatility was small and negative.

There were as many as five consecutive losses after a long time.

It was a string of losses over a few hours after the evening of the 26th.

In a movement with a small range

the wick ratio was large relative to the candle length

so this chart is one to avoid trading,

so let's remember that.

Because the VIP data for Forex Tester from last Thursday could not be downloaded,

this week covers six days of verification results.

November 20 (Thu)

November 21 (Fri)

November 24 (Mon)

November 25 (Tue)

November 26 (Wed)

November 27 (Thu)

Mr. K's Trading Style

The logic of System B devised by Mr. K.

Since the signal indicators are completed,

Mr. K has begun practical-style verification.

When sending the trade results on November 25 (Tue),

here are the result chart and impressions.

I will continue to publish the subsequent exchanges as well.

――――――――――――――――――――――――――――――――

● 2025.11.26: Mr. K

Today I came home a bit earlier than usual,

so I had four trades.

Entries were single-position, using value-shift adjustments.

There is a filter for excessive drawdown, but

the rest is a simple setting with not many other filters.

(I will attach ZigZagH set file)

Signals came out reasonably well, and I could recover positions nicely.

If you can enter early in a place where the legs have not extended fully

you can reach the target price more easily, increasing win rate.

Even the Strat Tester confirms the edge.

In a year of testing, PF 1.24, win rate 49.63%, 10 consecutive wins, 6 consecutive losses, total net 100.5.

Normally, the opposite direction of candles is set to TRUE to stabilize.

I feel that a wonderful tool is taking shape,

and I am convinced!!

I look forward to your continued cooperation.

● 2025.11.26: Do.

Thank you for the report!

Yesterday was four straight wins, right?

It feels very good.

I’ve looked at the ZigZagH set file.

Lining it up as below,

it seems to emphasize the core entry conditions and filters

in this set.

• Body high/low buffer: Open (more), Close (less)

• Body length filter

• Count filter

• Excessive drawdown filter

• ZigZag length filter

Viewed this way, two conditions below are well selected:

• Conditions that will likely produce volatility

• Conditions to avoid when volatility is excessive

By adding more filters,

attempting to pinpoint these can cause trade-offs and miss opportunities, so

we can generate more signals with looser conditions.

And after the entry preparation signal is issued, the final entry decision is

that discretionary judgment is involved, right?

For signals that were issued but traded away by discretion,

I think it’s the one around 22:50 with a single “Gii-Gii” signal.

If a signal like yesterday appears, it’s very easy.

I will also verify with this signal setting from my side.

Also, please send the set file for your current SimpleLimitG.

I would like to know about value shifts as well.

The performance in Strategy Tester is nice!

This is with ZigZagH settings you sent plus

the normal candle direction set to true.

To achieve this level of backtest results with scalping logic

is amazing.

Mr. K’s past experience and exploration have borne fruit!

The logic is nearing completion!

For me, the most joyful thing is that Mr. K is enjoying the research.

(My wife and I agree it's wonderful to meet wonderful people.)

Note: Do.: I have met Mr. K’s wife once.

We have come this far, so I’d like to give the logic a name soon.

Currently, the following logics exist, so

please send some ideas for a name in this direction.

It’s fine to have multiple candidates.

P.S.

Is the trading situation like this?

① Since the latest Heikin-Ashi candle and the confirmed candle alert are set to true,

first, check the chart status with this alert

(until then, perhaps you don’t look at the chart much?)

② With the latest candle starting price sign of the real-body engulfing signal,

enter with the Simple Limit G market order button

If you set the real-body engulfing signal latest candle to false,

is that because you are looking at the chart with the Heikin-Ashi alert?

I appreciate your guidance.

● 2025.11.26: Mr. K

About the 22:50 “Gii-Gii” signal

When I saw this question, I thought, was there a signal?

Upon rechecking, it was not a Gii-Gii signal but perhaps a downward exit signal.

That day, after signals appeared and the “auto-trading stop” was released,

I entered four trades.

About the naming of the logic

I have always called it “Shingi’s Principle,” but

if giving it a logic name, perhaps “Singi Logic.”

Nothing else comes to mind…

“Gold Scalping Logic: The Law of Truth and Falsehood!!”

If I were selling it, it would be something like this.

Reply to the PS.

[Question 1]

Since the latest Heikin-Ashi candle and confirmed candle alert are true,

first, check chart status with this alert

(until then, perhaps you don’t look at the chart much?)

Answer 1

I watch YouTube or drama, and when the alert sounds, I check the screen.

I don’t look at the chart much.

[Question 2]

With the latest candle start price sign of the real-body engulfing signal

enter with the Simple Limit G market order button

Answer 2

That’s correct.

[Question 3]

Let Simple Limit G handle the exit

Answer 3

Yes, let it handle it!

Setting the real-body engulfing alert to false, I realized only after you mentioned it.

I think I mistakenly set it to false.

I changed it back to true.

Currently, even when the Heikin-Ashi color changes, or when a signal appears, it uses the same alert sound, so

I plan to adjust it when I have more time.

● 2025.11.26: Do.

Thank you for your answers to the questions.

The Gii-Gii signal was my misread.

Apologies.

It was the exit arrow, right.

That day, all signals were entered and there were 4 consecutive wins.

Wonderful.

Thank you for the Simple Limit G set file.

I have confirmed it.

We are using only the 1.3 risk-reward for entry,

adding a stop-loss value-moving shift for a bailout setting,

so the capital management logic can be used as is.

Let’s keep the logic name as Singi Logic!

This title reminded me of it. When using the Breakthrough Logic, the beginning was “truth and false” as well.

Simple and very nice sounding.

Thank you for the reply to the PS as well.

Time to alert notifications is while watching YouTube or dramas,

so it was a trading style where you don’t watch the chart.

you just click the market order entry button in Simple Limit G

and leave the rest to automatic settlement.

Breakthrough logic required discretionary entry decisions, but

it seems to be getting easier, which is good.

If you change the two Heikin-Ashi color change sounds and

the two real-body engulfing candle sounds

to separate sounds, you can tell the chart status by just listening to the sounds.

Please try it.

P.S.

She was happy to hear that Mr. K could trade with YouTube or dramas more easily.

● 2025.11.27: Mr. K

Good morning. This is K.

While I was asleep, the backtest completed, so I am sending the parameter set we discussed previously.

Break down of backtest data is as follows.

Period: January 1 to November 22

Total net: 100.5

PF: 1.24

Win rate: 49.63%

Consecutive wins: 10

Consecutive losses: 6

Trades: 268

Wins: 133

Losses: 135

Low number of trades is because I did not set

“Latest ZigZag Filter 1” and “Latest ZigZag Filter 2” to true.

If either of these is set to true, the number of trades more than doubles.

Back data 400c (400b + Latest ZigZag Filter 2 true only)

Period: Jan 1 to Nov 22

Total net: 100.94

PF: 1.10

Win rate: 46.51%

Consecutive wins: 9

Consecutive losses: 12

Trades: 630

Wins: 293

Losses: 337

Back data 400a “400b + Latest ZigZag Filter 1 true only (ZigZag latest candle start condition False, ZigZag line judgment count 5)”

Period: Jan 1 to Nov 22

Total net: 125.42

PF: 1.13

Win rate: 47.13%

Consecutive wins: 8

Consecutive losses: 12

Trades: 592

Wins: 279

Losses: 313

Assuming fewer filters, and looking to increase trades a bit, you might

set “Latest ZigZag Filter 1” or “Latest ZigZag Filter 2” to true.

There are infinite combinations, so…

If you pick one axis, users may find it easier to use.

From backtesting, I felt that

no matter how many losses in a row you have manually,

you can still end up in positive overall, which is very reassuring and stabilizes the mind!!

That’s what backtesting is for.

――――――――――――――――――――――――――――――――

That was a very long quote, but

As Mr. K loves chart studies, I thought you might be trading while watching charts closely, but

the four straight wins with YouTube or dramas is surprising.

As discussed with Mr. K just now,

the logic name for System B has been decided as “Singi Logic.”

This week, the verification EA for System B has the same five exit/logics as Simple Limit G registered.

I tried running it on BTCUSD, and

there might be an edge there as well.

To make it a bit more user-friendly for crypto,

I added a reference value to all pips settings.

Thus, the general applicability will expand further.

Regarding System A (Key Foot Logic) mentioned last week

Mr. T from Simple Logic FX asked a question.

I will publish it since I have allowance from him (thanks, Mr. T).

――――――――――――――――――――――――――――――――

● 2025.11.25: Mr. T

Thank you for your support.

Last time, thank you for the advice on Auto Click.

Today I am emailing to ask about the previous YouTube video.

In the previous video, was the verification EA for System A (Key Foot Logic)

almost completed, as mentioned?

Is there any plan to sell this EA in the future?

Regarding future development, not a definite answer is fine, but

any information would be appreciated.

● 2025.11.25: Do.

Regarding the verification EA for System A (Key Foot Logic)

we appreciate your interest.

However, it could be very beneficial for users to perform various verifications and evolve their own rules, so

it is indeed a very valuable possibility.

If you thoroughly verify and set parameters yourself,

semi-automatic trading more convenient than Simple Limit could become possible.

During this holiday, I spoke with programmers several times to adjust the re-entry function.

To perform Re-entry 1–4 according to FT5 verification rules would be quite challenging and time-consuming.

(If done by a person, it's easy.)

So far, I have prepared countless tool specifications, and

System A’s verification EA is undoubtedly among the most difficult.

First, I will focus on completing it and continue the work.

Next year perhaps,

I will decide whether to sell it upon completion and inform you via newsletter.

Mr. T, like you,

there are people expecting System A’s verification EA, which is very encouraging for me as well.

Three-year-long EA development, but I’ll enjoy the final trial and keep building.

Although completion is still a while away,

please wait a little longer.

● 2025.11.25: Mr. T

Thank you for your support.

Thank you for your prompt reply.

Noted on your message!

Three years in development… an enormous project indeed.

while large-scale projects can take up to ten years,

the sense of accomplishment after completion is profound.

I look forward to the completion of Logic A’s verification EA!

● 2025.11.25: Do.

>Large projects may take ten years,

My main work has been residential construction,

and as it takes shape and is completed,

Previously aired projects include

Akashi Kaikyo Bridge, Tokyo Skytree,

Kalovia Line and Turkish undersea tunnels, etc.

• Free download period: December 7 (Sun) – December 22 (Mon) 14 days

• Usage period: December 7 (Sun) – December 26 (Fri) 18 days

Gratitude

Do.