【Practical Analysis Part 7】 ? Bearish exhausted selling, buying exhaustion reversal signal v1.0 — Application on weekly charts of the top 200 prime market cap stocks (as of November 28, 2025)

A Review of the Sell-off Drying Up / Buy Drying Up Reversal Signal v1.0

This time as well, we used the administrator's original

“Sell-off Drying Up / Buy Drying Up Reversal Signal v1.0”(TradingView indicator).

In short:

?Sell-off signal (BUY)

A state where recent declines and pullbacks indicate that selling pressure has peaked

Detects exhaustion of selling force from volume and candlestick patterns

There,a reversal-leaning candle pattern such as a bullish candle or a long lower wickoverlaps, signaling a “buy”

?Buy-off Drying Up Signal (SELL)

Detects excessive strength or overheating in an uptrend

Warns in zones where buying pressure is likely to exhaust and stall

Among these,“Weekly Sell-off Drying Up BUY signal”is picked up.

? Screening Criteria and Detection Process

The verification flow this time is as follows:

Target Universe

Tokyo Stock Exchange Prime Market

Top 200 by market capitalization(as of late November 2025, roughly the top group)

Chart Conditions

Timeframe:Weekly

Indicator:Sell-off Drying Up / Buy Drying Up Reversal Signal v1.0Applied to TradingView

Judgment Criteria:

Only extract stocks where a BUY signal is lit on the most recent confirmed weekly bar

Result

Extracted stocks are17

✅ After the most recent decline to pullback

✅ Indicate a completed selling pressure cycle on a weekly basis

✅ Show initial signs of rebound

and so on.

? List of the 17 Hit Stocks

First, from the list:

1605 INPEX(Energy & Resources)

4004 Resonac Holdings(Chemicals)

6201 Toyota Industries(Automobile-related machinery)

8031 Mitsui & Co.(Sogo Shosha / General trading)

7751 Canon(Precision equipment / Imaging)

8316 Sumitomo Mitsui Financial Group (SMFG)(Megabank)

1925 Daiwa House Industry(Housing & Real Estate)

7267 Honda Motor(Automotive)

7912 Dai Nippon Printing (DNP)(Printing / Electronics)

6971 Kyocera(Electronic Components)

4188 Mitsubishi Chemical Group(Chemical / Specialty Chemicals)

8604 Nomura Holdings(Securities)

6178 Japan Post Holdings(Postal/Logistics Financials)

7550 Zensho Holdings(Food Service)

7911 TOPPAN Holdings(Printing / DX Solutions)

6479 MinebeaMitsumi(Precision Components / Motors)

5844 Kyoto Financial Group(Regional Banks Group)

? How to read charts by stock and how to interpret the indicators (Digest)

A. Energy & Materials sector ? (Trend Pullback type)

1605 INPEX ?

A stock that tends to move in sync with resource and energy prices.

In the recent weeks of pullback, selling pressure has exhausted,

and on the weekly chart, the pattern shows a turn to a lower wick / bullish candle, lighting the sell-off dry-up BUYsignal.Over the medium to long term, resources remain thematically driven,

and this is positioned as a signal for a pullback in an uptrend and potential continuation.

4004 Resonac Holdings ?

A segment of the chemical sector that has raised its stock price levels in recent years.

After a pullback from recent highs and a weekly down candle continuing,

currently showingthe initial rebound signal + sell-off dry-up BUY.A readable form of signal as a phase where a high-level pullback completes and a re-acceleration is anticipated.

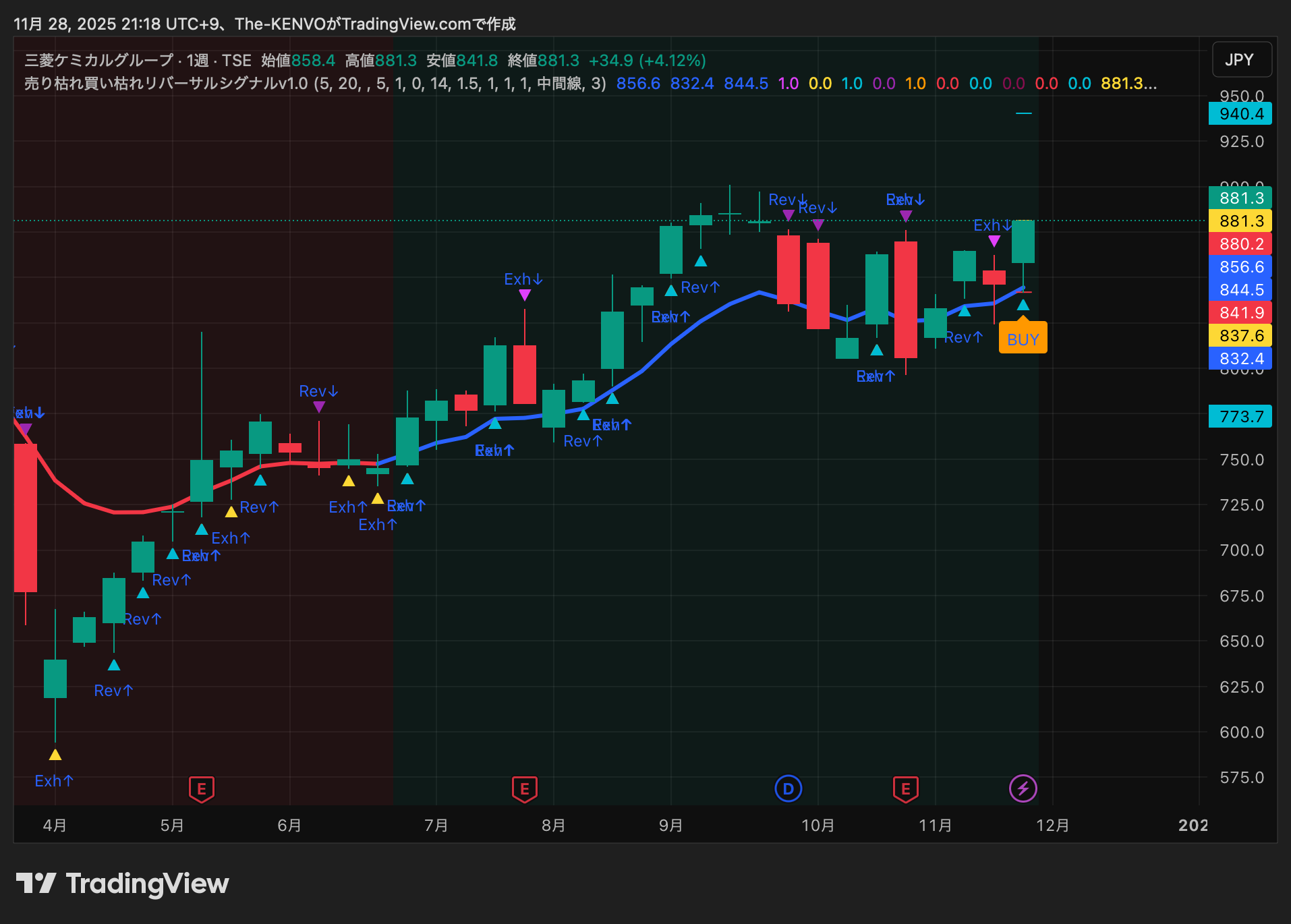

4188 Mitsubishi Chemical Group ?

Low PBR and high dividend yield, indicating a value-oriented stock.

On the weekly chart,the sell-off dry-up signal appears around the mid-to-lower part of the box pattern.

Pattern oftaking the bearish consensus near the lower end of the range and reversing.

B. Trading Companies / Auto / Precision Equipment ?? (Cycle / Correction Completion Pattern)

8031 Mitsui & Co. ?

One of the leaders of the “trading stocks boom” in Japan.

In the strong uptrend,stays at highs / pullbackand,

in that environment, sell-off drying up BUY is visible.Not a sign of the trend’s top, but a timing for re-acceleration from a mid-course pause.

6201 Toyota Industries ?

7267 Honda ?

Both are auto-related sectors, sensitive to global economy and exchange rates.

Recent several weeks of pullback

From there,a reversal that lights the sell-off dry-up BUY

is observed.

This is a textbook pattern for catching the weekly signal of “risk-on / recession in sensitivity”.

7751 Canon ?

In the medium-to-long term, within a gradual uptrend,a temporary pullback leads to sell-off dry-up BUY.

“A strong example of a defensive large-cap stock with a sell-off signal.”

6479 MinebeaMitsumi ⚙️

Global presence in bearings, small motors, and precision components.

While growth expectations have driven valuations up and pullbacks can be sizable,

currentlythe weekly chart shows a bottoming and sell-off dry-up BUY, indicating a potential crossroads for trend continuation or reversal.

C. Financial Sector ? (Sentiment Reversal Aim)

8316 Sumitomo Mitsui Financial Group (SMFG) ?

8604 Nomura Holdings ?→?

5844 Kyoto Financial Group ?

Financial stocks are highly sensitive to interest rates and market sentiment, and

“macro news selling off, then reversal as selling dries up”is a common pattern in this sector.the downtrend calms for a while

at that timing, weekly sell-off dry-up BUY occurs

as a flow.

In particular, the regional bank group, Kyoto Financial Group (5844),

requires chart reading that considers two axes:local economy and interest rate environment.

6178 Japan Post Holdings ?

A holding company with financial, logistics, and real estate businesses.

Over the long term, it trades in a box range, and

a sell-off dry-up BUY near the lower to mid-range tends to be a contrarian signal.An image of “picking the cheap part of the box range on the weekly chart.”

D. Residential, Printing, Dining & Life-related ??️ (Defensive-oriented Rebound)

1925 Daiwa House Industry ?

A developer supporting Japan’s infrastructure, including housing, logistics facilities, and commercial facilities.

Though cyclical, earnings are relatively stable, and

weekly pullback + sell-off dry-up BUYcan be interpreted as a mid-to-long-term accumulation point.

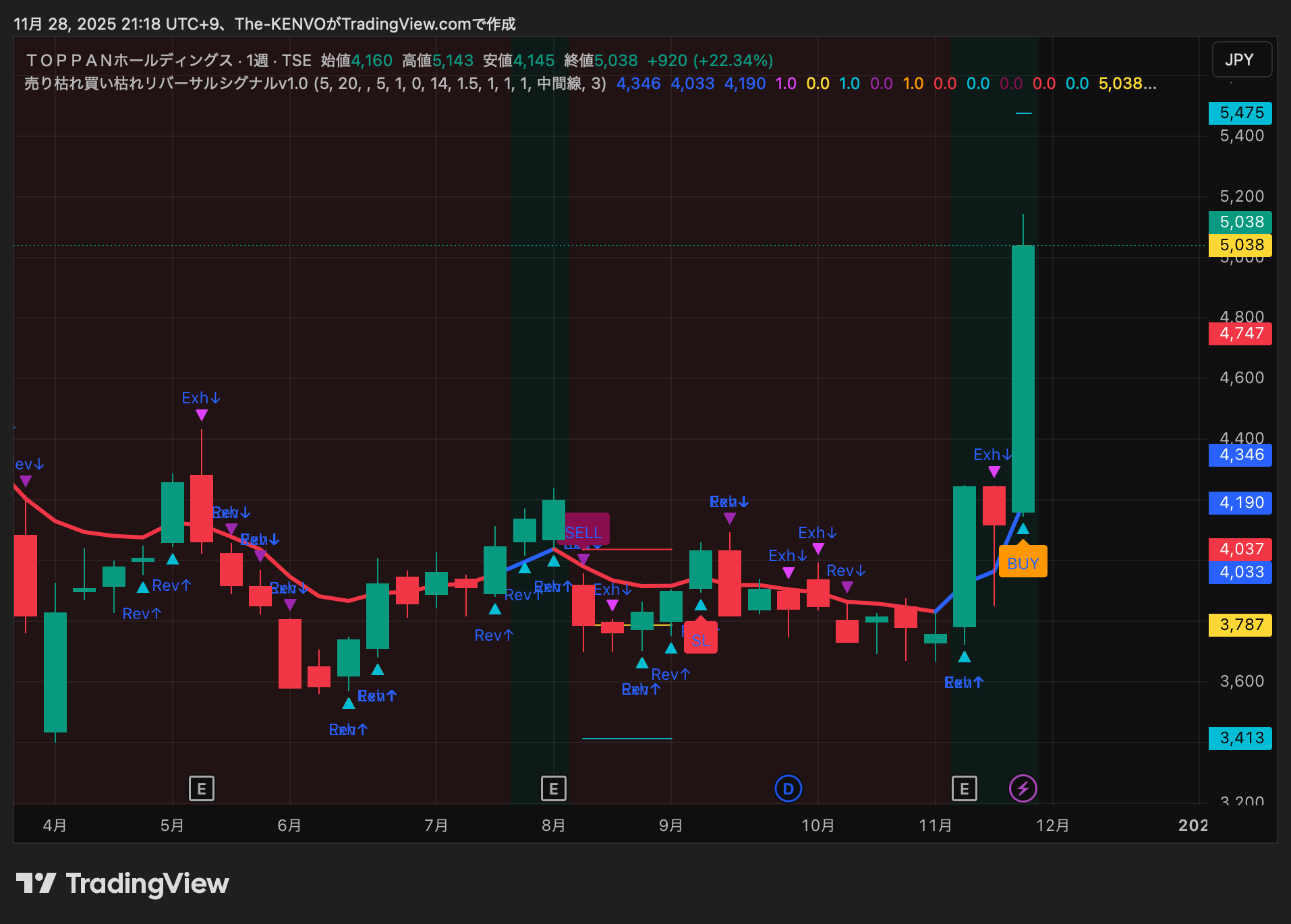

7912 Dai Nippon Printing (DNP) ?

7911 TOPPAN Holdings ?

Expands from traditional printing into semiconductor-related, display, and security businesses.

In both cases, within a mid-term uptrend,

the pattern appears aspullback completes → sell-off dry-up BUY → trend resumes.As a sector, they are seen as a group of stocks with a quiet but strengthened earnings base,

and it’s advisable to consider both technicals and fundamentals in this zone.

7550 Zensho Holdings ?

A major player in dining such as Sukiya.

Food service is volatile due to costs (labor, raw materials) and consumer sentiment,

weekly sell-off dry-up BUY tends to capture rebounds after bad news has run its courseIn this signal as well,

it’s natural to read it asthe point where short-term negative news caused selling pressure, but supply-demand stabilizes and rebound begins.

E. Technology-heavy Defensive ?

6971 Kyocera ?

A broad portfolio including electronic components, smartphone-related, and industrial equipment.

sell-off dry-up BUYappears.

As a stock with a balance of cyclicality and defensiveness,

it is suited for catching the initial rebound at the weekly level.

?A sequel with a full reveal is planned ?

In this article,

“As of November 28, 2025, 17 stocks with weekly BUY signals”are previewed first.

Going forward:

【Continuation】

Review the subsequent charts

“What commonalities and differences were there?”

to be examined. ??

⚠️ Disclaimer

This article is intended to share practical usage of

Sell-off Drying Up / Buy Drying Up Reversal Signal v1.0and does not recommend buying or selling specific stocks.

Investment decisions are your own responsibility.

Please consider fundamentals, news, and your risk tolerance.

? Purchase / Details Here

This indicator is listed on GogoJungle.

There are affordable options to try【Monthly Version】 and【One-time Purchase Version】.【Monthly Version】 3,000 JPY / month

【One-time Purchase Version】 30,000 JPY