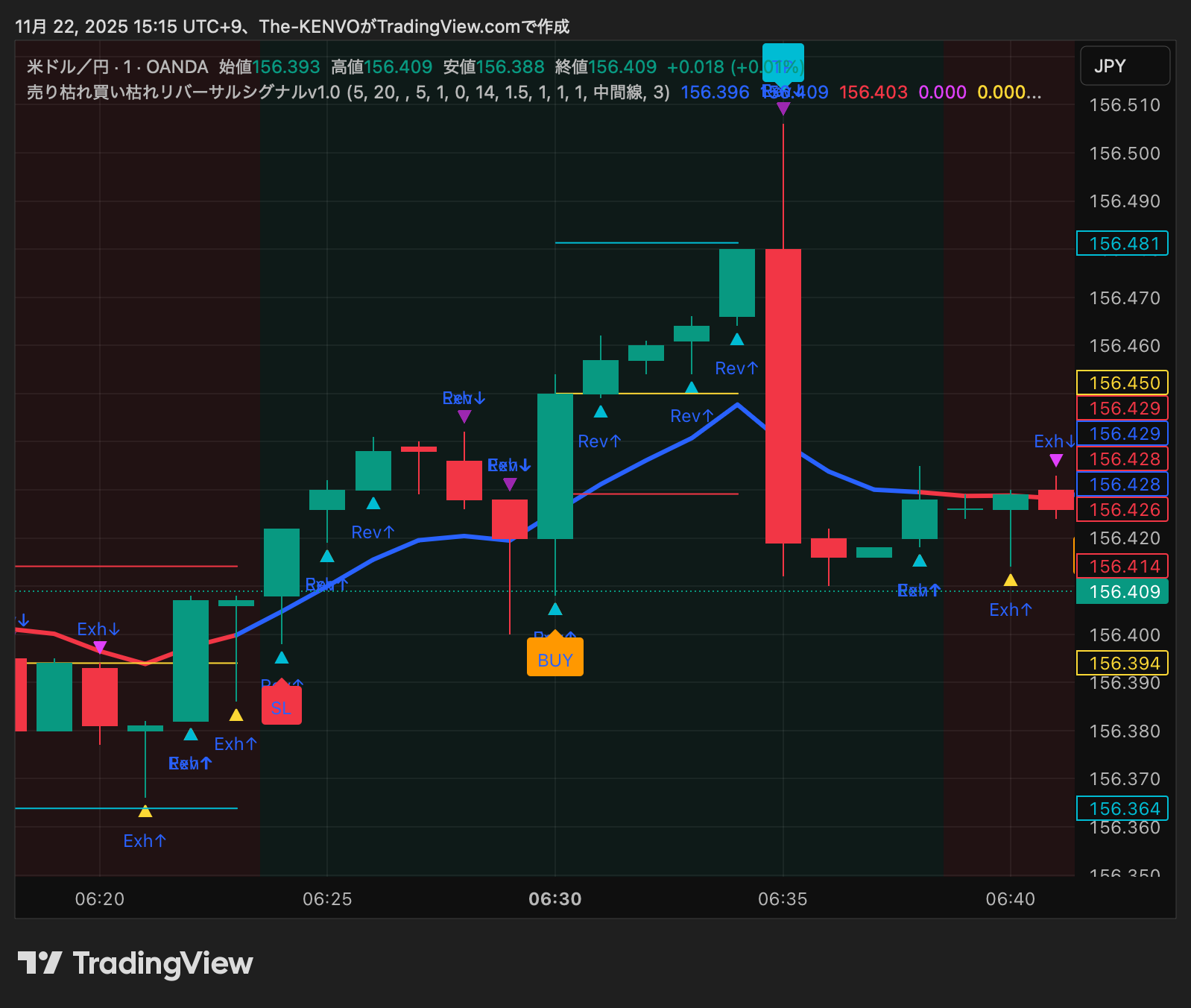

[Practical Commentary Part 4] Sell-off exhaustion and buy exhaustion reversal signal v1.0 —2025/11/22 Early Morning — Real-time Verification of USD/JPY 1-minute Chart

2025/11/22 Early Morning - Real-time Verification of USD/JPY 1-Minute Chart

?Used Chart: USD/JPY 1-minute chart | Early morning on November 22, 2025

?Applied Indicator: Sell Exhaustion / Buy Exhaustion Reversal Signal v1.0

This analysis displays signals on an actual 1-minute chart,

how to enter and where to take profit to maximize reproducibility

Focus on that “high-probability pattern.”

In conclusion, the true strengths of this indicator are two points below.

✅Conclusion: The key is to “pause for a breath before entering”

?① Signal lights up → a brief reversal → enter there

Sell exhaustion / Buy exhaustion signals

tend to light up just before the first wave reverses direction.

?Therefore, rather than jumping in right after the signal, waiting for a pullback or retracement after the reversal improves win rate.

?② Profit-taking: choose between “take small profit” or “wait for TP signal”

?If you want a safe route, take profit around +1–2 pips.

?If you want to extend, hold until the TP signal (blue TP label).

?If you want a safe route, take profit around +1–2 pips.

?If you want to extend, hold until the TP signal (blue TP label).

Even on actual charts,

▶Sell exhaustion (yellow upward triangle)

▶Buy exhaustion (blue downward triangle)

and in many cases profits are realized.

⭐ Practical Chart Commentary (05:10–06:50)

Below is an extraction of the points from the actual chart this time, a “winning pattern” analysis.

■ ① Around 05:15: Buy Exhaustion → Straight to TP

?BUY Exhaustion BUY▲

↓

Price briefly retraces 1–2 pips, but optimal entry is on the pullback.

↓

?Take profit at TP (blue icon): equivalent to +6–8 pips

?This is the most ideal movement.

This is the classic pattern where a solid reversal occurs after buy exhaustion.

■ ② 05:55–06:05: Sell Exhaustion Firing Repeatedly

This is a typical“pullback selling zone”.

Sell exhaustion signals light up in succession,

and whichever entry point you choose, you could gain a few pips.

? SELL▼ → retrace 2 pips →Enter on the pullback→ +4–6 pips

? When multiple signals occur, it’s a “weak buy, strong sell” environment.

For 1-minute scalp, this is the easiest time to capture profits.

■ ③ Around 06:20: Buy Exhaustion BUY▲ → Retrace → Sharp reversal

? BUY▲

↓

After a retrace, solid bottoming

↓

Ride the rise → +5–10 pips

? This is a highly reliable signal shape.

If you can endure the retracement, you can exit smoothly at the TP signal.

■ ④ 06:40–06:50:BUY signal → TP take profit → afterward a weak buy → zone where selling pressure begins

?BUY signal → retrace → enter on pullback → take profit possible by TP (around 06:42)

After that,

?a weak rebound continues from reversal signals, but buying advantage does not persist

And ultimately,

?From after 06:50, selling pressure clearly gains the upper hand

Around 06:40, buy exhaustion (Exh↑) and BUY signal light up,

retrace once and then reverse higher,making it an ideal form for TP at 06:42.

However afterward,

the reversal (Rev↑) continues, but buying pressure weakens,

and the time zone gradually shifts to selling dominance.

While a BUY signal is easy to capture immediately after,

after 06:50 the movement tends to shift strongly to the downside,

so do not chase; reset after TP.

retrace once and then reverse higher,making it an ideal form for TP at 06:42.

the reversal (Rev↑) continues, but buying pressure weakens,

and the time zone gradually shifts to selling dominance.

after 06:50 the movement tends to shift strongly to the downside,

so do not chase; reset after TP.

⭐ Reasons this indicator is strong — the essence of “sell exhaustion / buy exhaustion”

Signals light up at an optimal point:

“contrarian, yet able to ride the initial trend”

This describes the precise moment signals appear.

● Initial rise when selling pressure is exhausted

● Initial drop when buying pressure is exhausted

?“Sell exhaustion” = selling is exhausted and reversal is likely

?“Buy exhaustion” = buying is exhausted and reversal is likely downward

That’s why

the ideal entry point is after the retracement or pullback.

? Summary: The most usable reversal-based signals on a 1-minute chart

Finally, here are the lessons drawn from this chart.

✅Sell exhaustion / Buy exhaustion: do not jump on signals immediately

✅Profit-taking: “take small profit” or “wait for TP signal”

✅Signals in rapid succession occur in zones you will want to capture

✅1-minute chart shows excellent reproducibility. The most practical signals for trading

Disclaimer

This article is not trading advice but a practical analysis for learning. Please make investment decisions at your own risk.

? Purchase / Details here

This indicator is listed on GogoJungle.

There are accessible options to try:【Monthly Version】 and【One-time Purchase Version】.

【Monthly Version】 3,000 JPY / month

【One-time Purchase Version】 30,000 JPY