FX Gold: Can you create an EA like this with AI?

Simple Logic FX Sales Page

Simple Logic FX Gold Version Sales Page

Auto Click Sales Page

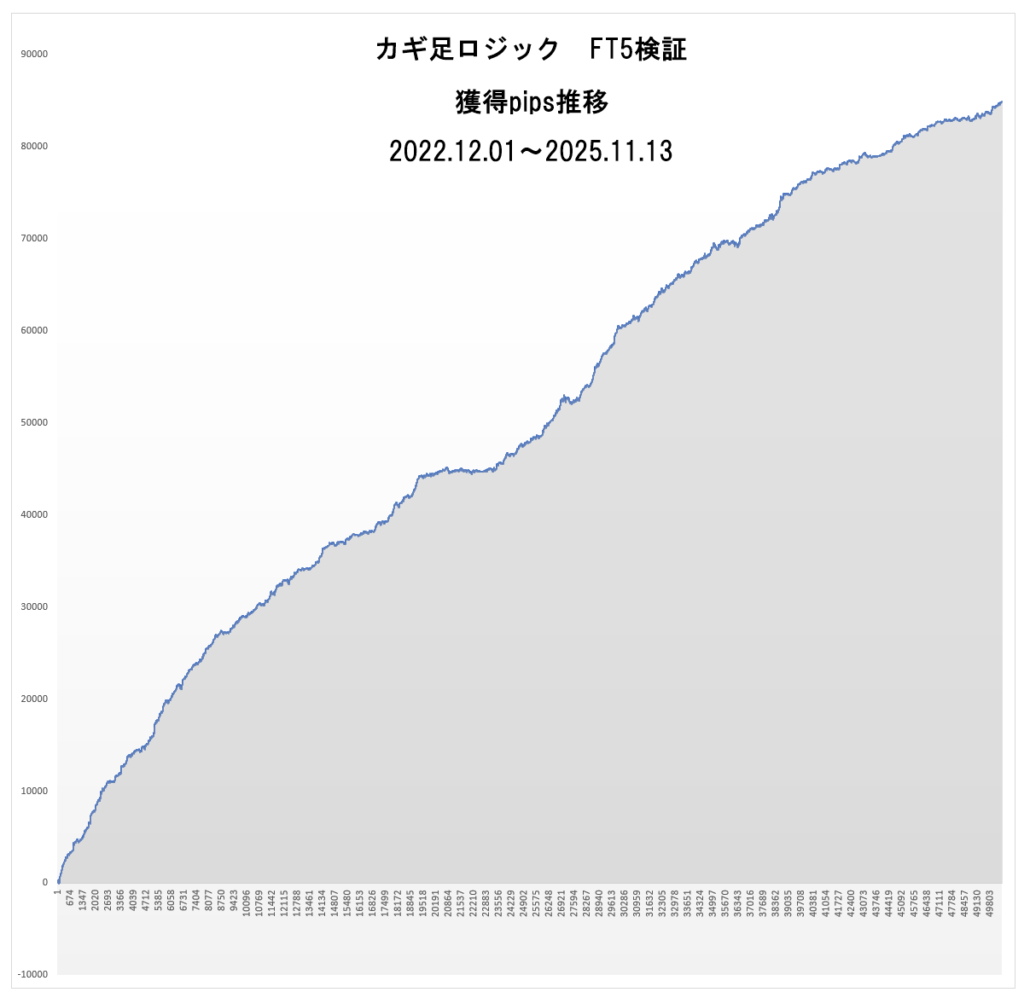

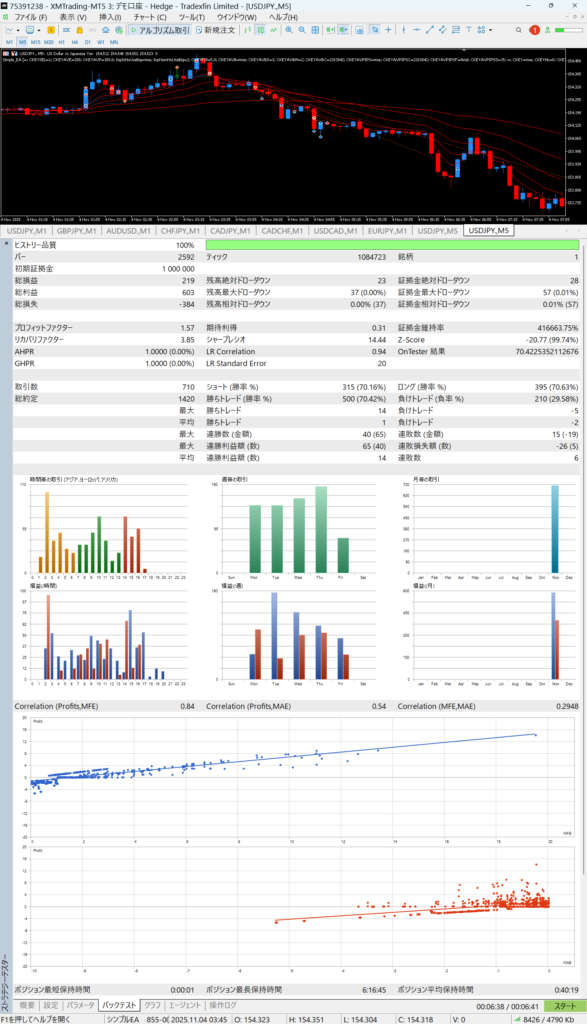

Dollar/Yen System A (Key Foot Logic) This Week’s FT5 Verification Result: 50,000 Runs Achieved

This week also showed a large positive result.

And we achieved 50,000 verifications.

FT5 verifications began in December 2022.

It was planned for about a month, but

before I knew it, it’s about to be three years.

We made some rule changes as tests, but

to continue delivering this result with a single logic for three years

is possible because it’s a classic trend strategy.

The verification EA for this key-foot logic is gradually taking shape,

and I’ll show you backtest results later.

Friday, November 7

Monday, November 10

Tuesday, November 11

Wednesday, November 12

Thursday, November 13

Let me explain the true role of the verification EA

EA is known as an automated trading tool,

so there’s an image of earning easily by letting the tool handle it.

Also, since there are many free martingale EAs,

many people feel it could eventually fail disastrously.

I have built more than 50 EAs, but

I didn’t build them to earn easily.

As I’ve continued to call it a “verification EA,”

I’ve been making EAs to facilitate verification.

(I can’t program; I didn’t have code written by AI, so

I prepare the specification and ask the programmer.)

Last week I shared themes like:

“The strongest way to survive in random environments – a hybrid of system and discretion.”

For half-discretionary trading,

why is EA needed?

I hope you’ll read that from the exchanges with Mr. K, who is developing System B together.

It will be a long read, but I’ll publish part of the exchanges from the start of this week to today.

――――――――――――――――――――――――――――――――

● 2025.11.10: Mr. K

I used the weekend to verify the EA.

The settlement is

Recent high/low + 5 candles

as the basis.

With a decided axis setting, I worked with grounds,

adding and removing settings, to derive high-performing values.

We strived to produce the best performance values!

We spent a lot of time on verification, but it yielded unexpected results.

Interestingly, settings with fewer filters performed well.

Unexpectedly, some settings with no filters achieved good results.

By adding filters, win rate was about 50%, and PF 1.20

was also found.

To organize, here are the commonalities:

Common:

Period: 7/1–9/30

24-hour operation

【Setting 221】[Shin-gi, Shin-shin (deviation only) + PO + ZigZag length filter]

Total net profit: 12.11

PF: 1.20

Win rate: 50%

Number of consecutive wins: 8

Number of consecutive losses: 8

【Setting 219】[Shin-gi, Shin-shin (deviation only)]

Total net profit: 32.92

PF: 1.10

Win rate: 45.43%

Consecutive wins: 8

Consecutive losses: 9

【Setting 222-a】[Shin-gi, Shin-shin (both), Gi-gi + ZigZag filter]

Total net profit: 46.84

PF: 1.10

Win rate: 44.74%

Consecutive wins: 7

Consecutive losses: 8

【Setting 222-a】[Shin-gi, Shin-shin (both), Gi-gi]

Total net profit: 29.59

PF: 1.05

Win rate: 43.71%

Consecutive wins: 7

Consecutive losses: 10

For details of the fine settings, please refer to the corresponding sheet in the attached Excel.

(The above settings are color-coded on the sheet tabs)

Due to PC specs, we could only run a three-month verification, but

I’m curious about the outcomes when run on a longer horizon.

Setting 221 has high win rate but extremely few entries,

averaging about one trade per day.

Total net profit is small, which feels a bit unsatisfying.

When combined with money management logic, it is stable, so

this might be the best setting.

Setting 222 includes all entry patterns.

Total net profit is the largest!

I felt this logic has an edge.

These are preliminary results, but

I think the ZigZag length filter is working.

● 2025.11.10: Do.

Thank you for the long backtest!

Your discussion of the results is thorough and excellent.

Slowly, the full logic is becoming clearer.

As experienced in this backtest,

many of the logics I’ve developed share the following tendencies:

- When the basic logic yields over 40% win rate,

filters don’t change it much

- More filters raise win rate but reduce trade count and total profit

- Among filters, those aligned with the core logic (scalping, high volatility, trend components) tend to be more effective

(This time: ZigZag length filter)

- As a result, the combination of the basic logic + discretion yields the largest total net profit

For this logic, ZigZag length filter is well-suited for capturing higher volatility regions.

● 2025.11.14: Mr. K

Since then, we tried various things with the EA,

but it’s quite challenging and we didn’t obtain good performance.

After some trial and error,

I found a setting that yields a clean, steadily rising profit curve.

Maybe if we boldly set the opposite,

wouldn’t it rise steadily?

So I changed the settings and ran backtests.

Ah! I finally found it! I was very excited at that moment.

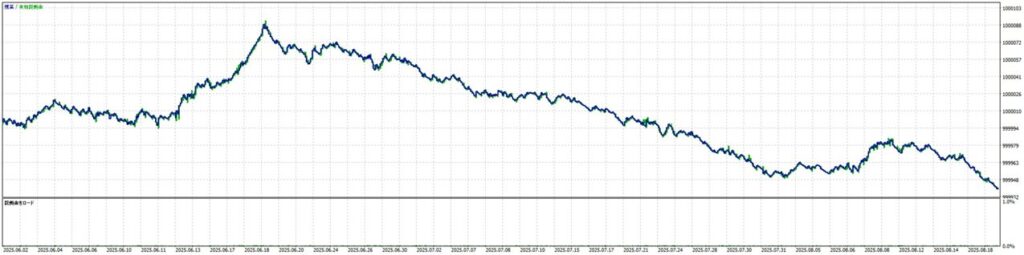

The test period was June 1–June 30 for one month.

But in the latter half it stopped growing,

so I wondered what would happen if I extended the test period a bit more.

Testing from 6/1 to 8/20 over two and a half months resulted in this… (-_-;)

Therefore, I decided to leave the chart unaltered on weekends without movement,

and on weekdays to have the chart signals assist with discretionary trading.

EA is so difficult…

Indeed, you have to try things to understand them.

Just realizing how difficult it is is a gain!!

Well then, I appreciate your continued support.

● 2025.11.14: Do.

In scalping where you can’t take big moves with the trend,

it is extremely difficult to produce a rising backtest result.

Considering money management logic, if we can stay in positive for about a year

it would still be amazing.

In System B’s scalping since last year,

from the start, money management logic was essential,

yet it has not been easy to stay positive,

ultimately returning to a trend to recover range losses.

(This is still ongoing; if there’s an edge, there’s a possibility to present as System C)

When verifying with backtests,

even if you don’t display charts in a visual mode,

it’s good to check the result charts.

By comparing with the graphs,

what differs in rising vs. falling chart conditions?

Another thing I often do is

run in visual mode while watching calmly.

Then, oh, it does this movement,

and you can see it clearly.

Also, I set specifications loosely and run on multiple MT5 in demo to observe their behavior.

I enjoy trying different configurations on about five MT5s and observing their characteristics.

Then use the hints gained there to inform the half-discretion part.

The beauty of an EA that trades automatically is here, I feel.

Not to win automatically, but

to automate a wide range of verifications and provide fodder for my half-discretion.

> EA is this difficult…

> You must try things to know them.

> Even just realizing how tough it is is a gain!!

I think taking the first step was a good start.

When basic tacit knowledge and trade-offs become clear,

the next level begins.

I believe you’re starting to see parts that will help your half-discretion trades.

Let’s use that to devise a strategy that includes money management logic.

● 2025.11.15: Do.

EA isn’t a magic tool that makes money easily,

but it greatly eases verification,

so I hope you’ll leverage that to spark ideas.

In scalping that makes winning with a one-shot approach based only on win rate and risk-reward,

auto-setting stops and limits make money management logic crucial.

Examine the entry timing that tools provide with discretion,

increase win rate, and push profits with money management logic.

That seems to be the outline of System B.

For reference, comparing this with a day-trading example of EA

will help you understand the difficulty of scalping EAs, I’ll explain briefly.

System A’s key-foot logic targets intraday trends, so

even without money management logic, you can refine entry timing

to push into the plus zone.

(Of course, in market conditions where trends don’t appear for weeks, it won’t be possible.)

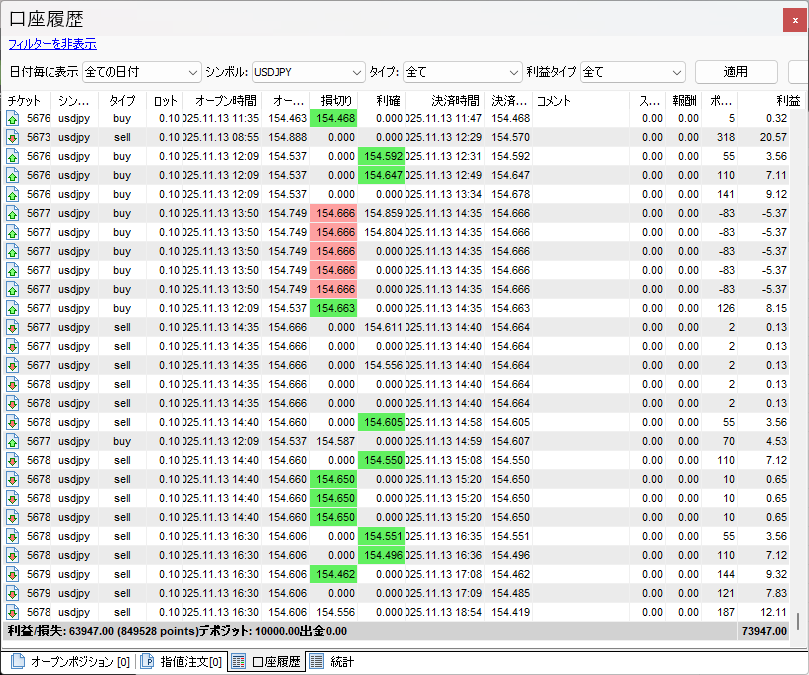

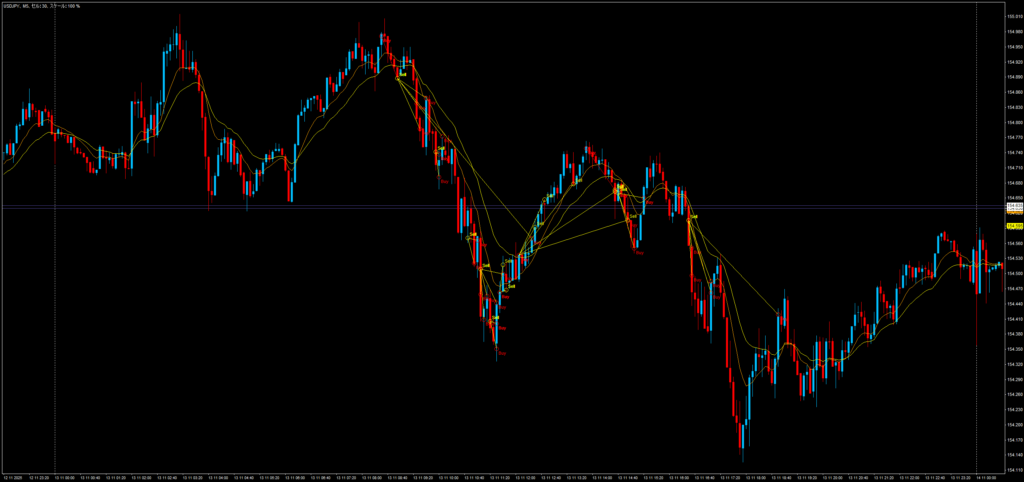

Below are results for System A’s verification EA from Nov 13 (Thu) onward.

This is after finishing three years of manual verification and then completing a semi-automated trading setup,

and the order was to create a verification EA, and we’ve finally reached this point.

it’s extremely complex, so many challenges remain.

I hope to complete it someday.

(FT5 verification results have achieved a 70% win rate equal to the target.)

This time, using the EA for verification has likely led to many discoveries.

Since yesterday, this long email has been written, but

I wanted you to grasp the overall picture of the EA.

● 2025.11.15: Mr. K

Good morning.

This is K.

> Not to win easily, but

> EA automatically performs various verifications

> and provides materials for my half-discretion.

In the past week, I’ve been eager to achieve good results and felt pressure to deliver,

and I was stubbornly seeking the optimal solution.

Receiving your words, I remembered the original purpose.

Thank you.

I also read your follow-up email.

I understand that scalping EAs are difficult,

and I learned a lot.

In truth, I had a bit of a confidence slump because results weren’t as expected…

But I realized I’m taking on something great, and it boosted my motivation again!!

Thank you (^^)

I’ll ease off the EA verifications for a while.

When you become focused on one thing, time passes unnoticed,

and it becomes everything.

Then it’s hard for good ideas to surface.

I’m very pleased with O’s collaboration!!

(Do. Note: I will introduce O later.)

Moreover, I’m delighted that O is researching slipping-through logic and using it.

I’m really grateful for his help.

Wonderful, and seeing that we share the same goal makes me even happier.

Regarding settings, he had set to “Normal Candlesticks_Reverse True,”

which I’m glad he is researching.

With long positions, this means “one candlestick’s worth of profit” for the entry.

Compared to normal candles, entry occurs when a bearish to bullish transition happens.

The “slip-through logic” entries rely heavily on intuition and are influenced by psychology,

making them less stable.

As for exits, watching price moves, manually exiting when it doesn’t extend,

or letting Simple Limit G handle auto-exits when it extends substantially.

On the other hand, System B under development

examines entry timing with logic and issues signals,

thus compensating for the part that relied on feel and stabilizing it mentally.

ZigZagH is an indicator, so

display ZigZagH signals on a chart based on Simple Logic (Gold version of System A),

and use them as the basis for entries, with exits left to “Slip-Through Logic.”

Furthermore, System B uses Heiken-Ashi color reversals to catch waves,

so after entry, if it moves in the opposite direction and there’s no real profit, borders on stop loss will decrease.

This makes using break-even shift exits to create drawdowns and increase wins more viable.

Thank you for adopting the “Too-narrow Range Filter.”

I’m looking forward to seeing the results in ranges and trend endings!

This filter holds a lot of promise!

Simple Logic FX Sales Page

Simple Logic FX Gold Version Sales Page

Auto Click Sales Page