Reasons to Promote Low-Revenue EAs (not high-profit) and Effective Operating Methods

Not explosive profits but low returnsReasons to advocate steady EA profits and effective operating methods

When you hear about automated forex trading (EA), many people may imagine things like "doubling funds in a short period" or "dream-like explosive profits." The internet is full of attractive promotional phrases, and many traders search for high-performance EAs in pursuit of large profits.

However, many EAs that boast explosive profits carry corresponding risks. High returns come with high risk, and behind temporary large gains lies a potential major pitfall called "collapse" that could occur someday.

The "peace of mind" gained in exchange for monotony

Stable-type, that is, low-profit EAs are,certainly more dull and boring compared to explosive-profit types. Daily profits are small, and the rate at which capital grows is slow. However, this "boringness" is precisely what provides the most important form of long-term security for asset formation.

Low-profit EAs have the clear advantage of thorough risk management, making the probability of collapse extremely low. They steadily accumulate profits and are designed to endure unexpected market fluctuations.

Do not arbitrarily increase the lot size

Thinking, "If profits are small, just increase the lot size," is very dangerous. Low-profit EAs stay safe only when used with recommended capital and lot balance. Ignoring the recommended values and doubling or tripling the lot increases risk proportionally, making the collapse rate as high as that of explosive-profit EAs.

Also, many people resist increasing the operating capital itself. So, how can you maintain safety while aiming for efficient operation?

The option of running multiple EAs simultaneously

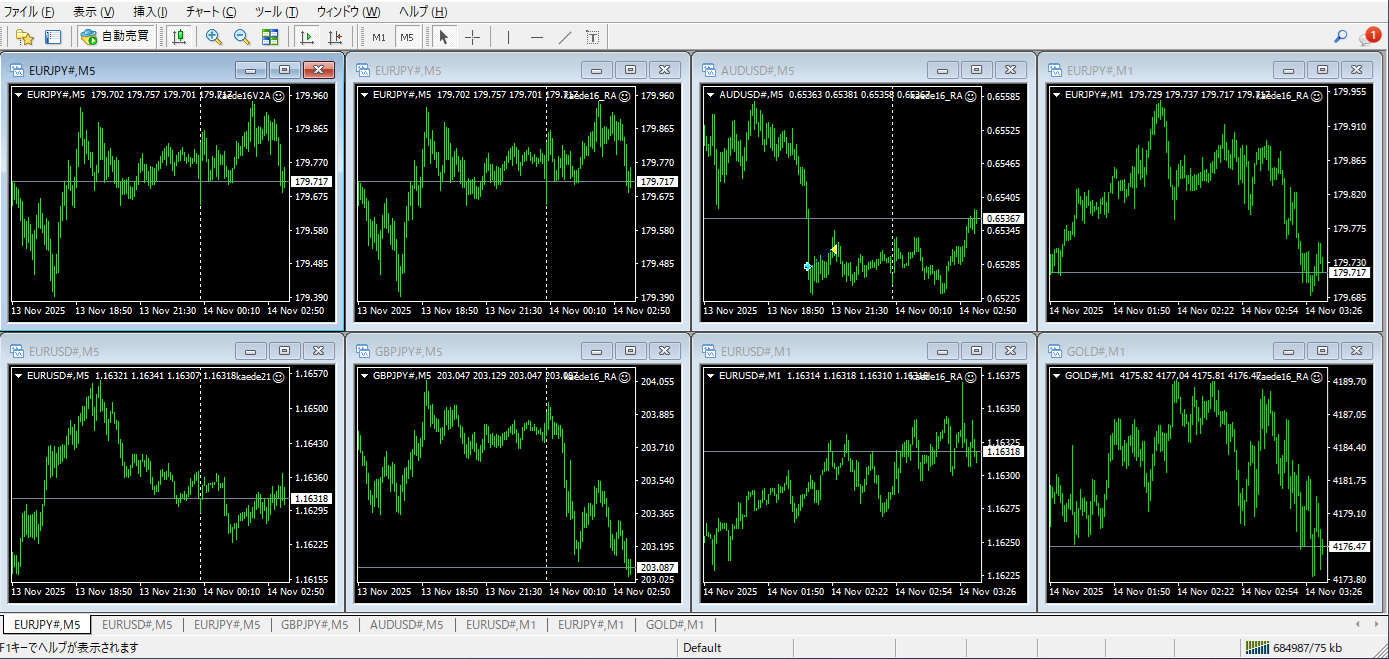

What I propose is to "run multiple low-profit EAs with different characteristics on a single account."

For example, suppose there is an EA designated for 0.1 lots with an recommended operating capital of 300,000 yen. The basic approach is to deposit 300,000 yen into one account and run that EA. However, if you want to improve capital efficiency, instead of depositing 600,000 yen into the same account and setting the lot to 0.2, you would run two EAs on the same account with different currency pairs (each at the recommended 0.1 lots) using around 300,000 yen plus a little extra.

This approach provides diversification benefits and higher safety than simply doubling the lot on one account with one EA. Of course, it is worth noting that it carries more risk than a single EA per one account with the basic lot, but it is far more prudent than doubling the lot.

Why is it safer than doubling the lot?

If you simply double the lot for the same EA, the drawdown (DD) also doubles. On the other hand, when combining EAs on different currency pairs or with different logic, the timing of maximum drawdown tends to be out of sync due to lower correlations, so total DD is less likely to coincide. This reduces risk while allowing increases in profitability.

The key to success is "the combination" and "the quality of the EAs"

Tips for making this strategy successful are as follows.

- Choose currency pairs with low correlation:Combining pairs with different price-movement tendencies, such as EURUSD and USDJPY, maximizes diversification effects.

- Choose combinations where the maximum drawdown timings do not coincide:From past backtests, select combinations that are unlikely to both incur large drawdowns at the same time.

- Select EAs with a preference for stability:Of course, the EAs being combined should not be explosive-profit types; stability is a fundamental prerequisite.

- Be careful with EA types:Single-position types or grid strategies without martingale are preferable for easier risk control. Martingale-based grid systems are very dangerous and not suitable for running multiple EAs simultaneously.

And the most important point is that this method is limited to EAs that can manage positions with a magic number and allow multiple simultaneous operations (coexistence). Not every EA can do this..

The essence of EA management is to “stay in business without going bankrupt for as long as possible.” It may not be flashy, but low-profit EAs are the best option for this purpose.Rather than gambling on explosive profits, by combining several steady EAs, aim for long-term, stable asset formation. This is the smart way to operate automated trading.

The following operations use a relatively high number of EAs with correlations ignored, but there has been zero default since operation began (not a demo, real account).

× ![]()