Essential basic rules of FX you should know before starting EA (EAを始める前に知っておくべきFXの基本ルール超入門)

Before starting FX automated trading (EA), the basic rules of FX are what you should first understand. Although EA is a convenient tool that trades automatically, it won’t work well unless you understand the market structure and basic risk management, regardless of which EA you use. Here are the minimum points you should grasp to succeed in EA operation.

■Make sure to cut losses properly

The most important thing in FX is to “cut losses.” Like humans, an EA cannot avoid losing trades. The issue is “how quickly you cut losses.” An EA that does not set a stop loss risks blowing up the account with a large drawdown, even if profits appear temporarily.

Generally, it is safe to reserve funds equal to 2–3 times the maximum drawdown that can be confirmed by backtesting, and operate within that range.

■Extend profits with trailing

The concept that pairs with stop loss is “trailing stop.” It automatically moves the take-profit line upward as profits accrue on a position.

By incorporating trailing in an EA, you can automate “how far you can extend profits when you’re winning.” Optimizing the trailing width (in pips) helps prevent missed profits while preparing for sudden reversals.

■Parameters should be grounded by backtesting

An EA has many parameter settings. The basics are to verify what values are optimal via backtesting.

For example, settings like “should the moving average period be 20 or 50,” or “should trailing be 30 pips or 50 pips,” become clear only after testing with historical data. Setting based on statistical grounds rather than intuition leads to long-term improvement in win rate.

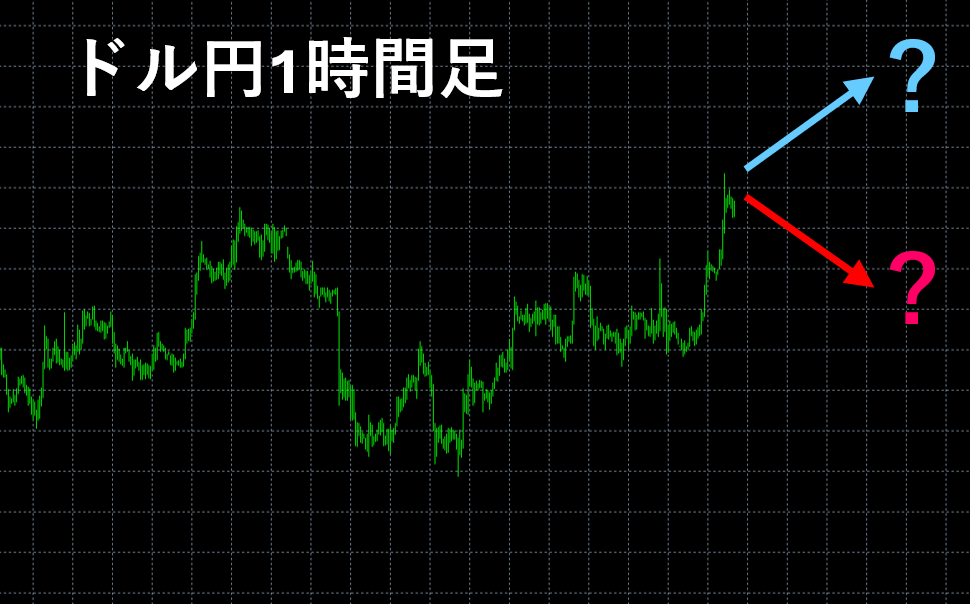

■Whether it’s a trend or a false breakout is unknown to anyone

Many traders struggle with the question of whether this is the start of a trend or a false breakout.

Does this chart rise to form a trend, or fall and continue in a range (ending as a false breakout)?

Unfortunately, at that moment no one knows.

What’s important then is to think about “entering at statistically or experientially favorable points.”

- Enter after breaking recent highs/lows

- Enter when volatility expands

- Wait for a certain reversal after a moving average cross

However, this is idealistic, and in actual trading the following concerns arise.

- Entering after breaking recent highs/lows—how do you judge the breakout?

- Entering when volatility expands—what level of volatility should be considered an entry signal?

- Waiting for a reversal after a moving average cross—what degree of reversal should trigger entry?

- Is it better to enter after the trend is clearly formed, or before it becomes clear?

By statistically investigating or empirically learning these rules, you can grasp reproducible winning patterns.

In EA automated trading, a discretionary trader’s experience-based sense of “this is it” is quantified and reproduced in the EA.

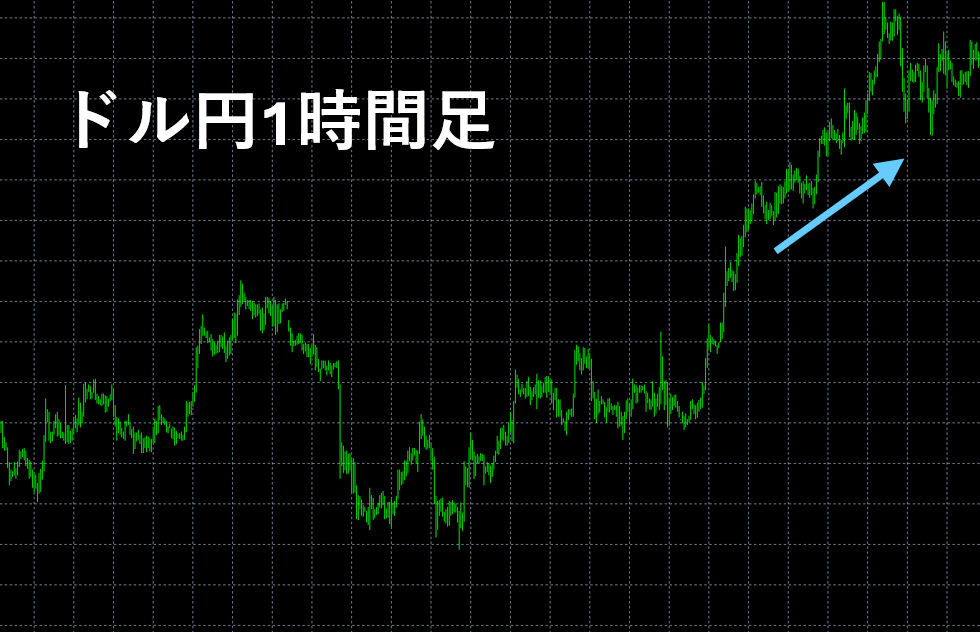

For example, the outlook on the chart above is as follows.

■ Fundamental or Technical?

In FX, there is a debate about whether moves are driven by news (fundamentals) or by charts (technical).

Personally, it is practical to think that the influence of fundamentals is already embedded in the chart.

In particular, EAs prioritize long-term statistical edge over short-term minute-by-minute changes. Rather than aiming for sharp volatility right after news, moving steadily with a consistent rule tends to be more stable in the long run.

■ Choose an EA that fits you

When using an EA, the most important thing is to “choose an EA that fits you.”

There are many types of EAs: trend-following, range-reversal, martingale/nanpin, and more. Clarify what market conditions you excel in and what risks you can tolerate, then choose accordingly.

In particular, beginners are recommended to start with single-entry EAs that have clear risk management rather than averaging down or martingale strategies.

■ Summary

EA trading is fighting in a “world of probability” with emotions removed.

Therefore,

- Enforce stop losses and trailing

- Ground decisions in backtesting

- Address trends and false breakouts with rules, not judgments

By focusing on these three aspects, you can build a foundation for stable trading.

EA is not a magic tool you can leave alone to earn money. If you understand the rules and use it proficiently, it becomes a powerful ally to protect and grow your assets.

That is all I want to convey today.

See you again!

× ![]()