[Trouble Prevention] Calculate the optimal amount of funds to deposit into the EA account!

When operating an EA (automatic trading), many people worry about “how much capital should be kept in the account?”

If the capital is too small, even small price movements can cause the margin maintenance rate to drop, potentially triggering a forced liquidation (dealing stop).

Also, even with a reasonable amount of funds, if you don’t anticipate a drawdown (loss) to some extent, it can break your resolve and you may stop operating.

And if you put in too much capital to increase safety, the trading efficiency can decrease.

Here, we’ll present a method to estimate the “just-right amount of funds” that prevents trouble while ensuring profits.

■ Backward calculation from margin maintenance rate → Conclusion is tricky

A quick approach is to aim for “not letting the margin maintenance rate fall below XXX%,” but in reality that method is very difficult to determine.

The purpose of operating an EA is to “consistently generate profits over the long term while enduring daily market fluctuations.”

Therefore, it is rational to consider based on “the drawdown in past backtests” rather than the margin maintenance rate.

■ Basic rule: “Relative drawdown × 2–3 times”

In simple terms, the target is to have on hand an amount equivalent to “2–3 times the relative drawdown” that can be temporarily lost as a safety margin during backtests for long-term operation.

This accounts for the gap between backtest and real trading (slippage, order latency, broker conditions, etc.).

For example, consider operating USD/JPY with 0.1 Lot (10,000 units).

If USD/JPY is at 150 yen, a position of 10,000 units equates to 1.5 million yen.

-

With 1x leverage, you would need 1.5 million yen.

-

With 25x leverage, 1.5 million ÷ 25 =60,000 yenas the minimum margin

However, with only 60,000 yen, the margin maintenance rate would be at the edge of 1.0% (nearly zero). Any slight unrealized loss could trigger a stopout, sothis is clearly insufficient.

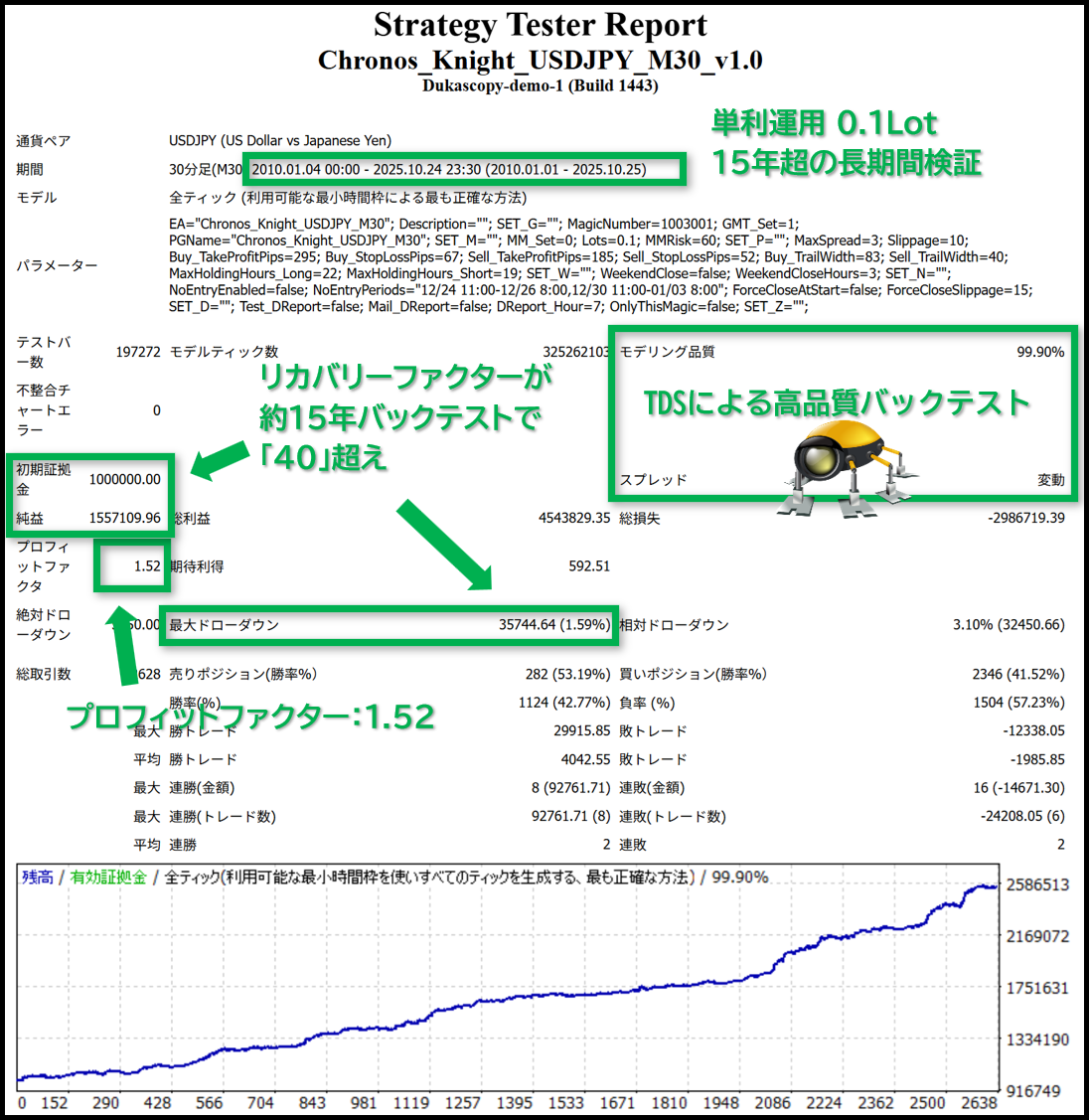

Here, for example, my EA: let's look at the backtest results.

In a backtest spanning more than 15 years, the relative drawdown isabout 32,450 yen (1.59%).

If you run this EA at 0.1 Lot, the backtest shows a temporary loss of about 30,000 yen.

In real trading, due to execution conditions and price deviation, this drawdown can become2–3 times.

Assuming 2.5 times, about81,000 yen.

In other words, you need enough funds to calmly withstand a temporary loss of about 80,000 yen.

■ Safe trading example

So, how much should you actually keep in to feel safe?

A rough guideline is as follows.

| Capital | Estimated drawdown | Balance | Notes |

|---|---|---|---|

| 300,000 yen | −80,000 yen | 220,000 yen | Barely able to continue operating |

| 500,000 yen | −80,000 yen | 420,000 yen | There is room |

| 1,000,000 yen | −80,000 yen | 920,000 yen | Safe operation; multiple EAs can be used together |

Thus, it is practical to set the funds in the account based on the amount you feel comfortable losing temporarily, such as 80,000 yen.

■ Lowering Lot to reduce risk is also effective

Of course, aside from increasing funds, you also have the option toreduce the number of Lots.

For example, decreasing from 0.1 Lot to 0.05 Lot halves the required margin, the expected drawdown, and the risk.

That said, profits will also be halved, but it is very effective for risk management.

■ Summary

The scariest thing in EA trading is an unforeseen drawdown that shakes your mental state, causing you to stop the EA and withdraw funds.

It is common for a good flow and profits to follow a drawdown, but if your mind collapses, you cannot patiently wait for those profits to materialize.

Continuing operation over the long term reveals the EA’s true potential.

Please refer to the backtest drawdown and use “relative drawdown × 2–3 times” as a guide for safe capital planning.

That is all I wanted to write today.

See you again!