Efficient operation methods for stable, low-earning EAs

In FX automated trading (EA), unlike high-risk types aiming for explosive profits, stable and low-yield EAs can feel “boring” to some. A steady monthly return of a few percent is attractive, but the growth rate of assets is slow, and many may feel unsatisfied.

However, the charm of stable EAs lies in their “low likelihood of bankruptcy.” Nevertheless, simply increasing lot sizes to chase higher profits raises the risk of funds blowing up due to unexpected market fluctuations. In addition, there is a psychological and practical resistance to increasing the operating capital.

So this time, we propose an efficient operation method: running multiple EAs in a single account.

✅ Specific operation example

For example, suppose there is an EA with recommended funds of 300,000 yen and recommended lot size of 0.1. Running this EA in one account with a 0.2 lot would double the risk.

Instead, you can deposit the same 300,000 yen into one account and run two EAs with different currency pairs, each at 0.1 lot. This approach increases earning opportunities with the same funds while avoiding risk concentration from doubling the lot size.

⚠️ Points to note and tips

Of course, there is more risk than operating just one EA at the basic lot size. Therefore, it is important to keep the following points in mind.

- Combine currency pairs with low correlation

Example: EURUSD and AUDJPY, choose pairs whose price movements are not highly correlated to reduce the risk of simultaneous losses.

- Choose a stability-focused EA

Rather than explosive or high-frequency types, prefer EAs that manage risk easily, such as single-position types or martingale-free grid types.Martingale-reverse types carry high bankruptcy risk, so avoiding them is prudent

- Check EA coexistence

Not all EAs support running multiple instances simultaneously. It is essential that position management by magic numbers is properly implemented and that the design does not interfere with other EAs.

? Summary

Stable EAs may be “boring,” but by adding the strategy of running multiple EAs simultaneously, you can reduce risk while increasing profitability. To maximize capital efficiency, careful strategy is required in selecting EAs and pairing currency pairs.

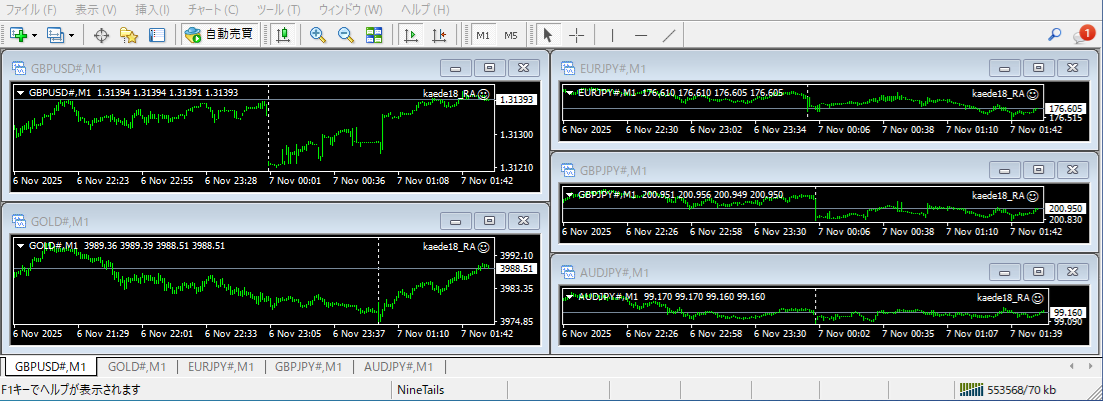

All of these EAs can be run simultaneously

The following operation is for testing with relatively heavy operation and ignores correlations, but there has been no bankruptcy since start of operation (real account).