Challenge to the established notion that "There is no EA that keeps winning"

What is an EA that you want to continue using forever?

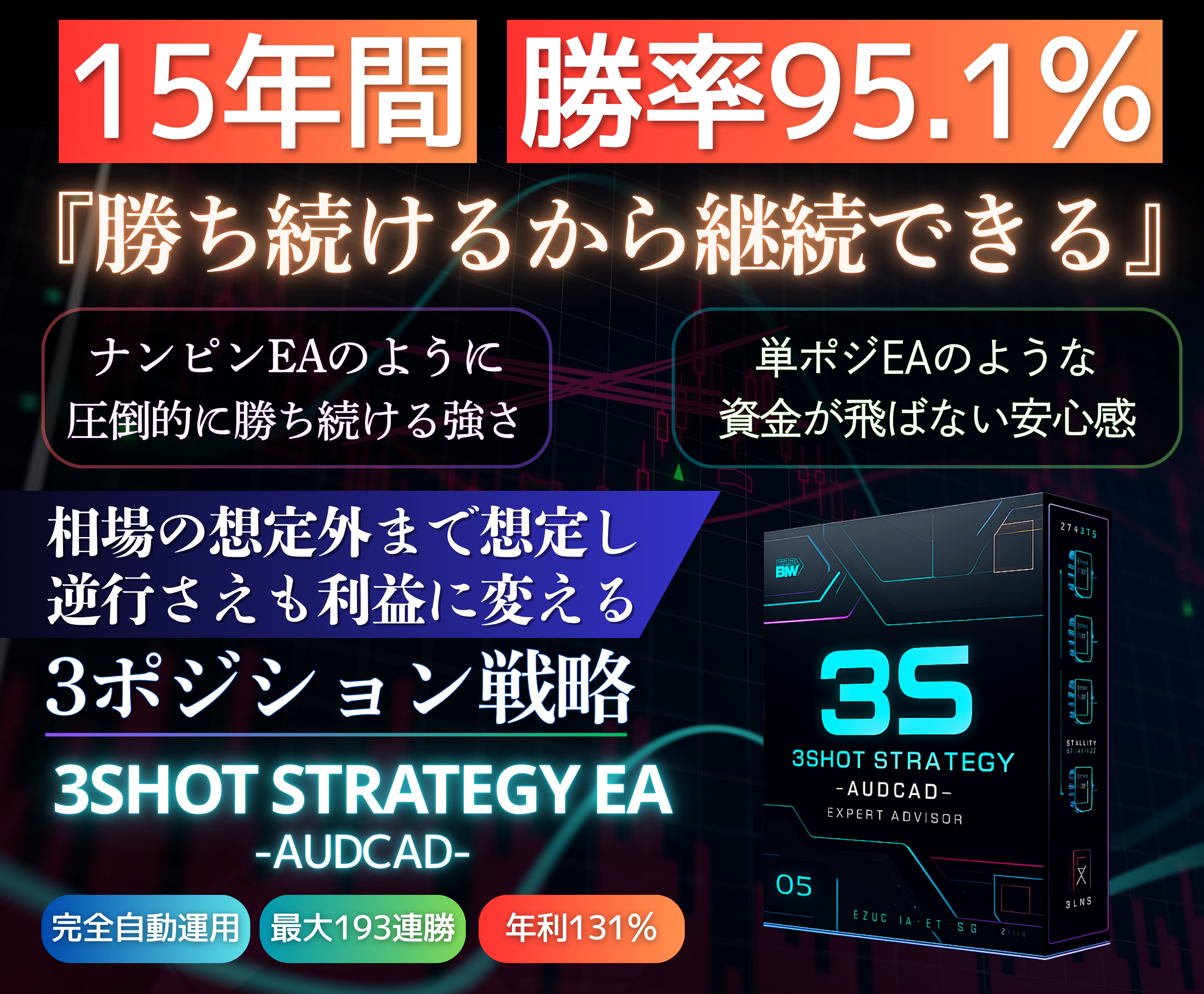

Only because you keep winning can you continue—an ongoing challenge in EA development

Introduction

EA (Expert Advisor) automated trading systems have permeated among traders as the optimal means to trade with emotions eliminated and to "trade with discipline." There are hundreds of thousands of EAs operating worldwide, but only a small number have been sustained over the long term.

Many EAs achieve short-term results, but eventually performance declines or a series of losses leads to stopping. In other words, it’s not that “you can’t win, so it ends,” but “you can’t continue, so it ends.”

Interestingly, the thing that stops EA operation is not the market, but the trader’s own hand. When consecutive losses occur or drawdowns arise, each time one feels, “This EA no longer works.”

However, in reality, that “stop” actually yields the greatest loss. So, what kind of EA would make a trader not want to stop?

In this paper, from the perspective of an EA that one would want to continue forever, we introduce its design philosophy and empirical data.

Why can't EAs keep winning?

There are three main reasons why EAs cannot endure long-term operation.

1. Changes in market structure (non-stationarity)

2. Overfitting

EAs that show perfect results in backtests are more likely to fail in real operation. This is because EAs optimize to the coincidental shapes of past data rather than to the market’s principles.

3. Trader’s operational resilience

Martingale EAs can risk capital with a few adverse moves despite high win rates; single-position EAs cause stress from alternating wins and losses. As a result, there arise reasons for traders to stop using EAs. This structure is the biggest barrier to continuation.

Conditions for an EA that you would want to continue using

Continuity doesn’t mean “create an EA that keeps winning.” It means creating an EA that eliminates reasons to stop.

The four conditions are below.

1. Fully automatic—eliminate discretion

- A structure that removes a trader’s hesitation and ensures everyone achieves the same result

- “Fully autonomous with identical outcomes” is a prerequisite for continuity

2. High win rate and risk balance

- Increase win rate as much as possible while designing risk so a single loss is not fatal

- It is essential to consider human psychology that cannot endure a series of losses or large drawdowns

3. Flexible multi-position management

- Single-position EAs are one-shot; martingale EAs carry catastrophic risk

- A multi-position control that combines the advantages of both achieves higher win rate and stability

4. The existence of an anticipated “loss”

- Not an EA that never loses, but an EA that can continue even after losses

- A structure that does not force exit after a single loss supports long-term asset growth

Original EA developed with these prerequisites in mind

Core of the strategy

1. Rebound-focused contrarian logic

2. Up to 3-position control

3. Currency pair optimization: AUDCAD

Implemented two capital-appropriate modes that can withstand small funds

| Mode | Annual Return | PF | Relative DD | Features |

| Profit-focused mode | 131.0% | 1.79 | 33.07% | High win rate with profit pursuit. Uses multi-tier lot increases. |

| Safety mode | 78.60% | 1.67 | 21.51% | Suitable for small funds. Emphasizes stability with fixed lots. |

Conclusion

- Fully automatic design without discretion

- High win-rate logic without reliance on martingale

- Flexible 3-position control

- Capital management that balances risk and recovery