Even with a small amount of funds, it’s okay! A roadmap for starting EA trading with a small budget

When people hear about FX automated trading, there may be an image that "you can't start without a substantial amount of money." However, in reality, there are EAs in the market that can turn 100,000 yen into 1 million or 100 million yen by starting with a small amount and operating with a compounding approach for more than 10 years with a steady stance.

That said, this is merely a hypothesis scenario based on past data, and no one can decisively predict how the future market will move. Still, if the market moves in line with past statistics to some extent, there can be upswings and downswings, but the same kind of performance is quite possible.

■ Why does "start small + use compounding" work?

For example, start with 100,000 yen using carefully selected EAs (with compounding functionality) and set them up to allow annual interest and reinvestment (compounding).

Maintain this position for over 10 years and continuously reinvest the profits as-is; as long as the EA shows a long-term upward trend, funds will grow like a snowball.

This reinvestment is the “power of compound interest” in the investment world, and the same idea applies to FX.

Specifically, because the principal plus past profits earn yields, if you can make time your ally, a small initial stake has the potential to turn into a substantial amount.

Compared to other investments, for example, if you invest 100,000 yen in an index fund (S&P 500 or All-World), assuming average performance over the past 10 years, even considering compounding, it would be roughly 200,000–300,000 yen at best.

With this in mind, select, for instance, five EAs capable of compounding; if even one of these grows to 10 million yen after 10 years, starting from 100,000 yen x 5 = 500,000 yen → 10,000,000 yen, that’s twentyfold growth. The idea is that you can dream even from a small starting amount.

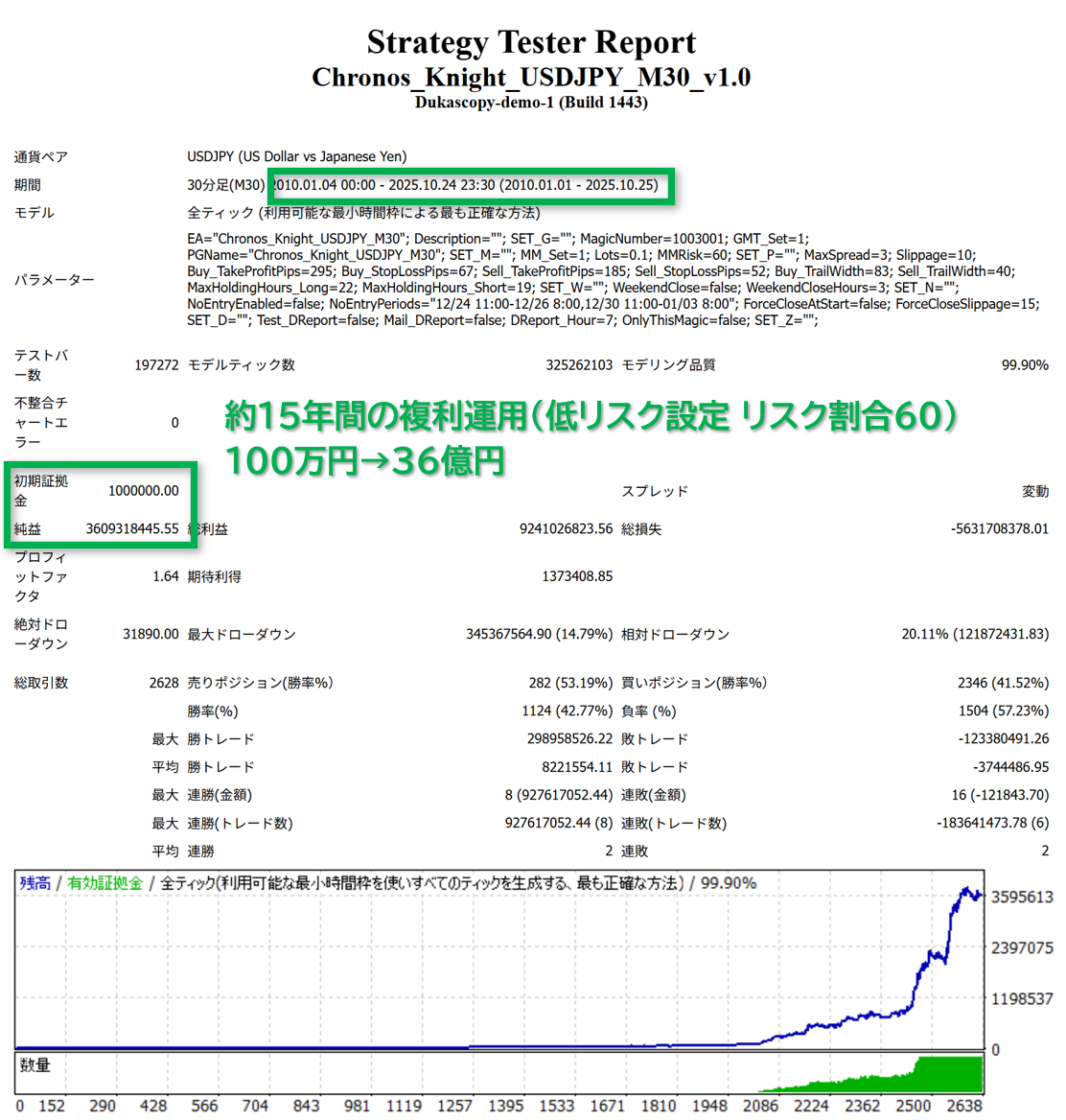

For example, the EA I plan to release includes such performance characteristics.

In backtests, 1,000,000 yen has grown to several tens of billions of yen over about 15 years.

In real trading, considering taxes that reduce the amount by about 20% each year, achieving those results seems unrealistic, but if you can select EAs that fit the market conditions, a certain amount of capital growth is possible.

■ Roadmap: Steps to aim for 10 years of operation from a small start

1. Decide the initial capital

For example, start from 500,000 yen. Of course, 100,000 yen is also fine, but when you consider VPS costs, spreads, taxes, etc., a reasonably comfortable amount provides peace of mind.

2. Select an EA with compounding capability

Compounding means “don't withdraw profits, but reinvest them into the principal for the next round of trading.” Choose EAs with compounding features or settings that reinvest profits monthly/yearly as part of the strategy.

3. Diversify the portfolio

If you’re selecting five, diversify across five different profiles: a trend-following EA, a breakout EA, a grid-type EA, a multi-currency EA, and a low-drawdown EA. Even if not all grow explosively, the idea is that at least one will perform significantly well.

4. Understand operating costs and taxes

Costs include VPS, account fees/spreads, swaps, and server downtime risks. Taxes also need to be considered. Ignoring these can halve the compounding effect.

5. Think long term, in years to decade

Compounding is time’s greatest ally. By operating over 5 or 10 years, even with modest yearly growth, exponential growth can be expected. Conversely, aiming for a 10x gain in a short period is high risk and often impractical.

6. Regular reviews and maintenance

Don’t leave EAs unattended; regularly check capital changes. If market conditions change, an EA’s performance can change too. If drawdowns linger, consider adjusting lot sizes or stopping operation; ongoing monitoring and maintenance may be needed.

7. Use index investing in parallel

Rather than betting everything on a single EA, combine with index investing for stability. A hybrid strategy—putting eggs in another basket of index investments to steadily grow funds while aiming for higher returns with EAs—is realistic.

■ Summary

Even with a small amount of capital, with proper EA selection and a compounding strategy, it is quite realistic to target substantial capital growth over a 10-year span.

However, if the investment grows, you must also have the nerve to leave that capital in the market. The longer the horizon, the more you may feel the urge to withdraw funds; this is something to consider in advance.

That tension can be a fun challenge in itself, so perhaps it’s best to view it as part of the enjoyment.

See you again!

× ![]()