An article to read after losing with contrarian moves and reflecting on it

I received your email. Thank you very much.

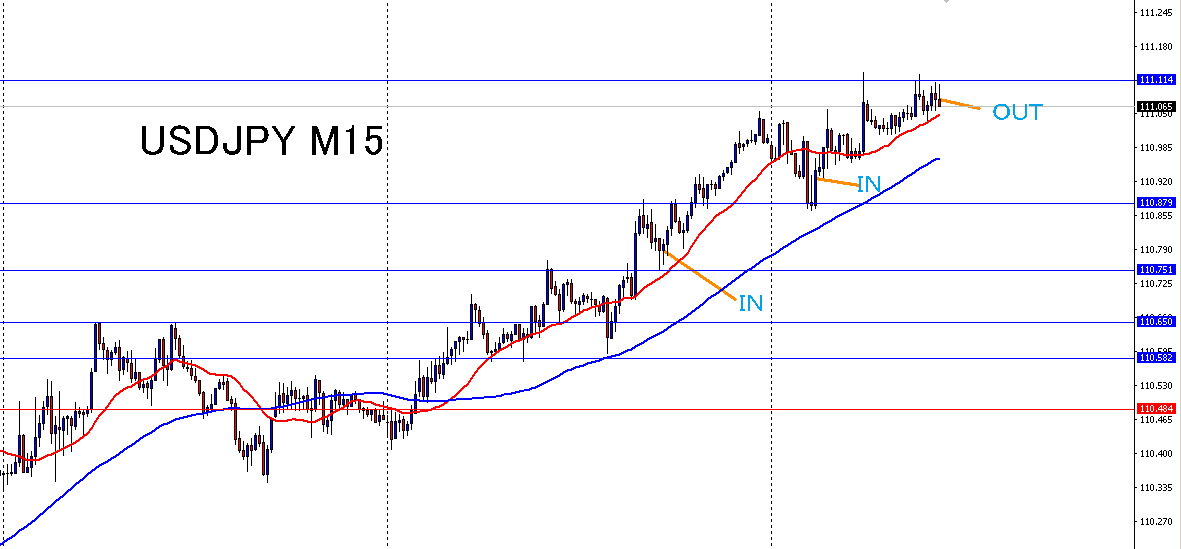

Looking at the attached image, it seems that entry was made at almost the same spot as where I entered yesterday. Wonderful!

I took profits and entered again, but this person kept holding onwith about 400,000 yen in unrealized gainsat that point.

The scenario also mentions profit targets, but no one can know whether the move will extend that far.

It's good to protect unrealized gains and stay disciplined until the end.

As this person writes,

when you enter in line with the trend and start winning, watching others lose by going against the trend will look strange to you.

Why would someone deliberately go against the flow to aim for a reversal, doing something difficult and keep losing?

But when you are losing like that, you don't notice at all.

That happens, doesn't it?

When you understand it, you wonder why you couldn't understand such a simple thing until now.

I will link to some past blog posts, so if you’re tired of contrarian trading, please refer to them.

The big difference between professionals and general investors

Psychology of contrarian traders, gambler’s fallacy, the law of small numbers

I buy because it's expensive ~

People who suffer big losses or exit are all hurt by contrarian trading, right?

Then you should not do it.

FX Trader with 600 million yen assets

What successful people have in common: Trend-oriented

What losing people have in common: Contrarian-oriented

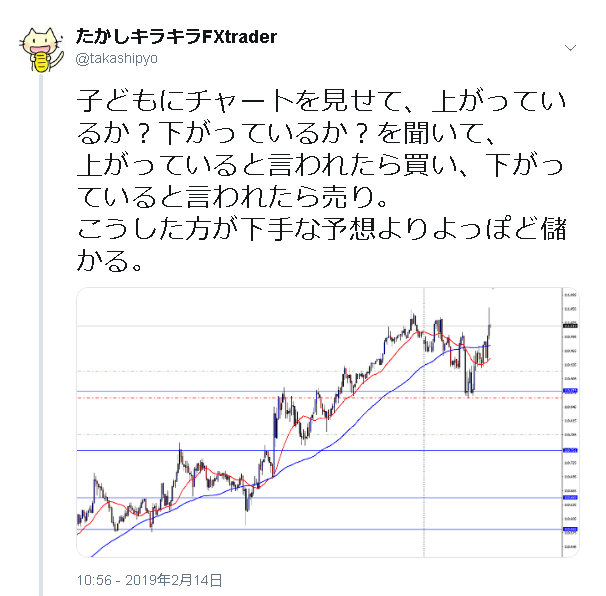

Earlier, I took profits on USD/JPY. Since it's moving up, just lift the bid as it ascends.

Past article link collection ↓

https://www.gogojungle.co.jp/finance/navi/699/11076