Pursuing "not breaking down." The final solution reached by EA developers

? Nanpin EA and the Dilemma of “Explosive Profits” vs. “Bankruptcy”

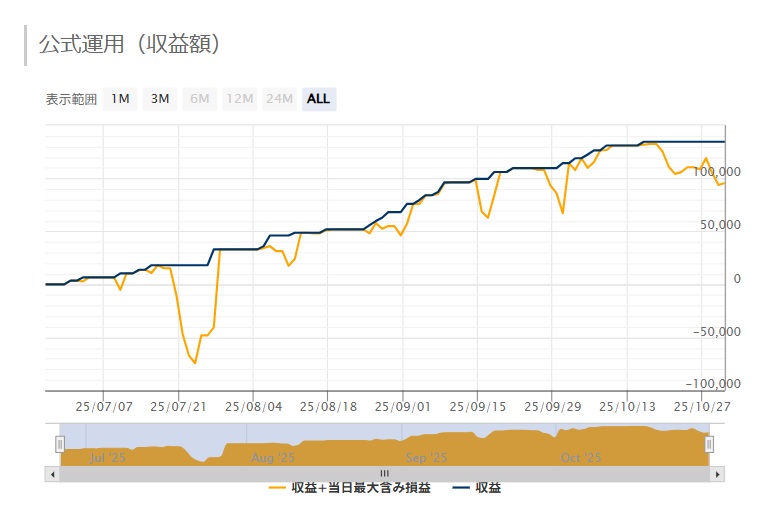

In the world of FX automated trading (EA), the “martingale-type” Nanpin offers explosive profits that attract traders, while many are troubled by its high risk of ruin. I, too, have confronted this dilemma while developing and operating numerous EAs (nanpin-martingale type, short-position type, swing trading type, etc.).

And after a long development, I arrived at the conclusion: A Nanpin without Martingale.

? Fundamental problems of traditional NanpinEAs

General NanpinEAs simply determine Nanpin by the price range (distance) at which the first position moves a certain number of pips in the opposite direction. This is a mechanical Nanpin that disregards market conditions and lacks justification.

In contrast, a skilled discretionary trader analyzes the chart in detail and makes Nanpin (or split-entry) decisions based on judgments such as “this is a trend reversal point” or “there is a basis for a bounce here.”In other words, Nanpin requires “basis.”

✨ 【Core of the EA】 Eliminating risk with “basis-based Nanpin”

This EA I developed has codified the thinking of a discretionary trader.

The Nanpin in thisEA does not rely on price ranges.

Using powerful indicators that show market volatility and direction, such as Bollinger Bands, as the basis, it adds positions only when it judges that “Nanpin here would have an advantageous edge.” This yields a level of stable operation backed by logic that is far beyond conventionalEAs.EAs.

?️ Design philosophy underpinning stability

- Rigorous risk management: Nanpin is limited to a maximum of 6 positions. Martingale doubling is not used.

- Stability under full operation: Recently, many freeEAs have failed, but thisEA has over 10 years of backtesting history and is designed to withstand full 24/7 operation throughout the year.

- Optimization for currency pairs and timeframes: Tuned meticulously for the EURUSD environment, the world’s most liquid pair where technical analysis works well, with a 5-minute cadence.

- Balance of offense and defense: Proper stop-losses are applied to lock in profits without letting drawdowns grow.

- Independent parameters: Long and short positions are independently parameterized and adapt flexibly to market conditions.

? Conclusion: Prioritize “steady profits” over explosive gains

ThisEA cannot promise massive one-shot profits. However, it is designed with the primary goal of consistently generating returns over time.

If you think, “General Nanpin EA is scary” or “I want an EA I can trust more,” this implementation of the “basis-based Nanpin” is the ultimate answer.

The EA above is here.

Creating a portfolio with these EAs will yield more stable profits.