Return rate over 65% — The strength of the "last three furlongs" is its high win rate!

Forward has exceeded one year, risk-reward ratio7.97, profit factor13.5

A highly stableEA “Last 3 Furlongs”

■Overview of Last 3 Furlongs

Currency pair:[USD/JPY]

Trading style:[Scalping]

Maximum number of positions:1 (Holding multiple positions is not necessary, making risk management easier)

Trading type:1lot trading

Maximum lots:1(This is the broker’s upper limit, but the EA has no restrictions)

Timeframe:M5

Max stop loss:90 (the maximum loss has an upper limit, which provides peace of mind)

Take profit:10 (If you use trailing stop, profits can be unlimited)

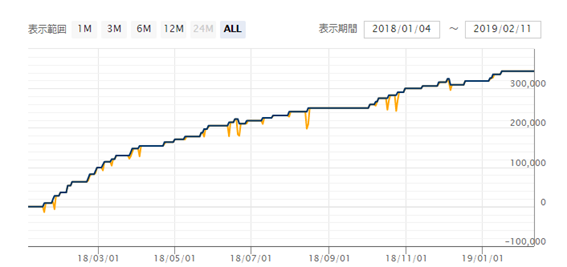

Forward operation exceeds one year,1lot trading yields a profit of¥340,000, and the return is65%

Win rate is also95%, and the profit factor (total profit ÷ total loss) is13, making it an excellentEA.

Although the number of trades is small and some may find it unsatisfying, the high win rate suggests it is a solid EA.

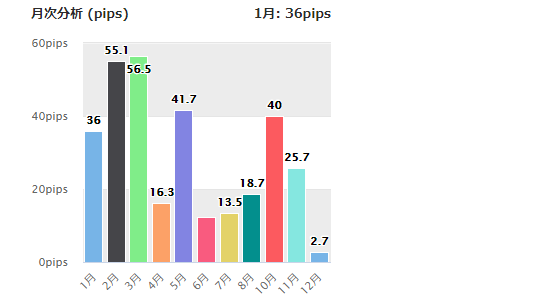

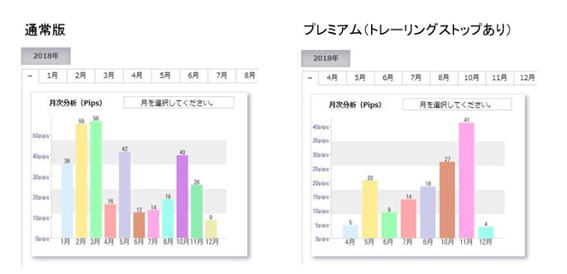

Last 3 Furlongs2018 monthly gains, and2019 January gains in Pips.2018 year had no months with large losses.2019 year started well, and the ability to secure stable profits may be the strength of “Last 3 Furlongs.”

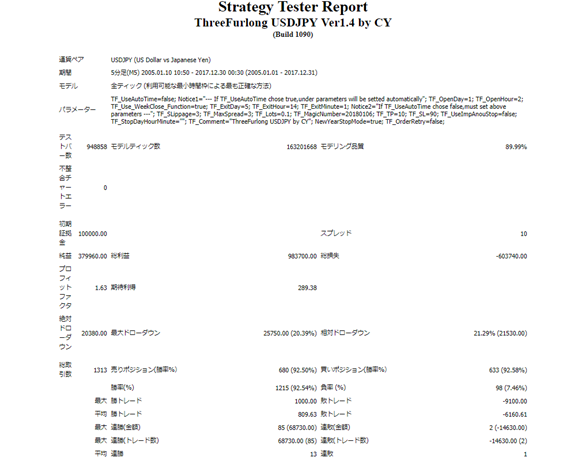

■Backtest

2005.01.10-2017.12.30

0.1lot fixed

Spread1.0

Net profit+37.9万円(annual average3.1万円)

Maximum drawdown2.6万円

Total trades1313回(annual average109回)

Win rate92%

PF 1.63

Thus.

0.1Margin required per 0.1 lot is

(4.5)+(2.6*2)=9.7万円

Approximately10万円, margin per 0.1 lot is0.1lot operation is possible.

Average annual profit is3.1万円, so the expected annual return is around +30%.

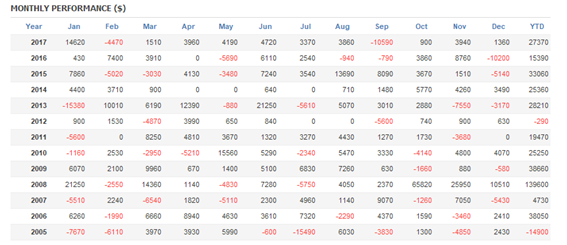

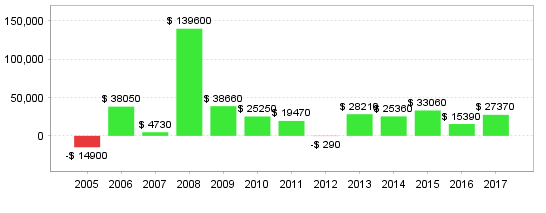

●Monthly and yearly profit/loss

Looking at monthly data,2014 had three months with no entries, so the trading frequency is low. There are months with substantial profits a few times per year.

Looking at the yearly totals,2008 stands out, indicating that in years with strong trends, trading activity increases and profits grow.

In the most recent5 years, the average gain is around2.5万円, so annually about200~300pips seem consistently achievable.2018 forward performance shows +320pips gained, indicating market conditions matched the Last 3 Furlongs better than in typical years.

■Differences from the Premium Version of Last 3 Furlongs

There is a premium version of Last 3 Furlongs with trailing features and compounding features.

Comparing Forward, trailing stops can extend profits in some cases, while fixed TP can yield less profit in others, so it’s hard to say which is definitively better.

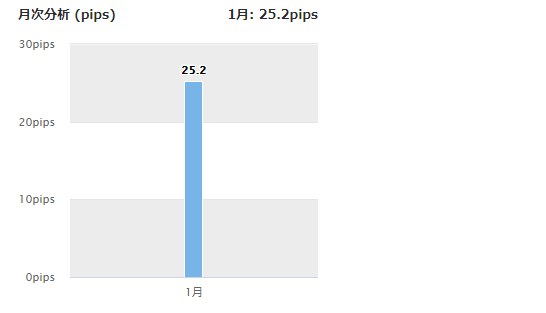

When comparing the earned Pips, the differences look like this.

However, if you’re considering long-term operation, substantial differences in profit amounts are expected within 2–3 years.

This is because the win rate is high and the profit factor is high.

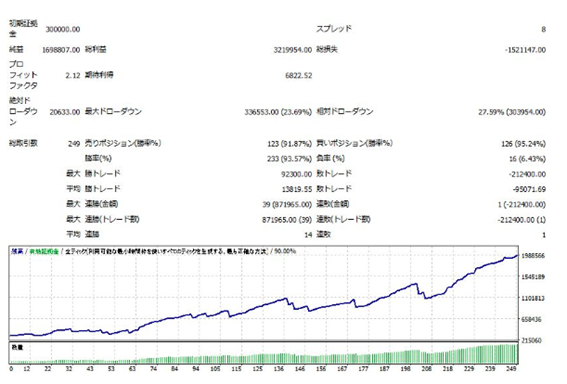

Three-year compounded backtest results are here

From ¥300,000 to ¥2,000,000! Net profit is +¥1,690,000, a rise of over 500%. With the default compounding settings, relative drawdown remains under 30%, so risk is not a concern.

■ Summary

As noted in product reviews, the average monthly trades are 3–4, and there are months with no entries, so those who want daily results may feel uneasy.

Understand each EA’s characteristics, accept that “Last 3 Furlongs” has a good win rate and PF but fewer trades, and operate on a half-year to yearly basis. It also often trades in the same direction as the popular “One-Win.” Although “One-Win” yields higher profits, “Last 3 Furlongs” has a higher win rate. Both are excellent EAs, but since “Last 3 Furlongs” is cheaper, if possible try using both. Because trade frequency is low, pairing with other EAs can be advantageous.