【Golden Turning Point】What happens if you trade using only the Gold RCI Signal...

Hello, this is Takafumi.

We will introduce how to approach trading signals for the currently on-sale 【Golden Turning Point】 Gold RCI Signal!

Even if we talk about how to trade, it boils down to: when a signal appears, check the risk-reward, and if it feels favorable, enter. That’s all there is to it.

We consider reproducing trades as trades that do not go against the expected value.

I frequently talk with full-time traders, and everyone is calm and composed.

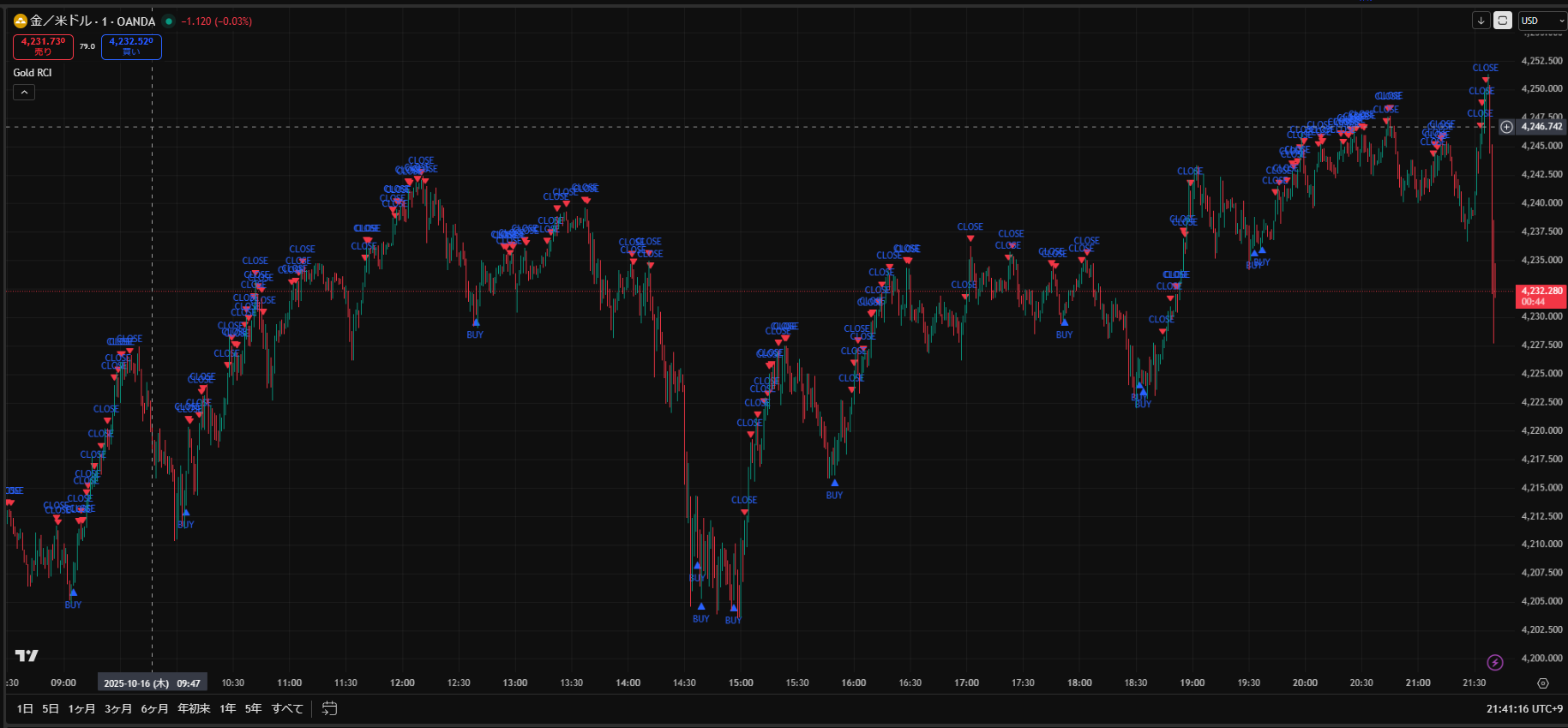

Now, this is gold’s 1-minute chart, and there is a signal to Long at a proper pullback!

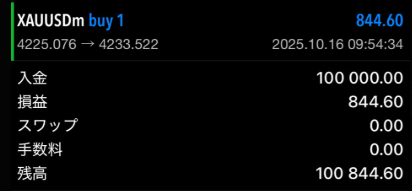

There are times you can’t trade, so I entered only once, but I have clearly profited.

Since I placed a limit order near the recent high, I was able to capture a 12-dollar range!

*The chart below shows the results of a demo trade; the entry was around 18:30 Japan time

October 16

Today's 1-minute signal is as shown below.

Recently, signals on the 5-minute chart have been scarce; there is little movement and it’s quiet.

In such times, it’s good to shorten the displayed time frame or, if that’s not favorable, simply take a break and rest.

This is my own belief, but I have never met a full-time trader who has been winning for years with just one strategy, so on such days it’s fine to embark on a journey to explore new strategies.

I hold multiple strategies for several assets, so I dedicate time to research and develop new strategies.

For how indicators signal, please refer to the YouTube video in the link below.

? Action Demonstration Video (YouTube)

This video is an actual live action demonstration, so you can see how the screen moves and what signals appear.

※This video is for demonstration purposes only and does not guarantee profits in actual trading. Please understand the risks and use at your own judgment in operation.

This indicatorintentionally only displays signals.

The reason isthat you should make the final entry and close decisions yourself.

Sustained success without personal growth is difficult, so in order to trade logically and calmly on a daily basis, please try combining your favorite lines or technical indicators as well.

I prefer the price-reaction “band,” so I don’t display technical indicators, only the signals.

That was a digression.

Finally

Although it overlaps with the product introduction article, typically I trade using a semi-discretionary approach with indicators across multiple assets such as cryptocurrency, USD/JPY, and gold.

Across all assets, the tools and thinking remain consistent, and entries are mainly long-focused.

The tools I use are mostly RCI and CCI, and I carefully select to avoid unnecessary entries depending on the asset.

Also, the reason for focusing on longs is that they tend to move logically more easily than shorts.

I have developed hundreds if not thousands of indicators, but with the same logic, it is almost never possible to profit from both long and short at the same time.

So rather than reducing profits by shorting unnecessarily, it’s better to focus on long entries. I am convinced that clearly separating what to do and what not to do is the key to thriving in trading for many years.