Brokerage Fraud Monitoring Function Included! "One-man Serious Trader" with 10 years of no losses

Industry first!? An EA with a monitoring feature to detect broker fraud

【Hitori Gachi Overview】

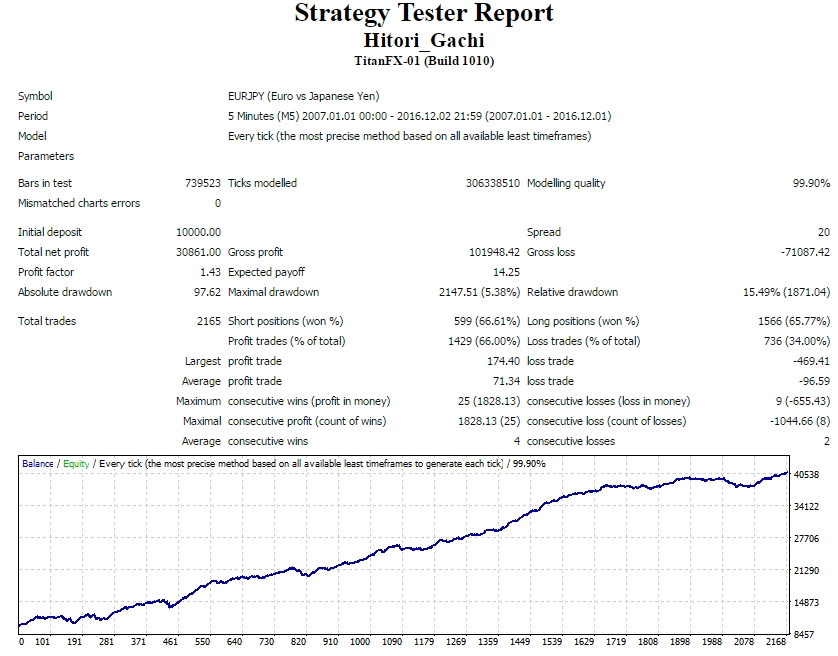

【Backtesting Data】

Backtesting covers a reliable 10 years from 2007 to 2016!

The maximum drawdown during backtesting was $2,147, but with a fixed 0.5 lot operation

this translates to a maximum drawdown of about 429 pips.

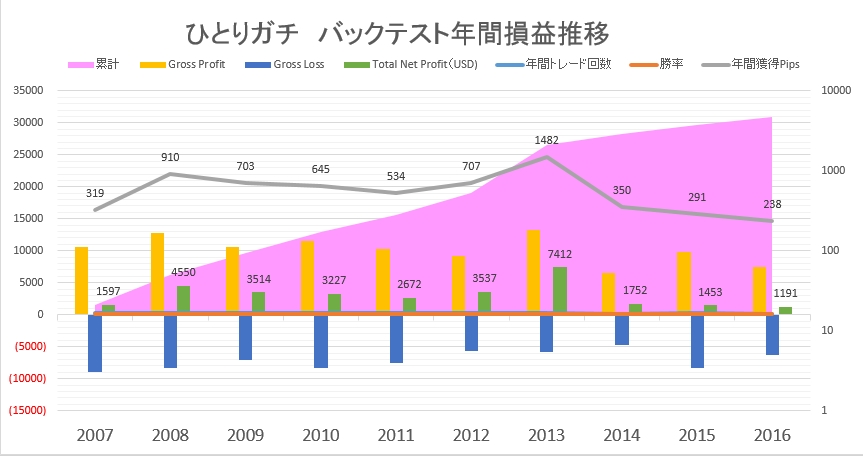

■ Backtesting boasts a stable record with no losing years over ten years

Results of backtest data aggregated year by year are shown here

(For 2016, data is up to 2016/12/2)

Win rate and annual pips vary, but above allthere has not been a year with a loss across the yearwhich is wonderful.

With a 1,000,000 yen account and 0.5 lot fixed operation,annual return of 12%–74%is achieved.

In 2007 and 2014–2016 profits are modest, but 2008 and 2013 show strong results.

Let’s look at the weekly chart from 2007 to 2016.

Euro/yen annual volatility is often around 20–30 yen, but in 2008 it swung more than 50 yen (over 5,000 pips).

However, even in suchrapid fluctuations in 2008, the strategy performed well, suggesting robustness to rapid market moves.

It has excellent stability as an EA, and another appeal of “Hitori Gachi” is…

It includes a broker fraud monitoring feature

.

■ What is the Broker Fraud Monitoring Feature?

“What would you do if you suspected a win but then you ended up with a loss due to timing?”

“What if the executed price differed from the order price you visually tracked?”

To understand these, you must monitor real account trading status with a program.

Why must it be a real account?

Because the order behavior differs between demo and real accounts.

The easiest point is whether orders go through at the targeted price during high volatility (liquidity).

In a real account, orders may slip and execute at a price different from the intended one, whereas with a demo account, orders usually fill at the targeted price.

That’s why you need to verify that orders actually go through on a real account and that there is no deliberate order rejection, to select the best broker.

The “Hitori Gachi” includes that capability, so you can quantify the best broker and VPS for EA operation!

The author, GodSpeed Tradings, reportedly spent four years developing this “Hitori Gachi.”

When thinking about how to earn steadily, they realized that beyond the trading logic, you need an environment and conditions that allow the EA to run safely.

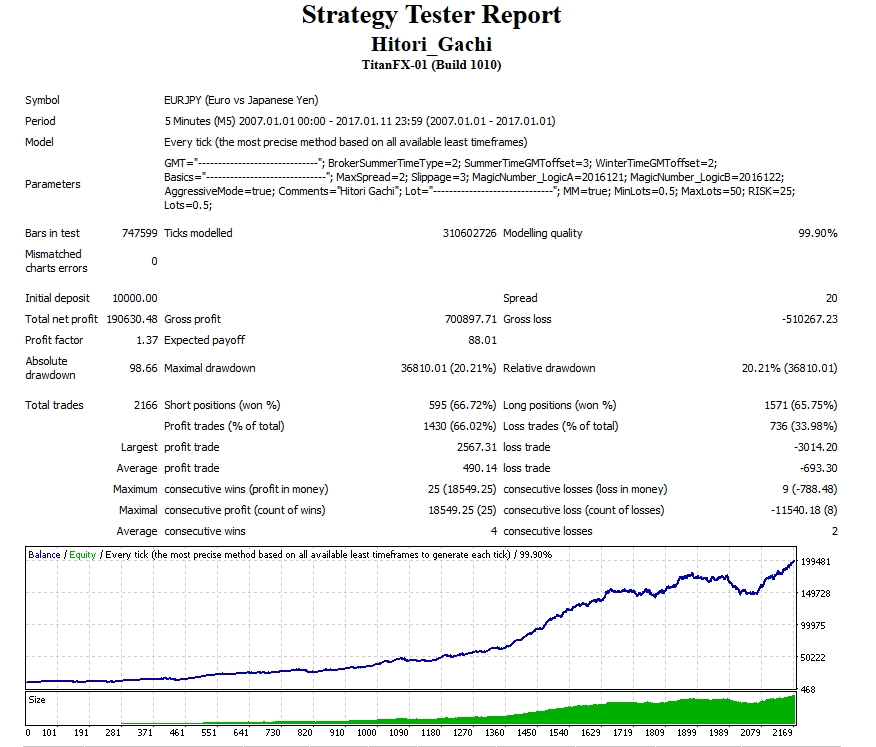

■ Happy with compound interest feature! The terrifying effect of compounding is…

“Hitori Gachi” also includes a popular compound interest feature.

You can set a RISK value as a parameter and use the MM (compound) feature.

Backtest results with a 10-year period and a RISK value of 25% show...

With a maximum drawdown of 20% risk, the increase over 10 years was 2000%.

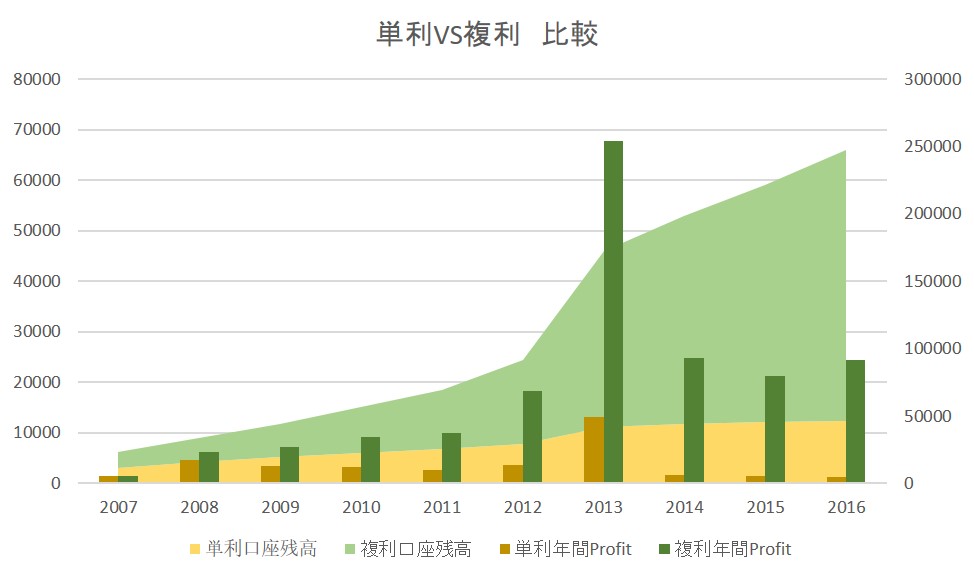

Here is a comparison of growth rates for simple interest vs. compound interest.

Truly a dream-like result!

In the first year profits aren’t much different, but as years pass, the accumulated profit diverges greatly.

An EA that “never has a negative year” hence, the effect of compounding is realized, and annual profits

continue to grow dramatically.

With stable performance, thorough manuals, broker fraud monitoring, and all three strengths, the price is only “10,000 yen” (for up to 50 copies)!

They say they set this price so people can try it and see its value.

50 copies are likely to sell out quickly, but there are plans for price increases in a sliding scale, so

as you watch forward results, consider it as a potential aid to your asset formation.

Industry first!? The ultimate EA with a system to measure broker fraud!!