Attention beginners!!! The mindset to become a winning trader

Good morning!

I am Motokeiri man, a former accountant, psychological counselor, and trader Takashi.

This time, for beginners who must-see!!!, please read it.

The mindset to become a winning traderstory.

Even if you obtain a book that contains all methods, you won’t be able to win without this mindset.

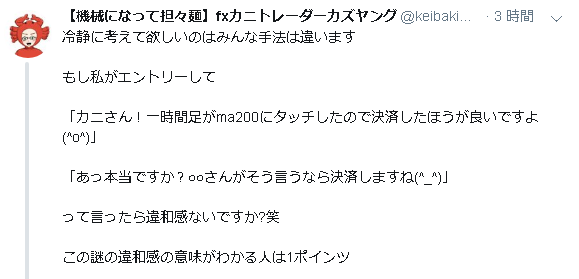

That famous crab posted something like this on Twitter.

Since they broadcast live trading, they might say, “You should settle” or something.

“Everyone uses different methods”

It’s strange for people with different methods to butt into others’ trades.

Trading is full of various methods and approaches, and there isn’t just one correct way, you know.

I think there are groups that gather to study trading, but that seldom works well.

It’s different from students gathering to study together.

In school, everyone studies with the same textbooks, and the answers are the same for everyone.

In that case, gathering to teach and learn among yourselves has meaning.

However, in trading, there isn’t a single correct answer, so you can’t teach each other in the same way.

Furthermore, if you only gather traders who can’t win in trading, no one will know how to win, making it very difficult to become profitable.

If you compare unsuccessful traders to golf, it’s like hitting the ball backward, which is a huge mistake.

Even if such people gather for a study session, it’s hard for golf to improve.

Even if someone notices the correct direction and says, “Maybe it’s better to hit the ball the other way,” the surrounding people would say, “No way, that’s not true lol,” and that would end it.

If you’re going to have a study group for trading, it only works if you have traders who can win with one particular method or approach.

I’ll return to the main thread since I went a bit off track.

Trading has many methods and approaches, so first, you must choose one.

“There is no growth without a foothold.

In flower arrangement, you’d have a classical school of ikebana, and an Ikebukuro class,

In swordsmanship, you’d have Shinkenryu Dojo, Ono-ha Itto-ryu instructors, and the like,

and learners are made to adopt one guiding principle from the start”

by Terutaro Hayashi

There are different schools, and none can be said to be the only correct one.

In trading, it might be easier to view it as a school of thought.

For example, if you study swordsmanship, learn a bit at a Shinkenryu Dojo, and the next day study Ono-ha Itto-ryu, you’d end up with a half-baked understanding and wouldn’t master any school of swordsmanship.

Study at a single dojo, and continue learning and internalizing only that school’s swordsmanship.

Trading is the same.

First, decide on one school of thought (one trading method) and study it.

Even if you decide on one trading method and start, many people will soon switch to another method.

Why?

Because you study one method but it doesn’t go well.

As you trade, you’ll also notice its flaws.

“Will this method really let me win?”

This is what happens.

It’s hard to do well, and flaws become evident.

You’ll think, “This method is not good,” and look for another method.

But what you seek may not exist in this world.

There is no method that works instantly or is flawless.

Even the methods used by winning traders have flaws, and you cannot expect to win immediately just by being taught.

“All methods and schools have their strengths and values, but they also come with drawbacks.

Do not try to fix the drawbacks; accept them.

In other words, to improve, you should intensely study and master one method or school.”

by Terutaro Hayashi

Strengths and weaknesses are two sides of the same coin.

Long = “to be excellent”

A particularly strong point is a “characteristic.”

“Conversely, it comes with weaknesses.”

Since they are tied, the strength cannot exist without the weakness.

There are cases where a flaw brings out a strength.

If you erase the flaw, the strength may disappear as well.

Human personality shows similar patterns.

Some say, “I am timid, that is my flaw.”

Some want to fix or erase their flaws.

However, timidness as a flaw also carries the virtue of being cautious.

If you remove the timid nature, you may also remove the strength of caution.

There is no such thing as a perfect person without flaws.

If you accept your flaws and what you can’t easily change, your worries may lessen.

Because of these flaws, there may be corresponding strengths.By turning your attention to strengths, you can more easily accept your flaws.

Psychologist Alfred Adler faced a complex about being short in height.

However, when Adler did counseling, he could point out a strength: “Being shorter makes it harder to intimidate the other person, which can be a good thing.” He could focus on strengths and accept it, becoming more comfortable.

Being short was a strength for his work.

Strengths and weaknesses are two sides of the same coin.

This may be one of the truths of this world.

There is no excellent trading method without flaws.

No method can be mastered to the point of instant victory.

Even if a method has flaws, you should not hop to another method, and keep at it.

Beyond that, there is the goal of mastering a profitable method.

“If things don’t go well immediately, or this flaw exists, this method is bad,”

you might think your current path is wrong and switch to another, but the same holds true wherever you go.

There is no easy, flat path to quick profit.

The goal lies beyond a challenging path that doesn’t go well right away.

Many losing traders fail to stay on one path, so they don’t reach the goal.

Summary of this time

There is no single correct method for trading.

There are many methods; think of them as roughly teaching separate subjects.

First, narrow it down to one school (one method or approach).

Every method has flaws; nothing you can learn instantly.

Even if you don’t succeed immediately, keep going. There is a goal beyond.

“Even if you lean, you must, above all, possess a practical philosophy; that is what a market trader is.”

To improve, you should intensely study and master one method or school.

Mastering a narrow school of thought means you have progressed in buying and selling.

The issue is the breadth, not the height of your skill”

by Terutaro Hayashi

From Wikipedia

Terutaro Hayashi (Hayashi Terutaro, October 17, 1926 – February 28, 2012) was a Japanese market expert.

He rose to prominence in commodity futures trading and contributed to general investor education.

He was knowledgeable about market techniques centered on the Sakata Kaisenhō (Sakata method), and his books are used in seminars by securities firms.

Past articles link collection↓

https://www.gogojungle.co.jp/finance/navi/699/11076