[Sea of Clouds UNKAI MT5 Version) Displayed signs all day. Can everyone trade it successfully?

10月中は下記の関連ツールも特別価格でご利用いただけます。

• 【Between the Sky 】

Both are designed to reduce trading hesitation as their core purpose.

I think it’s an optimal time for those who want to set up a complete environment, such as the KOMYO MT4 indicator.

Please, at this opportunityuse as a tool to reinforce your own rules.

We would be glad if you make use of it.

This video captures one full day of Unkai signals.

When you actually run it,

you can see the rhythm and momentum of the market.

Even for those who are not Sky Between users,

there are many who continue to use the MT4 version, but

combining Unkai’s logic with price action and triggers for breaking highs/lows is also effective.

It can function as momentum and entry support,

and visually helps you curb cases where you counter-trend even when signals are abundant.

We have public trade examples, but

it’s better to create your own SL/TP rules after installation.

That’s the first step to making the indicator your weapon.

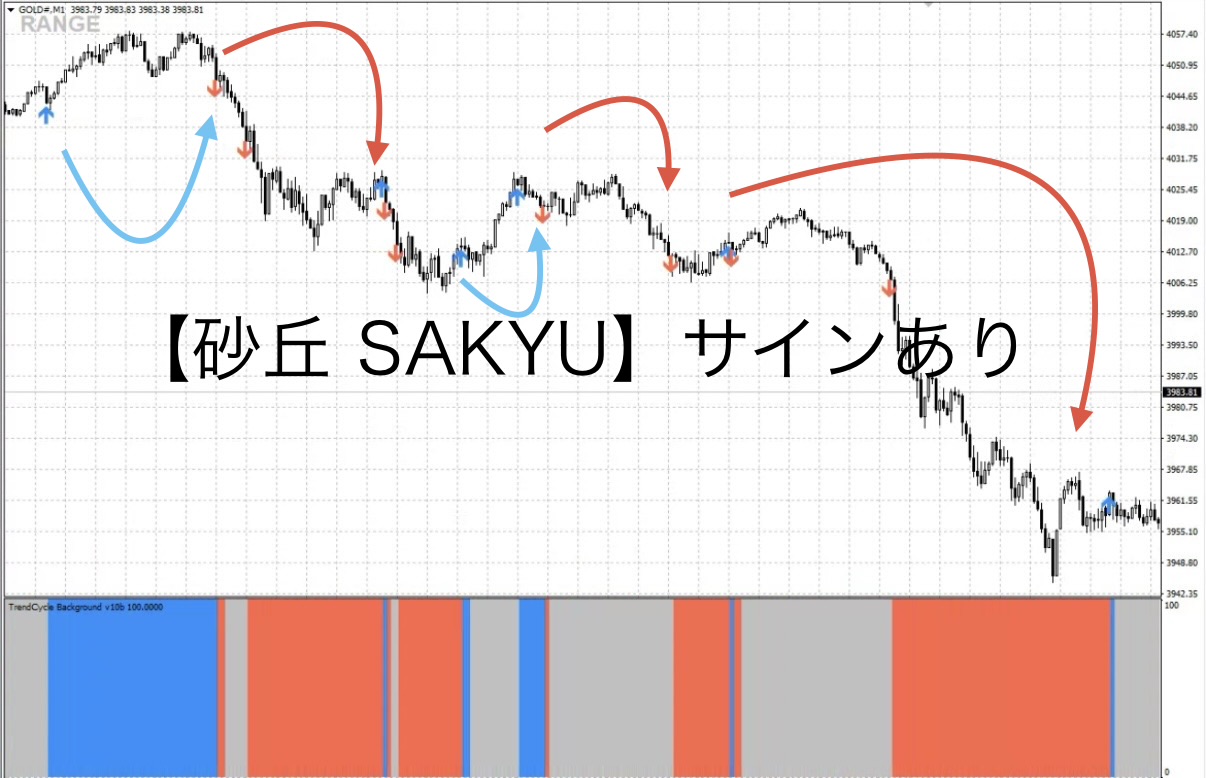

【SAKU Sand Dune】A lunch money worths a moment of realization. An indicator that “sees trends in color” born behind Unkai.

If you want to use a signal-reading Unkai entry EA, please

purchase either “Unkai” or “KOMYO” and use within

This EA is published without charging, buta notification will be sent when passwords are confirmed showing “who downloaded it.”

Therefore, we would appreciate if those who agree to the usage terms

could use it after entering the password.

Also,a manual has been created.

You can view it in the community’s manual thread.

Optimize operation to match market through level adjustment

In ranging markets,trades according to Unkai signals and settlements are not strongly recommended.

Only in markets where a trend is occurring do Unkai signals strongly perform.

However, in a completely ranging phase,by combining “Unkai entry” with “KOMYO level 1–3 settlements,”

you can trade repeatedly with even small price moves.

On the other hand, in clearly trending scenarios,

Unkai acts as a supportive sign for pullbacks,

and by operating KOMYO at levels 4–5, you can target settlements when profits are substantial.

⸻

“Unkai Entry EA” that automates trend decisions

The Unkai Entry EA features trend determination via ADX values.

This allows automated differentiation between range and trend and makes entries more precise,

reducing unnecessary entries in non-trending situations and letting the EA ride the wave only when momentum appears.

Additionally, KOMYO’s signal has a level adjustment function from 1 to 5,

• When range/momentum is weak →Levels 1–3

• When a clear trend appears →Levels 4–5

This enables flexible operation aligned with market conditions.

⸻

◆ Notes on settlements

For settlements, you can refer to trade examples, or decide settlement rules after entering when you are in profit.

If you leave it to do the work in the background, there are times when you can capture hundreds of pips in a strong trend.

However,so we recommend having clear take-profit and stop-loss criteria.

Finally

If you have requests like “please verify with this rule,” please let us know in the comments or messages.

By taking up verification topics, it could lead to future updates and improvements.

In particular, during the first half of Tokyo time or NY time, where momentum tends to appear, Unkai signals can be especially pronounced. The chart images published in Investment Navi may be helpful, so please take a look as well

On GOLD 1-minute charts, there are cases where the market extends even more than the situation where the article in Investment Navi felt “the opposite sign is about to appear,” and if you had entered as indicated by the signs, you could have profits large enough to cause anxiety.

Still, what I want to emphasize is thatUnkai is ultimately a tool that reflects the market’s “flow” as an auxiliary”So do not rely solely on signs; combine with your own rules as an indicator to confirm momentum. Do not become complacent; used as an auxiliary tool, it can be powerful.

In doing so, you can visually confirm momentum direction and add further confidence to trading.

(Note) We do not necessarily promote using it together with Sky Between, but after trading, you can reflect and decide, for example:

“Was it good to target the Sky Between zone?”

“There are many signs, so let’s be aware of the Sky Zone.”

“There are few signs, so I’ll settle in floating or air zones.”

This makes decisions easier.

Color-coding zones helps reduce cognitive load, which is a great advantage

For example

• If used with a trend-following rulethe blue arrows (up momentum) and red arrows (down momentum) from Unkai assist in confirming direction, helping avoid unnecessary counter-trend trades.Also helps to avoid unnecessary counter-trades.

• Rules using zones or linesWhen combined, you can simply judge “Is this a good moment to enter?” by confirming momentum with arrows after zone contact.This makes it straightforward to decide when to enter.

• A logic that emphasizes small losses and big gainsbenefits from entering in moments where arrows continue,so you can “ride only when the price is moving”.

Unkai is not just for entering and exiting exactly as signs indicate without discretion.

Rather, relying solely on signs increases the risk of “high price buying and low price buying.”

Unkai’s role is to visually reflect the market flow.

• When more blue arrows appear above, it indicates “the power of rising is strengthening.”

• When more red arrows appear below, it indicates “the power of falling is strengthening.”

Design is to let you intuitively grasp the direction of momentum.

It’s a tool for you to confirm the flow.Please take a look at the short video showing how these signs appear.

⸻

■ How the signs work

•

• Blue arrow (up arrow):Displayed when the momentum just before is upward

• Red arrow (down arrow)Displayed when the momentum just before is downward

If the bar with a blue arrow is a bullish candle, you captured price movement.

If the bar with a red arrow is a bearish candle, you visualize profit-taking in the downward direction.

• No repaint

Once a sign appears, it does not disappear. It remains even if price moves against you, making it easy to reflect and verify.

• Notification features

EA performing breakout strategies

Entry EA manual included

“Sky Between” entrusts entries to an automatic entry EA, and traders focus on monitoring after entry and executing settlements—simple strategy.

The EA constantly monitors the chart and can enter at the breakout moment accurately.

This eliminates the stress of sticking to the screen before entry and the anxiety of missing timing.

ADX, ATR, SMA, etc., are included as filters.

As a buyer perk, you will be able to use this EA.

Dyeing the white cloud—beam of light

For those who already have solid rules—UNKAII will strengthen your method.

Why publish negative results?

Investment Navi+ intentionally publishes negative results as well without hiding them.

The reason is that “trading cannot always win.”

Rather, by recording losses, you can analyze the conditions under which you lose and fortify the logic.

Instead of fixating on each win or loss,

Over a week or a month, as long as the total balance is positive, that is what matters..

• “I’m glad I won today”

• “I’m anxious because I lost today”

To eliminate these emotional waves, let the EA handle entries, and have humans focus on settling according to rules.

Not “I want to win,” but “I want to earn” —this mindset is the foundation for long-term profit.

Stability gained by adhering to the rules

•

•

⸻

There are numerous techniques in technical analysis—moving averages, RSI, MACD, Stochastics, Parabolic SAR, ADX, ATR, CCI, trendlines and channels, Fibonacci retracements and expansions, Ichimoku, volume, support/resistance lines, and many more.

There is no single correct method; what matters is to decide your own rule that you can test and refine.

⸻

We will validate a “maximum profit-taking” rule with Sky Between, which may include scenarios where station-keeping results occur, but by sticking to the rule you can calmly seize the next opportunity.

Even in situations where you could have earned more, by following the rules and closing at the break-even price, the overall total remains positive—this is the strength of this strategy.

What’s important in trading is not “win rate” but “reproducibility.”

Many traders chase “win rate,” but

What matters is having a rule that remains reproducible no matter who executes it.

Sky Between is designed to

•EA entry → mechanical stop → rule-based take profit

⸻

Strategy aimed at overall profitability

Focusing on daily wins and losses is risky.

If you’re interested in Sky Between, you’re invited to join the online community

Within the online community, while specific trading logic cannot be explained, you can participate in the “chart critique community” using Sky Between.

To those interested in Sky Between

Build a foundation to decide rules confidently in short-term trading—this is the core philosophy of Sky Between.

Free materials here:

▶︎ Download “Trail to the Narrow Gap”

In “Trail to the Narrow Gap,” we explain in more accessible terms when and how trades can be made,

the criteria for judgment is clarified more clearly.

The sales page for “Sky Between” may not fully convey,

the specific entry points and zone selections,

with diagrams and case-by-case explanations for clarity.

The setup is easy to replicate even for first-time readers, so if you’re interested, please check it out as well.

If you’re interested, please first receive the free material “Trail to the Narrow Gap.”

From there, your path within the Narrow Gap begins.

“Should I enter this chart?”

When in doubt,shift your thinking from “feeling” to “judging by rules.”