Analyze the real forward 5-year+ performance trends of CSMV_GBPCAD and CSMV_EURCAD

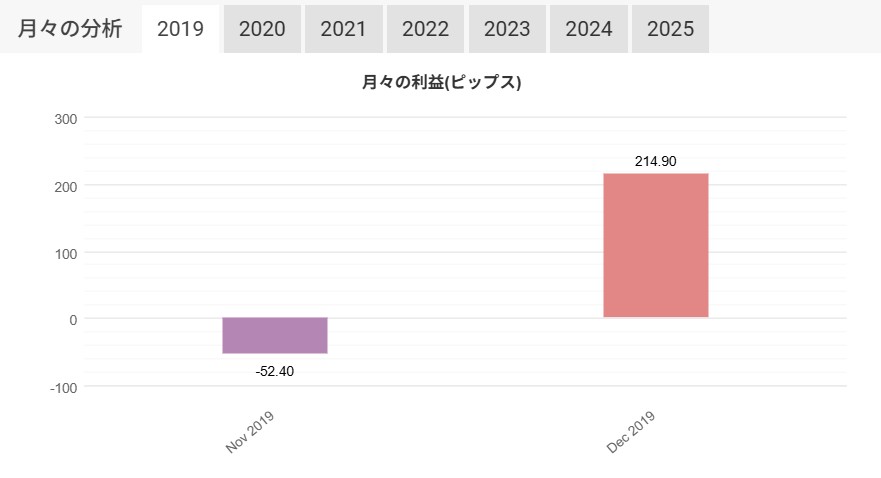

The original Loss-Larger Profit-More Morning Scalping EA, ChallengeScalMorning V GBPCAD (CSMV GBPCAD) and ChallengeScalMorning V EURCAD (CSMV EURCAD) are about to enter their sixth year of forward testing on real accounts.

After several updates, now at “ver5.0.”

Backtest results have improved, and we’d like to push further, but here I’d like to review the performance trends of the two EAs individually and also the performance when they were running simultaneously.

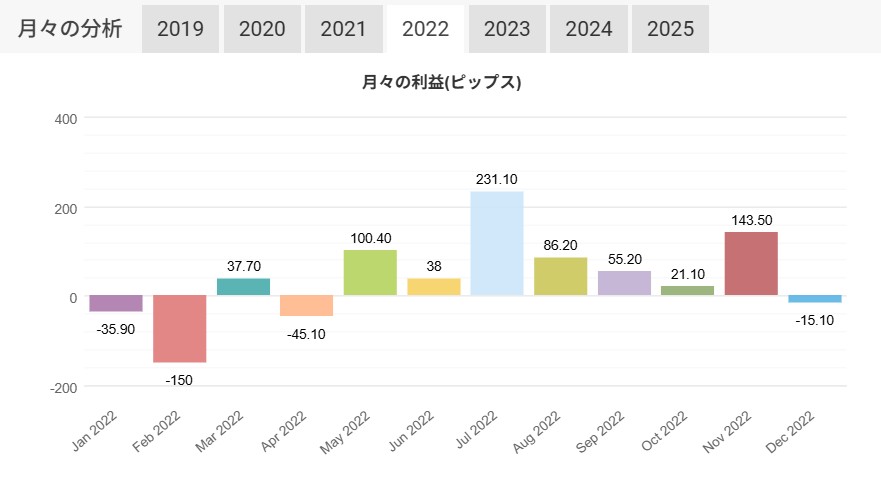

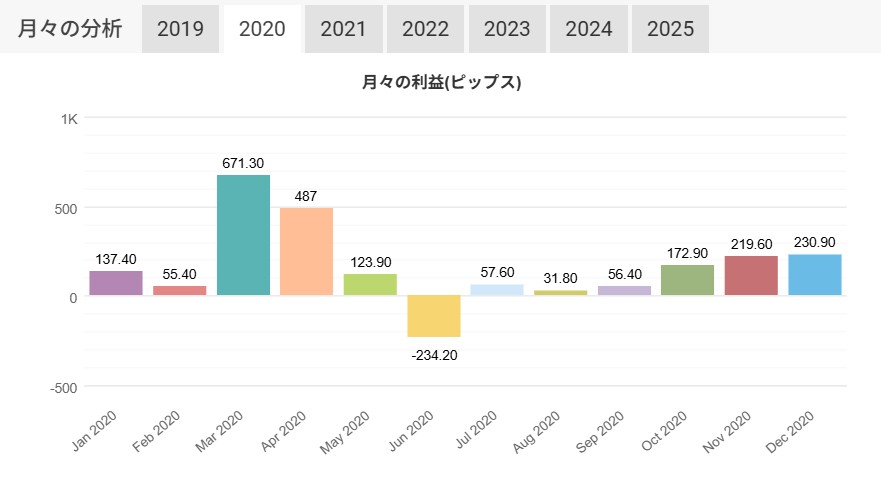

ChallengeScalMorning V GBPCAD

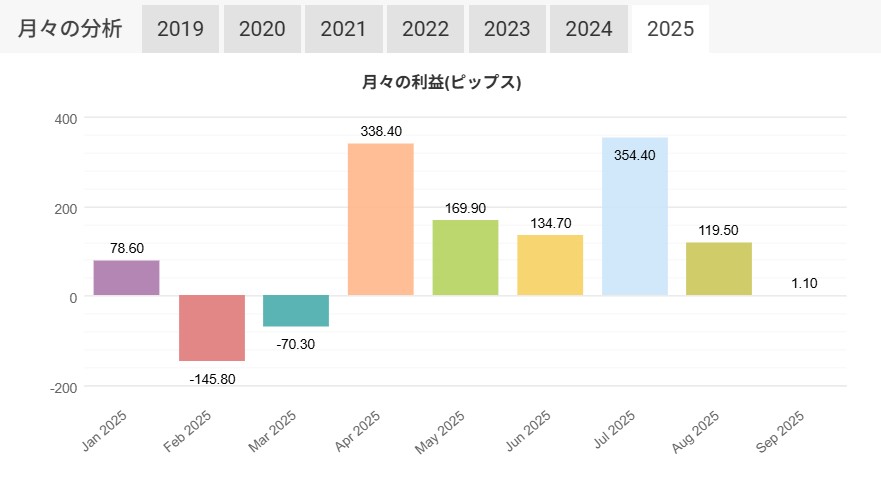

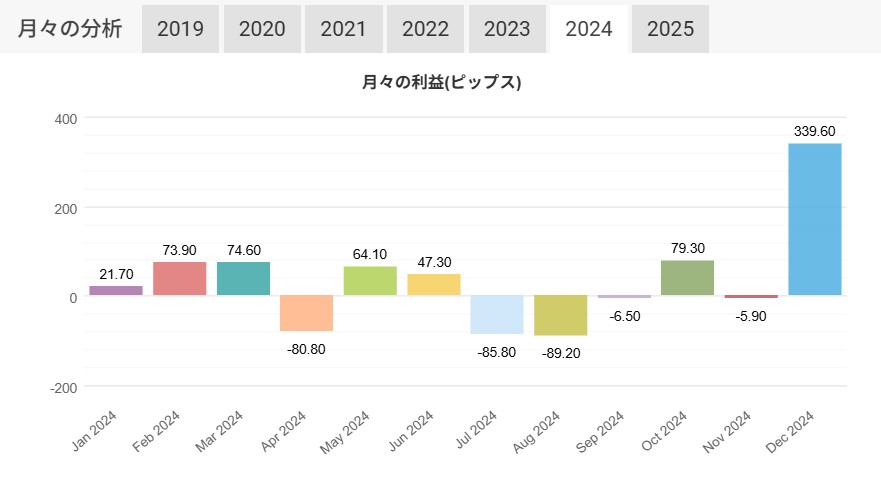

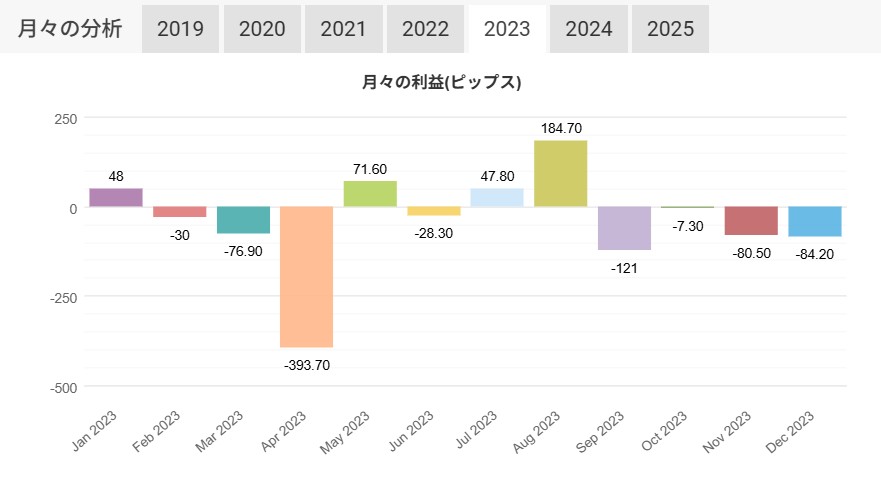

This is the profit/loss chart from the public RealTrade. From the end of 2019 to the end of 2022, the performance was miraculously strong, but the following two years stagnated, and it has finally been recovering, with the possibility of new peak profits appearing.

This is Myfxbook. The Japanese translation is slightly off, but “Average Win” = 14.22 pips, “Average Loss” = -10.76 pips, which shows the CSFV’s selling point of “Loss-Less, Profit-Large.”

Shorts have a slightly higher win rate at 64%, longs 52%, overall 55.7%.

Total acquired pips are about 3000 pips, with a PF (Profit Factor) of 1.42. Although GBPCAD has a large spread and nearly 1000 trades, I think the performance is quite good.

Average trade duration is about 7 hours, but this is because an earlier version held positions across weeks; currently there is no cross-week holding by default, with a maximum of 4 hours 50 minutes (CSMV EURCAD as well).

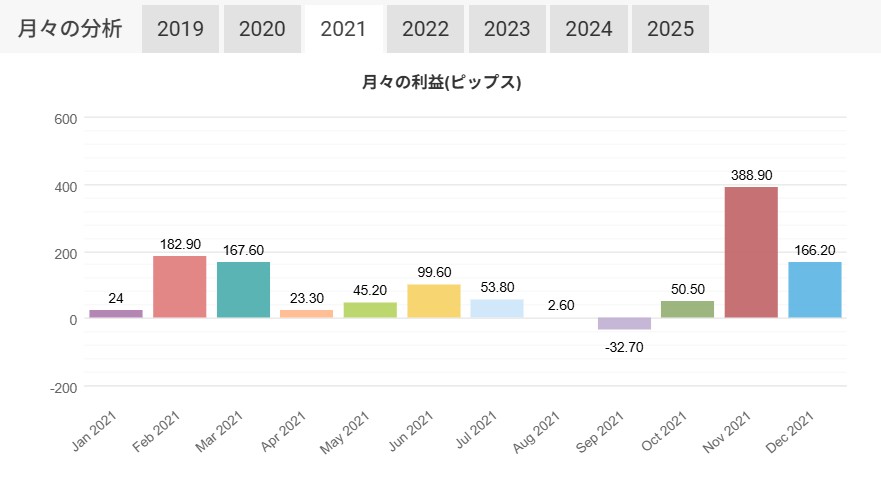

ChallengeScalMorning V EURCAD

CSMV EURCAD also shows “Average Win” = 12.48 pips and “Average Loss” = -9.76 pips, clearly a Loss-Less, Profit-Large profile.

Win rate: longs 54%, shorts 52%, overall 53.5%.

Total acquired pips is 1744.1 pips, which is considerably lower than CSMV GBPCAD, and PF is 1.18, showing somewhat modest results.

However, this year it has shown a strong recovery from long drawdowns even more pronounced than CSMV GBPCAD.

The improvement in backtest metrics for ver5.0 is much greater for CSMV EURCAD, so there is strong potential for future performance improvements.

CSMV GBPCAD + CSMV EURCAD

So what happens if you run these two EAs together?

The results are shown below. 2023 was negative, but in all other years it was positive, totaling 4754.5 pips gained, with a PF of 1.31.

Since the start of this year, monthly gains have been five consecutive wins since April, with total pips of 980.5.

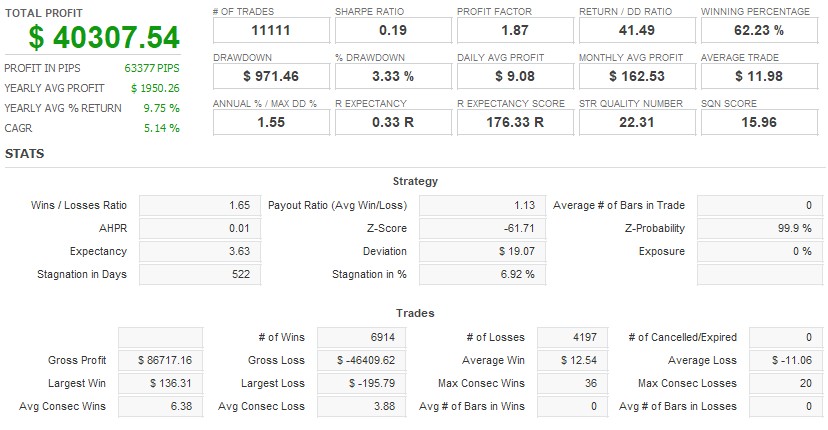

This is the ver5.0 backtest for CSMV GBPCAD and CSMV EURCAD read into QuantAnalyzer and synthesized.

PF 1.87, RF 41.49, indicating quite good performance. In the past about three years, losing months have been few, and performance has been especially strong.

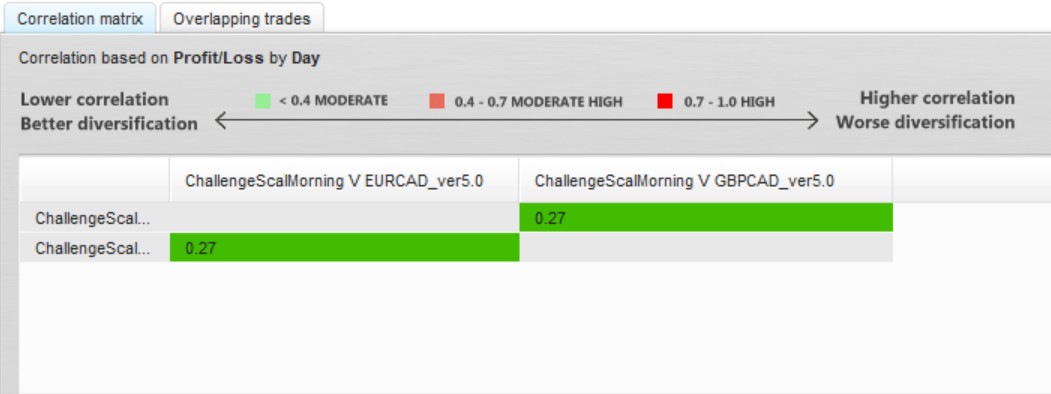

Here is the correlation between the two EAs. They are operated on currency pairs that include the same “CAD,” yet the correlation is surprisingly low.

I hope this low correlation translates into good results when both EAs run simultaneously, and even after 10 years I’d like to maintain results at least as good as now.

So, that concludes the forward real testing and backtesting verification for CSMV GBPCAD and CSMV EURCAD.

⇒Click here for the ChallengeScalMorning V GBPCAD product page

⇒Click here for the ChallengeScalMorning V EURCAD product page