Flat until October confirmed; technically it’s not functioning, intra-session handling is extremely important

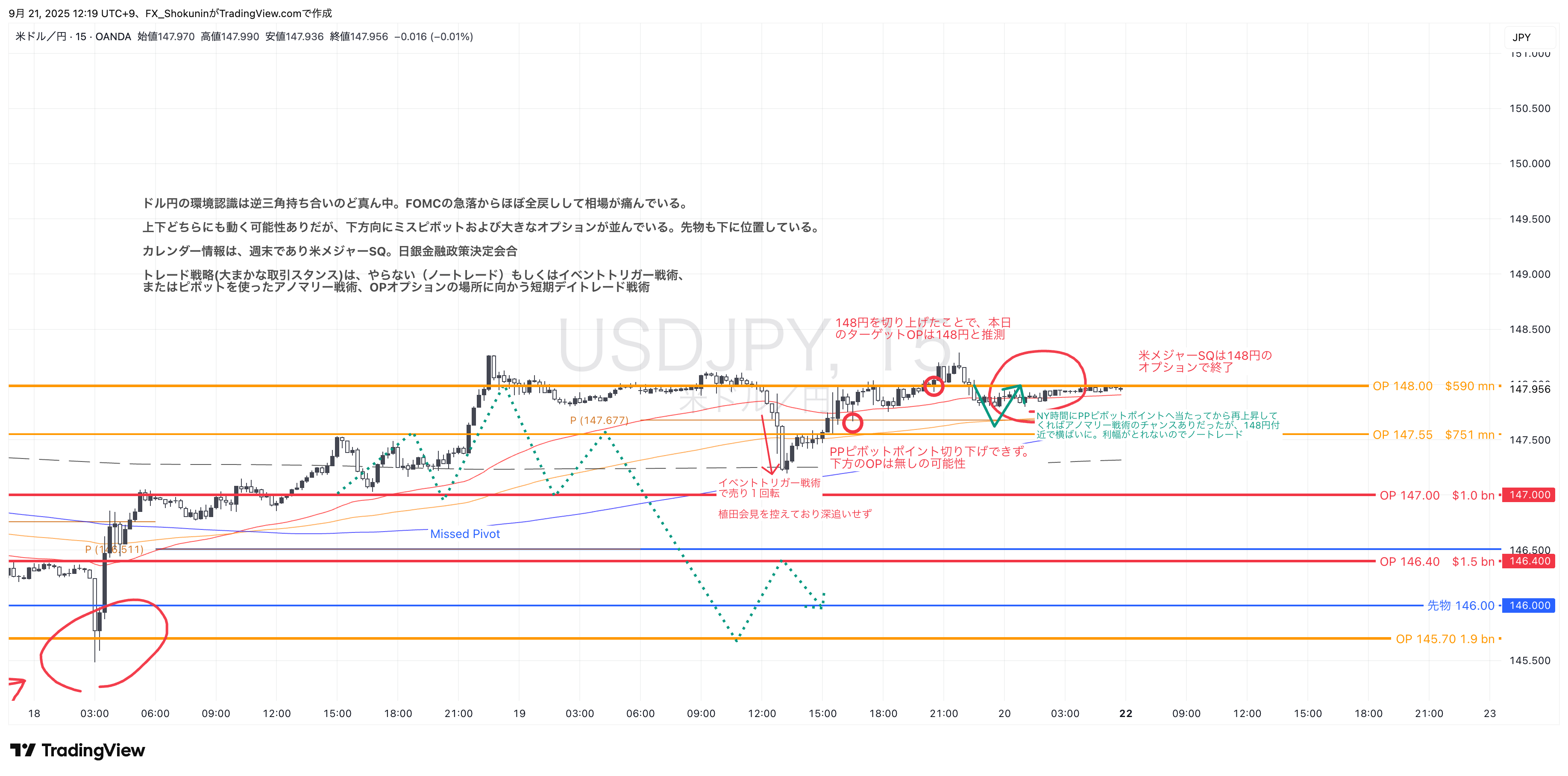

Last weekend was awaiting the Bank of Japan's Monetary Policy Meeting (MPM) announcement. It was also a major U.S. options expiration day, so a “do nothing” strategy was also an option.

Summary of BOJ MPM Announcementis as follows

・Exit strategy from easing policy: decided to sell the 37 trillion yen of stock ETFs and real estate REITs that had been purchased heavily

・Keep interest rates unchanged

・Did not specify timing of rate hikes

In a flash during the noon announcement, stocks fell and the dollar/yen also declined.

Afterwards, because Governor Ueda did not clearly state a timing for rate hikes, it did not turn into a panic.

The pace of selling ETFs, etc. was gradual.

Before the Liberal Democratic Party presidential election in October, it seems they cannot allow a stock plunge or a sharp appreciation of the yen.

Dollar/yen has again returned to the middle of a triangular range, so it will likely remain in a difficult (not regular) trading window.

That said, we must still turn price movements into profit, even in such conditions?

Acting to concretize strategy into profit is tactics. There are 13 of them.

/// Handling during the trading session is a crucial time ///

Among the 13 tactics, we selected event-triggered tactics or anomaly tactics.

However, in a market environment where no clear trend has formed, trend-following tactics that enter and then hold until TP (Take Profit, target point) cannot be used, so on-the-spot judgment becomes necessary.

On Friday, we were thinking like this at key points. Please use this as a reference.

Notes:

Strategy...the broad stance/policy for the day

Tactics...a series of actions to realize the strategy, 13 tactic patterns

Trend...a movement with regularity, continuity, and direction

Regularity...the “location information” works and high/low are consistently updated, and the pullback (retracement) is moderate (38.2-50%), and the direction is discernible to anyone, and timing is easy to measure

Location information...meaningful positional information that exists on the chart or externally, or their overlap is valued. That is the place to execute tactics, and where to set SP, TP