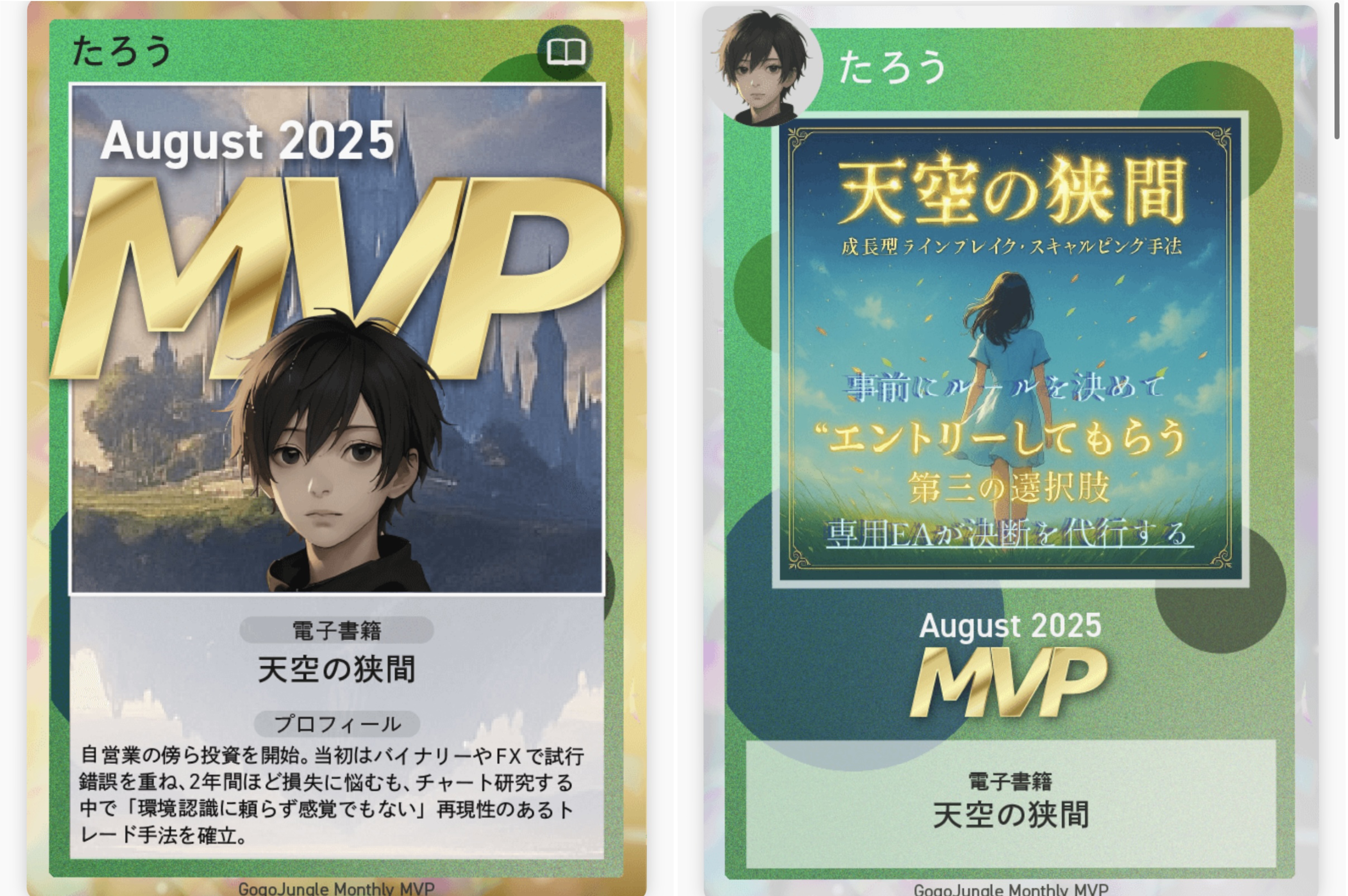

[August MVP Award Commemoration] Sky's Edge, Special Sale in Progress!

【August MVP Award Celebration】 Sky’s Edge Special Sale is now underway

Although unworthy, I have been chosen as the August MVP this time.

This is also thanks to everyone who

asks, “I want this feature in the Entry EA, is it possible?”

“Is this rule correct with this approach?”

“Wouldn’t it be better to do it this way?”

and so on—your proposals and opinions are what I’m grateful for.

And,the 4000 yen coupon is valid for a period, so to commemorate this MVP award,we’re holding a special sale.

⸻

Looking ahead

Based on the voices we’ve heard daily, currently we’re focused on codifying the “Cloud Sea” rules and updating indicators, but we will also continue to improve and update Sky’s Edge little by little.

With this award as motivation, we will continue to be of help to everyone, so we appreciate your ongoing support.

【Cloud Sea UNKAI】 How the sign appears

EA-driven breakout strategy

Entry EA manual included

“Sky’s Edge” is a simple strategy where entry is automated by the Entry EA, and traders simply monitor after entry and execute the exit rules.

The EA continuously monitors the chart and can enter precisely at the moment of a breakout without missing it, enabling precise execution.

This eliminates the stress of staying glued to the screen before entry and the anxiety of missing the timing.

Filters such as ADX, ATR, SMA, etc.

As a buyer’s perk, this EA is made available for use.

【Cloud Sea】 The light that dyes the white clouds — here

For those who already have solid rules—Cloud Sea UNKAI will further strengthen your method.

Why publish negative results?

Investment Navi+ deliberately publishes negative results without hiding them.

The reason is that “trading is not something you can win at all the time.”

Rather, by recording losses you can analyze “what situations cause losses” and make the logic more robust.

Rather than focusing on win/loss per single trade,

over a span of a week or a month, the total result being positive is most important,”.

• “I’m happy because I won today”

• “I’m uneasy because I lost today”

To remove these emotional swings, let the EA enter,and let humans focus on “execute according to the rules.”.

“Want to win” but “Want to earn”—this mindset is the fundamental premise for long-term profits.

Stability gained by following the rules

The common trait of people who lose big in trades is a strong urge to win leading to breaking the rules.

For example, delaying exits to “let it run more” or “watch a little longer” can wipe out profits in an instant.

Sky’s Edge is

• Entries fully automated by EA

• Exits governed by fixed, rule-based conditions

Thus, human intervention is minimized to the extreme, eliminating hesitation.

By mechanically following the rules, win rate and risk-reward naturally stabilize.

⸻

There are countless technical analysis methods—moving averages, RSI, MACD, Stochastics, Parabolic SAR, ADX, ATR, CCI, trendlines and channels, Fibonacci retracements and expansions, Ichimoku, volume, as well as support/resistance lines—

there is no single correct method, what matters is to decide on one personal rule that you believe in and then actually test it repeatedly. Doing so gives you the confidence that works in the market and the sense of “expectation building.”

⸻

We will test Sky’s Edge with a “maximum profit-taking” rule;

there are times when the value is settled often, but because we adhere to the rules we can calmly seize the next opportunity.

Even in moments where you could have taken more,

because you cut at break-even according to the rules, you end up keeping a total positive result—this is the strength of this strategy.

What matters in trading is “reliability” not “win rate”

Many traders worry about “win rate,” but

a win rate of 50% still grows capital if the risk-reward is favorable.

What matters is having a rule that is.

Sky’s Edge is,

•EA entry → mechanical stop → rule-based take profit

prioritizing the idea of making trading a “business.”.

⸻

A strategy aimed at overall profitability

Focusing on daily wins and losses is risky.

For example, over a week or a month, even with some negative days, as long as the total is positive, it’s OK.

Since the EA has no emotions, it is also ideal for long-term capital management.

Using a rule-based approach with a vision of “earning” rather than simply “winning” helps the growth curve of capital stay stable.

If you’re interested in Sky’s Edge, you’re invited to join the online community

Join the online community here

In the online community, specific trading logic cannot be explained, but you can join a “chart critique community” that uses Sky’s Edge.

To those interested in Sky’s Edge

Build a foundation to make decisions by rule rather than hesitation in short-term trading—

that is the basic philosophy of Sky’s Edge.

Free materials here:

▶︎ Download ‘Traces to the Edge’

In ‘Traces to the Edge,’ you’ll learn in what situations you can actually trade and the criteria for making judgments more clearly.

The sales page for “Sky’s Edge” could not fully convey,

the specifics of entry points and how to choose zones,

are also explained in diagrams and varied cases in detail.

Even beginners will find it easy to reproduce,

so if you’re curious, please make good use of it as well.

If you’re interested, please first receive the free material ‘Traces to the Edge.’

From there, your first step into the Edge begins.

“Can I enter this chart?”

When you’re unsure,it would be helpful to shift your thinking to “judge by rules, not by feeling.”