<Japanese Stock Day Trading Practical Guide> Morning session low-target strike ✖️ 'Sell-off/Buy-off Reversal Signal v1.0' (TradingView only)

Introduction: Target the “points” rather than the lines

In day trading, aim for the stock that moves up and down in small stepsnot a“line.”That day’s lowest price = a single pointthat is often decided in the morning session(especially 9:00–10:30)using the characteristic of Japanese stocks,to take the maximum price range with minimum risk—this is the tactic of this article. Trade only where you can surely win.

This guide adheres to the following policy.

Aim rigorously for the opening price support, morning lows, and premarket lows.

Low of the day up to 10:30 = buying opportunity, high prices unless they stay implemented = selling opportunity

Target one (max two) intraday rebound for the same security. Don’t do three times

In the afternoon, do not trade in principle.

Strictly adhere to buy price withdrawal (exit at same price). Do not hold with a loss

This tactic will be mechanically reproduced with“Sellout/Buyout Reversal Signal v1.0”.

? Indicator Overview

The indicator “Sellout/Buyout Reversal Signal v1.0” (TradingView only) combines

volume, candlesticks, and trendsto automatically display market reversal signals.

Detects sellout/buyoutand notifies when reversals are likely

Great compatibility with the day-trading strategy that targets morning lows.

Automatically displays take profit / stop loss reference lines(ATR-based).

Alerts keep you from missing opportunities.

For beginners, just “follow the signal”; for advanced users, use it as “strategy reinforcement.”

A simple yet practical reversal-detection tool.

This indicator is listed on GogoJungle.

There are two affordable options to try easily:【Monthly Version】 and【One-time Purchase Version】.

【Monthly Version】3,000 yen/month

【One-time Purchase Version】30,000 yen

1. Early Morning Routine

8:00–8:45: Candidate extraction (yesterday’s to today’s materials)

Recent S-high stocks, strong materials (results/IR/themes), top turnover, surge in volume, premarket GD for overnight declines

Prioritize stocks with thick order books and expected high volume(to aim for entry at a single point while managing risk)

Watchlist:

Large-core (top turnover on Prime Market)

Theme-based (semiconductors/AI/energy, etc.)

Smaller caps carry higher risk of “picking and sticking,” be cautious

8:45–8:59: Set alerts

Set BUY/SELL/EXIT alerts for candidate stocks..

Notifications only for “sellout → reversal (BUY)”to reduce temptation of chasing reversals.

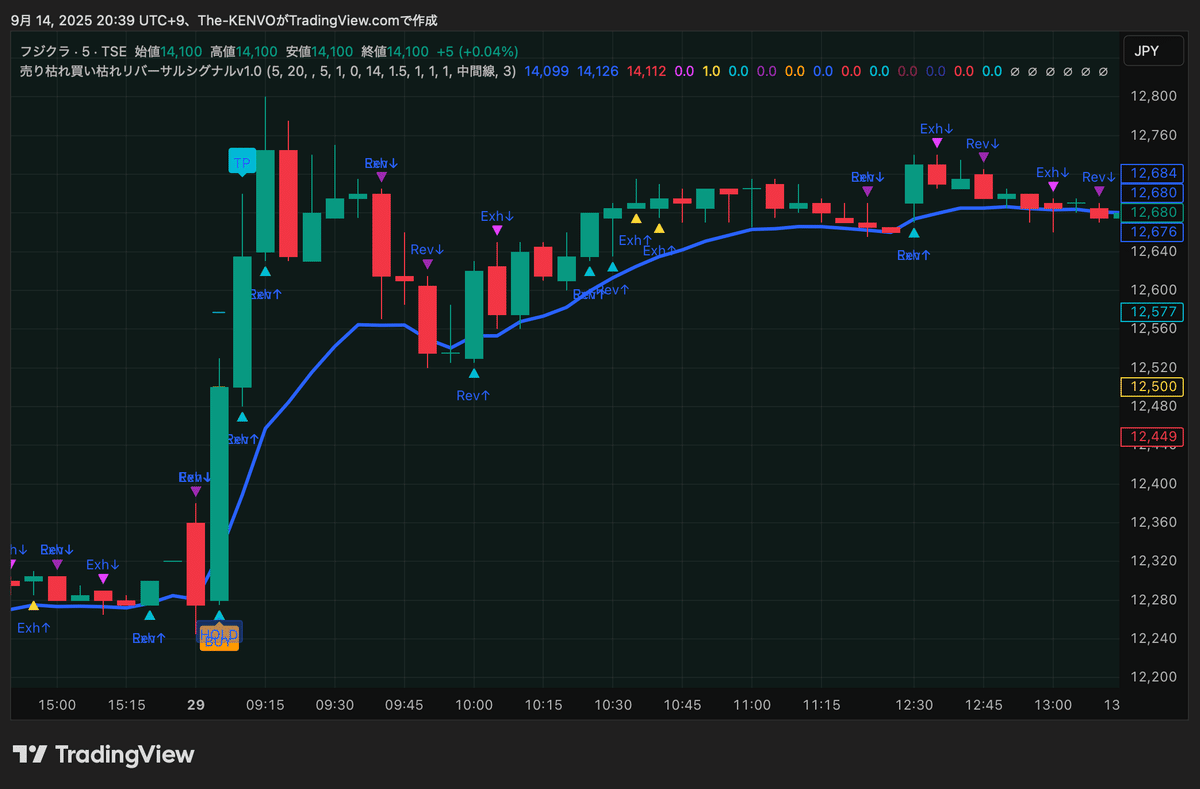

9:00–10:30: Time to chase the day’s lowest price at a single point

Rules:

Morning low is updated → “sellout” + reversal signalto enter with a buy

If you enter at the wrong spot, exit at entry price immediately (do not tolerate unrealized losses)

Max two attempts for the same stock’s rebound. Do not attempt a third time

For days when the overnight down move leads to morning lows,morning low is often decided

11:00 onward: Generally skip

2. How to Read the Indicator

BUY (orange)=sellout (excess selling) → reversalbuying opportunity

TP (light blue) / SL (red)=take profit / stop lossreference(ATR-based).Tp pacingis standard

HOLD (blue/navy)=holding signaldon’t chase a second big rebound

Trend background color(pale green = up, red = down);filters that reduce wasted counter-trend moves

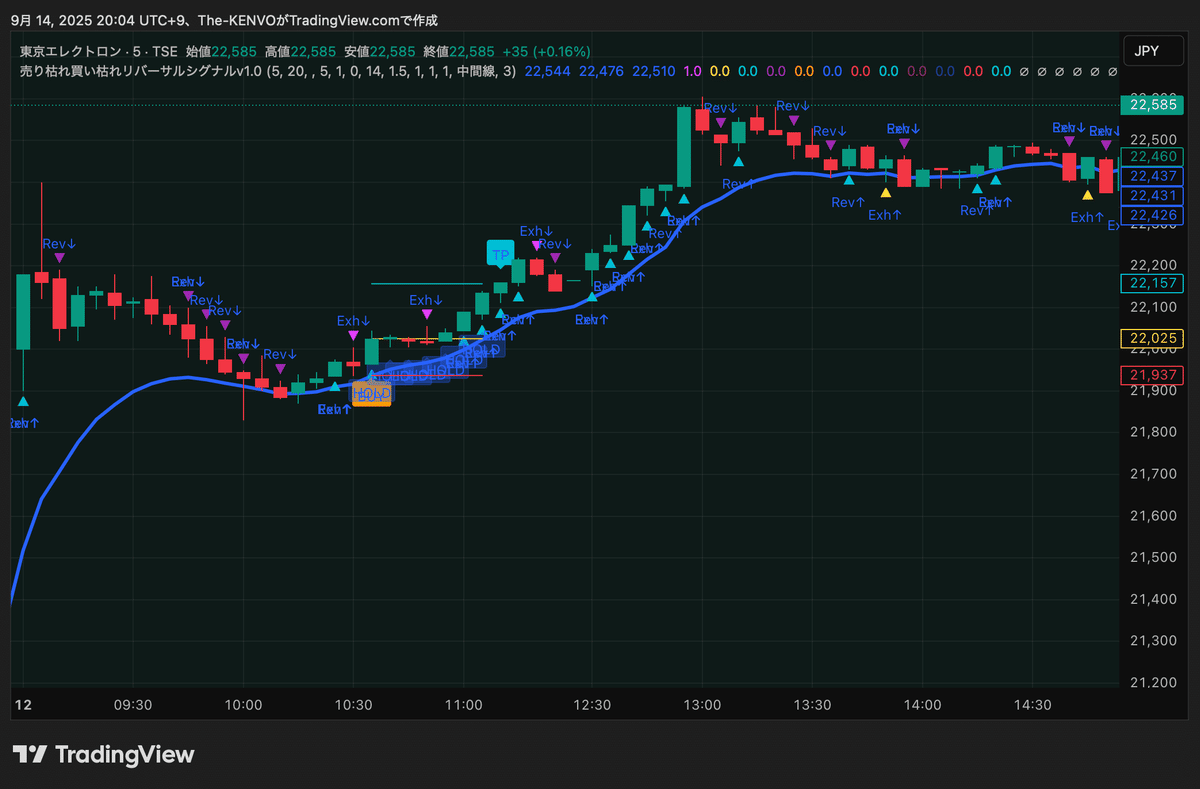

3. Preferred Scenarios: Morning Low Single-Point Target

A) Overnight drop → morning lows tend to be on the cheap

Strategy: after the open, update low →sellout + reversal signal (BUY)and enter

Perspective:the morning low is a single point. If hit here, the following upside range is wide“upward price movement”.

Exit:pacing out at TP, or extend to just before the morning session high.

What not to do:don’t chase beyond 2nd or 3rd time.

< Tokyo Electron (8035) > 5-minute chart

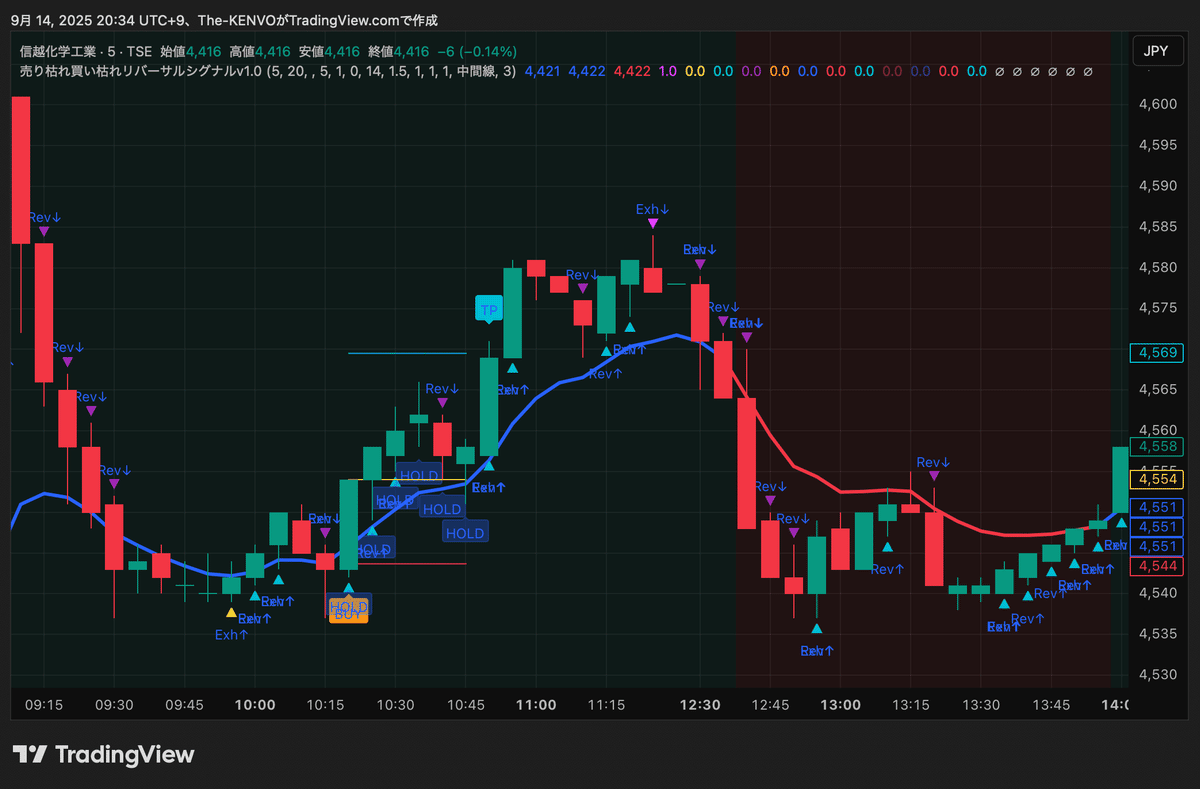

B) Open high → heavy selling → low comes by 10:30

Strategy:low until 10:30andconfirm sellout + reversalthen enter

Perspective:risk grows for a later afternoon decline, so generally aim to finish in the morning.

Exit:step TP. If momentum is strong, extend into early afternoon.

<信越化学工業(4063)> 5分足

4. Minimize Risk with “Pace Thinking”

“The lowest price is the single point”: that day’slowest pricethe morning session will test

Enter only when the upside range > downside range (a position where selling pressure is unlikely to be large)

Do not chase after a big rebound: second or third attempts reduce expected value

Do not attempt selling near the thinly traded small caps (they can’t return).

5. Recommended Presets

Timeframe:5-minute or 10–15-minute(thick boards for large caps = 5 min, small/medium OK with 15 min)

Trend reference:current chart or higher-timeframe = 60 minutes(to curb over-contrarian entries)

Profit/Stop:TP = ATR × 1.2–1.6, SL = ATR × 0.8–1.2

Display:Trend background = ON, EMA line = OFF, lines (Entry/TP/SL) = ON, markers = ON

Alerts:BUY signal / Long TP hit / Long SL hit(only BUY OK)

6. Entry and Exit Rules (Ultra-Simple)

Enter (BUY)

Between 9:00–10:30, update low →“sellout + reversal” signaland confirm

Ensure order book and volume accompany the move (avoid thin-volume stocks)

Exit

Take profit at TP(basically “pacing”)

SL or exit at entry price (do not endure)

Only one retry with the same stock (up to total of 2 times)

Do not

Do not chase after 11:00

Do not chase after a big rebound

Do not enter near thinly traded small caps

< Fujikura (5803) > 5-minute chart

7. Common Mistakes and How to Avoid Them

(Mistake)Chasing highs after a big rebound →(Avoid)enter at a single point before the rebound

(Mistake)Holding losses and “waiting” →(Avoid) default to exit at entry price.

(Mistake)Touching the same stock three times →(Avoid) limit to 2 times

(Mistake)Hit a stock with thin volume and you “stick” or slip →(Avoid) choose stocks with thick boards & volume.

(Mistake)Chasing and getting caught in the afternoon(Avoid)generally stick to mornings only

8. Q&A

A. Yes, butstart with stocks with solid depth and volumeto reduce mistakes.

A. Start with5 minutes. If difficult, try15 minutesto reduce noise.

A. Yes.Notify only on BUYfor a simple “hit once and done” setup.

A. Generally do not trade.

9. Summary: Build Probabilities with Rules

Morning session’s single point low (9:00–10:30)is captured by“sellout → reversal signal”.

Take profits stepwise; survive with SL/the same price withdrawal for a 100% survivability

Only twice for the same stock, and avoid the afternoon in principle

Value-range thinkingso you only trade scenarios with wide upside and narrow downside

With this rule alone, day trading becomes inherently low risk.

Next step: decide on about four candidate stocks each morning, set alerts, enter once, and done. That’s enough.

This indicator is listed on GogoJungle.

There are two affordable options to try easily:【Monthly Version】 and【One-time Purchase Version】

【Monthly Version】3,000 yen/month

【One-time Purchase Version】30,000 yen